Global Esim Market

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

4.03 Billion

2024

2032

USD

1.38 Billion

USD

4.03 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 4.03 Billion | |

|

|

|

|

E-Sim Market Size

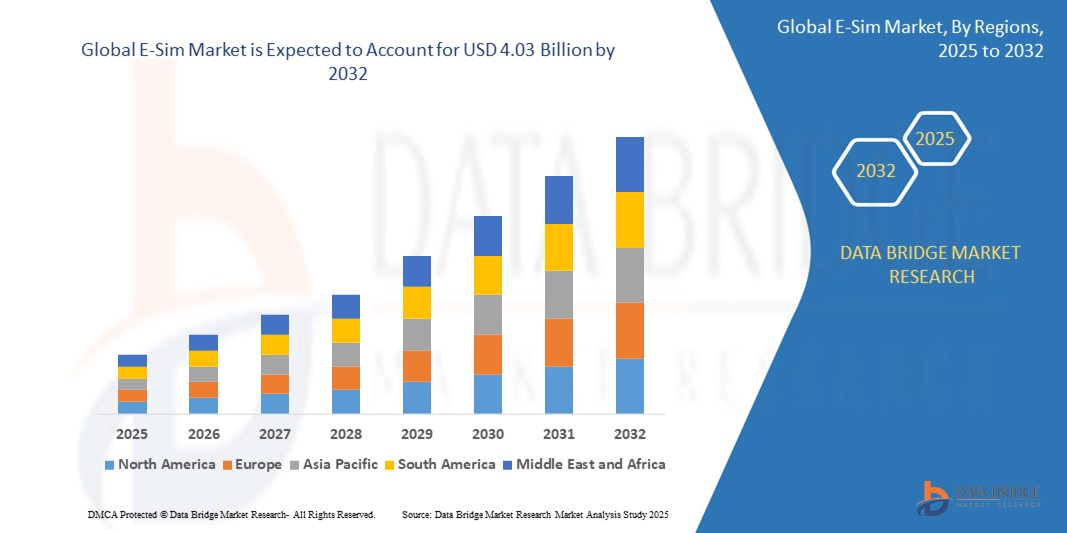

- The global E-Sim market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 4.03 billion by 2032, at a CAGR of 14.30% during the forecast period

- This growth is driven by factors such as the increasing adoption of IoT devices, rising demand for remote SIM provisioning for M2M applications, expanding mobile network penetration, and growing preference for compact and efficient connectivity solutions in consumer electronics and automotive sectors.

E-Sim Market Analysis

- The global embedded subscriber identity module market is shifting toward integrated SIM technology within devices to streamline connectivity and Simplify user activation processes

- This trend is evident in sectors such as consumer electronics and smart wearables, where built-in SIM functionality enables sleeker designs and uninterrupted mobile access

- North America is expected to dominate the E-Sim market with share of 39.1% due to early adoption of advanced mobile technologies and strong infrastructure

- Asia-Pacific is expected to be the fastest growing region in the E-Sim market during the forecast period due to increasing smartphone penetration and expanding mobile network infrastructure

- The M2M segment is expected to dominate the E-Sim market with the largest share of 68.06% in 2025 due to the increasing adoption of connected devices across industries that require reliable, secure, and remotely manageable connectivity solutions for applications such as smart metering, asset tracking, industrial automation, and fleet management.

Report Scope and E-Sim Market Segmentation

|

Attributes |

E-Sim Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

E-Sim Market Trends

“Advancements in Operating Microscopes & 3D Visualization for Intraocular Surgery”

- The current embedded subscriber identity module market is focused on the growing demand for seamless digital activation across connected devices

- Consumers are leaning toward built-in solutions that eliminate the need for traditional physical cards, especially in personal gadgets

- Device manufacturers are prioritizing integration of programmable subscriber identity modules to enhance user convenience and reduce hardware complexity

- For instance, many of the latest smartwatch models now offer remote mobile access directly through embedded technology without external components

- Service providers are also adapting by offering flexible subscription plans that align with the shift toward digital identity management

- In conclusion, this trend is shaping a more agile and user-friendly ecosystem where consumers can enjoy uninterrupted connectivity with greater control and less dependency on physical infrastructure

E-Sim Market Dynamics

Driver

“Increasing Adoption in Consumer Electronics”

- The rising use of embedded subscriber identity modules in consumer electronics such as smartphones, tablets, and smartwatches is streamlining device design and enhancing user convenience

- Major manufacturers such as Apple have adopted this technology in devices such as the iPhone 15 series and Apple Watch Series 9, where there is no physical card slot, offering a sleeker form and better water resistance

- For Instance, consumers benefit from the ability to switch mobile carriers digitally and manage multiple profiles on one device, improving flexibility and travel convenience

- Over-the-air provisioning supported by embedded technology reduces the need for store visits or manual SIM replacement, with brands such as Samsung offering such features in Galaxy Z flip and fold models

- As more devices rely on constant connectivity, this trend is driving greater demand, with companies now launching models that only support embedded modules for improved security and future readiness

- In conclusion, this shift is making embedded connectivity a standard in premium electronics and is expected to further influence mid-range device adoption in the coming years

Opportunity

“Growing Demand in Automotive Connectivity”

- The rising demand for advanced automotive connectivity is creating new opportunities for embedded subscriber identity modules to provide reliable, always-on mobile access in vehicles

- Connected cars use embedded modules to support critical functions such as in-car navigation, vehicle-to-everything communication, emergency services, remote diagnostics, and infotainment systems

- Automakers benefit from the ability to remotely manage mobile network profiles and push software updates over the air, enhancing vehicle functionality without physical visits

- For instance, electric vehicles from manufacturers such as Tesla and Volkswagen integrate embedded modules to enable real-time data exchange with cloud platforms, supporting both driver experience and maintenance

- This technology also prepares vehicles for future autonomous driving infrastructure that depends on constant communication between vehicles and networks

- In conclusion, as connectivity becomes essential in modern vehicles, embedded subscriber identity modules are positioned to drive long-term growth and foster closer collaboration between telecom and automotive industries

Restraint/Challenge

“Limited Interoperability Across Devices and Networks”

- Limited interoperability between devices, mobile carriers, and network standards presents a major challenge for the adoption of embedded subscriber identity modules

- Different manufacturers and operators use varied activation protocols, causing inconsistent user experiences and restricting seamless carrier switching

- Some devices are locked to specific carriers or do not fully support global roaming, which can inconvenience consumers traveling or relocating internationally

- For instance, a user buying a device in one country might face difficulties activating or switching carriers when moving to another region due to compatibility issues

- Additionally, many carriers lack the infrastructure needed for full over-the-air provisioning, limiting the widespread scalability of embedded modules

- In conclusion, without stronger industry standards and regulatory alignment, this fragmentation in compatibility and support continues to slow down the broad adoption of embedded connectivity solutions across consumer and enterprise markets

E-Sim Market Scope

The market is segmented on the basis of component, connectivity, data plan, pricing model, network type, deployment mode, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Connectivity |

|

|

By Data Plan |

|

|

By Pricing Model

|

|

|

By Network Type |

|

|

By Deployment Mode

|

|

|

By Application |

|

|

By End-User

|

|

In 2025, the M2M segment is projected to dominate the market with a largest share in application segment

The M2M segment is expected to dominate the E-Sim market with the largest share of 68.06% in 2025 due to the increasing adoption of connected devices across industries that require reliable, secure, and remotely manageable connectivity solutions for applications such as smart metering, asset tracking, industrial automation, and fleet management.

The hybrid microscopes is expected to account for the largest share during the forecast period in connectivity segment

In 2025, the Voice, SMS and data segment is expected to dominate the market with the largest market share of 88.10% due to the growing demand for seamless and integrated communication services across mobile devices, enabling users to stay connected through multiple channels with enhanced flexibility and convenience.

E-Sim Market Regional Analysis

“North America Holds the Largest Share in the E-Sim Market”

- North America holds a leading position in the embedded subscriber identity module market with share of 39.1% due to early adoption of advanced mobile technologies and strong infrastructure

- The presence of major technology companies and network providers in this region has accelerated the rollout and acceptance of embedded subscriber identity modules

- Consumers in North America benefit from a wide availability of devices supporting embedded connectivity, including smartphones, wearables, and connected cars

- Regulatory frameworks and supportive policies have further encouraged the integration of embedded solutions across various industries

- This region remains a hub for innovation, with continuous advancements in over-the-air provisioning and network management technologies

“Asia-Pacific is Projected to Register the Highest CAGR in the E-Sim Market”

- Asia Pacific is witnessing rapid growth in the embedded subscriber identity module market, due to increasing smartphone penetration and expanding mobile network infrastructure

- Countries in this region are aggressively adopting next-generation connectivity technologies, which supports the quick uptake of embedded subscriber identity modules

- The rising demand for connected devices across sectors such as consumer electronics, automotive, and Internet of Things solutions fuels this growth trend

- Government initiatives focused on digital transformation and smart city projects play a significant role in encouraging embedded connectivity adoption

- The region’s vast and diverse consumer base creates significant opportunities for market expansion and innovation in embedded connectivity services

E-Sim Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Telefonica S.A. (Spain)

- Semtech Corporation (U.S.)

- Giesecke+Devrient GmbH (Germany)

- AT&T Intellectual Property (U.S.)

- Orange (France)

- Arm Limited (U.K.)

- KORE Wireless (U.S.)

- Workz (U.A.E.)

- Oasis SmartSIM (U.A.E.)

- Vodafone Group (U.K.)

- STMicroelectronics (Switzerland)

- Thales (France)

- Deutsche Telekom AG (Germany)

- NXP Semiconductors (Netherlands)

- Infineon Technologies AG (Germany)

- Telit (U.K.)

- IDEMIA (France)

- Sinch (Sweden)

- Singtel (Singapore)

- Etisalat (U.A.E.)

Latest Developments in Global E-Sim Market

- In May 2023, Lonestar Cell MTN introduced E-sim technology in Liberia, enabling subscribers to effortlessly switch to E-sim-compatible devices by scanning a QR code at service centers, eliminating the need for physical SIM card removal

- In March 2023 saw the launch of Gcore's Zero-Trust 5G E-sim Cloud platform, providing organizations globally with a secure and high-speed networking solution. Gcore's software-defined E-sim facilitates secure connections to remote devices, corporate resources, or Gcore's cloud platform through regional 5G carriers

- In February 2023, Giesecssske+Devrient (G+D) and NetLync introduced AirOn360 ES, empowering Mobile Network Operators to deploy entitlements such as seamless SIM transfer on iPhones. This advancement simplifies digital activation processes and allows users to easily connect or transfer existing plans digitally, supporting multiple cellular plans on a single device

- In February 2023, Amdocs and Drei Austria collaborated to launch a groundbreaking E-sim solution. Drei Austria customers can now experience a fully app-based digital SIM journey using Amdocs' E-sim technology, enhancing connectivity through the innovative "up" app

- In January 2022, IDEMIA announced a collaboration with Microsoft to provide next-generation E-Sim connectivity services. This collaboration aims to expand connectivity offerings for consumer and M2M/IoT devices, enhancing IDEMIA's position in the market and improving its customer base

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF Global Esim Market

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ESIM MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL ESIM MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.2 PENETRATION AND GROWTH POSPECT MAPPING

5.3 COMPETITOR KEY PRICING STRATEGIES

5.4 TECHNOLOGY ANALYSIS

5.4.1 KEY TECHNOLOGIES

5.4.2 COMPLEMENTARY TECHNOLOGIES

5.4.3 ADJACENT TECHNOLOGIES

5.5 COMPANY PROFILING

5.5.1 COMPANY A

5.5.1.1. LIST OF ACQUISITIONS

5.5.1.2. SHAREHOLDING PATTERN

5.5.1.3. COMPANY’S COMPETITOR AND ALTERNATIVES

5.5.1.4. BUSINESS MODEL

5.5.1.5. HOW COMPANY’S MAKES MONEY CANVAS

5.5.1.5.1. COMPANY A CUSTOMER SEGMENTS

5.5.1.5.2. COMPANY A VALUE PROPOSITIONS

5.5.1.5.3. COMPANY A CHANNELS

5.5.1.5.4. COMPANY A CUSTOMER RELATIONSHIPS

5.5.1.5.5. COMPANY A REVENUE STREAMS

5.5.1.5.6. COMPANY A KEY RESOURCES

5.5.1.5.7. COMPANY A KEY ACTIVITIES

5.5.1.5.8. COMPANY A KEY PARTNERS

5.5.1.5.9. COMPANY A COST STRUCTURE

5.5.1.5.10. COMPANY A SWOT ANALYSIS

5.5.2 COMPETITIVE INTELLIGENCE

5.5.2.1. STRATEGIC DEVELOPMENT

5.5.2.2. TECHNOLOGY/PLATFORM COMPARATIVE MATRIX

5.5.2.3. TECHNOLOGY IMPLEMENTATION PROCESS

5.5.2.3.1. CHALLENGES

5.5.2.3.2. INHOUS IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.5.2.4. TECHNOLOGY SPEND OF COMPANY

5.5.2.5. COMPANY COMPARATIVE ANALYSIS

5.5.2.5.1. CUSTOMER BASE

5.5.2.5.2. SERVICE POSITIONING

5.5.2.5.3. CUSTOMER FEEDBACK/RATING

5.5.2.5.4. APPLICATION REACH

5.5.2.5.5. MARKET SHARE

5.6 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

6 GLOBAL ESIM MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.3 SERVICES

7 GLOBAL ESIM MARKET, BY ARCHITECTURE

7.1 OVERVIEW

7.2 M2M ESIM ARCHITECTURE

7.3 CONSUMER ELECTRONICS ESIM ARCHITECTURE

8 GLOBAL ESIM MARKET, BY END USER

8.1 OVERVIEW

8.2 MANUFACTURING

8.2.1 BY COMPONENT

8.2.1.1. HARDWARE

8.2.1.2. SERVICES

8.3 CONSUMER ELECTRONICS

8.3.1 BY TYPE

8.3.1.1. SMARTPHONES

8.3.1.2. LAPTOPS

8.3.1.3. TABLETS

8.3.1.4. WEARABLES

8.3.2 BY COMPONENT

8.3.2.1. HARDWARE

8.3.2.2. SERVICES

8.4 RETAIL

8.4.1 BY COMPONENT

8.4.1.1. HARDWARE

8.4.1.2. SERVICES

8.5 TRANSPORTATION AND LOGISTICS

8.5.1 BY COMPONENT

8.5.1.1. HARDWARE

8.5.1.2. SERVICES

8.6 AUTOMOTIVE

8.6.1 BY TYPE

8.6.1.1. CONNECTED CARS

8.6.1.2. EMERGENCY SYSTEMS

8.6.1.3. OTHERS

8.6.2 BY COMPONENT

8.6.2.1. HARDWARE

8.6.2.2. SERVICES

8.7 ENERGY AND UTILITIES

8.7.1 BY COMPONENT

8.7.1.1. HARDWARE

8.7.1.2. SERVICES

8.8 RESIDENTIAL

8.8.1 BY COMPONENT

8.8.1.1. HARDWARE

8.8.1.2. SERVICES

8.9 SPORTS AND ENTERTAINMENT

8.9.1 BY COMPONENT

8.9.1.1. HARDWARE

8.9.1.2. SERVICES

8.1 AGRICULTURE

8.10.1 BY COMPONENT

8.10.1.1. HARDWARE

8.10.1.2. SERVICES

8.11 OTHERS

9 GLOBAL ESIM MARKET, BY REGION

9.1 GLOBAL ESIM MARKET,(ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

9.1.1 NORTH AMERICA

9.1.1.1. U.S.

9.1.1.2. CANADA

9.1.1.3. MEXICO

9.1.2 EUROPE

9.1.2.1. GERMANY

9.1.2.2. FRANCE

9.1.2.3. U.K.

9.1.2.4. ITALY

9.1.2.5. SPAIN

9.1.2.6. RUSSIA

9.1.2.7. TURKEY

9.1.2.8. BELGIUM

9.1.2.9. NETHERLANDS

9.1.2.10. SWITZERLAND

9.1.2.11. REST OF EUROPE

9.1.3 ASIA PACIFIC

9.1.3.1. JAPAN

9.1.3.2. CHINA

9.1.3.3. SOUTH KOREA

9.1.3.4. INDIA

9.1.3.5. AUSTRALIA

9.1.3.6. SINGAPORE

9.1.3.7. THAILAND

9.1.3.8. MALAYSIA

9.1.3.9. INDONESIA

9.1.3.10. PHILIPPINES

9.1.3.11. REST OF ASIA PACIFIC

9.1.4 SOUTH AMERICA

9.1.4.1. BRAZIL

9.1.4.2. ARGENTINA

9.1.4.3. REST OF SOUTH AMERICA

9.1.5 MIDDLE EAST AND AFRICA

9.1.5.1. SOUTH AFRICA

9.1.5.2. SAUDI ARABIA

9.1.5.3. EGYPT

9.1.5.4. ISRAEL

9.1.5.5. REST OF MIDDLE EAST AND AFRICA

9.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

10 GLOBAL ESIM MARKET,COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.5 MERGERS & ACQUISITIONS

10.6 NEW PRODUCT DEVELOPMENT & APPROVALS

10.7 EXPANSIONS

10.8 REGULATORY CHANGES

10.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

11 GLOBAL ESIM MARKET, SWOT ANALYSIS

12 GLOBAL ESIM MARKET, COMPANY PROFILE

12.1 STMICROELECTRONICS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 GEOGRAPHIC PRESENCE

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 NXP SEMICONDUCTORS

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 GEOGRAPHIC PRESENCE

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 THALES GROUP

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 GEOGRAPHIC PRESENCE

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 NTT DOCOMO, INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 GEOGRAPHIC PRESENCE

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 SINGTEL

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 GEOGRAPHIC PRESENCE

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 TELEFÓNICA S.A.

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 GEOGRAPHIC PRESENCE

12.6.4 PRODUCT PORTFOLIO

12.6.5 RECENT DEVELOPMENTS

12.7 SIERRA WIRELESS

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 GEOGRAPHIC PRESENCE

12.7.4 PRODUCT PORTFOLIO

12.7.5 RECENT DEVELOPMENTS

12.8 INFINEON TECHNOLOGIESAG

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 GEOGRAPHIC PRESENCE

12.8.4 PRODUCT PORTFOLIO

12.8.5 RECENT DEVELOPMENTS

12.9 GIESECKE+DEVRIENT MOBILE SECURITY GMBH

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 GEOGRAPHIC PRESENCE

12.9.4 PRODUCT PORTFOLIO

12.9.5 RECENT DEVELOPMENTS

12.1 AT&T

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 GEOGRAPHIC PRESENCE

12.10.4 PRODUCT PORTFOLIO

12.10.5 RECENT DEVELOPMENTS

12.11 ORANGE

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 GEOGRAPHIC PRESENCE

12.11.4 PRODUCT PORTFOLIO

12.11.5 RECENT DEVELOPMENTS

12.12 IDEMIA

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 GEOGRAPHIC PRESENCE

12.12.4 PRODUCT PORTFOLIO

12.12.5 RECENT DEVELOPMENTS

12.13 CLX COMMUNICATIONS

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 GEOGRAPHIC PRESENCE

12.13.4 PRODUCT PORTFOLIO

12.13.5 RECENT DEVELOPMENTS

12.14 APPLE

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 GEOGRAPHIC PRESENCE

12.14.4 PRODUCT PORTFOLIO

12.14.5 RECENT DEVELOPMENTS

12.15 DEUTSCHE TELEKOM AG

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 GEOGRAPHIC PRESENCE

12.15.4 PRODUCT PORTFOLIO

12.15.5 RECENT DEVELOPMENTS

12.16 VODAFONE GROUP

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 GEOGRAPHIC PRESENCE

12.16.4 PRODUCT PORTFOLIO

12.16.5 RECENT DEVELOPMENTS

12.17 TELIT

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 GEOGRAPHIC PRESENCE

12.17.4 PRODUCT PORTFOLIO

12.17.5 RECENT DEVELOPMENTS

12.18 TELENOR CONNEXION

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 GEOGRAPHIC PRESENCE

12.18.4 PRODUCT PORTFOLIO

12.18.5 RECENT DEVELOPMENTS

12.19 SAMSUNG

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 GEOGRAPHIC PRESENCE

12.19.4 PRODUCT PORTFOLIO

12.19.5 RECENT DEVELOPMENTS

12.2 ETISALAT

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 GEOGRAPHIC PRESENCE

12.20.4 PRODUCT PORTFOLIO

12.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

13 RELATED REPORTS

14 QUESTIONNAIRE

15 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.