Global Epa And Dha Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

3.75 Billion

2024

2032

USD

1.89 Billion

USD

3.75 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 3.75 Billion | |

|

|

|

|

EPA and DHA Market Size

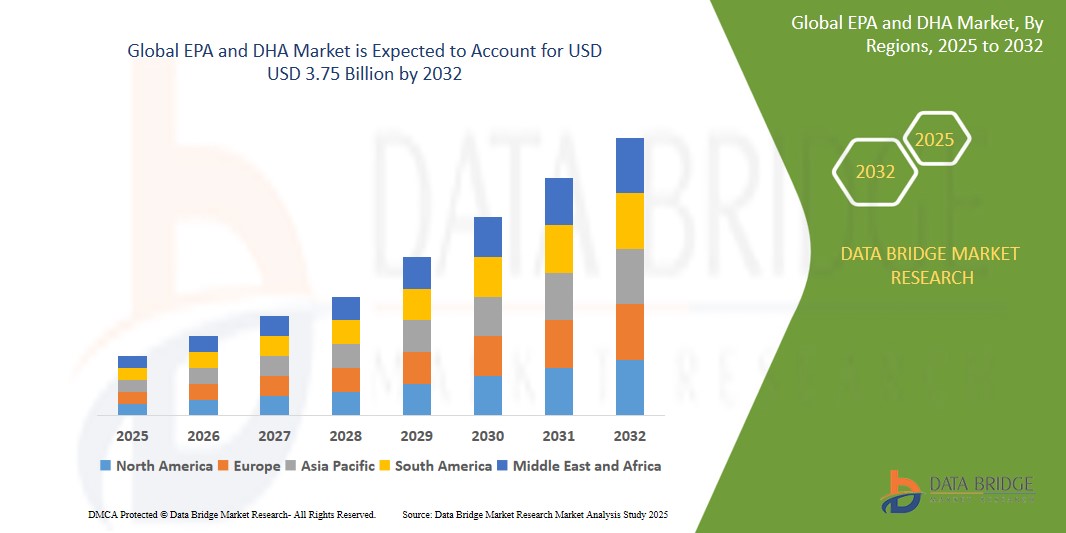

- The global EPA and DHA market size was valued at USD 1.89 billion in 2024 and is expected to reach USD 3.75 billion by 2032, at a CAGR of 8.95% during the forecast period

- This growth is driven by factors such as the aging population, increasing prevalence of eye diseases, and advancements in ophthalmic technology

EPA and DHA Market Analysis

- EPA (Eicosapentaenoic Acid) and DHA (Docosahexaenoic Acid) are essential omega-3 fatty acids widely used in nutritional supplements, pharmaceuticals, and functional food applications due to their well-documented benefits for heart, brain, and eye health

- The demand for EPA and DHA is significantly driven by the increasing prevalence of age-related chronic conditions, including cardiovascular disease, cognitive decline, and vision disorders, along with a growing preference for preventive healthcare

- North America is expected to dominate the global EPA and DHA market, accounting for 40% of the total market share in 2024. This dominance is driven by high awareness of health supplements, a growing elderly population, and the strong presence of key omega-3 product manufacturers in the region

- Asia-Pacific is anticipated to be the fastest-growing region in the EPA and DHA market, with a CAGR of 7.8% during the forecast period. The region's market share is expected to increase to 30% by 2032. This growth is driven by rising health consciousness, increasing disposable income, and growing demand for infant and maternal nutrition products

- The dietary supplements segment is expected to dominate the EPA and DHA market, holding a significant share of 45% in 2024. This growth is fueled by high consumer adoption for managing heart and brain health, alongside innovations in delivery formats such as soft gels, powders, and gummies

Report Scope and EPA and DHA Market Segmentation

|

Attributes |

EPA and DHA Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

EPA and DHA Market Trends

“Shift Toward Plant-Based and Sustainable Omega-3 Sources”

- One prominent trend in the EPA and DHA market is the rising shift toward plant-based and sustainable omega-3 sources, driven by environmental concerns, dietary preferences, and innovations in biotechnology

- These developments are reshaping the supply landscape by reducing dependency on traditional marine sources such as fish oil and krill, addressing issues like overfishing and allergen concerns

- For instance, In September 2023, BASF and Cargill announced the joint development of fermentation-derived omega-3 products, leveraging precision fermentation technology to produce high-purity EPA and DHA without marine input

- Similarly, Royal DSM launched an algae-derived DHA oil in December 2023 after receiving regulatory approval in India, catering to vegan consumers and sustainable nutrition markets

- These innovations are transforming the omega-3 sector by offering eco-friendly, scalable alternatives while meeting the growing demand for clean-label and ethical nutritional solutions

EPA and DHA Market Dynamics

Driver

“Growing Need Due to Prevalence of Chronic Health Conditions”

- The increasing prevalence of chronic health conditions such as cardiovascular disease, cognitive decline, and eye-related disorders is significantly driving the demand for EPA and DHA-based products

- As the global population continues to age, there is a higher incidence of diseases that can benefit from omega-3 supplementation, particularly in older adults who are more vulnerable to inflammation-related conditions and neurological degeneration

- With growing awareness of the role of EPA and DHA in preventive health, especially in managing triglyceride levels, maintaining cognitive function, and preserving vision, the demand for omega-3 supplements is on the rise across all age groups.

For instance,

- In February 2024, a study published by the American Academy of Ophthalmology highlighted the positive impact of DHA in slowing the progression of age-related macular degeneration (AMD), a leading cause of blindness in seniors

- In addition, In March 2023, the American Heart Association reaffirmed that EPA and DHA supplementation can reduce the risk of major cardiovascular events, especially in high-risk patients

- As a result of these findings and the growing prevalence of chronic illnesses, EPA and DHA are increasingly incorporated into therapeutic and preventive health regimens, fueling sustained market growth

Opportunity

“Expanding Applications in Cognitive and Maternal Health”

- The potential of EPA and DHA to support cognitive development, mental health, and prenatal care presents a significant growth opportunity for the market, particularly as scientific understanding and consumer awareness of these benefits continue to expand

- DHA plays a critical role in fetal brain development, and both EPA and DHA are increasingly recommended during pregnancy and early childhood to support neurological and visual development. In addition, they are gaining attention for their potential to reduce symptoms of depression and anxiety in adults

- As public health agencies and clinical practitioners promote omega-3 intake in maternal and child health, the market is expected to see rising demand from prenatal and pediatric nutrition segments

For instance,

- In September 2023, Nordic Naturals launched a prenatal DHA softgel designed specifically for expectant mothers, emphasizing its role in fetal brain and eye development

- Similarly, in April 2023, a clinical trial published in The Lancet Psychiatry highlighted that omega-3 fatty acids—particularly EPA—may be effective as an adjunctive treatment for major depressive disorder (MDD), bolstering their use in mental health care

- These developments reflect the expanding role of EPA and DHA in holistic health and open new avenues for product innovation in maternal wellness, early life nutrition, and cognitive performance support

Restraint/Challenge

“Regulatory Hurdles and Market Fragmentation”

- One significant challenge facing the EPA and DHA market is the complexity of regulatory approvals and the fragmentation in market standards across different regions, which can slow the speed of product launches and limit market growth

- Regulatory bodies like the FDA in the U.S. and the EFSA in the EU have stringent guidelines for omega-3 health claims, labeling, and ingredient sourcing, making it difficult for new players to enter the market or for existing companies to introduce new formulations without lengthy approval processes

- In addition, regional differences in approval timelines, consumer preferences, and market conditions can further complicate efforts to standardize products and achieve broader market penetration

For instance,

- In July 2023, Aker BioMarine reported delays in obtaining Novel Food approval for a new omega-3 formulation in the European Union, due to the regulatory complexities in securing approvals for new ingredients

- In March 2023, GOED Omega-3 published a report highlighting the fragmented nature of omega-3 regulations globally, noting that different regulatory bodies have distinct requirements for dosage recommendations, safety testing, and claims around heart and cognitive health benefits

- These regulatory barriers and market fragmentation can slow down product development, increase operational costs, and limit the ability to scale in certain regions, hindering overall market growth

EPA and DHA Market Scope

The market is segmented on the basis on type, concentration type, form, source, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Concentration Type |

|

|

By Form |

|

|

By Source |

|

|

By Application |

|

In 2025, the dietary supplements is projected to dominate the market with a largest share in application segment

The dietary supplements segment is projected to dominate the global EPA and DHA market in 2025, holding the largest share due to the rising demand for heart, brain, and eye health support, particularly among the aging population. The market share for this segment is expected to account for approximately 60-65% globally, with North America holding the largest share of around 40% due to high awareness and healthcare spending. The Asia-Pacific region is forecasted to grow rapidly, capturing about 15-20% of the market share as demand for supplements increases across key countries like China and India

The Algal oil-based omega-3s is expected to account for the largest share during the forecast period in technology segment

Algal oil-based omega-3s are projected to capture a significant share of the global EPA and DHA market due to their sustainable production and plant-based alternative to fish oil. Rich in DHA and EPA, algal oil is increasingly sought after as demand for vegan, cruelty-free, and environmentally friendly products rises. This technology is being adopted by manufacturers responding to the trend toward plant-based supplements. Algal oil omega-3s are expected to hold 25-30% of the market, with North America leading at 35-40%, and Europe growing at 20-25% due to rising demand for sustainable options

EPA and DHA Market Regional Analysis

“North America Holds the Largest Share in the EPA and DHA Market”

- North America is expected to dominate the global EPA and DHA market, accounting for 40% of the total market share in 2024. This dominance is driven by high awareness of health supplements, a growing elderly population, and the strong presence of key omega-3 product manufacturers in the region

- The U.S. holds a significant market share due to its well-established health-conscious consumer base, rising incidence of chronic conditions such as cardiovascular diseases, and increasing demand for dietary supplements. The presence of key market players, coupled with strong marketing and distribution networks, further bolsters the region's market leadership

- In addition, regulatory support for omega-3 products and the availability of diverse supplement formats (e.g., soft gels, gummies, and powders) enhance the growth prospects in the region

- The region’s market is also supported by an increasing focus on preventive healthcare and functional foods, coupled with greater emphasis on sustainability, particularly plant-based sources like algae-derived omega-3

- Overall, North America’s market dominance is expected to continue, fueled by rising awareness of the health benefits of EPA and DHA, along with increasing consumer preference for premium and sustainable omega-3 products

“Asia-Pacific is Projected to Register the Highest CAGR in the EPA and DHA Market”

- Asia-Pacific is anticipated to be the fastest-growing region in the EPA and DHA market, with a CAGR of 7.8% during the forecast period. The region's market share is expected to increase to 30% by 2032. This growth is driven by rising health consciousness, increasing disposable income, and growing demand for infant and maternal nutrition products

- Countries such as China, India, and Japan are emerging as key markets for EPA and DHA supplements, as increasing awareness about the benefits of omega-3s, particularly for heart, brain, and eye health, is fueling demand

- China and India, with their large populations and rising prevalence of chronic conditions like cardiovascular diseases, are seeing significant market growth. The region also benefits from a rapidly growing middle class seeking preventive healthcare options, including omega-3 supplements

- Japan, with its advanced healthcare infrastructure, increasing adoption of health-conscious lifestyles, and high awareness of omega-3’s benefits, is expected to continue driving market growth. In addition, the rising trend of plant-based supplements and the increasing availability of sustainable algal oil omega-3s contribute to the region's expanding market share

- As consumer awareness about the importance of omega-3s increases, and with improved access to dietary supplements, the Asia-Pacific region is set to lead the market in growth during the forecast period

EPA and DHA Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DSM (Netherlands)

- ADM (Archer Daniels Midland) (U.S.)

- Cargill, Incorporated (U.S.)

- BASF SE (Germany)

- Epax (Norway)

- Lonza (Switzerland)

- Orkla (Norway)

- Corbion (Netherlands)

- KD Pharma Group SA (Germany)

- GC Rieber (Norway)

- Guangdong Runke Bioengineering Co. Ltd. (China)

- Nordic Naturals (U.S.)

- GOLDEN OMEGA (Chile)

- Biosearch Life (Spain)

- Pharma Marine AS (Norway)

- Polaris Inc. (U.S.)

- Sinomega Biotech Engineering Co., Ltd. (China)

- Huatai Biopharm Resource Co., Ltd. (China)

- KinOmega Biopharm Inc. (China)

- AlgiSys (U.S.)

Latest Developments in Global EPA and DHA Market

- In January 2024, Omega Protein Corporation launched a new range of EPA/DHA soft gels enriched with added vitamins, addressing the rising demand for multi-functional dietary supplements. These soft gels are designed to provide essential omega-3 fatty acids along with additional nutrients, offering a comprehensive solution for health-conscious consumers. The innovative product line reflects Omega Protein's commitment to meeting evolving wellness trends and enhancing overall health through convenient supplementation

- In December 2023, Nordic Naturals introduced a groundbreaking omega-3 gummy designed specifically for seniors, addressing the increasing demand for convenient and health-oriented supplements. These gummies aim to support the unique nutritional needs of older adults, offering a practical and enjoyable way to incorporate essential omega-3 fatty acids into their daily routine. The launch reflects Nordic Naturals' commitment to innovation and wellness, catering to the growing trend of functional supplements that prioritize both health benefits and ease of use

- In July 2023, Aker BioMarine announced delays in securing Novel Food approval for its innovative omega-3 formulation in the European Union. The setback was attributed to the intricate regulatory processes involved in obtaining approval for new ingredients. Despite the challenges, Aker BioMarine remains committed to advancing its product development and navigating the complexities of EU regulations. This situation underscores the hurdles faced by companies introducing novel health-focused formulations in highly regulated markets

- In March 2023, GOED Omega-3 released a report emphasizing the global fragmentation of omega-3 regulations. The report highlighted how various regulatory bodies differ in their requirements for dosage recommendations, safety testing, and health claims related to heart and cognitive benefits. These disparities pose challenges for manufacturers and marketers aiming to navigate the complex landscape of omega-3 products worldwide. The findings underscore the need for harmonized standards to streamline compliance and foster innovation in the omega-3 industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Epa And Dha Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Epa And Dha Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Epa And Dha Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.