Global Epstein Barr Virus Drug Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

2.26 Billion

2024

2032

USD

1.65 Billion

USD

2.26 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 2.26 Billion | |

|

|

|

|

Epstein-Barr Virus Drug Market Size

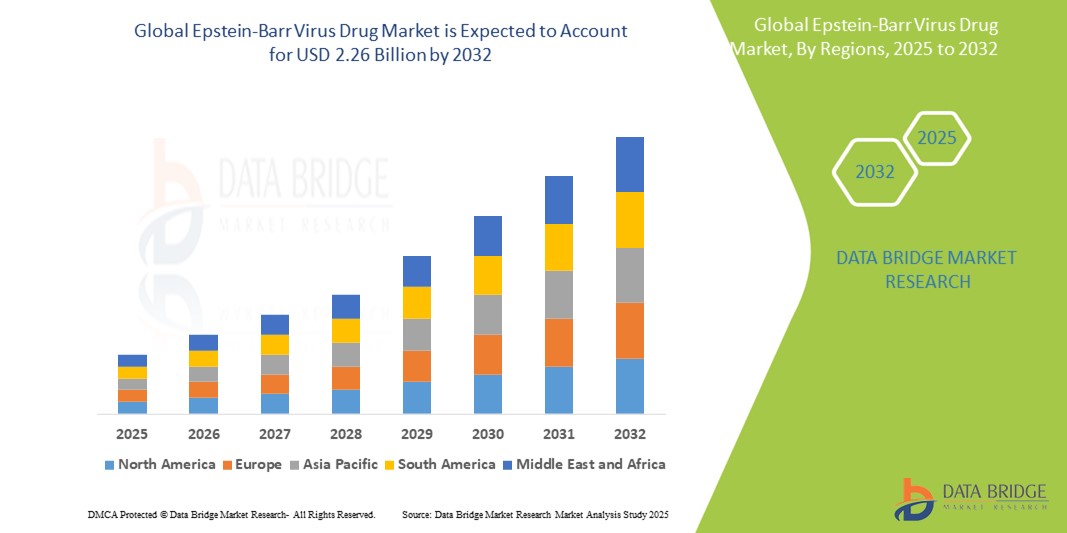

- The global Epstein-Barr Virus Drug market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 2.26 billion by 2032, at a CAGR of 4.0% during the forecast period

- This growth is driven by factors such as increasing incidence of EBV-associated malignancies, rising awareness of viral oncology, and expanding research in antiviral immunotherapies

Epstein-Barr Virus Drug Market Analysis

- The Epstein-Barr virus (EBV), a member of the herpesvirus family, is one of the most common human viruses linked to infectious mononucleosis and a range of malignancies including nasopharyngeal carcinoma and certain lymphomas. The market for EBV drugs is shaped by growing recognition of its oncogenic role and ongoing efforts to develop disease-modifying therapies

- The demand for Epstein-Barr virus (EBV), is significantly driven by growing recognition of its oncogenic role and ongoing efforts to develop disease-modifying therapies

- North America dominates the EBV drug market due to a high prevalence of EBV-associated disorders, robust clinical research infrastructure, and access to innovative antiviral therapies

- Asia-Pacific is projected to grow at the fastest pace due to increasing incidence of EBV-related cancers, improving diagnostic capabilities, and expanding oncology treatment access, particularly in China and Southeast Asia

- Antiviral agents are expected to account for the largest market share of 43.23% in 2025, owing to their central role in suppressing viral replication and disease progression. The introduction of combination regimens and investigational agents further boosts this segment

Report Scope and Epstein-Barr Virus Drug Market Segmentation

|

Attributes |

Epstein-Barr Virus Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Epstein-Barr Virus Drug Market Trends

"Rise of Targeted Immunotherapies and Vaccine Development"

- A key trend in the EBV drug market is the emergence of immune-based strategies targeting latent viral reservoirs and associated cancers. Novel immunotherapies and vaccine candidates are reshaping disease management paradigms

- For instance, In January 2025, a Phase I clinical trial began in the U.S. to test a nanoparticle-based EBV vaccine aimed at preventing infectious mononucleosis and reducing the risk of lymphoma development.

- This innovation signals a pivotal shift in EBV management, from symptomatic treatment to preemptive and precision-based interventions, with the potential to drastically reduce EBV-associated disease burdens

Global Graves' Disease Treatment Market Dynamics

Driver

"Increasing Burden of EBV-Associated Diseases and Cancer Links"

- The global rise in Epstein-Barr Virus (EBV)-associated malignancies such as Burkitt lymphoma, Hodgkin lymphoma, and nasopharyngeal carcinoma is significantly contributing to the demand for advanced diagnostics and targeted therapies.

- EBV has been increasingly recognized as a key oncogenic virus, particularly in low- and middle-income countries where diagnostic delays and limited treatment options exacerbate disease burden.

- For instance, in March 2024, a report by the International Agency for Research on Cancer (IARC) estimated that EBV contributes to 1.5% of all global cancer cases, spurring initiatives among global health bodies and pharmaceutical firms to accelerate EBV-related cancer research.

- These findings highlight a global call to action, reinforcing the importance of investing in EBV-targeted therapeutics and diagnostics to address both viral pathogenesis and its oncologic consequences.

Opportunity

"Pipeline Expansion in Immuno-Oncology"

- The unmet need for EBV-specific treatment has fueled innovation in immuno-oncology, with a growing number of companies developing therapies targeting viral antigens expressed in EBV-associated tumors.

- This includes novel CD8+ T-cell engagers, monoclonal antibodies, and therapeutic vaccines aimed at overcoming immune evasion by EBV-infected cells

- For instance, in October 2024, Gilead Sciences entered a strategic partnership with a biotech firm to co-develop a CD8+ T-cell engager designed to target EBV-transformed B cells in patients with refractory lymphomas, signaling momentum in virus-driven immunotherapy.

- As immuno-oncology continues to evolve, EBV presents a unique viral target that aligns with next-generation therapies, offering commercial and clinical potential in the oncology sector.

Restraint/Challenge

"Latency and Lack of FDA-Approved EBV-Specific Therapies"

- Despite the virus's well-documented role in oncogenesis, EBV remains a challenging target due to its latency phase, during which it persists silently in host B cells and evades immune detection. This biological complexity has hindered the development of effective antivirals and vaccines. Moreover, the absence of FDA-approved EBV-specific therapies continues to limit clinical options.

- For instance, in August 2023, The Lancet underscored that most EBV-related treatments are off-label and show limited efficacy, as the virus’s latent form resists conventional antiviral drugs, posing a major hurdle in therapeutic development.

- Overcoming these biological and regulatory obstacles is crucial for advancing EBV drug development. Increased investment, cross-disciplinary research, and regulatory incentives will be key to unlocking the next wave of EBV-targeted therapies

Global Epstein-Barr Virus Drug Market Scope

The market is segmented on the basis of treatment type, route of administration, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Drug Class |

|

|

By Route of Administration |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the Antivirals segment is projected to dominate the market with a largest share in treatment type segment

In 2025, the Antivirals segment is projected to dominate the market with the largest share of 43.23% due to their central role in EBV suppression and ease of integration in multi-drug regimens particularly for immunocompromised and oncology patients. Antivirals such as ganciclovir, valganciclovir, and acyclovir are frequently prescribed to manage acute EBV symptoms and prevent complications in transplant settings and EBV-associated malignancies. Their established safety profile, oral and intravenous availability, and growing use in off-label protocols contribute to their continued dominance in EBV therapeutics.

The Hospital segment is expected to account for the largest share during the forecast period in indication market

In 2025, the Hospitals segment is expected to dominate the market with the largest share of 51.16% due to increased hospitalization rates in cancer therapy and infectious mononucleosis management. EBV-related complications such as lymphoproliferative disorders, neurologic involvement, and organ-specific sequelae often necessitate intensive inpatient care, including diagnostic imaging, IV antiviral administration, and monitoring. Hospitals serve as primary centers for managing complex EBV-associated cases, benefiting from specialized infectious disease units and access to advanced diagnostic modalities, which sustains their leadership in this segment.

Global Epstein-Barr Virus Drug Market Regional Analysis

“North America Holds the Largest Share in the Epstein-Barr Virus Drug Market”

• In 2025, North America accounts for the highest share of 45.62% in the global Epstein-Barr Virus (EBV) drug market. This leadership is attributed to advanced virology research capabilities, early adoption of innovative antiviral therapies, and the presence of major biotech and pharmaceutical companies actively developing EBV-specific treatments

• The U.S. holds a dominant 62.35% share within North America, driven by robust funding from the National Institutes of Health (NIH), early access to investigational therapies through expanded access programs, and the proliferation of academic-industry research collaborations

• The region is home to leading virology and oncology research institutions such as the NIH and MD Anderson Cancer Center, facilitating the development and clinical validation of novel EBV-targeted treatments including immunotherapies and therapeutic vaccines

• Reimbursement systems across the U.S., including Medicare, Medicaid, and private insurers, support access to high-cost, EBV-related oncology treatments like those for Hodgkin lymphoma and nasopharyngeal carcinoma. This reduces financial burdens and drives patient uptake of new therapies

• Fast-track, Orphan Drug, and Breakthrough Therapy designations by the U.S. FDA further incentivize pharmaceutical innovation in this domain, positioning the U.S. as the global leader in EBV drug approvals and clinical trial density

“Asia-Pacific is Projected to Register the Highest CAGR in the Epstein-Barr Virus Drug Market”

• The Asia-Pacific region is expected to register the highest CAGR and currently holds a 25.47% share of the global EBV drug market. The growth is fueled by high EBV seroprevalence rates, increasing government awareness campaigns, and the expansion of public healthcare coverage for cancer diagnostics and antiviral therapies.

• China alone contributes approximately 15.2% to the global EBV drug market, supported by state-led oncology programs and improved access to EBV testing and targeted therapies through Tier-1 hospitals and regional cancer centers.

• Nations like South Korea and Japan are actively funding EBV-associated cancer surveillance programs and have integrated EBV screening into national cancer control strategies. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) and South Korea's Ministry of Food and Drug Safety (MFDS) offer fast-track regulatory approvals for virology-focused therapies.

• India is expanding its virology research infrastructure with new collaborations between public hospitals and international biotech firms, enhancing the availability of diagnostics and investigational EBV drugs.

• Public-private partnerships are also accelerating biosimilar development and access to essential antivirals in underserved areas, particularly in Southeast Asia, further contributing to the region’s rapid market expansion.

Global Epstein-Barr Virus Drug Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Gilead Sciences, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (U.K.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- AbbVie Inc. (U.S.)

- Sanofi (France)

- Johnson & Johnson Services, Inc. (U.S.)

- Novartis AG (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Atara Biotherapeutics, Inc. (U.S.)

- Viracta Therapeutics, Inc. (U.S.)

- AlloVir (U.S.)

- ModernaTX, Inc. (U.S.)

- Immunitas Therapeutics (U.S.)

- Schrödinger, Inc. (U.S.)

- VelosBio Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Acerta Pharma B.V. (Netherlands)

- medac GmbH (Germany)

- Pierre Fabre (France)

- Eutilex Co., Ltd. (South Korea)

- Marengo Therapeutics, Inc. (U.S.)

- Cothera Bioscience, Inc. (U.S.)

- Hornet Therapeutics (U.K.)

- EBViously (Germany)

- Labo'Life (Spain)

- Tessa Therapeutics Ltd. (Singapore)

Latest Developments in Global Epstein-Barr Virus Drug Market

- In January 2025, the U.S. NIH launched a collaborative consortium project focused on evaluating the efficacy and safety of therapeutic T-cell vaccines specifically targeting EBV-related Hodgkin lymphoma. This initiative involves multiple cancer research centers and aims to offer a more targeted and durable treatment option for patients with EBV-driven lymphomas.

- In October 2024, Roche initiated Phase II clinical trials of a novel small-molecule antiviral drug designed to inhibit EBV DNA polymerase, a key enzyme involved in viral replication. The compound is intended to suppress EBV reactivation and reduce disease progression in associated conditions.

- In July 2024, a UK-based academic research group reported encouraging interim findings from a prophylactic EBV vaccine trial involving university students. The vaccine demonstrated strong immune responses and potential for preventing primary EBV infection in young adults, a population particularly vulnerable to infectious mononucleosis.

- In April 2024, Pfizer announced the development of a next-generation antibody-drug conjugate (ADC) engineered to selectively target EBV-transformed lymphocytes. The ADC combines a monoclonal antibody directed at EBV-related antigens with a potent cytotoxic agent, aiming to destroy infected cells while minimizing damage to healthy tissue.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.