Global Eukaryotic Expression Systems Market

Market Size in USD Billion

CAGR :

%

USD

764.42 Billion

USD

1,173.14 Billion

2024

2032

USD

764.42 Billion

USD

1,173.14 Billion

2024

2032

| 2025 –2032 | |

| USD 764.42 Billion | |

| USD 1,173.14 Billion | |

|

|

|

|

Eukaryotic Expression Systems Market Size

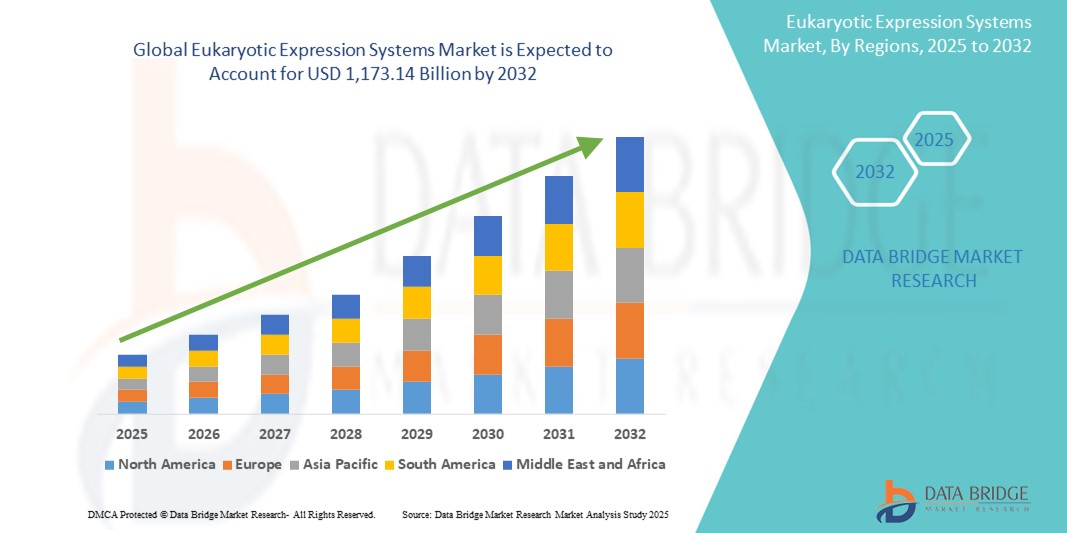

- The global eukaryotic expression systems market size was valued at USD 764.42 billion in 2024 and is expected to reach USD 1,173.14 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the increasing utilization of eukaryotic expression systems in biologics production, particularly monoclonal antibodies, vaccines, and recombinant proteins, due to their superior ability to perform complex post-translational modifications compared to prokaryotic systems

- Furthermore, rising demand for advanced therapies, such as gene therapy and personalized medicine, is establishing eukaryotic expression platforms—especially mammalian and yeast cells—as the preferred systems for high-yield, high-fidelity protein expression. These converging factors are accelerating the adoption of Eukaryotic Expression Systems solutions, thereby significantly boosting the industry's growth

Eukaryotic Expression Systems Market Analysis

- Eukaryotic expression systems, such as mammalian, yeast, and insect cells, are increasingly vital components in modern biopharmaceutical manufacturing due to their ability to perform complex post-translational modifications and produce human-compatible therapeutic proteins, vaccines, and monoclonal antibodies

- The escalating demand for high-quality biologics, rising prevalence of chronic diseases, and growing investments in gene and cell therapy development are key drivers fueling the adoption of eukaryotic expression systems across pharmaceutical and biotechnology industries

- North America dominated the eukaryotic expression systems market with the largest revenue share of 41.6% in 2024, driven by the strong presence of key biologics manufacturers, advanced healthcare infrastructure, high R&D spending, and favorable regulatory support. The U.S. leads the region with extensive biopharma production capabilities and adoption of advanced expression platforms

- Asia-Pacific is expected to be the fastest-growing region in the eukaryotic expression systems market, projected to register a CAGR of 11.8% from 2025 to 2032, fueled by rapid expansion of the biotechnology sector, growing outsourcing trends, and rising healthcare investments in countries such as China, India, and South Korea

- CHO (Chinese Hamster Ovary) cell line systems dominated the eukaryotic expression systems market with a market share of 34.6% in 2024, owing to their extensive use in producing therapeutic proteins, especially monoclonal antibodies, due to their high expression efficiency, scalability, and capacity for proper protein folding and post-translational modifications essential for biologic function and safety

Report Scope and Eukaryotic Expression Systems Market Segmentation

|

Attributes |

Eukaryotic Expression Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Eukaryotic Expression Systems Market Trends

“Increasing Demand for High-Yield, Scalable Protein Production Platforms”

- A significant and accelerating trend in the global eukaryotic expression systems market is the increasing reliance on high-efficiency platforms for producing complex recombinant proteins used in therapeutics, diagnostics, and vaccine development

- For instance, Chinese Hamster Ovary (CHO) cells are widely used in biologics manufacturing due to their ability to produce human-like glycosylation patterns. Companies are investing in optimizing these systems to reduce costs and improve yields

- Eukaryotic systems such as yeast and insect cells are being leveraged for their scalability and ability to express proteins with post-translational modifications, crucial for the bioactivity of therapeutic proteins

- Moreover, advancements in gene editing tools and synthetic biology are enabling more precise genetic modifications in host systems such as S. cerevisiae, thereby improving productivity and customization

- Integration of these systems into bioprocess automation workflows is driving greater reproducibility and efficiency, making them increasingly attractive for large-scale commercial use

- As regulatory bodies increasingly favor biologics and biosimilars, demand for robust, compliant, and cost-effective expression systems is surging across both established markets and emerging economies. This is paving the way for expanded adoption of eukaryotic expression platforms in drug discovery and biomanufacturing pipelines

Eukaryotic Expression Systems Market Dynamics

Driver

“Growing Need Due to Rising Demand for Advanced Therapeutics and Biologics”

- The increasing prevalence of chronic diseases and the rising demand for targeted biologic therapies are significant drivers fueling the adoption of eukaryotic expression systems

- For instance, in April 2024, Thermo Fisher Scientific launched a new high-efficiency CHO expression platform designed to accelerate biologic development and manufacturing. Such innovations by key players are expected to drive the eukaryotic expression systems industry growth during the forecast period

- As pharmaceutical companies increasingly shift toward producing complex biologics such as monoclonal antibodies, vaccines, and therapeutic proteins, eukaryotic systems offer the ability to carry out post-translational modifications necessary for proper protein function

- Furthermore, the growing popularity of personalized medicine and the rise in R&D investments are positioning eukaryotic expression systems—particularly mammalian and yeast systems—as core technologies for advanced therapeutic development

- The ability to scale up production efficiently, coupled with flexibility in expressing various recombinant proteins, makes these systems ideal for both academic research and large-scale commercial bioproduction. The emergence of biosimilars and increasing outsourcing to CROs and CMOs are also contributing to the robust market expansion

Restraint/Challenge

“Complexity, High Production Costs, and Regulatory Hurdles”

- Despite their advantages, eukaryotic expression systems often require sophisticated infrastructure, skilled personnel, and costly reagents—posing financial and operational barriers for smaller biotech firms and research labs

- For instance, mammalian systems such as CHO cells, while offering high yield and quality, entail lengthy development timelines, complex culture requirements, and high media costs, limiting their accessibility in resource-constrained settings

- Moreover, stringent regulatory requirements surrounding the use of genetically modified organisms and biologic production add complexity to approval pathways. Ensuring batch consistency, purity, and meeting Good Manufacturing Practice (GMP) standards remains a challenge

- Addressing these issues through innovations in vector design, host cell engineering, and process optimization is essential to reducing time-to-market and production expenses

- Wider adoption also hinges on improving scalability and reducing dependency on animal-derived components, while ensuring robust protein expression. Regulatory clarity and global harmonization efforts will be crucial to facilitating smoother product development and commercialization

Eukaryotic Expression Systems Market Scope

The market is segmented on the basis of type, host type, and application.

• By Type

On the basis of type, the eukaryotic expression systems market is segmented into MEL, COS, CHO, insect cells, reagents, expression vectors, and competent cells. The CHO (Chinese Hamster Ovary) cell line segment held the largest market revenue share of 34.6% in 2024, owing to its widespread application in producing therapeutic proteins, particularly monoclonal antibodies.

The insect cells segment is projected to witness the fastest CAGR of 10.9% from 2025 to 2032, driven by increasing demand for complex protein expression using baculovirus systems in pharmaceutical and vaccine development.

• By Host Type

On the basis of host type, the market is segmented into S. cerevisiae, Filamentous Fungi, Leishmania, and Baculovirus-Infected Cells. The S. cerevisiae (baker’s yeast) segment captured the highest market share of 28.7% in 2024, supported by its broad usage in industrial biotechnology and ease of genetic manipulation.

The Leishmania segment is expected to grow at the highest CAGR of 11.3% during the forecast period, attributed to its superior post-translational modification capabilities and increasing interest in vaccine and therapeutic research.

• By Application

On the basis of application, the market is segmented into Bacterial Expression System, Yeast Expression System, Insect Expression System, and Mammalian Expression System. The Mammalian Expression System segment dominated with a market share of 41.2% in 2024, due to its pivotal role in manufacturing biopharmaceuticals requiring human-like protein structures.

The Yeast Expression System segment is anticipated to register the fastest CAGR of 9.8% from 2025 to 2032, driven by rising demand for scalable, cost-effective production platforms in diagnostics, therapeutics, and industrial enzymes.

Eukaryotic Expression Systems Market Regional Analysis

- North America dominated the with the largest revenue share of 41.6% in 2024, driven by the strong presence of key biologics manufacturers, advanced healthcare infrastructure, high R&D spending, and favorable regulatory support

- U.S. leads the region with extensive biopharma production capabilities and adoption of advanced expression platforms

- The demand is particularly strong in the U.S. and Canada due to the rising need for biologics and gene therapies, which require robust and scalable expression platforms such as CHO and yeast systems

U.S. Eukaryotic Expression Systems Market Insight

The U.S. eukaryotic expression systems market accounted for 82.5% of the North American market share in 2024, underpinned by its strong pharmaceutical industry, well-established academic research institutions, and the increasing number of FDA-approved biologics. The growing adoption of precision medicine and the presence of contract development and manufacturing organizations (CDMOs) are further propelling market growth.

Europe Eukaryotic Expression Systems Market Insight

The Europe eukaryotic expression systems market is projected to grow at a CAGR of 10.4% from 2025 to 2032, driven by expanding biosimilar approvals and increasing investment in personalized medicine. Germany, the U.K., and France lead the regional growth with strong manufacturing capabilities and innovation-driven biotechnology sectors.

U.K. Eukaryotic Expression Systems Market Insight

The U.K. eukaryotic expression systems market is expected to grow at a CAGR of 9.8% during the forecast period, supported by robust academic-industry collaborations and favorable government funding for life sciences and biologics research.

Germany Eukaryotic Expression Systems Market Insight

The Germany eukaryotic expression systems market is anticipated to register a CAGR of 9.5% from 2025 to 2032, driven by increasing demand for advanced therapeutic proteins and the country’s focus on automation and high-throughput biologics production technologies.

Asia-Pacific Eukaryotic Expression Systems Market Insight

The Asia-Pacific eukaryotic expression systems market is poised to grow at the fastest CAGR of 11.8% from 2025 to 2032, owing to a surge in biologics development, rising healthcare expenditure, and growing clinical research activities. In 2024, the region accounted for 21.2% of the global revenue, with China, India, and Japan driving adoption due to improved infrastructure and supportive regulatory environments.

Japan Eukaryotic Expression Systems Market Insight

The Japan eukaryotic expression systems market is expected to grow at a CAGR of 11.7% during the forecast period, backed by its strong focus on regenerative medicine, integration of advanced bioprocessing technologies, and rising demand for efficient protein expression platforms for drug development.

China Eukaryotic Expression Systems Market Insight

The China eukaryotic expression systems market held the largest market share in Asia-Pacific at 38.6% in 2024, driven by a rapidly expanding biotechnology industry, government-backed research initiatives, and a rise in partnerships with global pharmaceutical companies. The country is also witnessing significant growth in outsourcing biologics production to domestic CDMOs utilizing eukaryotic cell expression systems.

Eukaryotic Expression Systems Market Share

The Eukaryotic Expression Systems industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- QIAGEN (Germany)

- Promega Corporation (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- GenScript (U.S.)

- New England Biolabs (U.S.)

- OXFORD EXPRESSION TECHNOLOGIES LTD (U.K.)

- LifeSensors Inc. (U.S.)

- Lonza (Switzerland)

- ProteoGenix (France)

- Viridos Inc. (U.S.)

- Sygnature Discovery Ltd (U.K.)

- Sino Biological Inc. (China)

- ARTES Biotechnology GmbH (Germany)

Latest Developments in Global Eukaryotic Expression Systems Market

- In January 2023, Agilent Technologies partnered with Akoya Biosciences to develop multiplex-immunohistochemistry and immunofluorescence workflows. By combining Agilent’s Dako Omnis autostainer and Akoya’s PhenoImager HT imaging platform, both companies aim to deliver an end-to-end commercial solution for tissue biomarker analysis in precision oncology

- In April 2025, Akoya Biosciences teamed up with Enable Medicine to launch the world’s largest commercially available single-cell spatial proteomics atlas, profiling over 100 million cells across 8,500+ samples and 15 cancer types — a significant milestone in spatial biology

- In January 2025, Genethon and Eukarÿs announced a strategic partnership to reduce biomanufacturing costs for gene therapies. The collaboration leverages Eukarÿs’ proprietary C3P3 mRNA expression platform within mammalian cells

- In April 2025, AGC Biologics launched a dedicated Cell & Gene Technologies Division across global CDMO sites. This expands manufacturing capacity for viral vectors and cell therapies, supporting accelerated development pipelines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.