Global Fabric Softener and Conditioners Market Segmentation, By Product Type (Liquid, Dryer Sheets, Dryer Bars, Tablets, and Sprays), Application (Residential and Commercial), Distribution Channel (Store-Based Retail and Non-Store Retail), Nature (Organic and Conventional) - Industry Trends and Forecast to 2032

Fabric Softener and Conditioners Market Size

-

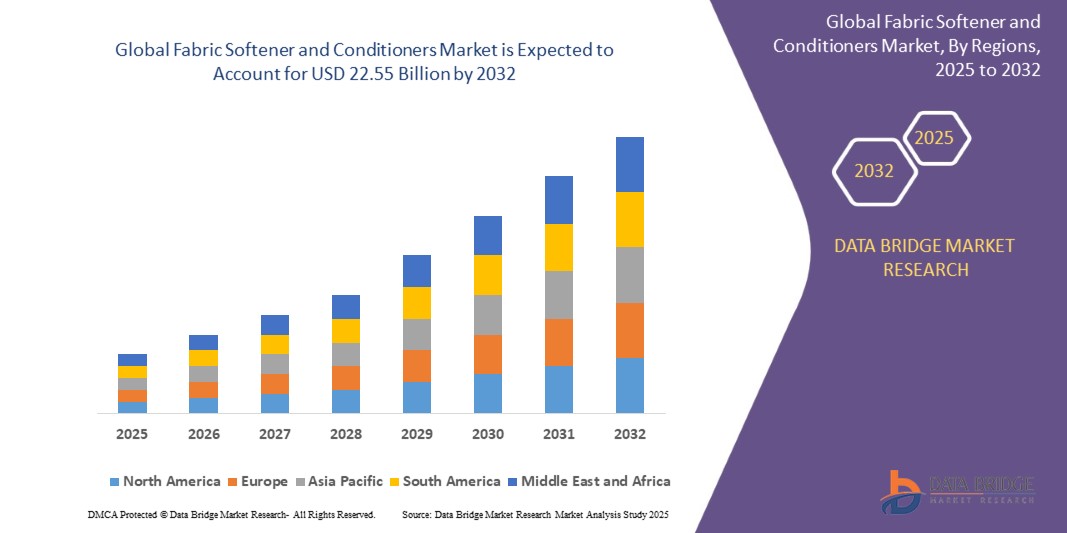

The global fabric softener and conditioners market size was valued at USD 15.31 billion in 2024 and is expected to reach USD 22.55 billion by 2032, at a CAGR of 4.96% during the forecast period

- This growth is driven by rising personal disposable income

Fabric Softener and Conditioners Market Analysis

-

Fabric softener and conditioners are laundry care products designed to soften fabric, reduce static cling, and enhance fragrance retention. They are widely used across both residential and commercial sectors for enhancing garment care and improving the overall laundry experience

- The demand for fabric softener and conditioners is being significantly driven by increasing consumer focus on fabric care, rising awareness of garment longevity, and the growing preference for pleasant-smelling and fresh-feeling clothes

- Asia-Pacific is expected to dominate the fabric softener and conditioners market with the market share of 39.37%, due to mature consumer base, high product penetration, growing demand for premium laundry care, and widespread retail and e-commerce channels

- North America is projected to be the fastest-growing region in the fabric softener and conditioners market, fueled by urbanization, increasing disposable incomes, and growing adoption of convenient and time-saving household products

- The commercial segment is expected to dominate the market with the market share of 66.98%, driven by the hospitality and healthcare sectors, large-scale laundry services, and a rising focus on hygiene standards. In addition, liquid fabric softeners are anticipated to lead the market owing to their ease of use, quick dissolving capabilities, and wide variety of fragrance options

Report Scope and Fabric Softener and Conditioners Market Segmentation

|

Attributes

|

Fabric Softener and Conditioners Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players

|

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Fabric Softener and Conditioners Market Trends

“Innovation in Fragrance and Sensory Experience”

- The market is witnessing a surge in demand for multi-sensory experiences, with consumers increasingly preferring fabric softeners and conditioners that offer long-lasting freshness, aromatherapy benefits, and customized fragrance blends

- Manufacturers are focusing on scent layering technologies, micro-encapsulation, and mood-enhancing fragrances to cater to diverse consumer preferences and enhance the laundry experience

- New product innovations are being driven by consumer emotions—associating freshness with comfort, nostalgia, and luxury, especially in premium product segments

- For instance, in March 2025, Downy (Procter & Gamble) launched its "MoodScents" range, blending fragrances such as lavender-vanilla and citrus-rose to elevate emotional wellness through laundry care

- This trend is shaping R&D investments, encouraging co-branding with perfume companies, and differentiating products in an otherwise commoditized category

Fabric Softener and Conditioners Market Dynamics

Driver

“Rising Demand for Hypoallergenic and Dermatologically-Tested Products”

-

With growing concerns around skin sensitivity, allergies, and chemical exposure, there is an increasing shift toward hypoallergenic, dye-free, and fragrance-free fabric softeners

- Dermatologically-tested formulations are gaining popularity, especially among households with infants, elderly, or sensitive skin users, prompting brands to clearly label and certify their products

- Regulatory encouragement for transparency in ingredient disclosure is further pushing brands toward cleaner, health-focused formulations

- For instance, in February 2025, Seventh Generation introduced a new ultra-sensitive line certified by dermatologists and free from known irritants, targeting skin-conscious consumers

- This driver is reshaping product positioning and marketing, particularly in North America and Europe, where consumer demand for “clean label” household care is rising

Opportunity

“Expansion in Emerging Markets through Affordable SKUs”

-

Growing middle-class populations in Asia-Pacific, Latin America, and Africa are opening new opportunities for fabric softener brands offering smaller, affordable SKUs suited to price-sensitive consumers

- Regional players and global brands alike are launching travel-size, sachet, and refill pouches, allowing broader penetration even in rural or semi-urban areas

- These markets also exhibit high brand loyalty potential, offering a long-term customer base when approached with strategic pricing and localized marketing

For instance,

- In January 2025, Unilever launched a budget-friendly Comfort pouch variant in Indonesia and the Philippines, driving significant volume growth through mom-and-pop store distribution

- In October 2024, Colgate-Palmolive rolled out small-format fabric conditioner packs in Kenya, targeting first-time users and expanding rural presence

- Affordable SKUs increase adoption and help in brand trial and conversion in untapped segments of emerging economies

Restraint/Challenge

“Consumer Misconceptions and Low Product Awareness in Some Regions”

-

Growing middle-class populations in Asia-Pacific, Latin America, and Africa are opening new opportunities for fabric softener brands offering smaller, affordable SKUs suited to price-sensitive consumers

- Regional players and global brands alike are launching travel-size, sachet, and refill pouches, allowing broader penetration even in rural or semi-urban areas

- These markets also exhibit high brand loyalty potential, offering a long-term customer base when approached with strategic pricing and localized marketing

Fabric Softener and Conditioners Market Scope

The market is segmented on the basis of product type, application, distribution channel, and nature.

|

Segmentation

|

Sub-Segmentation

|

|

By Product Type

|

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Nature

|

|

In 2025, the liquid segment is projected to dominate the market with a largest share in application segment

The liquid segment is expected to dominate the fabric softener and conditioners market with the largest share of 56.76% in 2025 due to growing preference for trendy and versatile bags among young and urban consumers. As a favored choice for both style and practicality, the integration of eco-friendly materials and modern aesthetics boosts demand, supporting market growth. Rising environmental awareness, evolving fashion trends, and increasing disposable incomes are key factors contributing to the segment’s dominance.

The commercial is expected to account for the largest share during the forecast period in application segment

In 2025, the commercial segment is expected to dominate the fabric softener and conditioners market with the largest share of 66.98% due to increased demand from hotels, hospitals, and laundromats for bulk usage and enhanced fabric care solutions.

Fabric Softener and Conditioners Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Fabric Softener and Conditioners Market”

- Asia-Pacific dominates the fabric softener and conditioners market with the market share of 39.37% owing to its vast population base, rising disposable incomes, and growing preference for enhanced laundry care solutions across emerging economies

- Countries such as China, India, and Japan lead the regional market due to heightened awareness of hygiene, increased urbanization, and expansion of retail and e-commerce channels

- The presence of local and global manufacturers, coupled with aggressive marketing strategies and the introduction of eco-conscious and fragrance-rich products, further fuels growth in the region

- The increasing demand for fabric care solutions tailored to tropical climates and diverse fabric types continues to drive strong consumer adoption in Asia-Pacific

“North America is projected to register the Highest CAGR in the Fabric Softener and Conditioners Market”

- North America is expected to witness the highest CAGR in the fabric softener and conditioners market driven by increasing consumer awareness regarding eco-friendly and sustainable products, particularly in the U.S. and Canada

- The rising trend of personalization and premiumization in fabric softeners, as well as the growing demand for plant-based and organic formulations, is propelling market expansion in this region

- Major market players are focusing on innovations such as concentrated fabric softeners and biodegradable solutions to cater to the environmentally conscious consumer

- The increasing popularity of online shopping and direct-to-consumer strategies in North America further supports the strong growth projections for the market

Fabric Softener and Conditioners Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Reckitt (U.K.)

- Lion Corporation (Japan)

- Dropps (U.S.)

- Procter & Gamble (U.S.)

- Kao Corporation (Japan)

- Unilever (U.K.)

- LG H&H Co., Ltd. (South Korea)

- Henkel AG & Co. KGaA (Germany)

- Colgate-Palmolive Company (U.S.)

- Marico (India)

- The Clorox Company (U.S.)

- Seventh Generation Inc. (U.S.)

- Ecover (Belgium)

- Godrej Consumer Products Limited (India)

- AlEn USA (U.S.)

- S.C. Johnson & Son Inc. (U.S.)

- Church & Dwight Co., Inc. (U.S.)

- Melaleuca Inc. (U.S.)

- Werner & Mertz (Germany)

Latest Developments in Global Fabric Softener and Conditioners Market

- In May 2024, Comfort introduced a new botanical-inspired collection of fabric conditioners, featuring natural-scented fragrances aimed at consumers seeking a fresh and nature-derived laundry experience. This product line is expected to strengthen Comfort’s position in the premium fragrance segment

- In February 2024, LION CORPORATION rolled out the "SOFLAN Premium Deodorizer," a fabric softener formulated with powerful antibacterial agents to inhibit bacterial growth and odors before garments are fully dry. This innovation reflects the rising demand for hygienic and functional fabric care solutions in the Asia-Pacific market

- In August 2023, Colgate-Palmolive launched Soupline Hearts Concentrates, a concentrated line of fabric conditioners that provide the same softness and fragrance as regular variants while using significantly less plastic. This initiative reinforces the brand’s commitment to sustainability and environmental responsibility

- In September 2022, Lenor, under Procter & Gamble, unveiled three new "Outdoorable" fabric conditioners featuring Solar Dry technology. This launch was part of Lenor’s innovation drive to broaden the consumer base and enhance freshness during line-drying. The move demonstrates Lenor's investment in performance-based innovation

- In August 2021, Unilever launched Comfort’s Ultimate Care fabric conditioners, formulated to extend the life of garments while reducing environmental impact. This step aligns with the brand’s long-term goal of sustainable fabric care and garment longevity

SKU-