Global Esoteric Testing Market

Market Size in USD Billion

CAGR :

%

USD

20.87 Billion

USD

52.62 Billion

2024

2032

USD

20.87 Billion

USD

52.62 Billion

2024

2032

| 2025 –2032 | |

| USD 20.87 Billion | |

| USD 52.62 Billion | |

|

|

|

|

Esoteric Testing Market Size

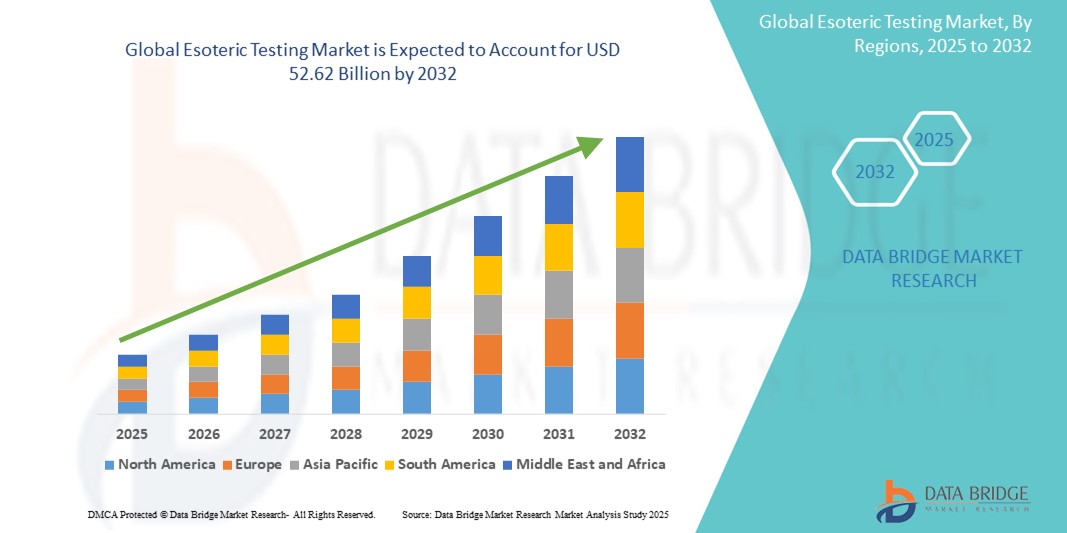

- The global esoteric testing market size was valued at USD 20.87 billion in 2024 and is expected to reach USD 52.62 billion by 2032, at a CAGR of 12.25 % during the forecast period

- This growth is driven by factors such as the rising chronic disease prevalence, technological advancements, and demand for specialized diagnostics.

Esoteric Testing Market Analysis

- The esoteric testing market is experiencing significant growth, with projections indicating a substantial increase in market size over the coming years

- This expansion is attributed to the rising demand for specialized diagnostic tests and the continuous advancements in testing technologies

- North America is expected to dominate the esoteric testing market due to its advanced healthcare infrastructure, high adoption of specialized diagnostic technologies, and strong presence of leading laboratory service providers. Favourable reimbursement policies and high awareness of early disease detection further reinforce its market leadership.

- Asia-Pacific is expected to be the fastest growing region in the esoteric testing market during the forecast period due to rapid improvements in healthcare access, rising investments in diagnostic technologies, and increasing prevalence of chronic and rare diseases. Growing government initiatives and expanding patient awareness are also fuelling market expansion

- The infectious disease testing segment is expected to dominate the esoteric testing market with the largest share of 31.6% in 2025. This growth is primarily driven by the rising prevalence of infectious diseases such as HIV, hepatitis, and newly emerging viral infections. The need for early detection, disease surveillance, and effective patient management has increased the adoption of specialized diagnostic tests. Advances in molecular diagnostics and increased global awareness about infectious diseases are further supporting this trend. In addition, public and private sector initiatives to strengthen infectious disease control are fuelling demand for esoteric testing in this segment.

Report Scope and Esoteric Testing Market Segmentation

|

Attributes |

Esoteric Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Esoteric Testing Market Trends

“Personalized Medicine Driving Esoteric Testing Growth”

- Personalized medicine is transforming esoteric testing by enabling diagnostics tailored to individual genetic and molecular profiles, enhancing treatment precision and patient outcomes

- For instance, oncology tests now detect specific gene mutations to recommend targeted therapies for cancer patients

- Technologies such as next-generation sequencing and mass spectrometry are pivotal in identifying unique biomarkers, facilitating early detection and targeted therapies

- For instance, sequencing-based tests can detect inherited conditions such as Lynch syndrome, allowing for proactive treatment planning

- Companies such as Quest Diagnostics have introduced consumer-initiated genetic tests, empowering individuals to assess their health risks and make informed decisions

- Collaborations between diagnostic firms and pharmaceutical companies are fostering the development of companion diagnostics, aligning treatments with specific patient needs

- The integration of artificial intelligence in esoteric testing is streamlining data analysis, improving diagnostic accuracy, and supporting the advancement of personalized healthcare

Esoteric Testing Market Dynamics

Driver

“Growing Prevalence of Chronic and Rare Diseases”

- The rising prevalence of chronic and rare diseases such as cancer, autoimmune disorders, and inherited genetic conditions is increasing the demand for advanced diagnostic tools that go beyond routine testing

- For instance, autoimmune diseases such as lupus often require complex antibody profiling, which is available through esoteric testing

- Esoteric tests offer deeper insights into disease mechanisms by using highly specialized techniques not commonly found in standard labs, allowing for more accurate and detailed diagnoses

- These tests are particularly valuable in oncology, where molecular testing helps identify gene mutations that guide targeted therapy and improve treatment outcomes

- For instance, BRCA1 and BRCA2 gene testing helps determine breast and ovarian cancer risks and treatment pathways

- Patients with unexplained symptoms or rare disorders benefit from esoteric testing, which can uncover underlying metabolic or genetic causes that routine diagnostics may miss

- As healthcare infrastructure improves and awareness increases worldwide, the adoption of esoteric testing is expected to accelerate, supporting early detection, personalized treatment, and better disease management

Opportunity

“Integration of Artificial Intelligence in Diagnostics”

- Artificial intelligence is enhancing esoteric testing by improving the speed and accuracy of complex data analysis, especially in fields such as genomics and proteomics

- For instance, AI tools are used to analyze whole-genome sequencing data to identify disease-causing mutations in rare genetic disorders

- Machine learning algorithms can detect hidden patterns in massive datasets, enabling faster and more precise diagnostic decisions for conditions that are difficult to identify through conventional testing

- AI-powered platforms are now widely used to interpret genetic variations related to cancer, increasing the accuracy of identifying inherited risks and informing treatment choices

- For instance, AI algorithms assist in interpreting BRCA mutations for breast cancer risk assessment

- Beyond diagnostics, AI contributes to test development by identifying potential biomarkers and optimizing assay design, making tests more reliable and commercially viable

- As AI reduces the complexity and resource demands of esoteric testing, more laboratories can adopt these solutions, expanding market access and creating innovative healthcare delivery models

Restraint/Challenge

“High Cost and Limited Accessibility”

- The high cost of esoteric testing remains a major barrier, as these procedures require advanced equipment, highly trained personnel, and specialized lab infrastructure, increasing overall operational expenses

- For instance, setting up a molecular diagnostics lab for esoteric tests demands significant upfront investment that many facilities cannot afford

- Healthcare providers in low- and middle-income countries face financial challenges in offering esoteric tests, making these services largely inaccessible in underserved regions

- Patients often bear the financial burden since many esoteric tests are not covered by insurance, limiting affordability and deterring utilization

- For instance, a single genetic test for a rare disorder can cost over a thousand dollars, placing it out of reach for many families

- Esoteric testing often involves sending samples to reference laboratories located far away, resulting in longer turnaround times and delayed treatment decisions

- These cost and access barriers collectively slow down the adoption of esoteric testing, particularly in resource-limited healthcare systems around the world

Esoteric Testing Market Scope

The market is segmented on the basis of type, technology, and laboratory type.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Technology |

|

|

By Laboratory Type |

|

In 2025, the infectious diseases is projected to dominate the market with a largest share in type segment

The infectious disease testing segment is expected to dominate the esoteric testing market with the largest share of 31.6% in 2025. This growth is primarily driven by the rising prevalence of infectious diseases such as HIV, hepatitis, and newly emerging viral infections. The need for early detection, disease surveillance, and effective patient management has increased the adoption of specialized diagnostic tests. Advances in molecular diagnostics and increased global awareness about infectious diseases are further supporting this trend. In addition, public and private sector initiatives to strengthen infectious disease control are fuelling demand for esoteric testing in this segment.

The chemiluminescence immunoassay is expected to account for the largest share during the forecast period in technology segment

In 2025, the chemiluminescence immunoassay segment is projected to lead the market with a 24.6% share due to its high precision, speed, and ability to handle a wide array of analytes. This technology is widely used for detecting hormones, proteins, and infectious markers with improved sensitivity and specificity. Its automation capabilities and compatibility with large-scale testing make it ideal for hospital and reference laboratories. The increasing use of chemiluminescence assays in oncology, endocrinology, and infectious disease diagnostics is also boosting its adoption. As healthcare providers seek reliable and cost-effective solutions, this segment is expected to maintain its leadership in esoteric testing technology.

Esoteric Testing Market Regional Analysis

“North America Holds the Largest Share in the Esoteric Testing Market”

- North America accounts for the largest market share of 45.52%, with the U.S. leading due to robust healthcare systems and widespread use of advanced diagnostic tools

- High healthcare spending, availability of reimbursement, and strong presence of key market players continue to support regional dominance

- Rising cases of chronic and rare diseases along with an aging population increase the need for specialized diagnostic services

- Government initiatives to promote healthcare quality and adoption of cutting-edge testing technologies enhance market stability

“Asia-Pacific is Projected to Register the Highest CAGR in the Esoteric Testing Market”

- Asia Pacific is growing at the fastest rate in the esoteric testing market due to the increasing demand for early and accurate diagnostics

- Countries such as China and India are investing heavily in healthcare infrastructure and expanding access to specialized testing

- Supportive government policies and rising presence of diagnostic technology firms are accelerating market growth

- Increased awareness of personalized medicine and adoption of advanced diagnostic techniques are driving rapid market expansion

Esoteric Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Quest Diagnostics (U.S.)

- OPKO Health, Inc. (U.S.)

- MIRACA HOLDINGS Inc. (Japan)

- Myriad Genetics, Inc. (U.S.)

- Sonic Healthcare Limited (Australia)

- FOUNDATION MEDICINE, INC. (U.S.)

- ACM Global Laboratories (India)

- ARUP Laboratories (U.S.)

- Fulgent Genetics (U.S.)

- Invitae Corporation (U.S.)

- Mayo Foundation for Medical Education and Research (U.S.)

- Fresenius Medical Care Asia Pacific Limited (Germany)

- Charles River Laboratories (U.S.)

- Pacific Bio labs, Inc. (U.S.)

- Merck KGaA (Germany)

- WuXi AppTec (China)

- North American Science Associates Inc. (U.S.)

- Nelson Laboratories, LLC (U.S.)

Latest Developments in Global Esoteric Testing Market

- In July 2023, Quest Diagnostics introduced its first consumer-initiated genetic test using cutting-edge technology to analyze individuals' risk for hereditary health conditions. This move marks a significant step toward personalized healthcare by allowing consumers to access advanced genetic insights directly. It empowers individuals to take proactive health measures without needing a physician referral. The launch strengthens Quest’s position in the esoteric testing space and broadens market accessibility. This initiative is expected to drive higher consumer engagement and expand the demand for direct-to-consumer genetic diagnostics

- In July 2022, Laboratory Corporation of America Holdings (LabCorp) launched its innovative Neurofilament Light Chain (NfL) blood test for detecting markers of neurodegenerative diseases. The test provides clinicians with a non-invasive and efficient tool to identify conditions such as multiple sclerosis and Alzheimer’s at an early stage. By facilitating quicker diagnoses, it helps streamline patient management and treatment planning. This development enhances LabCorp’s neurology-focused offerings within the esoteric testing domain. It also reflects the market’s growing emphasis on specialized, disease-targeted diagnostics

- In May 2022, LabCorp unveiled a novel immunohistochemistry (IHC) test to evaluate Lymphocyte-activation gene 3 (LAG-3) expression in tumor tissue samples. The test supports precision oncology by aiding oncologists in identifying candidates for immunotherapy. It allows for more targeted and effective cancer treatments based on individual tumor biology. This advancement reinforces LabCorp’s commitment to expanding its oncology diagnostics portfolio. It contributes to the growing integration of personalized medicine in esoteric testing

- In February 2021, Quest Diagnostics partnered with GRAIL to support the Galleri multi-cancer early detection blood test. This test uses next-generation sequencing to screen for multiple types of cancer from a single blood sample. The collaboration demonstrates a strong focus on innovation in early cancer detection and diagnosis. By participating in such cutting-edge projects, Quest strengthens its role in advancing esoteric testing technologies. The partnership reflects the market’s shift toward non-invasive, early diagnostic tools with broad clinical applications

- In January 2021, OPKO Health Inc. (BioReference Laboratories) launched Scarlet Health, a fully integrated in-home diagnostic platform in the U.S. The platform enables patients to schedule and receive lab services at home, enhancing convenience and access to care. This digital innovation caters to the growing demand for remote and flexible healthcare solutions. It significantly extends diagnostic services to underserved or mobility-limited populations. Scarlet Health represents a major step in decentralizing esoteric testing and expanding its market reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.