Global Ethylbenzene Market

Market Size in USD Billion

CAGR :

%

USD

3.28 Billion

USD

4.43 Billion

2022

2030

USD

3.28 Billion

USD

4.43 Billion

2022

2030

| 2023 –2030 | |

| USD 3.28 Billion | |

| USD 4.43 Billion | |

|

|

|

|

Ethylbenzene Market Analysis and Size

A monocyclic organic molecule with the chemical formula C6H5CH2CH3, ethylbenzene is an organic substance. It is a flammable, white liquid with a smell reminiscent of gasoline. It is extensively utilized in the petrochemical sector as a manufacturing intermediary for styrene and as a polystyrene precursor. Commercial production of it involves blending benzene and ethylene. The market is anticipated to be driven by the growing use of ethylbenzene as an anti-knocking ingredient in gasoline.

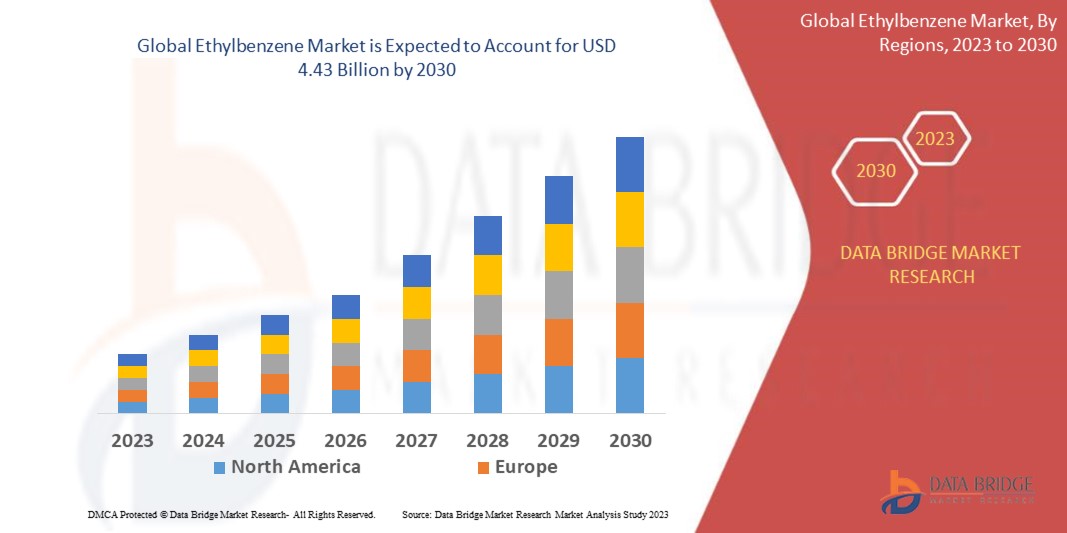

Data Bridge Market Research analyses that the global ethylbenzene market which was USD 3.28 billion in 2022, is expected to reach USD 4.43 billion by 2030, and is expected to undergo a CAGR of 3.83% during the forecast period 2022-2030. “Styrene” dominates the application segment of the global ethylbenzene market due to The main drivers of the segment's growth include the expanding usage of various styrene-based polymers, elastomers, and resin in a variety of end-user sectors, including electronics, packaging, agriculture, petrochemicals, and construction. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Ethylbenzene Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2023 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (AICI3 Liquid Hydrocarbon Method, Zeolite Gas Catalystic Method, Zeolite Liquid Catalysitc Method), Product (Purity >99%, Purity >98%, Others), Application (Styrene, Gasoline, Diethylbenzene, Natural Gas, Plastics, Rubber/Latex, Paints, Asphalt & Naphtha), End-User (Packaging, Electronics, Construction, Agriculture) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Cepsa (Spain), Deten Quimica S.A. (Brazil), Chevron Phillips Chemical Company (U.S), Honeywell International Inc (U.S.), Huntsman International LLC. (U.S.), Reliance Industries Limited (India), Jingtung Petrochemical Corp., Ltd (China), SASOL (South Africa), PT Unggul Indah Cahaya Tbk (Indonesia), Desmet Ballestra (France), Farabi Petrochemicals Co. (Saudi Arabia), S.B.K HOLDING (U.A.E), Indian Oil Corporation Ltd (India), Qatar Petroleum (Qatar), JXTG Nippon Oil & Energy Corporation (Japan), and ISU Chemical (South Korea) |

|

Market Opportunities |

|

Market Definition

Ethylbenzene is a transparent, flammable liquid that is produced commercially by the catalysed reaction of ethylene and benzene at around 40 pressure and temperatures around 250 °C. It smells a lot like gasoline. The substance is frequently utilized as a starting point to make styrene monomer. The substance is produced for industrial use by mixing ethylene and benzene in an acid-catalyzed process; it is found naturally in coal tar and petroleum.

Ethylbenzene Market Dynamics

Drivers

- Ethylbenzene is Being Used More Often to Make Styrene

The widespread use of ethyl benzene in the manufacture of styrene will spur an increase in demand. Styrene is a precursor to several chemicals, including acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN), resins, polystyrene, acrylonitrile butadiene, styrene protective coatings, SBR, and styrene polyester, which will drive the expansion of the ethylbenzene industry in the next ten years. The main factors influencing the growth of the ethylbenzene market are the rising demand for styrene from various end-user industries and the rising use of ethylbenzene in the recovery of natural gas. Additionally, ethylbenzene demand is predicted to rise throughout the course of the forecast period due to the widespread usage of styrene-based polymers, elastomers, and resins in a variety of end-user sectors, including electronics, packaging, agriculture, petrochemicals, and construction.

- The Global Gasoline Market's Rising Demand

The expansion of ethylbenzene in fuel effectively reduces the knocking of the internal combustion (IC) engines. The fuel's octane value is also increased above normal levels, making it one of the most efficient fuels available. The development of efficient fuels has begun in response to the rising demand for gasoline globally. The development of ethylbenzene as a fuel efficiently satisfies this desire for more modern fuels, which in turn is propelling the ethylbenzene market.

Opportunities

- The Expanding Automobile, Agricultural, and Construction Industries

The worldwide ethylbenzene market is expected to provide lucrative prospects in the application sector. Many emerging nations are making substantial changes to their laws governing the use of ethylbenzene, creating attractive prospects for market participants. During the projected period, the growing usage of ethylbenzene in end-use sectors such polymer, construction, automotive, and agricultural is anticipated to fuel market expansion. Ethylbenzene is also commonly used in the paint and coating industries to make lacquers, paints, and varnishes. Ethylbenzene is also a component used in the manufacture of insecticides for the agricultural sector.

Restraint/Challenge

- The Effects of Prolonged and Excessive Exposure to Ethylbenzene on Humans

Since concentrations of ethylbenzene are frequently present in soil and air and are easily transported from soil and water, prolonged and excessive exposure to it can have negative effects on human health. In the upcoming years, the ethylbenzene market may see some restraint due to rising worries about the dangers of ethylbenzene, such as throat and eye irritation, dizziness, and other neurological effects. Additionally, it is anticipated that one of the major factors impeding market expansion in the projected period will be the existence of strict laws and regulations of various governments regulating the use of ethylbenzene.

This global ethylbenzene market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ethylbenzene market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In April 2021, In order to produce gasoline that burns cleaner and complies with increasingly strict regulations, such as the euro V standard, which caps the sulphur content and limits carbon emissions from gasoline and diesel vehicles, Honeywell today announced a new refinery configuration created by Honeywell UOP

- In May 2021, the polystyrene substance has made a significant contribution to social progress for over a century, and INEOS Styrolution, the world leader in styrenics, is commemorating its 90th anniversary. One of the earliest commercially accessible polymers, polystyrene has since enabled a wide range of goods that improve our everyday life. The material of choice for the future is polystyrene since it is designed for recycling

Global Ethylbenzene Market Scope

The ethylbenzene market is segmented on the basis of type, product, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications

Type

- AICI3 Liquid Hydrocarbon Method

- Zeolite Gas Catalystic Method

- Zeolite Liquid Catalysitc Method

Product

- Purity >99%

- Purity >98%

- Others

Application

- Styrene

- Gasoline

- Diethylbenzene

- Natural Gas

- Plastics

- Rubber/Latex

- Paints

- Asphalt & Naphtha

End-User

- Packaging

- Electronics

- Construction

- Agriculture

Global Ethylbenzene Market Regional Analysis/Insights

The global ethylbenzene market is analysed and market size insights and trends are provided by country, type, product, application and end-user as referenced above.

The countries covered in the ethylbenzene market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa

Asia-Pacific dominates the market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2023-2030. This is due to the expansion of the packaging sector as a result of the success of e-commerce and online food and beverage services.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Ethylbenzene Market Share Analysis

The global ethylbenzene market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ethylbenzene market.

Some of the major players operating in the global ethylbenzene market are:

- Cepsa (Spain)

- Deten Quimica S.A. (Brazil)

- Chevron Phillips Chemical Company (U.S)

- Honeywell International Inc (U.S.)

- Huntsman International LLC. (U.S.)

- Reliance Industries Limited (India)

- Jingtung Petrochemical Corp., Ltd (China)

- SASOL (South Africa)

- PT Unggul Indah Cahaya Tbk (Indonesia)

- Desmet Ballestra (France)

- Farabi Petrochemicals Co. (Saudi Arabia)

- S.B.K HOLDING (U.A.E)

- Indian Oil Corporation Ltd (India)

- Qatar Petroleum (Qatar)

- JXTG Nippon Oil & Energy Corporation (Japan)

- ISU Chemical (South Korea)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ethylbenzene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ethylbenzene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ethylbenzene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.