Global Feed Acidifiers Market

Market Size in USD Billion

CAGR :

%

USD

2.86 Billion

USD

4.59 Billion

2022

2030

USD

2.86 Billion

USD

4.59 Billion

2022

2030

| 2023 –2030 | |

| USD 2.86 Billion | |

| USD 4.59 Billion | |

|

|

|

|

Feed Acidifiers Market Analysis and Size

The global feed acidifiers market is growing demand for animal protein is expected to drive market growth. Additionally, government regulations and restrictions on antibiotic growth are expected to drive market growth.

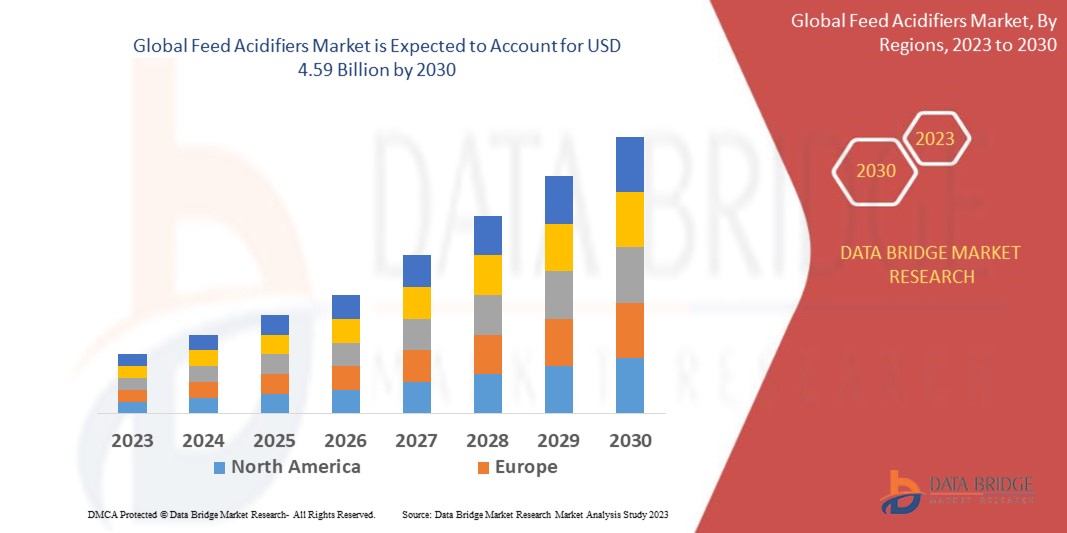

Data Bridge Market Research analyses that the global feed acidifiers market which was USD 2.86 billion in 2022, would rocket up to USD 4.59 billion by 2030, and is expected to undergo a CAGR of 6.1% during the forecast period of 2023 to 2030. “Propionic acid” dominates the type segment of the global feed acidifiers market and helps curb bacterial growth in molds. Hence, it can also be used as a preservative in animal feed. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Feed Acidifiers Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Tons, Pricing in USD |

|

Segments Covered |

Type (Propionic Acid, Formic Acid, Lactic Acid, Citric Acid, Sorbic Acid, Malic Acid, Others), Form (Dry, Liquid), Compound (Blended, Single), Livestock (Poultry, Swine, Ruminants, Aquaculture, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America. |

|

Market Players Covered |

BASF SE (Germany), Novus International, Inc. (USA), Perstorp Holding AB (Sweden), Kemin Industries, Inc. (USA), Nutrex NV/SA (Belgium), Impextraco NV (Belgium), ADDCON Group GmbH (Germany), Biomin Holding GmbH (Austria), Pancosma SA (Switzerland), Anpario plc (United Kingdom), Acidifiers International Group Ltd. (United Kingdom), Jefo Nutrition Inc. (Canada), Impextraco Asia Pacific Sdn. Bhd. (Malaysia) |

|

Market Opportunities |

|

Market Definition

Feed acidifiers are additives added to feed to promote livestock's gut health by modulating the gut microbiota. Acidifiers used in the preparation of feed have bacteriostatic and bactericidal properties, which aid in maintaining the growth of microbes in the gastrointestinal tract. Animal feed Acidifiers are again the organic acids incorporated with the feed for nutritional or preservative benefits. This acidifier help to control microbial growth, inhibit pathogenic bacteria, reduction of feed buffer capacity, and also improve nutrient digestibility. Acidifiers are also found to enhance congestion and microbiological balance in the alimentary and digestive tracts of livestock. The global feed acidifiers market is driven by significant growth in the livestock feed industry and growing demand for livestock products, including milk, eggs, meat, and wool, amongst others.

Global Feed Acidifiers Market Dynamics

Drivers

- Growing demand for animal protein

The increasing global population and changing dietary preferences have led to rising demand for animal protein, driving the need for improved animal nutrition and health through feed additives like acidifiers.

- Rising focus on animal health and welfare

Acidifiers are known to improve gut health, enhance feed digestibility, and support animal growth and performance. Increasing awareness of animal health and welfare among producers is driving the adoption of feed acidifiers.

Opportunities

- Expansion in the aquaculture industry

The aquaculture sector is witnessing significant growth due to the increasing demand for seafood. Acidifiers can be used to enhance feed efficiency and disease resistance in aquaculture, presenting opportunities for market growth.

- Development of innovative acidifier formulations

Ongoing research and development efforts are focused on developing advanced acidifier formulations that provide better efficacy, stability, and targeted delivery, which can create opportunities for market expansion.

Restraints/Challenges

- Lack of awareness and understanding

The adoption of feed acidifiers may be hindered by a lack of awareness and understanding among producers, particularly in developing regions. Educating and promoting the benefits of acidifiers will be essential to overcome this restraint.

- Fluctuating raw material prices

The prices of raw materials used in the production of feed acidifiers, such as organic acids, can be volatile. Fluctuations in raw material prices can impact the cost of production and potentially affect market stability.

Recent Development

-

On November 21, 2022 ADM announced the release of two SUCRAM products, which are in-feed sweetening solutions for cattle species. Pancosma, SUCRAM M'I Sweet, and SUCRAM Specifeek are sweeteners created by ADM's worldwide feed additives business to increase the palatability of feed for young animals, particularly weanling pigs. Palatants and sweeteners are effective nutrition solutions for increasing feed intake and increasing producer efficiencies while also improving animal health and well-being. As a result, the company's product line has grown.

Global Feed Acidifiers Market Scope

The global feed acidifiers market is segmented on the basis of type, form, compound, and Livestock. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Propionic Acid

- Formic Acid

- Lactic Acid

- Citric Acid

- Sorbic Acid

- Malic Acid

- Others

Form

- Dry

- Liquid

Compound

- Blended

- Single

Livestock

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others

Global Feed Acidifiers Market Regional Analysis/Insights

The global feed acidifiers market is analysed and market size insights and trends are provided by country, type, price range, and application, as referenced above.

The countries covered in the global ammonia market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

Asia-Pacific dominates the feed acidifiers market due to increasing demand for livestock feed with rich nutrients, increasing awareness regarding the health benefits associated with meat, and rising demand for hygienic products globally.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Feed Acidifiers Market Share Analysis

The feed acidifiers market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the feed acidifiers market.

Some of the major players operating in the global feed acidifiers market are:

- BASF SE (Germany)

- Novus International, Inc. (USA)

- Perstorp Holding AB (Sweden)

- Kemin Industries, Inc. (USA)

- Nutrex NV/SA (Belgium)

- Impextraco NV (Belgium)

- ADDCON Group GmbH (Germany)

- Biomin Holding GmbH (Austria)

- Pancosma SA (Switzerland)

- Anpario plc (United Kingdom)

- Acidifiers International Group Ltd. (United Kingdom)

- Jefo Nutrition Inc. (Canada)

- Impextraco Asia Pacific Sdn. Bhd. (Malaysia)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FEED ACIDIFIERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FEED ACIDIFIERS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FEED ACIDIFIERS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTE PRODUCTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.5 OVERVIEW ON TECHNOLOGICAL INNOVATIONS

5.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 REGULATORY FRAMEWORK AND GUIDELINES

7 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON SUPPLY CHAIN

7.3 IMPACT ON SHIPMENT

7.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

8 PRICING ANALYSIS

9 GLOBAL FEED ACIDIFIERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION) (KILO TONS)

9.1 OVERVIEW

9.2 PROPIONIC ACID

9.3 FUMARIC ACID

9.4 LACTIC ACID

9.5 TARTARIC ACID

9.6 BUTYRIC ACID

9.7 ACETIC ACID

9.8 FORMIC ACID

9.9 CITRIC ACID

9.1 SORBIC ACID

9.11 BENZOIC ACID

9.12 MALIC ACID

9.13 OTHERS

10 GLOBAL FEED ACIDIFIERS MARKET, BY FORM, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 LIQUID

10.3 DRY

10.3.1 DRY, BY TYPE

10.3.1.1. CUBES

10.3.1.2. POWDER

10.3.1.3. FLAKES

10.3.1.4. PELLET

10.3.1.5. OTHERS

11 GLOBAL FEED ACIDIFIERS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 GLOBAL FEED ACIDIFIERS MARKET, BY COMPOUND, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 SINGLE

12.3 BLENDED

13 GLOBAL FEED ACIDIFIERS MARKET, BY LIFECYCLE, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 GROWER FEED

13.2.1 GROWER FEED, BY PRODUCT TYPE

13.2.1.1. PROPIONIC ACID

13.2.1.2. FUMARIC ACID

13.2.1.3. LACTIC ACID

13.2.1.4. TARTARIC ACID

13.2.1.5. BUTYRIC ACID

13.2.1.6. ACETIC ACID

13.2.1.7. FORMIC ACID

13.2.1.8. CITRIC ACID

13.2.1.9. SORBIC ACID

13.2.1.10. BENZOIC ACID

13.2.1.11. MALIC ACID

13.2.1.12. OTHERS

13.3 FINISHER FEED

13.3.1 FINISHER FEED, BY PRODUCT TYPE

13.3.1.1. PROPIONIC ACID

13.3.1.2. FUMARIC ACID

13.3.1.3. LACTIC ACID

13.3.1.4. TARTARIC ACID

13.3.1.5. BUTYRIC ACID

13.3.1.6. ACETIC ACID

13.3.1.7. FORMIC ACID

13.3.1.8. CITRIC ACID

13.3.1.9. SORBIC ACID

13.3.1.10. BENZOIC ACID

13.3.1.11. MALIC ACID

13.3.1.12. OTHERS

13.4 STARTER FEED

13.4.1 STARTER FEED, BY PRODUCT TYPE

13.4.1.1. PROPIONIC ACID

13.4.1.2. FUMARIC ACID

13.4.1.3. LACTIC ACID

13.4.1.4. TARTARIC ACID

13.4.1.5. BUTYRIC ACID

13.4.1.6. ACETIC ACID

13.4.1.7. FORMIC ACID

13.4.1.8. CITRIC ACID

13.4.1.9. SORBIC ACID

13.4.1.10. BENZOIC ACID

13.4.1.11. MALIC ACID

13.4.1.12. OTHERS

13.5 BROODER FEED

13.5.1 BROODER FEED, BY PRODUCT TYPE

13.5.1.1. PROPIONIC ACID

13.5.1.2. FUMARIC ACID

13.5.1.3. LACTIC ACID

13.5.1.4. TARTARIC ACID

13.5.1.5. BUTYRIC ACID

13.5.1.6. ACETIC ACID

13.5.1.7. FORMIC ACID

13.5.1.8. CITRIC ACID

13.5.1.9. SORBIC ACID

13.5.1.10. BENZOIC ACID

13.5.1.11. MALIC ACID

13.5.1.12. OTHERS

14 GLOBAL FEED ACIDIFIERS MARKET, BY FUNCTION, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 DIGESTIVE HEALTH

14.3 IMMUNE HEALTH

14.4 RESPIRATORY HEALTH

14.5 HYDRATION

14.6 WEIGHT GAIN

14.7 BONE AND MUSCLE HEALTH

14.8 OTHERS

15 GLOBAL FEED ACIDIFIERS MARKET, BY LIVESTOCKS, 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 POULTRY

15.2.1 POULTRY, BY TYPE

15.2.1.1. CHICKEN

15.2.1.1.1. BROILERS

15.2.1.1.2. LAYERS

15.2.1.2. TURKEY

15.2.1.3. GEESE

15.2.1.4. DUCKS

15.2.1.5. GUINEA FOWL

15.2.1.6. QUAIL

15.2.1.7. OTHERS

15.2.2 POULTRY, BY PRODUCT TYPE

15.2.2.1. PROPIONIC ACID

15.2.2.2. FUMARIC ACID

15.2.2.3. LACTIC ACID

15.2.2.4. TARTARIC ACID

15.2.2.5. BUTYRIC ACID

15.2.2.6. ACETIC ACID

15.2.2.7. FORMIC ACID

15.2.2.8. CITRIC ACID

15.2.2.9. SORBIC ACID

15.2.2.10. BENZOIC ACID

15.2.2.11. MALIC ACID

15.2.2.12. OTHERS

15.3 RUMINANTS

15.3.1 RUMINANTS, BY TYPE

15.3.1.1. CALVES

15.3.1.2. DAIRY CATLE

15.3.1.3. BEEF CATLE

15.3.1.4. OTHERS

15.3.2 RUMINANTS, BY PRODUCT TYPE

15.3.2.1. PROPIONIC ACID

15.3.2.2. FUMARIC ACID

15.3.2.3. LACTIC ACID

15.3.2.4. TARTARIC ACID

15.3.2.5. BUTYRIC ACID

15.3.2.6. ACETIC ACID

15.3.2.7. FORMIC ACID

15.3.2.8. CITRIC ACID

15.3.2.9. SORBIC ACID

15.3.2.10. BENZOIC ACID

15.3.2.11. MALIC ACID

15.3.2.12. OTHERS

15.4 SWINE

15.4.1 SWINE, BY TYPE

15.4.1.1. STARTER

15.4.1.2. GROWER

15.4.1.3. SOW

15.4.2 SWINE, BY PRODUCT TYPE

15.4.2.1. PROPIONIC ACID

15.4.2.2. FUMARIC ACID

15.4.2.3. LACTIC ACID

15.4.2.4. TARTARIC ACID

15.4.2.5. BUTYRIC ACID

15.4.2.6. ACETIC ACID

15.4.2.7. FORMIC ACID

15.4.2.8. CITRIC ACID

15.4.2.9. SORBIC ACID

15.4.2.10. BENZOIC ACID

15.4.2.11. MALIC ACID

15.4.2.12. OTHERS

15.5 PETS

15.5.1 PETS, BY TYPE

15.5.1.1. CATS

15.5.1.2. DOGS

15.5.1.3. RABBITS

15.5.1.4. OTHERS

15.5.2 PETS, BY PRODUCT TYPE

15.5.2.1. PROPIONIC ACID

15.5.2.2. FUMARIC ACID

15.5.2.3. LACTIC ACID

15.5.2.4. TARTARIC ACID

15.5.2.5. BUTYRIC ACID

15.5.2.6. ACETIC ACID

15.5.2.7. FORMIC ACID

15.5.2.8. CITRIC ACID

15.5.2.9. SORBIC ACID

15.5.2.10. BENZOIC ACID

15.5.2.11. MALIC ACID

15.5.2.12. OTHERS

15.6 AQUACULTURE

15.6.1 AQUACULTURE, BY TYPE

15.6.1.1. FISH

15.6.1.1.1. HERRING

15.6.1.1.2. MAHI-MAHI

15.6.1.1.3. COD

15.6.1.1.4. SALMON

15.6.1.1.5. TILAPIA

15.6.1.1.6. SEA BASS

15.6.1.1.7. TROUTS

15.6.1.1.8. CATFISH

15.6.1.1.9. MILKFISH

15.6.1.1.10. STURGEON

15.6.1.1.11. TURBOT

15.6.1.1.12. CARPS

15.6.1.1.13. GROUPER

15.6.1.1.14. BARRAMUNDI

15.6.1.1.15. EEL

15.6.1.1.16. SEA BREAM

15.6.1.1.17. KINGFISH

15.6.1.1.18. MEAGRE

15.6.1.1.19. SOLE

15.6.1.1.20. ROCKFISH

15.6.1.1.21. PIKE PERCH

15.6.1.1.22. OTHERS

15.6.1.2. CRUSTACEANS

15.6.1.2.1. CRABS

15.6.1.2.2. KRILL

15.6.1.2.3. LOBSTERS

15.6.1.2.4. CRAYFISH

15.6.1.2.5. SHRIMPS

15.6.1.2.6. PRAWNS

15.6.1.2.7. OTHERS

15.6.1.3. MOLLUSKS

15.6.1.3.1. GASTOPODS

15.6.1.3.2. SCALLOPS

15.6.1.3.3. OYSTERS

15.6.1.3.4. MUSSELS

15.6.1.3.5. OTHERS

15.6.2 AQUACULTURE, BY PRODUCT TYPE

15.6.2.1. PROPIONIC ACID

15.6.2.2. FUMARIC ACID

15.6.2.3. LACTIC ACID

15.6.2.4. TARTARIC ACID

15.6.2.5. BUTYRIC ACID

15.6.2.6. ACETIC ACID

15.6.2.7. FORMIC ACID

15.6.2.8. CITRIC ACID

15.6.2.9. SORBIC ACID

15.6.2.10. BENZOIC ACID

15.6.2.11. MALIC ACID

15.6.2.12. OTHERS

15.7 EQUINE

15.7.1 EQUINE, BY PRODUCT TYPE

15.7.1.1. PROPIONIC ACID

15.7.1.2. FUMARIC ACID

15.7.1.3. LACTIC ACID

15.7.1.4. TARTARIC ACID

15.7.1.5. BUTYRIC ACID

15.7.1.6. ACETIC ACID

15.7.1.7. FORMIC ACID

15.7.1.8. CITRIC ACID

15.7.1.9. SORBIC ACID

15.7.1.10. BENZOIC ACID

15.7.1.11. MALIC ACID

15.7.1.12. OTHERS

15.8 OTHERS

16 GLOBAL FEED ACIDIFIERS MARKET, BY END USER, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 FEED MANUFACTURERS

16.3 CONTRACT MANUFACTURERS

16.4 LIVESTOCK PRODUCERS

16.5 FARMERS

16.6 OTHERS

17 GLOBAL FEED ACIDIFIERS MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (KILO TONS)

17.1 GLOBAL FEED ACIDIFIERS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.2 NORTH AMERICA

17.2.1 U.S.

17.2.2 CANADA

17.2.3 MEXICO

17.3 EUROPE

17.3.1 GERMANY

17.3.2 U.K.

17.3.3 ITALY

17.3.4 FRANCE

17.3.5 SPAIN

17.3.6 SWITZERLAND

17.3.7 NETHERLANDS

17.3.8 BELGIUM

17.3.9 RUSSIA

17.3.10 DENMARK

17.3.11 SWEDEN

17.3.12 POLAND

17.3.13 TURKEY

17.3.14 REST OF EUROPE

17.4 ASIA-PACIFIC

17.4.1 JAPAN

17.4.2 CHINA

17.4.3 SOUTH KOREA

17.4.4 INDIA

17.4.5 AUSTRALIA

17.4.6 SINGAPORE

17.4.7 THAILAND

17.4.8 INDONESIA

17.4.9 MALAYSIA

17.4.10 PHILIPPINES

17.4.11 NEW ZEALAND

17.4.12 VIETNAM

17.4.13 REST OF ASIA-PACIFIC

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 UAE

17.6.3 SAUDI ARABIA

17.6.4 OMAN

17.6.5 QATAR

17.6.6 KUWAIT

17.6.7 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL FEED ACIDIFIERS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

18.6 MERGERS & ACQUISITIONS

18.7 NEW PRODUCT DEVELOPMENT & APPROVALS

18.8 EXPANSIONS & PARTNERSHIP

18.9 REGULATORY CHANGES

19 GLOBAL FEED ACIDIFIERS MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL FEED ACIDIFIERS MARKET, COMPANY PROFILE

20.1 VALOR CHEMICAL CO.,LTD

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 NOVUS INTERNATIONAL

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.3 BASF SE

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENTS

20.4 YARA

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 KEMIN INDUSTRIES, INC.

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENTS

20.6 DSM

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENTS

20.7 CORBION

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENTS

20.8 BARENTZ (PESTELL NUTRITION)

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENTS

20.9 IMPEXTRACO NV

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 PERSTORP

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENTS

20.11 PANCOSMA

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 JEFO

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENTS

20.13 NUTREX

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT DEVELOPMENTS

20.14 ADDCON GROUP GMBH

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 PETERLABS HOLDINGS BERHAD

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENTS

20.16 VETLINE (A DIVISION OF SIMFA LABS PVT LTD )

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENTS

20.17 TEX BIOSCIENCES

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENTS

20.18 AJINOMOTO HEALTH & NUTRITION NORTH AMERICA, INC.

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT DEVELOPMENTS

20.19 AUSEN CHEMICAL GROUP CO., LIMITED

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENTS

20.2 VETSFARMA LTD

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENTS

20.21 NOREL S.A

20.21.1 COMPANY OVERVIEW

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 QUESTIONNAIRE

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Feed Acidifiers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Feed Acidifiers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Feed Acidifiers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.