Global Envelope Paper Market

Market Size in USD Billion

CAGR :

%

USD

3.26 Billion

USD

3.80 Billion

2025

2033

USD

3.26 Billion

USD

3.80 Billion

2025

2033

| 2026 –2033 | |

| USD 3.26 Billion | |

| USD 3.80 Billion | |

|

|

|

|

What is the Global Envelope Paper Market Size and Growth Rate?

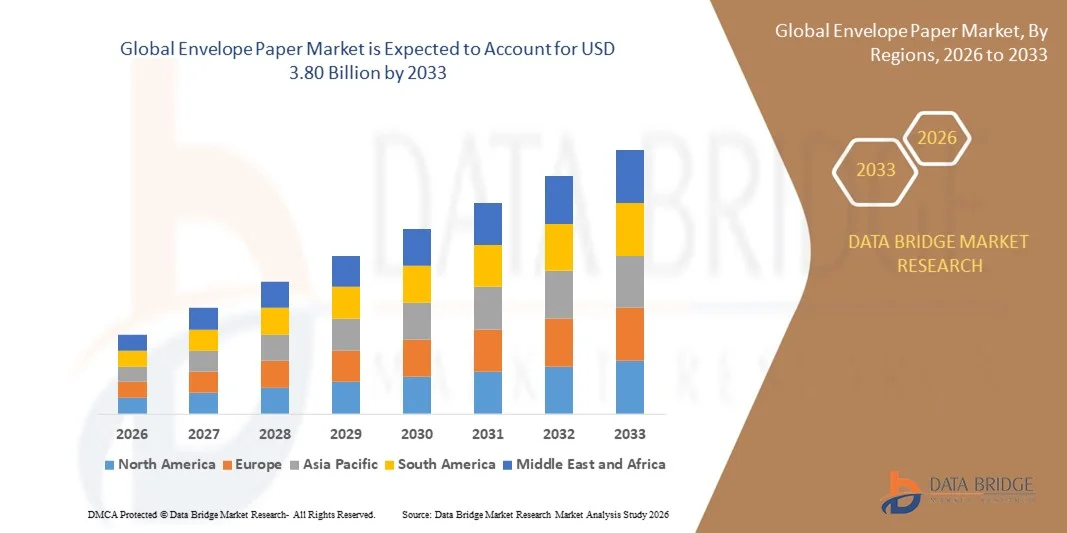

- The global envelope paper market size was valued at USD 3.26 billion in 2025 and is expected to reach USD 3.80 billion by 2033, at a CAGR of1.95% during the forecast period

- Rise in the growth in the demand for attractive design and precision construction for food products as well as medicinal packaging is the major factor escalating the market growth, also rise in the parcel delivery industry that offers shipping envelopes free to their customers by the providers of overnight services such as express mail, federal express among others, rise in the benefits of envelope such as light weight, occupy less storage space, easily transportable, and recyclable and rise in the environment conscious customers are the major factors among others propelling the growth of envelope paper market

What are the Major Takeaways of Envelope Paper Market?

- Rising research and development activities to develop advanced plastics and increasing development of patient-specific implants and 3D printed devices will further create new opportunities for the envelope paper market

- Rise in the use of digital payment system like net banking and e-wallets for transferring money and also modern people losing the rituals and tradition to exchange money envelopes during the marriage or any other occasion are the major factors among others restraining the market growth, and will further challenge the growth of envelope paper market

- North America dominated the envelope paper market with a 41.69% revenue share in 2025, driven by strong demand for commercial mailing envelopes, office stationery, packaging-grade papers, and document-handling solutions across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.98% from 2026 to 2033, supported by rapid expansion of paper manufacturing, growth in commercial printing, and increasing consumption across postal services, corporate mailing, education, and retail packaging

- The Wood Pulp segment dominated the market with a 44.7% share in 2025, driven by its wide availability, low production cost, strong printability, and suitability for mass envelope manufacturing across mailing, office stationery, and commercial documentation

Report Scope and Envelope Paper Market Segmentation

|

Attributes |

Envelope Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Envelope Paper Market?

Increasing Shift Toward Sustainable, Recyclable, and High-Performance Envelope Papers

- The envelope paper market is experiencing a rapid transition toward eco-friendly, FSC-certified, and biodegradable paper materials, driven by rising environmental regulations and brand sustainability commitments

- Manufacturers are increasingly developing lightweight, durable, and high-strength envelope papers suitable for high-speed printing, automated mailing systems, and e-commerce packaging

- Growing adoption of water-based coatings, recycled fibers, and chlorine-free pulp is improving print quality, opacity, and tear resistance across commercial, corporate, and institutional applications

- For instance, leading players such as Mondi, International Paper, Neenah, and Glatfelter have expanded their sustainable envelope paper ranges with improved recyclability, bulk strength, and lower carbon footprint

- Rising demand for premium textured papers, security-tinted envelopes, and digital-print compatible substrates further accelerates product innovation

- As postal services, corporate communication, and e-commerce packaging continue evolving, the shift toward sustainable and performance-driven envelope papers will remain a defining market trend

What are the Key Drivers of Envelope Paper Market?

- Rising demand for durable, printable, and cost-efficient envelope papers across business communication, banking, insurance, and direct mail marketing sectors

- For instance, in 2025, major companies including Mondi, Domtar, and LINTEC expanded their recyclable and high-brightness paper lines to support bulk mailing and premium envelope manufacturing

- Growth of e-commerce, gifting, office stationery, and document packaging is driving large-scale consumption of kraft, specialty, and coated envelope papers

- Advancements in pulp bleaching, fiber optimization, and surface calendaring technologies are enhancing strength, smoothness, print compatibility, and ink absorption

- Increasing adoption of security envelopes, tamperproof papers, and branded printed envelopes is boosting premium segment demand across corporations, financial institutions, and logistics companies

- Supported by rising investments in sustainable pulp sourcing, automated converting equipment, and digital printing, the Envelope Paper market is expected to record strong long-term growth

Which Factor is Challenging the Growth of the Envelope Paper Market?

- High production costs associated with premium recycled papers, specialty textures, and eco-friendly coatings limit adoption among cost-sensitive manufacturers and small print houses

- For instance, during 2024–2025, fluctuations in pulp prices, shipping rates, and energy costs increased manufacturing expenses for leading global paper producers

- Increasing digitization and the shift toward paperless communication, online billing, and digital documentation reduce envelope usage across corporate and government sectors

- Limited awareness about specialty envelope paper grades, sustainability certifications, and high-speed printing compatibility restrains adoption in emerging markets

- Strong competition from synthetic envelopes, plastic mailers, and digital communication tools creates pricing pressure and reduces category expansion in certain regions

- To address these challenges, companies are focusing on cost-efficient recycled fibers, automation, premium biodegradable coatings, and enhanced product education to drive wider global adoption of envelope papers

How is the Envelope Paper Market Segmented?

The market is segmented on the basis of material type, envelope type, product, application, and thickness.

- By Material Type

On the basis of material type, the envelope paper market is segmented into Wood Pulp, Cotton Fiber, Paperboard, Synthetic Substrates, and Others. The Wood Pulp segment dominated the market with a 44.7% share in 2025, driven by its wide availability, low production cost, strong printability, and suitability for mass envelope manufacturing across mailing, office stationery, and commercial documentation. Its compatibility with high-speed printing, recyclability, and lightweight characteristics further support large-scale adoption.

The Synthetic Substrates segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for tear-resistant, waterproof, and long-lasting envelopes used in secure mailing, logistics, archival storage, and specialty packaging. The rise of e-commerce parcels, temperature-stable mailing solutions, and high-durability communication products continues to expand the need for engineered synthetic envelope materials.

- By Envelope Type

On the basis of envelope type, the market is segmented into Open Side Envelope and Open End Envelope. The Open Side Envelope segment dominated the market with a 52.1% share in 2025, attributed to its widespread use in office correspondence, billing statements, documentation, direct mail advertising, and high-volume corporate mailing. Its side-opening design supports compatibility with automated insertion machines, making it the preferred choice for banks, telecom companies, insurance providers, and government agencies.

The Open End Envelope segment is expected to grow at the fastest CAGR during 2026–2033, driven by rising adoption in industrial packaging, document storage, catalogs, e-commerce inserts, and secure content mailing. Their robust structure, easier vertical insertion, and suitability for thicker paper stacks increase demand across printing houses, logistics companies, and administrative institutions.

- By Product

On the basis of product, the envelope paper market is segmented into Hard Paper and Soft Paper. The Hard Paper segment dominated the market with a 48.5% share in 2025, supported by its strong rigidity, premium finish, and extensive use in business communication, invitations, legal documents, certificates, and secure mailing applications. Its durability, crease resistance, and superior print compatibility make it ideal for high-end corporate and institutional use.

The Soft Paper segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand in bulk mailing, lightweight envelopes, daily office stationery, and personal-use communication. Its flexibility, low cost, and eco-friendly composition make it popular among SMEs, educational institutions, retail stationery brands, and mass-market envelope manufacturers.

- By Application

On the basis of application, the market is segmented into Personal Use and Commercial Use. The Commercial Use segment dominated the market with a 58.3% share in 2025, driven by strong utilization across corporate communication, banking, insurance, education, logistics, direct mail campaigns, and document handling. High-volume envelope consumption in billing, promotional mailing, and official correspondence continues to support category leadership.

The Personal Use segment is expected to record the fastest CAGR between 2026 and 2033, owing to rising demand for gifting envelopes, greeting card envelopes, decorative envelopes, wedding stationery, and craft-based applications. Increased consumer interest in premium textured papers, customized designs, and eco-friendly stationery products further strengthens adoption.

- By Thickness Type

On the basis of thickness, the envelope paper market is segmented into 80 GSM, 90 GSM, and 100 GSM. The 90 GSM segment dominated with a 46.2% share in 2025, as it offers the ideal balance of strength, opacity, flexibility, and print quality for business envelopes, postal mailing, and branded corporate stationery. Its widespread availability, lower cost, and compatibility with high-speed printing machines make it the industry standard.

The 100 GSM segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for premium envelopes used in legal documentation, luxury communication, certificates, invitations, and secure mailing applications. Its high stiffness, enhanced durability, and premium tactile feel support growth across corporate, academic, and ceremonial sectors.

Which Region Holds the Largest Share of the Envelope Paper Market?

- North America dominated the envelope paper market with a 41.69% revenue share in 2025, driven by strong demand for commercial mailing envelopes, office stationery, packaging-grade papers, and document-handling solutions across the U.S. and Canada. Growth in e-commerce shipping, financial correspondence, direct mail marketing, postal communication, and corporate documentation supports large-scale consumption of envelope-grade papers. Increasing use of lightweight, recyclable, and FSC-certified materials continues to strengthen the region’s market position

- Leading manufacturers in North America are expanding production of premium textured papers, specialty envelope grades, security envelopes, and sustainable paper substrates. Investments in modern paper mills, digital printing compatibility, and eco-friendly pulping technologies further reinforce market leadership

- High paper recycling rates, strong printing and packaging ecosystems, and rising adoption of sustainable mailing products continue to drive long-term growth

U.S. Envelope Paper Market Insight

The U.S. is the largest contributor in North America, driven by strong demand from banking, insurance, government agencies, educational institutions, and corporate communication sectors. Large-scale usage of commercial envelopes for billing statements, postal correspondence, promotional mailers, and legal documentation significantly boosts consumption. The rise of customized printed envelopes, premium stationery, and security-enhanced envelopes also supports growth. A well-established printing industry, large e-commerce logistics networks, and expanding sustainable paper production further reinforce the U.S. market’s dominance.

Canada Envelope Paper Market Insight

Canada contributes substantially to regional growth due to increasing adoption of eco-friendly envelopes, rising postal service activity, and steady demand for office stationery. Expansion of commercial printing facilities, government communication programs, and business documentation requirements continues to enhance consumption. Strong emphasis on recyclable materials, sustainable paper manufacturing, and forest management practices boosts long-term demand. Educational institutions, SMEs, and financial service providers remain key consumers across the country.

Asia-Pacific Envelope Paper Market

Asia-Pacific is projected to register the fastest CAGR of 7.98% from 2026 to 2033, supported by rapid expansion of paper manufacturing, growth in commercial printing, and increasing consumption across postal services, corporate mailing, education, and retail packaging. High-volume production capabilities in China, India, Japan, and South Korea enable competitive pricing and large-scale regional exports. Growing demand for customized printed envelopes, gift envelopes, and eco-friendly mailing products further accelerates adoption. E-commerce expansion, rising literacy rates, and strong retail communication needs support long-term market growth.

China Envelope Paper Market Insight

China is the largest contributor to Asia-Pacific due to its massive paper production capacity, extensive commercial printing ecosystem, and growing demand for mailing and packaging envelopes. Strong domestic consumption from logistics companies, financial institutions, and government agencies drives market expansion. Increasing focus on biodegradable materials, recycled fiber integration, and mass-scale envelope manufacturing strengthens China’s competitive advantage across domestic and export segments.

Japan Envelope Paper Market Insight

Japan shows steady growth driven by high usage of premium envelopes in corporate communication, official documentation, and ceremonial purposes. Precision printing technologies, strong quality standards, and preference for premium textured and high-strength papers support market stability. Demand for compact mailing products, gift envelopes, and high-opacity paper continues to rise. Growing modernization across postal services and steady business documentation needs reinforce long-term adoption.

India Envelope Paper Market Insight

India is emerging as a major growth hub due to rising postal service usage, increasing commercial mailing, expansion of educational institutions, and strong demand for affordable stationery products. Growth in retail communication, financial correspondence, and government mailing programs drives wide-scale adoption. Rising production of soft paper envelopes, customized printed envelopes, and recycled paper options supports rapid market penetration. Expanding paper mills and growing SMEs in printing and packaging further strengthen the segment.

South Korea Envelope Paper Market Insight

South Korea contributes significantly to regional growth due to strong demand from corporate communication, premium stationery markets, and e-commerce packaging. Rising consumption of high-quality envelope papers for financial documentation, administrative communication, and direct mail campaigns boosts market adoption. The country’s advanced printing sector, focus on eco-friendly materials, and growing premium gifting culture continue to support steady market expansion.

Which are the Top Companies in Envelope Paper Market?

The envelope paper industry is primarily led by well-established companies, including:

- International Paper (U.S.)

- Mondi (South Africa)

- DuPont (U.S.)

- Domtar Corporation (Canada)

- Neenah Paper and Packaging (U.S.)

- Cenveo Worldwide Limited (U.S.)

- L A Envelope Co (U.S.)

- Om Xpress Print Pack Private Limited (India)

- Ravi Exports (India)

- Rama Pulp and Papers Limited (India)

- Glatfelter Corporation (U.S.)

- LINTEC Corporation (Japan)

- Altenew (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Envelope Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Envelope Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Envelope Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.