Global Fault And Classification Fdc Market

Market Size in USD Billion

CAGR :

%

USD

5.21 Billion

USD

10.32 Billion

2024

2032

USD

5.21 Billion

USD

10.32 Billion

2024

2032

| 2025 –2032 | |

| USD 5.21 Billion | |

| USD 10.32 Billion | |

|

|

|

|

Fault and Classification (FDC) Market Size

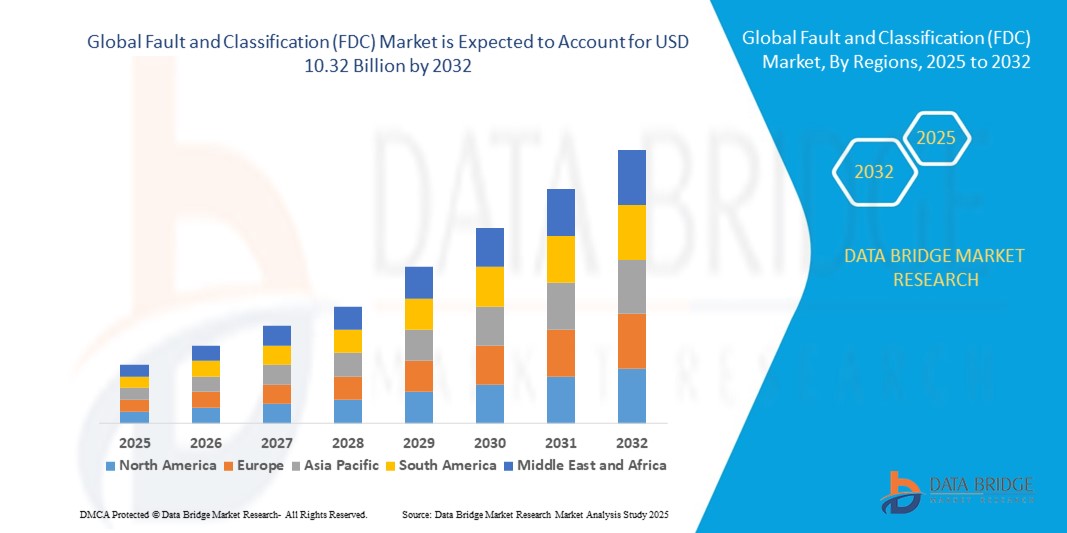

- The global fault and classification (FDC) market size was valued at USD 5.21 billion in 2024 and is expected to reach USD 10.32 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancements in industrial automation, semiconductor manufacturing, and IoT-based monitoring systems, leading to enhanced digitalization in both manufacturing and infrastructure environments. Fault and Classification (FDC) solutions are being increasingly implemented to ensure operational efficiency, reduce downtime, and improve product quality

- Furthermore, the rising demand for real-time fault detection, predictive maintenance, and data-driven decision-making across industries such as electronics, automotive, energy, and pharmaceuticals is significantly accelerating the uptake of Fault and Classification (FDC) systems. These solutions play a critical role in identifying defects early in the production process and enabling timely corrective actions, thus boosting yield and minimizing losses

Fault and Classification (FDC) Market Analysis

- The fault detection and classification (FDC) market is increasingly critical in modern industrial automation systems across manufacturing and quality control environments due to its capability to improve operational efficiency, reduce defects, and enable predictive maintenance

- The rapid rise in smart manufacturing and Industry 4.0 initiatives is fueling strong demand for FDC solutions, empowered by real-time data collection, machine learning-based diagnostics, and integration with IIoT platforms

- North America dominated the fault detection and classification (FDC) market with the largest revenue share of 33.7% in 2024, supported by early adoption of advanced analytics, significant investments in semiconductor and automotive manufacturing, and a well-established ecosystem of FDC technology providers

- Asia‑Pacific is expected to be the fastest‑growing region in the fault detection and classification (FDC) market during the forecast period, driven by rapid industrialization, government-led smart factory initiatives, and rising demand in electronics, automotive, and packaging sectors

- The software segment dominated the fault detection and classification (FDC) market with a revenue share of 62.4% in 2024, owing to the critical role of data analytics, pattern recognition, and anomaly detection in real-time across industrial processes. Software tools help in reducing downtime and improving product quality by identifying faults early in the process

Report Scope and Fault and Classification (FDC) Market Segmentation

|

Attributes |

Fault and Classification (FDC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fault and Classification (FDC) Market Trends

Integration Of Advanced Machine Learning (ML) and Artificial Intelligence (AI) Algorithms Into Semiconductor Manufacturing Processes

- A significant and accelerating trend in the global Fault Detection and Classification (FDC) market is the integration of advanced machine learning (ML) and artificial intelligence (AI) algorithms into semiconductor manufacturing processes. This technological convergence is enabling more accurate, real-time detection and classification of anomalies across complex fabrication workflows

- For instance, companies like KLA Corporation are developing AI-driven FDC platforms that can automatically distinguish between process-induced variations and true defects, dramatically reducing false positives. These solutions use high-dimensional data from equipment sensors and metrology tools to enhance pattern recognition and fault isolation

- AI-enhanced FDC systems can learn from historical data to predict potential equipment failures or wafer defects before they occur, thereby minimizing unplanned downtime and yield loss. For example, PDF Solutions offers AI-powered analytics that continuously monitor manufacturing performance and can trigger alerts or corrective actions based on intelligent anomaly detection

- The ability to apply AI and ML within FDC not only improves detection accuracy and reduces response times but also facilitates continuous process optimization. Integrated with cloud-based platforms, these systems can aggregate and analyze data across multiple fabs and tools, providing manufacturers with a scalable, enterprise-wide view of operational health

- This trend is reshaping the expectations for yield management and process control in the semiconductor industry. As a result, major players such as Applied Materials are embedding AI-native architectures into their process control solutions to support smarter, more autonomous fabs that can rapidly adapt to production variability

- The growing demand for zero-defect manufacturing, coupled with increasing chip complexity, is driving widespread adoption of AI-powered FDC systems across both legacy and advanced semiconductor nodes. This is particularly critical in sectors such as automotive and consumer electronics, where quality and reliability are non-negotiable

Fault and Classification (FDC) Market Dynamics

Driver

Growing Need for Fault Detection in Smart Manufacturing Environments

- The increasing complexity of modern manufacturing systems and the demand for zero-defect production are major factors driving the adoption of Fault and Classification (FDC) solutions. These systems are essential in identifying, classifying, and resolving faults in real-time, ensuring high product quality and reduced downtime

- For instance, the integration of AI and machine learning in FDC systems allows manufacturers to detect anomalies and perform predictive maintenance, leading to cost savings and improved operational efficiency

- The rise of Industry 4.0 and smart factories is further propelling the demand for FDC technologies, particularly in high-precision sectors such as semiconductors, automotive, and pharmaceuticals

- Increasing investments in automation and data analytics across emerging and developed economies support the adoption of intelligent FDC platforms capable of handling large-scale production data

- The growing adoption of edge computing and IoT devices across industrial settings enhances real-time decision-making, which strengthens the role of FDC in closed-loop process control

- Demand for energy-efficient and waste-reducing technologies is pushing manufacturers to deploy FDC systems to monitor operations continuously, minimize rework, and reduce scrap rates

- Government initiatives supporting smart manufacturing and digital transformation (such as "Make in India," "Made in China 2025," and Germany’s "Industrie 4.0") further amplify the uptake of FDC solutions in production lines

Restraint/Challenge

High Implementation Costs and Integration Complexities

- One of the major restraints in the FDC market is the high initial cost associated with deploying advanced fault detection and classification systems, especially for small and medium-sized enterprises (SMEs)

- These systems often require significant investment in hardware (e.g., sensors, controllers), software platforms, and integration services, making them less accessible for budget-conscious manufacturers

- Integrating FDC solutions with legacy systems can be technically challenging, leading to delays and operational disruptions during implementation

- Skilled personnel are often required to operate and interpret FDC data outputs, which can be a hurdle in regions lacking technical expertise or sufficient training resources

- The fragmented nature of industrial data across different platforms and departments limits the ability of FDC systems to deliver holistic analysis, thereby reducing system efficiency

- Data privacy and intellectual property concerns—especially in multinational manufacturing setups—also act as a restraint, as companies are often hesitant to share sensitive production data with external platforms or cloud services

- In rapidly changing manufacturing environments, frequent system recalibration and model retraining may be needed, which adds to the maintenance burden and costs for end users

Fault and Classification (FDC) Market Scope

The market is segmented on the basis of offering type, application, and end use.

- By Offering Type

On the basis of offering type, the Fault and Classification (FDC) market is segmented into software, hardware, and services. The software segment dominated the largest market revenue share in 2024, accounting for 62.4%, owing to the critical role of data analytics, pattern recognition, and anomaly detection in real-time across industrial processes. Software tools help in reducing downtime and improving product quality by identifying faults early in the process. In addition, advanced software platforms are increasingly integrated with AI and machine learning capabilities, enabling predictive analytics and adaptive learning. Seamless integration with SCADA, MES, and ERP systems also makes software solutions highly scalable across multiple industry verticals.

The services segment is expected to witness the fastest CAGR of 10.3% from 2025 to 2032, driven by the growing demand for predictive maintenance, system integration, and technical support. As more companies adopt FDC solutions, they seek expert consulting and managed services to tailor these systems to their specific operational needs. Services also include regular software updates, troubleshooting, and employee training to ensure optimal system performance. The complexity of integrating FDC with legacy infrastructure requires specialized service providers, boosting the segment’s growth.

- By Application

On the basis of application, the Fault and Classification (FDC) market is segmented into manufacturing and packaging. The manufacturing segment held the largest market revenue share in 2024, supported by widespread adoption of FDC systems in high-precision environments such as electronics, automotive, and semiconductor production where fault detection is crucial to avoid defects and costly recalls. Manufacturers leverage these systems to monitor quality in real-time, reduce cycle time, and enhance throughput. FDC solutions in manufacturing also play a key role in ensuring regulatory compliance and traceability.

The packaging segment is projected to grow at the fastest CAGR of 9.8% from 2025 to 2032, owing to the increasing automation in food, pharmaceutical, and consumer goods industries. FDC systems in packaging ensure quality assurance by identifying issues such as mislabeling, seal failures, and fill-level discrepancies. These systems reduce rework and wastage by catching errors early in the production line. Packaging operations are increasingly using machine vision integrated with FDC software to achieve high-speed, high-accuracy inspections.

- By End Use

On the basis of end use, the Fault and Classification (FDC) market is segmented into automotive, electronics & semiconductor, and metal & machinery. The electronics & semiconductor segment led the market with a dominant revenue share of 39.6% in 2024, due to the sector’s heavy reliance on real-time monitoring and process control. The high complexity and cost of semiconductor fabrication make FDC indispensable for minimizing yield loss. FDC systems help detect micro-defects and anomalies in wafer processing, photolithography, and assembly stages. With increasing miniaturization and chip density, the margin for error is extremely low, necessitating robust FDC implementation.

The automotive segment is expected to grow at the fastest CAGR of 11.1% during the forecast period, driven by rising vehicle complexity and the integration of Industry 4.0 practices in production lines. Automakers are increasingly using FDC tools to enhance defect detection, reduce waste, and ensure compliance with quality standards. The shift toward electric vehicles (EVs) and autonomous technologies demands more stringent quality control, fueling FDC deployment.

Fault and Classification (FDC) Market Regional Analysis

- North America dominated the Fault and Classification (FDC) market with the largest revenue share of 33.7% in 2024, driven by the region’s early adoption of Industry 4.0 technologies and widespread investment in automated manufacturing solutions

- The strong presence of semiconductor, automotive, and electronics industries across the U.S. and Canada is fueling the demand for fault detection and classification systems to ensure high product quality and process reliability

- Significant R&D spending and the presence of key technology players—such as KLA Corporation, Cognex, and Applied Materials—support market expansion in this region

U.S. Fault and Classification (FDC) Market Insight

The U.S. fault and classification (FDC) market held the largest revenue share in North America in 2024, owing to the country’s leadership in semiconductor manufacturing and electronics. Strong governmental and private investments in smart manufacturing and the Industrial Internet of Things (IIoT) are encouraging the adoption of real-time analytics and fault prediction systems across sectors. U.S.-based tech companies are also advancing AI- and ML-powered FDC solutions that offer predictive insights, reducing production downtime and improving yield. Moreover, collaborations between technology providers and universities in the U.S. are fostering innovation in intelligent fault classification.

Europe Fault and Classification (FDC) Market Insight

The Europe fault and classification (FDC) market is projected to expand at a substantial CAGR during the forecast period, driven by the region’s focus on sustainable and defect-free production in automotive and aerospace sectors. Countries such as Germany, the U.K., and France are emphasizing automation, digital twins, and quality control, boosting demand for FDC platforms. European manufacturers are increasingly integrating machine learning algorithms to classify and rectify manufacturing defects in real-time. In addition, initiatives under “Industrie 4.0” and the EU’s Green Deal are encouraging the use of energy-efficient and precision-driven manufacturing systems powered by FDC technologies.

U.K. Fault and Classification (FDC) Market Insight

The U.K. fault and classification (FDC) market is expected to grow at a notable CAGR, supported by the rise of advanced manufacturing sectors and growing automation in production lines. Adoption of AI and IoT-based FDC solutions is growing rapidly across British pharmaceutical, defense, and machinery manufacturing industries. Supportive government policies promoting digital transformation in manufacturing (such as the UK’s Industrial Strategy) are further stimulating market growth.

Germany Fault and Classification (FDC) Market Insight

The Germany fault and classification (FDC) market, being the manufacturing hub of Europe, is a significant contributor to the regional FDC market. The country’s strong emphasis on precision engineering, automated factories, and predictive maintenance has made FDC solutions a core component of its industrial systems. High adoption of robotics and real-time analytics in German factories is reinforcing the demand for effective fault detection and classification systems.

Asia-Pacific Fault and Classification (FDC) Market Insight

The Asia-Pacific fault and classification (FDC) market is projected to witness the fastest CAGR of 24% from 2025 to 2032, driven by rapid industrialization and the growing presence of high-tech manufacturing in countries such as China, Japan, South Korea, and India. Government initiatives such as "Made in China 2025" and "Make in India" are promoting the deployment of intelligent manufacturing solutions, including FDC platforms. Rising demand for semiconductors, consumer electronics, and electric vehicles in the region is pushing companies to adopt real-time quality control and predictive diagnostics.

Japan Fault and Classification (FDC) Market Insight

The Japan fault and classification (FDC) market is seeing robust growth in the FDC market due to its dominance in robotics, automotive, and electronics manufacturing. The country’s focus on high-precision and high-efficiency manufacturing processes makes FDC tools essential for real-time anomaly detection. Japanese manufacturers are increasingly implementing AI-driven FDC systems to stay competitive and maintain their quality standards in global markets.

China Fault and Classification (FDC) Market Insight

The China fault and classification (FDC) market accounted for the largest market share in Asia-Pacific in 2024 due to its vast manufacturing ecosystem. The government’s push toward intelligent manufacturing and the growing adoption of advanced automation technologies across industries are supporting the FDC market’s growth. Strong domestic demand for consumer electronics, semiconductors, and EVs is leading Chinese manufacturers to invest in scalable and cloud-integrated FDC systems.

Fault and Classification (FDC) Market Share

The Fault and Classification (FDC) industry is primarily led by well-established companies, including:

- ADVANTEST CORPORATION (Japan)

- Amazon Web Services, Inc. (U.S.)

- Applied Materials, Inc. (U.S.)

- CIM Environmental Pty Ltd. (Australia)

- Cognex Corporation (U.S.)

- einnoSys Technologies Inc. (U.S.)

- INFICON (Switzerland)

- KILI TECHNOLOGY (U.K.)

- KLA Corporation (U.S.)

- Microsoft (U.S.)

- MobiDev (Ukraine)

- OMRON Corporation (Japan)

- Qualitas Technologies (U.S.)

- SAMSUNG SDS (South Korea)

- Siemens AG (Germany)

- Synopsys, Inc. (U.S.)

- Teradyne Inc. (U.S.)

- Tokyo Electron Limited (Japan)

Latest Developments in Global Fault and Classification (FDC) Market

- In September 2024, Washington State University researchers, supported by a U.S. Department of Energy grant, developed novel recycled carbon fiber components for the automotive industry focused on improved sustainability and fault classification accuracy

- In March 2024, Vartega Inc. expanded its services to supply recycled carbon fiber for industrial 3D‑printing, marking a sustainable shift in additive manufacturing and supporting fault detection applications in composite parts

- In March 2023, Samsung SDS launched an AI-powered FDC solution for transportation. The solution is designed to help transportation companies detect and classify faults in vehicles & infrastructure, improving safety and efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fault And Classification Fdc Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fault And Classification Fdc Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fault And Classification Fdc Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.