Global Farm Video Surveillance System Market

Market Size in USD Billion

CAGR :

%

USD

2.53 Billion

USD

6.59 Billion

2025

2033

USD

2.53 Billion

USD

6.59 Billion

2025

2033

| 2026 –2033 | |

| USD 2.53 Billion | |

| USD 6.59 Billion | |

|

|

|

|

Farm Video Surveillance System Market Size

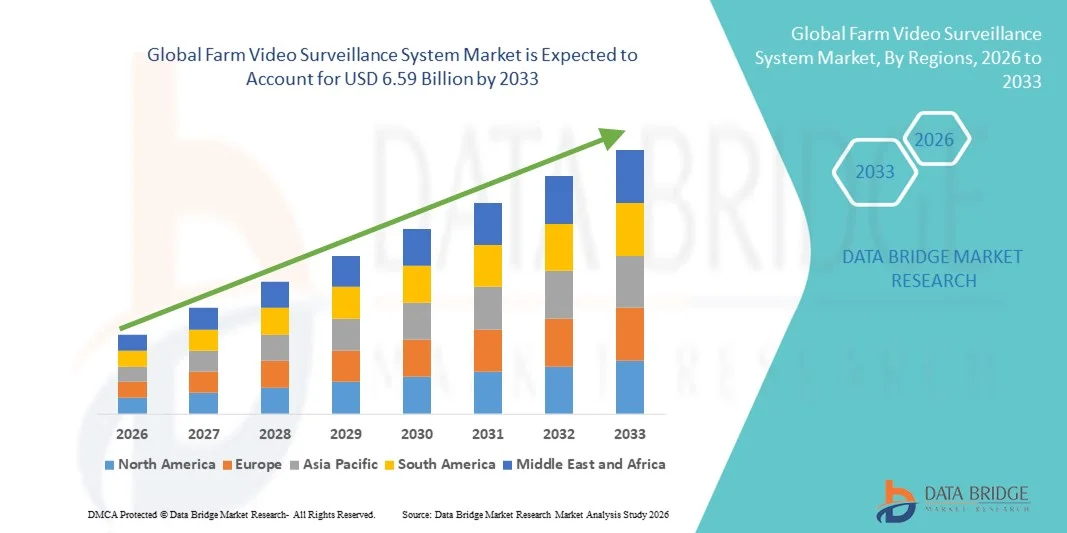

- The global farm video surveillance system market size was valued at USD 2.53 billion in 2025 and is expected to reach USD 6.59 billion by 2033, at a CAGR of 12.70% during the forecast period

- The market growth is largely fueled by the increasing adoption of smart farming practices and technological advancements in video surveillance systems, leading to enhanced monitoring, security, and operational efficiency across agricultural operations

- Furthermore, rising demand from farmers and agribusinesses for real-time, reliable, and integrated monitoring solutions for crops, livestock, and farm equipment is establishing farm video surveillance systems as essential tools in modern agriculture. These converging factors are accelerating the uptake of surveillance technologies, thereby significantly boosting market growth

Farm Video Surveillance System Market Analysis

- Farm video surveillance systems, offering real-time monitoring of livestock, crops, equipment, and farm operations, are increasingly vital components of modern agricultural management due to their ability to improve security, optimize productivity, and enable data-driven decision-making

- The escalating demand for these systems is primarily fueled by the adoption of precision farming, growing concerns over theft and crop/livestock safety, and the rising preference for remote monitoring and automated farm management solutions

- North America dominated the farm video surveillance system market with a share of over 37% in 2025, due to the increasing need for security and operational monitoring across commercial and large-scale farms, as well as growing awareness of advanced surveillance technologies

- Asia-Pacific is expected to be the fastest growing region in the farm video surveillance system market during the forecast period due to rapid urbanization, increasing disposable incomes, and technological adoption in countries such as China, India, and Japan

- Hardware segment dominated the market with a market share of 63% in 2025, due to the high demand for cameras, sensors, and recording equipment essential for farm monitoring. Farmers and agribusinesses often prioritize investing in robust hardware to ensure uninterrupted surveillance and long-term reliability

Report Scope and Farm Video Surveillance System Market Segmentation

|

Attributes |

Farm Video Surveillance System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Farm Video Surveillance System Market Trends

Rising Adoption of Smart and Connected Farm Monitoring Solutions

- A significant trend in the farm video surveillance system market is the increasing adoption of smart and connected monitoring solutions, driven by the need for real-time oversight of livestock, crops, and farm equipment to improve operational efficiency and security. These solutions are enabling farmers to remotely monitor farm activities, detect anomalies, and respond to issues promptly, enhancing productivity and reducing losses

- For instance, companies such as Arlo Technologies and Hikvision offer advanced farm surveillance cameras with IoT connectivity and AI-based analytics, allowing farms to track livestock movements, detect intrusions, and monitor environmental conditions remotely. These solutions are strengthening farm security and enabling proactive management decisions

- The integration of AI and machine learning into surveillance systems is allowing automated event detection such as unusual animal behavior or equipment malfunctions, reducing the need for constant manual monitoring. This trend is positioning smart surveillance as an indispensable tool for precision farming

- Drone-assisted video surveillance is gaining traction as drones equipped with high-resolution cameras provide aerial monitoring for large farmlands. These aerial insights support crop health assessment, irrigation planning, and early detection of pests or disease outbreaks

- Cloud-based video storage and analytics are becoming increasingly popular, enabling farmers to access historical data, generate reports, and analyze trends over time. This approach is supporting better farm management decisions and fostering predictive maintenance strategies

- The market is witnessing a strong push for integrated farm management platforms where surveillance systems complement sensors, weather stations, and automated equipment, creating a unified farm monitoring ecosystem. This rising incorporation of connected technologies is accelerating the adoption of data-driven agriculture practices

Farm Video Surveillance System Market Dynamics

Driver

Growing Demand for Real-Time Livestock, Crop, and Equipment Surveillance

- The increasing need for constant, real-time monitoring of livestock, crops, and farm machinery is driving the demand for advanced video surveillance systems that enhance farm productivity and security. These systems enable farmers to detect threats, monitor animal welfare, and track equipment usage efficiently

- For instance, companies such as Netvue and Dahua Technology provide farm surveillance solutions that offer motion detection, night vision, and remote access through mobile applications, helping farmers respond instantly to potential threats and operational issues

- The rising adoption of precision agriculture practices is creating demand for surveillance systems that can integrate with sensors and IoT devices to provide comprehensive farm insights. This integration supports better resource management and reduces operational costs

- Farmers are increasingly leveraging surveillance technology to comply with regulatory requirements for animal welfare and food safety, driving system adoption across dairy, poultry, and livestock farms

- The growing trend of smart farming initiatives and government-backed digital agriculture programs is supporting investments in connected surveillance systems. The expectation for enhanced operational control and risk mitigation continues to fuel market growth

Restraint/Challenge

High Initial Investment and Infrastructure Requirements

- The farm video surveillance system market faces challenges due to the high upfront costs of purchasing advanced cameras, sensors, drones, and supporting infrastructure such as network connectivity and cloud services. These costs can be prohibitive for small- and medium-sized farms

- For instance, installing end-to-end solutions from companies such as Hikvision or Axis Communications involves expenses for cameras, storage devices, and AI software integration, which may limit adoption among budget-conscious farmers

- Ensuring stable network connectivity across expansive or remote farmlands requires additional investment in wireless infrastructure, routers, and repeaters, increasing the complexity and cost of deployment

- Maintenance of surveillance systems, software updates, and potential repairs add to operational expenditures and require technical expertise

- The market continues to face constraints in providing affordable, scalable solutions that meet diverse farm sizes and geographic challenges. These barriers collectively affect adoption rates despite rising awareness of the benefits of farm surveillance technology

Farm Video Surveillance System Market Scope

The market is segmented on the basis of component and application.

- By Component

On the basis of component, the farm video surveillance system market is segmented into hardware and professional services. The hardware segment dominated the market with the largest revenue share of 63% in 2025, driven by the high demand for cameras, sensors, and recording equipment essential for farm monitoring. Farmers and agribusinesses often prioritize investing in robust hardware to ensure uninterrupted surveillance and long-term reliability. The segment’s growth is supported by advancements in camera resolution, night vision, and weather-resistant designs, enhancing monitoring efficiency in varied farm conditions. Hardware solutions also integrate easily with existing farm management systems, enabling real-time alerts and automated operations.

The professional services segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of installation, maintenance, and monitoring services across large-scale farms. For instance, companies such as Bosch Security offer end-to-end surveillance services that help farms optimize operations, reduce theft, and monitor crop and livestock health remotely. The rising complexity of surveillance systems and demand for expert support in data analysis further contribute to the growth of professional services. Integration with AI-driven analytics and predictive monitoring solutions also drives the rising adoption of these services.

- By Application

On the basis of application, the farm video surveillance system market is segmented into intruder monitoring, livestock & crop monitoring, water supply monitoring, employee monitoring, equipment monitoring, operations monitoring, and others. The intruder monitoring segment dominated the market in 2025, driven by the increasing need to protect valuable assets such as crops, livestock, and farm equipment from theft and vandalism. Farms often invest in high-resolution cameras and motion detection systems to ensure security across vast agricultural areas. The segment also benefits from integration with alarm systems and mobile notifications, enabling farm owners to respond quickly to security breaches. Demand is further boosted by government regulations and insurance requirements that emphasize farm security compliance.

The livestock & crop monitoring segment is expected to register the fastest growth from 2026 to 2033, fueled by the rising adoption of precision farming practices. For instance, companies such as DJI offer drone-based and camera-assisted monitoring solutions that help farmers track livestock movement, detect crop diseases, and optimize irrigation schedules. Advanced monitoring solutions provide real-time data analytics and remote access, enabling improved farm productivity and resource management. Increased focus on sustainable agriculture and yield optimization drives the adoption of these applications across farms of all scales.

Farm Video Surveillance System Market Regional Analysis

- North America dominated the farm video surveillance system market with the largest revenue share of over 37% in 2025, driven by the increasing need for security and operational monitoring across commercial and large-scale farms, as well as growing awareness of advanced surveillance technologies

- Farmers and agribusinesses in the region highly value the real-time monitoring, remote accessibility, and integration capabilities offered by farm video surveillance systems with other farm management solutions such as automated irrigation and livestock tracking

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the growing preference for precision agriculture solutions, establishing video surveillance systems as a favored investment for both productivity and security purposes

U.S. Farm Video Surveillance System Market Insight

The U.S. farm video surveillance system market captured the largest revenue share in 2025 within North America, fueled by the adoption of connected monitoring solutions and the expanding trend of smart farming. Farmers are increasingly prioritizing surveillance systems to protect crops, livestock, and equipment, as well as to optimize farm operations through remote monitoring. The growing preference for scalable solutions, combined with robust demand for mobile and web-based monitoring platforms, further propels the market. Moreover, integration with IoT-enabled sensors and AI-driven analytics is significantly contributing to market expansion.

Europe Farm Video Surveillance System Market Insight

The Europe farm video surveillance system market is projected to expand at a substantial CAGR during the forecast period, primarily driven by the need for enhanced farm security, compliance with safety regulations, and the rising adoption of precision farming practices. Increased urbanization and technological awareness among farmers are fostering the uptake of video surveillance systems. European farmers are also drawn to solutions that improve operational efficiency and reduce crop and livestock losses. The region is witnessing significant adoption across both small-scale and industrial farms, with surveillance systems integrated into new and existing agricultural setups.

U.K. Farm Video Surveillance System Market Insight

The U.K. farm video surveillance system market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of smart farming and a focus on crop and livestock security. Concerns regarding theft, animal welfare, and operational monitoring are encouraging both small and large farms to adopt connected surveillance solutions. The U.K.’s robust digital infrastructure and increasing familiarity with IoT-enabled devices are expected to continue stimulating market growth.

Germany Farm Video Surveillance System Market Insight

The Germany farm video surveillance system market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced agricultural monitoring technologies and the demand for technologically integrated solutions. Germany’s well-developed farming infrastructure, combined with its focus on sustainability and efficiency, promotes the adoption of video surveillance systems across both crop and livestock operations. Integration with farm management platforms and AI-enabled analytics is also becoming increasingly prevalent, supporting secure and efficient farm operations.

Asia-Pacific Farm Video Surveillance System Market Insight

The Asia-Pacific farm video surveillance system market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, increasing disposable incomes, and technological adoption in countries such as China, India, and Japan. The region’s growing interest in precision farming, supported by government initiatives and digital agriculture programs, is fueling the uptake of video surveillance systems. Furthermore, APAC’s emergence as a hub for affordable surveillance equipment and IoT-enabled farm solutions is expanding accessibility to a wider farming community.

Japan Farm Video Surveillance System Market Insight

The Japan farm video surveillance system market is gaining momentum due to the country’s high-tech agricultural practices, rapid urbanization, and demand for operational efficiency. Japanese farmers emphasize livestock welfare and crop protection, and the adoption of video surveillance systems is driven by the integration with smart farm platforms and automated monitoring solutions. Aging farmers are also likely to increase demand for easy-to-use and reliable monitoring systems that reduce manual oversight.

China Farm Video Surveillance System Market Insight

The China farm video surveillance system market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the expanding commercial farming sector, rapid urbanization, and high adoption of smart farm technologies. China is one of the largest markets for precision agriculture devices, and video surveillance systems are increasingly used for crop monitoring, livestock management, and equipment tracking. Government initiatives promoting smart agriculture, along with competitive domestic manufacturers, are key factors propelling market growth in China.

Farm Video Surveillance System Market Share

The farm video surveillance system industry is primarily led by well-established companies, including:

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Dahua Technology Co., Ltd. (China)

- Axis Communications AB (Sweden)

- Bosch Sicherheitssysteme GmbH (Germany)

- Hanwha Techwin America (U.S.)

- Avigilon Corporation (Canada)

- FLIR Systems, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Panasonic i-PRO Sensing Solutions Co., Ltd. (Japan)

- Pelco (U.S.)

- Agent Video Intelligence Ltd (Israel)

- CP PLUS (India)

- Genetec Inc. (Canada)

Latest Developments in Global Farm Video Surveillance System Market

- In February 2026, industry trends emphasized a major shift toward cellular monitoring for off-grid surveillance systems, with ranchers increasingly replacing traditional trail cams with live-streaming, solar-powered cellular camera networks. This change is driving market growth by expanding reliable, real-time monitoring across remote farms and ranches where Wi-Fi is unavailable, underscoring the rising need for robust, always-connected surveillance infrastructure

- In December 2025, modern farm and ranch camera technology advancements significantly enhanced agricultural security, with integrated AI-enabled autonomous systems and edge processing delivering proactive threat detection across remote properties. These innovations are influencing the market by enabling smart, data-driven surveillance that reduces false alerts and expands remote monitoring capabilities, accelerating adoption among large-scale farming operations

- In June 2025, advanced 3D video monitoring technology was deployed at a land-based college farm to transform dairy livestock care, using combined 2D/3D infrared cameras and real-time analytics to monitor cow health and mobility. This highlights the market shift toward smart monitoring systems that improve animal welfare, enhance productivity, and demonstrate the value of real-time data-driven insights for commercial farms, boosting demand for high-end surveillance solutions in agriculture

- In June 2024, Hogeye launched its Farm & Ranch Camera System to elevate safety and security, showcasing enhanced remote monitoring features for agricultural environments. This launch underscored growing farmer demand for integrated, rugged surveillance solutions that provide real-time visibility and remote access across farmland, reinforcing the importance of specialized video systems in protecting assets and livestock

- In February 2024, Yokogawa Electric Corporation completed the design, supply, and commissioning of a remote operation and monitoring system for offshore and onshore agricultural operations, providing end-to-end monitoring and maintenance capabilities. This development emphasizes the market’s expansion toward comprehensive, scalable monitoring systems that integrate multiple farm operations, increasing operational efficiency and safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.