Global Epoxy Composite Market

Market Size in USD Billion

CAGR :

%

USD

40.23 Billion

USD

80.76 Billion

2024

2032

USD

40.23 Billion

USD

80.76 Billion

2024

2032

| 2025 –2032 | |

| USD 40.23 Billion | |

| USD 80.76 Billion | |

|

|

|

|

Epoxy Composites Market Size

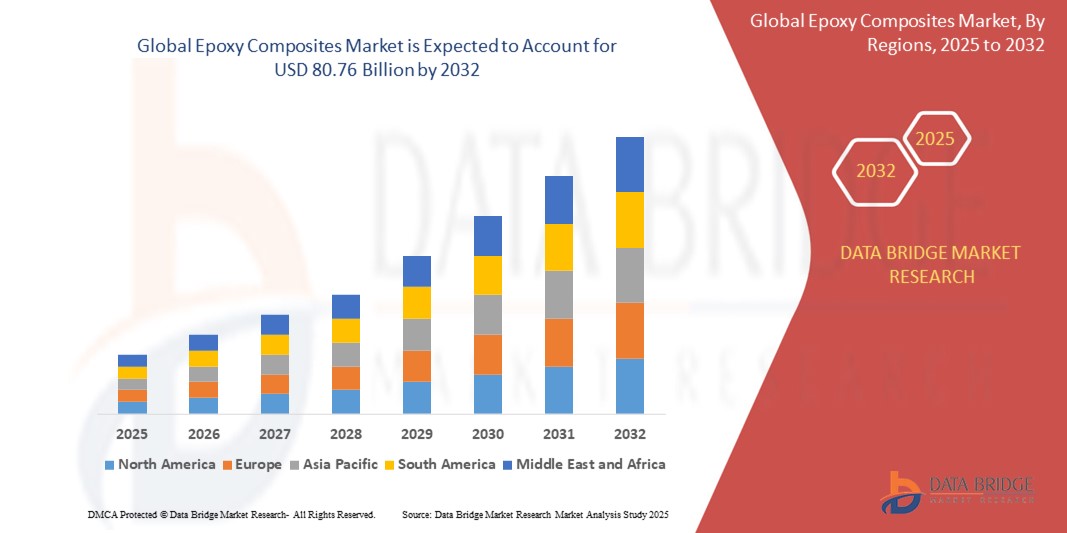

- The global epoxy composites market size was valued at USD 40.23 billion in 2024 and is expected to reach USD 80.76 billion by 2032, at a CAGR of 9.10% during the forecast period

- This growth is driven by factors such as the increasing demand for lightweight and high-performance materials in automotive and aerospace industries, rising adoption in wind energy applications, and advancements in manufacturing technologies such as resin transfer molding and automated lay-up processes

Epoxy Composites Market Analysis

- The global epoxy composites market is witnessing a strong surge in demand due to its superior mechanical strength and thermal stability, making it ideal for structural applications across industries

- Industries are increasingly turning to epoxy composites for producing durable and lightweight components, enhancing performance while reducing material fatigue and maintenance needs

- Asia-Pacific is expected to dominate the epoxy composites market with share of 7.05% due to large-scale industrial activity and strong manufacturing infrastructure

- North America is expected to be the fastest growing region in the epoxy composites market during the forecast period due to strong advancements in automotive, aerospace, and renewable energy sectors

- The glass fiber segment is expected to dominate the epoxy composites market with the largest share of 60.05% in 2025 due to its excellent balance of strength, cost-effectiveness, and versatility across various applications. Glass fiber-reinforced epoxy composites offer high tensile strength, corrosion resistance, and thermal stability, making them suitable for industries such as automotive, construction, wind energy, and electronics.

Report Scope and Epoxy Composites Market Segmentation

|

Attributes |

Epoxy Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Epoxy Composites Market Trends

"Shifting Focus to Sustainable Epoxy Composite Solutions"

- The epoxy composites market is seeing a clear trend toward sustainable product development, as manufacturers shift focus to environmentally friendly solutions

- Growing awareness around environmental impact is encouraging companies to invest in green composite alternatives that reduce reliance on petroleum-based inputs

- Product innovation now centers around using plant-based epoxy resins that maintain strength and durability while being biodegradable or recyclable

- Many producers are redesigning production lines to support cleaner processes and lower emissions without compromising the performance of epoxy composites

- For instance, some manufacturers are replacing traditional curing agents with bio-based alternatives to minimize environmental harm while maintaining high material standards

- In conclusion, the epoxy composites market is steadily evolving toward sustainability, with eco-friendly innovations shaping its future growth.

Epoxy Composites Market Dynamics

Driver

“Rising Demand from Automotive and Aerospace Sectors”

- The use of epoxy composites is rising in the automotive and aerospace sectors as these industries demand strong, durable, and lightweight materials

- In the automotive industry, epoxy composites are used in body panels and chassis parts to improve fuel efficiency and extend vehicle lifespan

- The aerospace sector relies on epoxy composites for wings, fuselage, and cabin structures to reduce weight and boost fuel economy

- For instance, BMW and Audi are incorporating epoxy composites into electric vehicle production to meet efficiency targets, while Boeing and Airbus use them in lightweight aircraft components

- These materials offer long-term durability, corrosion resistance, and flexibility in design, making them essential in advanced mobility applications

- In conclusion, automotive and aerospace applications continue to lead demand for epoxy composites due to their performance-enhancing benefits across modern transport systems

Opportunity

“Advancements in Resin Technology and Processing Methods”

- Advancements in epoxy resin formulations are improving strength, curing speed, and chemical resistance, aligning with diverse industrial needs

- New processing methods such as resin transfer molding and vacuum-assisted resin infusion are enabling precise, large-scale composite manufacturing

- Automated fiber placement is helping reduce production time, lower costs, and improve quality control for complex composite structures

- For instance, snap-cure epoxy systems are being adopted in electronics and automotive industries to shorten cycle times and boost throughput

- Self-healing and toughened epoxy systems are also being explored to meet the needs of high-stress, safety-critical applications

- In conclusion, continued innovation in resin and processing technologies is unlocking high-efficiency production and opening new application opportunities for epoxy composites

Restraint/Challenge

“High Cost of Raw Materials and Processing”

- High raw material costs, especially for premium epoxy resins and carbon fibers, make epoxy composites less competitive than traditional materials such as metals

- The processing of epoxy composites involves expensive molds, precise temperature controls, and labor-intensive techniques, raising overall production costs

- Small- and medium-sized enterprises face challenges adopting these materials due to the need for costly equipment and skilled labor

- For instance, in the construction industry, despite performance advantages, epoxy composites are often bypassed in favor of cheaper options such as steel or concrete

- Price volatility driven by supply chain issues and geopolitical factors adds to the uncertainty, hindering broader market adoption in budget-sensitive sectors

- In conclusion, high production and material costs remain a major barrier, especially for industries or markets focused on cost efficiency over advanced performance

Epoxy Composites Market Scope

The market is segmented on the basis of fiber type, manufacturing process, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Fiber Type |

|

|

By Manufacturing Process |

|

|

By End User |

|

In 2025, the glass fiber segment is projected to dominate the market with a largest share in fiber type segment

The glass fiber segment is expected to dominate the epoxy Composites Market with the largest share of 60.05% in 2025 due to its excellent balance of strength, cost-effectiveness, and versatility across various applications. Glass fiber-reinforced epoxy composites offer high tensile strength, corrosion resistance, and thermal stability, making them suitable for industries such as automotive, construction, wind energy, and electronics. Their ability to be molded into complex shapes while maintaining lightweight properties supports advanced manufacturing needs. Glass fibers are more affordable than carbon fibers, making them an attractive choice for mass production. The growing adoption of electric vehicles and renewable energy technologies is further accelerating demand for glass fiber-based composites.

The automotive & transportation segment is expected to account for the largest share during the forecast period in end user segment

In 2025, the hybrid s segment is expected to dominate the market with the largest market share of 25.05% due to its ability to combine the strengths of different imaging technologies into a single platform. These s offer enhanced imaging capabilities by integrating techniques such as optical, electron, and scanning probe microscopy, providing users with multi-dimensional insights. This versatility supports a wide range of research and industrial applications, including materials science, semiconductor analysis, and biomedical studies. Hybrid systems improve workflow efficiency by reducing the need to switch between instruments, thereby saving time and resources.

Epoxy Composites Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Epoxy Composites Market”

- Asia Pacific leads the epoxy composites market with share of 7.05% due to large-scale industrial activity and strong manufacturing infrastructure

- Countries such as China, India, and Japan contribute significantly through their automotive, electronics, and construction sectors

- Increased production in transportation and aerospace industries is further driving the regional market

- Rapid urban development and infrastructure expansion are pushing demand for high-performance composite materials

- For instance, automotive manufacturers across Asia are integrating epoxy composites to meet efficiency and safety standards

- In conclusion, Asia Pacific will such asly maintain its dominance in the market due to consistent industrial growth and strong end-use sector demand

“North America is Projected to Register the Highest CAGR in the Epoxy Composites Market”

- North America is the fastest growing region in the epoxy composite market, due to strong advancements in automotive, aerospace, and renewable energy sectors

- The region’s growth is propelled by the increasing adoption of epoxy composites for lightweight, high-performance applications, especially in automotive and aerospace industries

- Significant investments in sustainable technologies and renewable energy, such as wind energy, are creating new opportunities for epoxy composite materials in North America

- Technological innovations and increased production capabilities in the region are supporting rapid market expansion

- North America’s emphasis on high-quality manufacturing processes and innovation positions it as the fastest growing region in the global market.

Epoxy Composites Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Huntsman International LLC (U.S.)

- Solvay (Belgium)

- Owens Corning (U.S.)

- Hexcel Corporation (U.S.)

- Rotec Composite Group B.V. (Netherlands)

- ISOSPORT Verbundbauteile GmbH (Austria)

- Axiom Materials, Inc. (U.S.)

- Scott Bader Company Ltd. (U.K.)

- Gurit (Switzerland)

- SGL Carbon (Germany)

- Sumitomo Bakelite Co., Ltd. (Japan)

- SpecialChem (France)

- Barrday Inc. (Canada)

- IDI Composites International (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Avient (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- Arkema (France)

- Teijin Carbon Europe GmbH (Germany)

- TPI Composites (U.S.)

Latest Developments in Global Epoxy Composites Market

- In March 2025, Fairmat unveiled its innovative FairPly material and Infinite Recycling technology at JEC World 2025 . FairPly is a novel composite material that offers a 90% reduction in CO₂ emissions compared to conventional composites. The Infinite Recycling process enables the continuous reuse of composite materials without compromising their structural integrity. These advancements position Fairmat at the forefront of sustainable composite solutions, addressing the growing demand for eco-friendly materials in various industries

- In February 2025, Westlake Epoxy announced the launch of its EpoVIVE portfolio, a new range of epoxy products designed with sustainability in mind. This portfolio includes epoxy phenolic resins and curing agents that offer advantages such as reduced carbon footprint, energy efficiency, safer materials, lower emissions, and support for circular solutions. EpoVIVE products are tailored for various industries, including adhesives, aerospace, automotive, civil engineering, construction, composites, wind energy, electronics, electrical laminates, marine, and protective coatings

- In August 2019, BASF and Toray Advanced Composites entered into a supply agreement to produce continuous fiber-reinforced thermoplastic (CFRT) tapes for the automotive and industrial markets. Toray Advanced Composites manufactures CFRT tapes using BASF's Ultramid engineering thermoplastics, reinforcing them with glass or carbon fibers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Epoxy Composite Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Epoxy Composite Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Epoxy Composite Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.