Global Enterprise Quantum Computing Market

Market Size in USD Billion

CAGR :

%

USD

5.84 Billion

USD

63.35 Billion

2025

2033

USD

5.84 Billion

USD

63.35 Billion

2025

2033

| 2026 –2033 | |

| USD 5.84 Billion | |

| USD 63.35 Billion | |

|

|

|

|

Enterprise Quantum Computing Market Size

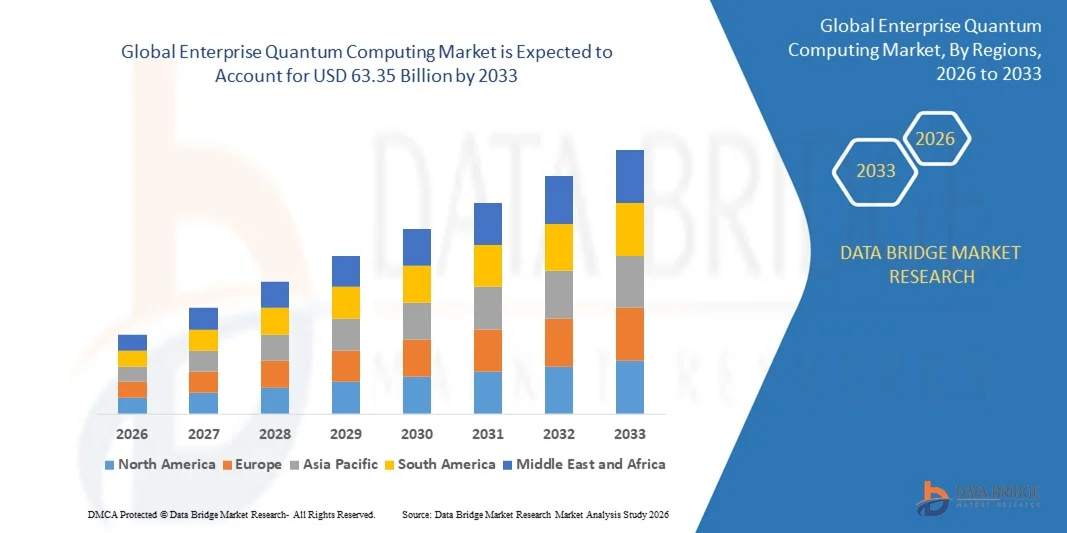

- The global enterprise quantum computing market size was valued at USD 5.84 billion in 2025 and is expected to reach USD 63.35 billion by 2033, at a CAGR of 34.70% during the forecast period

- The market growth is largely driven by increasing enterprise demand for advanced computational capabilities to solve complex problems that are impractical for classical systems, accelerating the adoption of quantum computing across data-intensive industries

- Furthermore, rising investments from governments and large enterprises, combined with rapid progress in quantum hardware, algorithms, and cloud accessibility, are strengthening confidence in enterprise-grade quantum solutions. These converging factors are accelerating pilot deployments and early commercialization, thereby significantly boosting overall market growth

Enterprise Quantum Computing Market Analysis

- Enterprise quantum computing refers to the use of quantum processors, software platforms, and hybrid quantum–classical systems to address optimization, simulation, cryptography, and advanced analytics challenges across industries

- The growing adoption of enterprise quantum computing is primarily fueled by digital transformation initiatives, increasing complexity of business data, and the need for competitive advantage through faster, more accurate computational outcomes

- North America dominated the enterprise quantum computing market with a share of around 45% in 2025, due to strong government funding, early enterprise adoption, and the presence of leading quantum technology developers

- Asia-Pacific is expected to be the fastest growing region in the enterprise quantum computing market during the forecast period due to rising digital transformation initiatives, expanding enterprise IT spending, and government-backed quantum programs

- Hardware segment dominated the market with a market share of around 50% in 2025, due to heavy investments in quantum processors, cryogenic systems, and control electronics required to build and stabilize quantum systems. Enterprises and research-driven organizations continue to allocate substantial capital toward superconducting qubits, trapped-ion systems, and supporting infrastructure to achieve higher qubit counts and lower error rates. Leading technology players and national laboratories are prioritizing hardware development as a foundational step toward scalable, fault-tolerant quantum computing

Report Scope and Enterprise Quantum Computing Market Segmentation

|

Attributes |

Enterprise Quantum Computing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Enterprise Quantum Computing Market Trends

Rising Adoption of Cloud-Based Quantum Computing Platforms

- A major trend in the enterprise quantum computing market is the increasing adoption of cloud-based quantum computing platforms, as enterprises seek flexible access to quantum resources without investing in costly on-premise infrastructure. Cloud delivery models are enabling organizations to experiment with quantum algorithms for optimization, machine learning, and simulation while reducing upfront hardware and maintenance burdens

- For instance, IBM has expanded access to its IBM Quantum platform through IBM Cloud, allowing enterprises, research institutions, and developers to run quantum workloads on real quantum processors and simulators. This approach is accelerating enterprise familiarity with quantum computing and supporting early-stage commercial use cases

- Large technology providers are integrating quantum services with existing cloud ecosystems, making it easier for enterprises to combine classical and quantum computing workflows. This hybrid model is improving usability and encouraging practical experimentation across industries such as finance, logistics, and pharmaceuticals

- The growing availability of software development kits and quantum-as-a-service offerings is lowering technical entry barriers for enterprises. These tools enable teams to design, test, and refine quantum algorithms without deep hardware-level expertise

- Enterprises are increasingly leveraging cloud-based quantum platforms for proof-of-concept projects focused on complex problem solving. This trend is helping organizations assess potential business value while preparing for future quantum advantage

- The continued expansion of cloud-accessible quantum systems is reinforcing market momentum by promoting scalable adoption, collaborative development, and gradual integration of quantum computing into enterprise digital strategies

Enterprise Quantum Computing Market Dynamics

Driver

Growing Enterprise Demand for Advanced Optimization and Simulation Capabilities

- Enterprises are driving demand for quantum computing due to its potential to solve highly complex optimization and simulation problems that are difficult or inefficient for classical systems. Industries such as finance, manufacturing, energy, and life sciences are exploring quantum approaches to improve decision-making and operational efficiency

- For instance, JPMorgan Chase has partnered with IBM to research quantum algorithms for financial modeling, portfolio optimization, and risk analysis. These initiatives highlight how enterprises are actively investing in quantum capabilities to gain competitive advantages in data-intensive environments

- The need to optimize supply chains, logistics networks, and production scheduling is pushing enterprises toward quantum-enhanced optimization techniques. Quantum computing offers the ability to evaluate vast solution spaces more effectively than traditional methods

- Simulation of molecular structures and chemical reactions is another critical driver, particularly for pharmaceutical and materials companies. Quantum simulations can significantly improve accuracy in drug discovery and materials design processes

- The expanding recognition of quantum computing’s ability to address high-value, computation-heavy challenges is strengthening enterprise interest and investment. This demand is positioning quantum technologies as strategic enablers for next-generation enterprise innovation

Restraint/Challenge

High Technical Complexity and Limited Availability of Skilled Quantum Talent

- The enterprise quantum computing market faces significant challenges due to the high technical complexity associated with developing, deploying, and maintaining quantum solutions. Quantum systems require specialized knowledge in physics, mathematics, and computer science, which limits widespread enterprise adoption

- For instance, companies such as Google Quantum AI rely on highly specialized research teams to design quantum hardware and algorithms, underscoring the scarcity of skilled professionals in this field. This talent gap makes it difficult for many enterprises to build in-house quantum expertise

- The limited availability of trained quantum engineers and developers increases reliance on external partners and cloud providers. This dependence can slow internal capability development and constrain customization of quantum solutions

- Quantum software development involves unfamiliar programming paradigms and error mitigation techniques that differ significantly from classical computing. Enterprises often face steep learning curves when integrating quantum workflows into existing systems

- The combination of technical complexity and talent shortages remains a critical restraint for the market. Overcoming these challenges will require sustained investment in education, partnerships, and user-friendly platforms to support broader enterprise adoption

Enterprise Quantum Computing Market Scope

The market is segmented on the basis of component, technology, deployment model, application, and end user.

- By Component

On the basis of component, the enterprise quantum computing market is segmented into hardware, software, and services. The hardware segment dominated the largest market revenue share of around 50% in 2025, driven by heavy investments in quantum processors, cryogenic systems, and control electronics required to build and stabilize quantum systems. Enterprises and research-driven organizations continue to allocate substantial capital toward superconducting qubits, trapped-ion systems, and supporting infrastructure to achieve higher qubit counts and lower error rates. Leading technology players and national laboratories are prioritizing hardware development as a foundational step toward scalable, fault-tolerant quantum computing.

The services segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for quantum consulting, system integration, training, and managed services. As most enterprises lack in-house quantum expertise, service providers play a critical role in use-case identification, algorithm development, and hybrid quantum–classical deployment. This shift reflects a growing preference for outcome-oriented adoption rather than direct ownership of complex quantum infrastructure.

- By Technology

On the basis of technology, the market is segmented into quantum annealing (adiabatic), superconducting, trapped ion, quantum dot, and others. The superconducting segment accounted for the largest revenue share in 2025, supported by its relative technological maturity and strong backing from major enterprise-focused quantum developers. Superconducting qubits enable faster gate operations and benefit from established semiconductor fabrication processes, making them attractive for enterprises pursuing near-term quantum advantage. Continuous improvements in coherence times and error correction further reinforce their dominant position.

The trapped ion segment is expected to grow at the fastest rate during the forecast period, driven by its high qubit fidelity and longer coherence times, which are critical for complex enterprise workloads. Enterprises exploring precision-heavy applications, such as simulation and optimization, are increasingly evaluating trapped-ion systems for their accuracy and scalability potential. Ongoing advancements in modular ion-trap architectures are accelerating enterprise interest in this technology.

- By Deployment Model

On the basis of deployment model, the enterprise quantum computing market is segmented into on-premises and cloud. The cloud segment held the largest market revenue share in 2025, as enterprises favored cloud-based access to quantum systems without the cost and complexity of owning physical hardware. Cloud deployment enables organizations to experiment with quantum algorithms, scale usage on demand, and integrate quantum workflows with existing enterprise IT environments. This model significantly lowers entry barriers and supports collaborative innovation across global teams.

The on-premises segment is projected to register the fastest growth from 2026 to 2033, driven by increasing concerns around data sovereignty, security, and latency-sensitive workloads. Large enterprises, government agencies, and defense-related organizations are investing in on-site quantum systems to maintain tighter control over sensitive data. As hardware stability improves, on-premises deployment is becoming more viable for mission-critical applications.

- By Application

On the basis of application, the market is segmented into machine learning/deep learning/AI, optimization, simulation and data modeling, cybersecurity, and others. The optimization segment dominated the market in 2025, as enterprises actively leveraged quantum approaches to solve complex optimization problems across logistics, supply chains, portfolio management, and scheduling. Quantum optimization offers significant performance advantages for multi-variable problems that are computationally intensive for classical systems. This strong alignment with immediate enterprise needs has driven early adoption.

The machine learning/deep learning/AI segment is expected to witness the fastest growth over the forecast period, supported by growing interest in quantum-enhanced learning models and data processing capabilities. Enterprises are exploring quantum techniques to improve training efficiency, pattern recognition, and model accuracy for large-scale datasets. The convergence of AI and quantum computing is emerging as a high-impact growth area.

- By End User

On the basis of end user, the enterprise quantum computing market is segmented into healthcare and life sciences, IT and telecom, manufacturing, BFSI, energy and utilities, aerospace and defense, and others. The BFSI segment accounted for the largest revenue share in 2025, driven by strong demand for quantum solutions in risk analysis, portfolio optimization, fraud detection, and cryptography. Financial institutions are early adopters due to their data-intensive operations and the clear value proposition of quantum acceleration. Strategic pilot programs and partnerships have further strengthened BFSI dominance.

The healthcare and life sciences segment is anticipated to grow at the fastest rate from 2026 to 2033, propelled by rising use of quantum computing in drug discovery, molecular simulation, and personalized medicine. Enterprises in this sector are increasingly investing in quantum tools to reduce R&D timelines and improve predictive accuracy. The growing intersection of quantum computing with biomedical research positions healthcare as a key future growth driver.

Enterprise Quantum Computing Market Regional Analysis

- North America dominated the enterprise quantum computing market with the largest revenue share of around 45% in 2025, driven by strong government funding, early enterprise adoption, and the presence of leading quantum technology developers

- Enterprises across the region actively invest in quantum hardware, cloud-based quantum platforms, and hybrid quantum–classical solutions to gain early computational advantages

- This leadership is further supported by a mature digital ecosystem, advanced research infrastructure, and close collaboration between enterprises, academia, and government agencies, positioning North America as the global hub for enterprise quantum innovation

U.S. Enterprise Quantum Computing Market Insight

The U.S. enterprise quantum computing market captured the largest revenue share within North America in 2025, supported by aggressive R&D investments and early commercialization initiatives. Enterprises across BFSI, defense, healthcare, and IT sectors are increasingly piloting quantum solutions for optimization, simulation, and cryptography. Strong federal programs, defense-backed research, and the presence of major cloud and quantum platform providers continue to accelerate enterprise-level adoption and ecosystem development.

Europe Enterprise Quantum Computing Market Insight

The Europe enterprise quantum computing market is projected to expand at a steady CAGR during the forecast period, driven by coordinated regional initiatives focused on technological sovereignty and digital resilience. Enterprises across manufacturing, energy, and automotive sectors are exploring quantum computing to enhance complex modeling and optimization capabilities. Supportive regulatory frameworks and cross-border research collaborations are strengthening enterprise confidence in long-term quantum deployment.

U.K. Enterprise Quantum Computing Market Insight

The U.K. enterprise quantum computing market is expected to grow at a notable CAGR over the forecast period, supported by strong academic research output and growing enterprise participation. Organizations are increasingly integrating quantum capabilities into advanced analytics, cybersecurity, and financial modeling workflows. National quantum programs and close industry–academia collaboration continue to position the U.K. as a key innovation center in Europe.

Germany Enterprise Quantum Computing Market Insight

The Germany enterprise quantum computing market is anticipated to register considerable growth during the forecast period, driven by demand from manufacturing, automotive, and industrial engineering sectors. German enterprises are focusing on quantum-enabled simulation and optimization to improve production efficiency and materials research. The country’s emphasis on precision engineering, data security, and industrial innovation supports sustained adoption.

Asia-Pacific Enterprise Quantum Computing Market Insight

The Asia-Pacific enterprise quantum computing market is expected to witness the fastest CAGR from 2026 to 2033, driven by rising digital transformation initiatives, expanding enterprise IT spending, and government-backed quantum programs. Enterprises across the region are increasingly adopting cloud-based quantum access models to overcome infrastructure constraints. Rapid technological advancement and growing participation from both public and private sectors are accelerating market momentum.

Japan Enterprise Quantum Computing Market Insight

The Japan enterprise quantum computing market is gaining traction, supported by strong government backing and a technology-driven enterprise landscape. Japanese enterprises are focusing on quantum applications in materials science, optimization, and advanced manufacturing. The country’s emphasis on precision, long-term innovation, and high-performance computing integration continues to support steady market growth.

China Enterprise Quantum Computing Market Insight

The China enterprise quantum computing market accounted for the largest revenue share in Asia-Pacific in 2025, driven by large-scale government investment and rapid enterprise adoption. Chinese enterprises are increasingly leveraging quantum computing for cryptography, optimization, and simulation applications. Strong domestic development capabilities and national digital infrastructure initiatives are reinforcing China’s position as a major enterprise quantum computing market.

Enterprise Quantum Computing Market Share

The enterprise quantum computing industry is primarily led by well-established companies, including:

- Intel Corporation (U.S.)

- D-Wave Systems Inc. (Canada)

- CAMBRIDGE QUANTUM COMPUTING LTD. (U.K.)

- IBM (U.S.)

- QCWare (U.S.)

- Rigetti & Co., Inc. (U.S.)

- Google (U.S.)

- Quantum Circuits, Inc. (U.S.)

- Microsoft (U.S.)

- Cisco Systems, Inc. (U.S.)

- Atos SE (France)

- Huawei Technologies Co., Ltd. (China)

- Robert Bosch GmbH (Germany)

- ID Quantique (Switzerland)

- Toshiba Europe Limited (U.K.)

- Honeywell International Inc. (U.S.)

- Accenture (Ireland)

- FUJITSU (Japan)

- Hitachi, Ltd. (Japan)

Latest Developments in Global Enterprise Quantum Computing Market

- In April 2024, IonQ signed a memorandum of understanding with Intellian to extend its quantum computing footprint into South Korea, strengthening its presence in a strategically important Asia-Pacific market. This move supports wider enterprise adoption by enabling regional access to trapped-ion quantum systems and accelerates commercialization across telecommunications, manufacturing, and advanced research sectors, reinforcing the globalization of the enterprise quantum computing market

- In April 2024, IonQ entered into an agreement with Toyota Tsusho and AIST to expand the reach of its quantum computers in Japan, targeting industrial and research-driven enterprise use cases. The collaboration enhances market penetration in Japan by aligning quantum capabilities with automotive, materials science, and optimization-focused applications, supporting long-term enterprise demand in high-precision industries

- In April 2024, IonQ established a $22 million quantum computing and networking hub in Chattanooga, Tennessee, as part of its expansion strategy to scale enterprise access and ecosystem development. This investment strengthens regional quantum infrastructure, supports workforce development, and accelerates commercialization, positioning IonQ to capture growing enterprise demand for quantum-as-a-service and hybrid computing models

- In April 2024, IBM announced a $30 billion R&D investment in the U.S., as part of a broader $150 billion spend, with a portion dedicated to quantum computing, alongside a partnership with the Basque Government to deploy Europe’s first IBM Quantum System 2 in Spain. This development reinforces IBM’s leadership in enterprise quantum platforms, expands global access to advanced quantum systems, and accelerates adoption across European enterprises seeking scalable quantum solutions

- In February 2024, Microsoft unveiled the Majorana 1 chip, the world’s first quantum processor powered by topological qubits, marking a critical milestone toward fault-tolerant and scalable quantum computing. This breakthrough has significant market implications by addressing long-standing stability and error-correction challenges, strengthening enterprise confidence in long-term quantum investments and advancing the path toward practical, large-scale quantum commercialization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.