Global Feed Probiotic Yeast Market

Market Size in USD Billion

CAGR :

%

USD

2.25 Billion

USD

3.54 Billion

2024

2032

USD

2.25 Billion

USD

3.54 Billion

2024

2032

| 2025 –2032 | |

| USD 2.25 Billion | |

| USD 3.54 Billion | |

|

|

|

|

Feed Probiotic Yeast Market Size

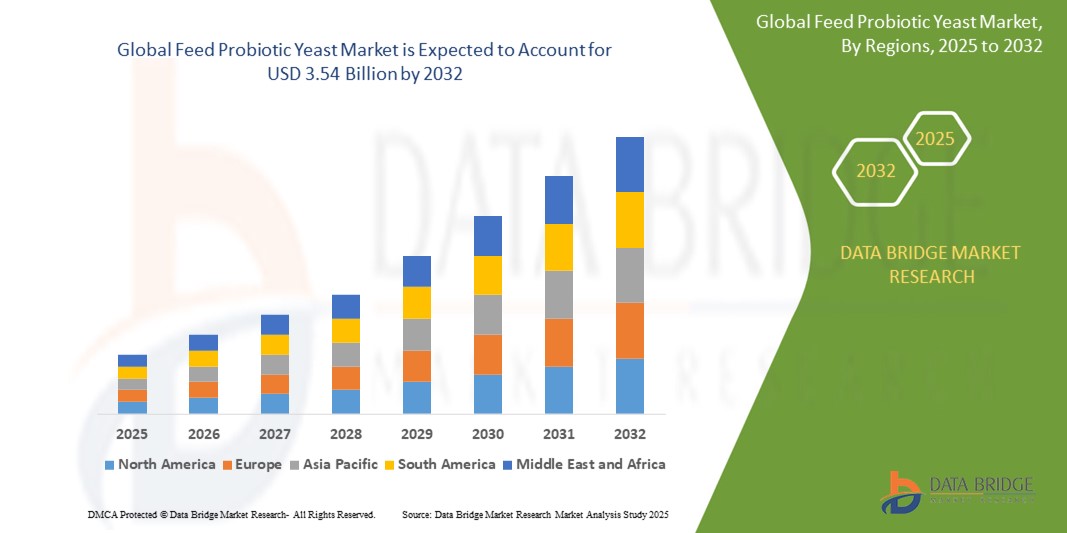

- The global feed probiotic yeast market size was valued at USD 2.25 billion in 2024 and is expected to reach USD 3.54 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is primarily driven by the increasing demand for natural and sustainable feed additives, heightened awareness of animal health and nutrition, and the growing trend of reducing antibiotic use in livestock farming

- In addition, the rising adoption of probiotic yeast in animal feed to enhance gut health, improve feed efficiency, and boost immunity in livestock is significantly contributing to market expansion.

Feed Probiotic Yeast Market Analysis

- Feed probiotic yeast, used as a natural feed additive, plays a critical role in improving animal health, enhancing digestion, and promoting growth across various livestock species, including ruminants, poultry, swine, aquatic animals, pets, and equine

- The surge in demand for feed probiotic yeast is driven by the global shift toward sustainable farming practices, growing consumer preference for antibiotic-free meat and dairy products, and advancements in probiotic yeast formulations for improved efficacy

- North America dominated the feed probiotic yeast market with the largest revenue share of 38.5% in 2024, attributed to advanced livestock farming practices, high awareness of animal nutrition, and the presence of leading market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid growth in livestock production, increasing meat consumption, and rising investments in animal feed technologies in countries such as China and India

- The ruminants segment held the largest market revenue share of 40% in 2024, driven by the extensive use of probiotic yeast in cattle diets to enhance rumen fermentation, improve milk production, and boost immunity

Report Scope and Feed Probiotic Yeast Market Segmentation

|

Attributes |

Feed Probiotic Yeast Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Feed Probiotic Yeast Market Trends

“Increasing Integration of Biotechnology and Precision Nutrition”

- The global feed probiotic yeast market is experiencing a notable trend toward the integration of advanced biotechnology and precision nutrition techniques

- These advancements enable the development of tailored probiotic yeast strains, optimizing animal health, growth performance, and feed efficiency across various livestock species

- Biotechnology-driven solutions allow for precise formulations that address specific nutritional needs, such as improving gut health, enhancing immunity, and reducing digestive disorders

- For instance, companies are leveraging genetic and microbial research to create specialized yeast strains, such as Saccharomyces cerevisiae and Kluyveromyces spp., that cater to the unique dietary requirements of ruminants, poultry, swine, aquatic animals, pets, and equine

- This trend enhances the efficacy of probiotic yeast, making it a preferred choice for livestock producers aiming to meet consumer demand for sustainable and antibiotic-free animal products

- Precision nutrition platforms analyze feed composition and animal performance data to recommend optimal probiotic yeast dosages, improving overall productivity and animal welfare

Feed Probiotic Yeast Market Dynamics

Driver

“Rising Demand for Sustainable Animal Nutrition and Antibiotic Alternatives”

- Growing consumer awareness of animal welfare and environmental sustainability is a key driver for the global feed probiotic yeast market

- Probiotic yeast enhances animal health by improving gut flora balance, boosting immunity, and increasing feed conversion efficiency, making it a vital component in modern livestock diets

- Regulatory bans on antibiotic growth promoters, particularly in regions such as Europe and Asia-Pacific, are accelerating the adoption of probiotic yeast as a natural alternative

- The expansion of IoT and data analytics in agriculture supports real-time monitoring of animal health and feed performance, enabling broader use of probiotic yeast in precision farming

- Livestock producers are increasingly incorporating probiotic yeast into feed formulations to meet consumer demand for high-quality, antibiotic-free meat, dairy, and eggs

Restraint/Challenge

“High Production Costs and Regulatory Complexities”

- The high cost of developing, producing, and incorporating probiotic yeast into animal feed poses a significant barrier, particularly for small-scale producers in emerging markets

- The complexity of scaling up biotechnological processes for yeast production, including strain development and quality control, adds to the overall expense

- Data security and regulatory compliance concerns also present challenges, as probiotic yeast formulations require rigorous testing and approval to meet diverse regional standards for safety and efficacy

- The fragmented regulatory landscape across countries, with varying requirements for feed additives, complicates market entry and expansion for manufacturers

- These factors can limit adoption in cost-sensitive regions and among producers with limited access to advanced feed technologies, potentially slowing market growth

Feed Probiotic Yeast market Scope

The market is segmented on the basis of livestock, genus, and product type.

- By Livestock

On the basis of livestock, the feed probiotic yeast market is segmented into ruminants, poultry, swine, aquatic animals, pets, and equine. The ruminants segment held the largest market revenue share of 40% in 2024, driven by the extensive use of probiotic yeast in cattle diets to enhance rumen fermentation, improve milk production, and boost immunity. Saccharomyces cerevisiae strains are particularly effective in stabilizing rumen pH, reducing lactate concentrations, and improving feed efficiency.

The poultry segment is expected to witness the fastest growth rate of 8.2% from 2025 to 2032, fueled by increasing global demand for poultry meat and eggs, coupled with the need for antibiotic-free feed solutions. Probiotic yeast enhances gut health, improves feed conversion ratios, and supports disease resistance in broilers and layers, driving adoption in commercial poultry farming.

- By Genus

On the basis of genus, the feed probiotic yeast market is segmented into Saccharomyces spp., Kluyveromyces spp., and others. The Saccharomyces spp. segment dominated the market with a revenue share of 47.2% in 2024, attributed to its widespread use in animal feed for its proven efficacy in improving gut health, nutrient absorption, and immune response. Saccharomyces cerevisiae and Saccharomyces boulardii are key strains, with the former being the most utilized due to its compatibility with various feed systems and safety profile.

The Kluyveromyces spp. segment is anticipated to experience significant growth from 2025 to 2032, driven by its niche applications in specialized feed formulations. Kluyveromyces marxianus, for instance, is gaining traction for its ability to enhance digestion and address specific health challenges in swine and aquaculture.

- By Product Type

On the basis of product type, the feed probiotic yeast market is segmented into live, spent, and yeast derivatives. The live yeast segment accounted for the largest market revenue share of 54.3% in 2024, driven by its ability to deliver active microorganisms that enhance digestion, nutrient uptake, and immunity

The yeast derivatives segment is expected to witness the fastest growth rate of 7.8% from 2025 to 2032. Yeast derivatives, including beta-glucans and mannooligosaccharides, are valued for their role in immune modulation and pathogen binding, particularly in swine and aquaculture applications. Their use in reducing digestive disorders and supporting sustainable feed solutions is driving demand.

Feed Probiotic Yeast Market Regional Analysis

- North America dominated the feed probiotic yeast market with the largest revenue share of 38.5% in 2024, attributed to advanced livestock farming practices, high awareness of animal nutrition, and the presence of leading market players

- Consumers prioritize probiotic yeast for improving gut health, boosting immunity, and reducing antibiotic use in livestock, particularly in regions with stringent regulations on animal feed

- Growth is supported by advancements in probiotic yeast technology, including live yeast cultures and yeast derivatives, alongside rising adoption in both commercial and small-scale farming operations

U.S. Feed Probiotic Yeast Market Insight

The U.S. feed probiotic yeast market captured the largest revenue share of 78.3% in 2024 within North America, fueled by strong demand from the livestock sector and growing consumer awareness of the benefits of probiotic yeast for animal health. The trend toward sustainable farming and bans on antibiotic growth promoters further boost market expansion. The integration of probiotic yeast in ruminant, poultry, and swine feed, along with aftermarket adoption in pet and equine nutrition, creates a diverse market ecosystem.

Europe Feed Probiotic Yeast Market Insight

The Europe feed probiotic yeast market is expected to witness significant growth, supported by regulatory emphasis on banning antibiotics in animal feed and promoting natural alternatives. Consumers seek yeast-based solutions that enhance gut health and feed efficiency while complying with safety standards. The growth is prominent in both large-scale livestock operations and niche applications, with countries such as Germany and France showing significant uptake due to rising environmental concerns and animal welfare standards.

U.K. Feed Probiotic Yeast Market Insight

The U.K. market for feed probiotic yeast is expected to witness rapid growth, driven by demand for improved animal health and productivity in poultry and swine farming. Increased awareness of the benefits of Saccharomyces spp. and Kluyveromyces spp. for gut health and immunity encourages adoption. Evolving regulations on antibiotic use and a focus on sustainable livestock production influence consumer choices, balancing efficacy with compliance.

Germany Feed Probiotic Yeast Market Insight

Germany is expected to witness rapid growth in the feed probiotic yeast market, attributed to its advanced livestock and aquaculture sectors and high consumer focus on sustainable animal nutrition. German farmers prefer technologically advanced yeast products, such as live and yeast derivatives that enhance digestion and contribute to disease resistance. The integration of these products in premium feed formulations and aftermarket solutions supports sustained market growth.

Asia-Pacific Feed Probiotic Yeast Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding livestock and aquaculture production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of probiotic yeast benefits, including heat stress reduction and improved feed efficiency, boosts demand. Government initiatives promoting sustainable agriculture and animal health further encourage the adoption of advanced probiotic yeast products.

Japan Feed Probiotic Yeast Market Insight

Japan’s feed probiotic yeast market is expected to witness rapid growth due to strong consumer preference for high-quality, scientifically backed yeast products that enhance animal health and productivity. The presence of major feed manufacturers and the integration of probiotic yeast in poultry, swine, and aquatic animal feed accelerate market penetration. Rising interest in pet and equine nutrition also contributes to growth.

China Feed Probiotic Yeast Market Insight

China holds the largest share of the Asia-Pacific feed probiotic yeast market, propelled by rapid urbanization, rising livestock and aquaculture production, and increasing demand for natural feed additives. The country’s growing focus on food security and sustainable farming supports the adoption of advanced probiotic yeast products, such as live and spent yeast. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Feed Probiotic Yeast Market Share

The feed probiotic yeast industry is primarily led by well-established companies, including:

- GrainCorp (Australia)

- Malteurop (France)

- Rahr Corporation (U.S.)

- BOORTMALT (Belgium)

- Indesso (Indonesia)

- DSM (Netherlands)

- Kemin Industries, Inc. (U.S.)

- Impextraco NV (Belgium)

- Novus International, Inc. (U.S.)

- ADDCON GmbH (Germany)

- Biomin Holding GmbH (Austria)

- Diamond V (U.S.)

- Leiber GmbH (Germany)

- Biorigin (Brazil)

- Ohly GmbH (Germany)

What are the Recent Developments in Global Feed Probiotic Yeast Market?

- In March 2025, IFF expanded its animal nutrition portfolio by launching Enviva® PRO, a three-strain Bacillus probiotic formulated specifically for swine. Tailored to support piglet gut health during the vulnerable weaning and post-weaning phases, the probiotic helps mitigate challenges such as nutritional stress, digestive issues, and growth setbacks. Backed by extensive research, Enviva PRO demonstrated a 2.5% improvement in average daily weight gain and a 6.3% reduction in diarrhea frequency. Already proven in poultry, this extension underscores IFF’s commitment to targeted, science-driven solutions that enhance livestock welfare, performance, and sustainability across life stages

- In October 2024, Lallemand Animal Nutrition and the Micalis Institute (INRAE, AgroParisTech, Université Paris-Saclay) launched the Biofilm1Health joint laboratory to advance research on beneficial microbial biofilms. This initiative focuses on exploring microbial communities to enhance animal health and develop environmentally sustainable solutions. By integrating high-throughput biofilm phenotyping and AI-driven tools, the collaboration aims to reduce chemical inputs and improve livestock welfare. The project reflects Lallemand’s strong commitment to R&D in microbial innovation, bridging fundamental science with real-world applications in animal nutrition and ecosystem health

- In October 2024, Lesaffre, a global leader in fermentation and yeast-based solutions, acquired a 70% stake in BiOrigin, a Brazilian subsidiary of Zilor, to strengthen its capabilities in producing yeast derivatives for both human food and animal nutrition. This strategic acquisition enhances Lesaffre’s ability to meet the rising global demand for natural, sustainable ingredients, particularly in the savory ingredients and feed yeast markets. BiOrigin’s production facility in Quatá, São Paulo, offers access to abundant local resources such as sugar and renewable energy, aligning with Lesaffre’s sustainability goals and expanding its global manufacturing footprint

- In January 2024, Novozymes A/S and Chr. Hansen Holding A/S officially completed their merger, forming a new global biosolutions leader named Novonesis. This strategic union combines deep expertise in enzymes, microbial solutions, and probiotic yeast technologies, significantly strengthening the company’s presence in the feed and nutrition markets. The merger is expected to unlock substantial sales synergies, accelerate innovation, and expand the portfolio of targeted microbial solutions for animal health and performance. With a shared commitment to sustainability and science-driven development, Novonesis is poised to deliver transformative solutions across the biosolutions value chain

- In January 2024, BIO-CAT, Inc. partnered with Caldic North America to introduce its proprietary probiotic strains and the OPTIFEED ingredient brand to the North American companion animal nutrition market. This collaboration leverages BIO-CAT’s expertise in enzyme and microbial formulations and Caldic’s strong distribution network to deliver customizable, high-performance solutions for pet food and health. The OPTIFEED line, developed at BIO-CAT’s FDA-registered, SQF-certified fermentation facility, is designed to support digestive and gastrointestinal health in pets. The partnership enhances Caldic’s portfolio with innovative ingredients that align with the growing demand for nutritionally advanced pet products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.