Global Ent Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.32 Billion

USD

4.33 Billion

2024

2032

USD

2.32 Billion

USD

4.33 Billion

2024

2032

| 2025 –2032 | |

| USD 2.32 Billion | |

| USD 4.33 Billion | |

|

|

|

|

ENT Devices Market Size

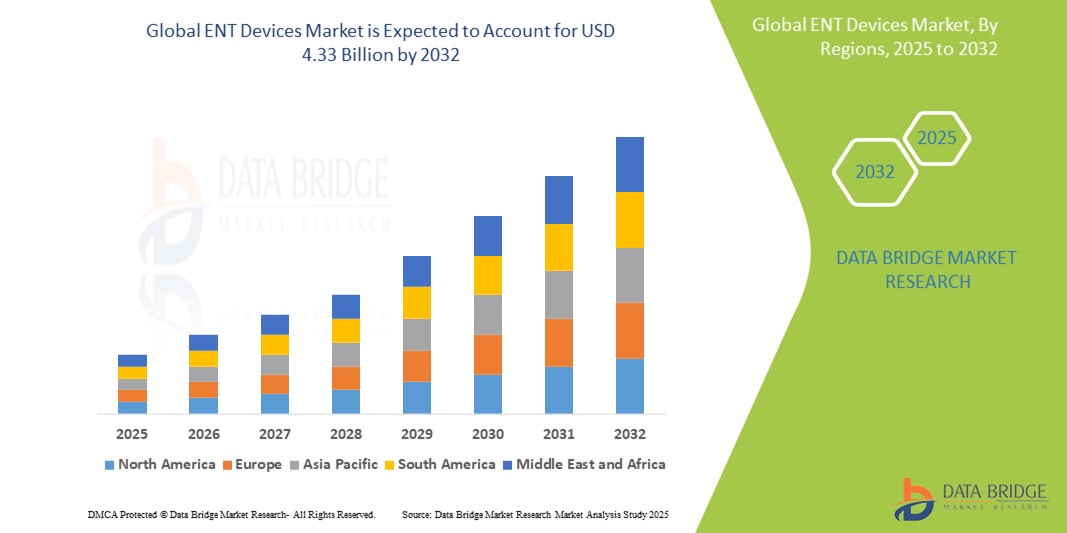

- The global ENT devices market size was valued at USD 2.32 billion in 2024 and is expected to reach USD 4.33 billion by 2032, at a CAGR of 8.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of ENT disorders globally, particularly hearing loss, driven by factors such as the growing geriatric population and environmental influences

- ·Furthermore, rising consumer demand for advanced and minimally invasive ENT procedures, coupled with continuous technological advancements in diagnostic and surgical devices, is accelerating the adoption of ENT solutions, thereby significantly boosting the industry's growth

ENT Devices Market Analysis

- ENT devices, encompassing a wide range of diagnostic, surgical, and therapeutic instruments for ear, nose, and throat conditions, are crucial for addressing the increasing global burden of ENT disorders and improving patient outcomes through advanced medical interventions

- The escalating demand for ENT devices is primarily fueled by the rising prevalence of hearing loss and other ENT-related conditions, a rapidly aging global population, and the growing preference for minimally invasive surgical procedures offering quicker recovery times and reduced complications

- North America dominates the ENT devices market with the largest revenue share of 35.49% in 2024, characterized by a high prevalence of ENT disorders, well-established healthcare infrastructure, favorable reimbursement policies, and significant investments in research and development by key industry players. The U.S. specifically holds a substantial share within this region due to technological advancements and numerous product approvals

- Asia-Pacific is expected to be the fastest growing region in the ENT devices market during the forecast period due to increasing urbanization, rising healthcare expenditure, a large patient pool, and growing awareness of ENT disorders, coupled with technological innovations and supportive regulatory environments

- Hearing aids segment dominates the ENT devices market with a market share of 31.11% in 2024, driven by its high global prevalence of hearing impairment and continuous advancements in hearing aid technology, including smart and AI-integrated devices.

Report Scope and ENT Devices Market Segmentation

|

Attributes |

ENT Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

ENT Devices Market Trends

“Enhanced Precision and Efficiency Through AI and Robotic Integration”

- A significant and accelerating trend in the global ENT devices market is the deepening integration of artificial intelligence (AI) and robotic surgical systems. This fusion of technologies is significantly enhancing diagnostic precision, surgical accuracy, and overall patient outcomes in ear, nose, and throat procedures

- For instance, AI-powered diagnostic tools are enabling more accurate and faster detection of conditions such as laryngeal cancers and ear infections by analyzing medical images and patient data with high accuracy. Similarly, robotic-assisted surgical systems, such as the da Vinci Surgical System, are increasingly employed in complex head and neck surgeries, offering surgeons enhanced control, greater dexterity in confined spaces, and minimal tissue damage

- AI integration in ENT devices extends to hearing aids, where AI-powered devices can learn user preferences and adapt to different acoustic environments in real-time, filtering background noise and enhancing speech clarity. This leads to a more personalized and effective hearing experience. Furthermore, AI is being explored for predictive analysis, identifying patients at risk for certain ENT conditions, and optimizing treatment plans

- The seamless integration of these advanced technologies with existing ENT workflows facilitates more efficient and streamlined clinical processes. Through improved visualization, navigation, and data analysis, healthcare providers can make more informed decisions, potentially reducing surgical risks and improving recovery times

- This trend towards more intelligent, precise, and interconnected ENT devices is fundamentally reshaping patient care and treatment paradigms. Consequently, companies are investing heavily in R&D to develop AI-enabled diagnostic platforms, robotic surgical tools, and smart hearing solutions, aiming to deliver superior clinical results and enhance patient quality of life

- The demand for ENT devices that offer enhanced precision and efficiency through AI and robotic integration is growing rapidly across healthcare settings, as clinicians increasingly prioritize advanced, less invasive, and more effective treatment options

ENT Devices Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of ENT Disorders and Aging Population”

- The increasing global prevalence of various ear, nose, and throat (ENT) disorders, coupled with a rapidly expanding geriatric population, is a significant driver for the heightened demand for ENT devices

- For instance, the World Health Organization (WHO) highlights the widespread incidence of hearing loss, which disproportionately affects older adults. This demographic shift naturally increases the demand for diagnostic tools and therapeutic devices such as hearing aids and cochlear implants. Similarly, conditions such as chronic sinusitis, allergic rhinitis, and obstructive sleep apnea are becoming more common due to lifestyle factors and environmental changes, necessitating more frequent diagnoses and interventions with specialized ENT devices

- As individuals become more aware of these conditions and seek timely treatment, ENT devices offer advanced solutions ranging from precise diagnostic imaging to minimally invasive surgical instruments. These tools enable earlier detection, more accurate diagnoses, and less invasive treatments, providing compelling advantages over traditional methods

- Furthermore, the convenience of advanced technologies that improve patient comfort and reduce recovery times, such as smaller endoscopes and integrated surgical systems, are key factors propelling the adoption of ENT devices across hospitals, ENT clinics, and ambulatory surgical centers

- The ongoing efforts by healthcare providers and governments to improve access to ENT care and increase awareness about early detection further contribute to market growth

Restraint/Challenge

“High Cost of Advanced Devices and Regulatory Complexities”

- Concerns surrounding the high initial cost of advanced ENT devices pose a significant challenge to broader market penetration. These devices, including robotic surgical systems and high-precision diagnostic tools, involve substantial R&D and manufacturing expenses

- For instance, advanced cochlear implants or AI-driven diagnostic platforms represent considerable capital investments for healthcare providers, limiting their accessibility, especially in developing regions or for facilities with budget constraints

- Addressing these cost concerns through economies of scale and the development of more cost-effective solutions is crucial for building wider adoption. Companies are focusing on producing more affordable, yet effective, diagnostic and therapeutic devices

- In addition, the complex and lengthy regulatory approval processes for medical devices, particularly for novel ENT technologies, create significant barriers. These stringent requirements add considerable time and cost to product development and market entry.

- Overcoming these challenges through the development of more affordable ENT device options and streamlined, yet robust, regulatory pathways will be vital for sustained market growth

ENT Devices Market Scope

The market is segmented on the basis of procedure type, product, end user, and distribution channel.

- By Procedure Type

On the basis of procedure type, the global ENT devices market is segmented into tonsillectomy & adenoidectomy, tympanostomy tube insertions, septoplasty, turbinate reduction, epistaxis, and laryngeal procedures. The Tonsillectomy & Adenoidectomy segment is expected to hold the largest market revenue share in 2024. This is primarily driven by the high prevalence of tonsillitis and adenoid hypertrophy, especially among pediatric populations, and the established nature of these procedures as a common ENT intervention. The market also sees consistent demand for devices that enable less invasive techniques and faster patient recovery in these common surgeries

The septoplasty segment is anticipated to witness the fastest growth during the forecast period. This acceleration is fueled by the increasing prevalence of deviated septums causing breathing difficulties and a growing patient preference for surgical correction. Advancements in endoscopic techniques and related instruments, leading to improved surgical precision and reduced recovery times, further propel the growth of this segment

- By Product

On the basis of product, the global ENT devices market is segmented into diagnostic ENT devices, surgical ENT devices, hearing aids, hearing implants, and nasal splints. The hearing aids segment dominates the market with the largest revenue share in 2024. This dominance is primarily fueled by the growing global prevalence of hearing loss, especially among the aging population, and continuous technological advancements in hearing aid functionality, including smart features, improved sound processing, and connectivity options. The market also sees strong demand for hearing aids due to increased consumer awareness and favorable reimbursement policies in many regions.

The surgical ENT devices segment is anticipated to witness a considerable growth rate, driven by the increasing incidence of ENT disorders requiring surgical intervention and ongoing innovations in surgical tools, particularly those enabling less invasive and more precise procedures.

- By End User

On the basis of end user, the global ENT devices market is segmented into ENT clinics, hospitals, ambulatory settings, and others. The hospitals segment held the largest market revenue share in 2024. This dominance is attributed to hospitals being the primary facilities for a comprehensive range of ENT diagnostic, surgical, and therapeutic procedures. They are equipped with advanced infrastructure and specialized medical professionals, making them central to addressing complex ENT conditions and emergencies. The market also sees strong demand from hospitals due to the increasing volume of ENT surgeries performed and the need for high-end diagnostic equipment.

The ENT clinics segment is anticipated to witness significant growth, fueled by advancements in clinical diagnostic tools and increasing patient preference for specialized outpatient care settings due to convenience and often lower costs for routine consultations and minor procedures.

- By Distribution Channel

On the basis of distribution channel, the global ENT devices market is segmented into direct tender, retail sales, and online sales. The direct tender segment is expected to hold a significant market revenue share, driven by large-volume procurements of expensive and specialized ENT equipment by hospitals, government healthcare programs, and large medical institutions through competitive bidding processes. Direct tenders often involve bulk purchasing and long-term contracts.

The retail sales segment, is anticipated to witness a robust growth rate. This is fueled by increasing consumer access to retail pharmacies and specialized medical stores.

ENT Devices Market Regional Analysis

- North America dominates the ENT devices market with the largest revenue share of 35.49% in 2024, driven by high prevalence of ENT disorders, well-established healthcare infrastructure, favorable reimbursement policies, and significant investments in research and development by key industry players

- Consumers and healthcare providers in the region highly value the cutting-edge diagnostic and surgical capabilities offered by advanced ENT devices, coupled with favorable reimbursement policies that support the adoption of innovative technologies such as robot-assisted endoscopes and next-generation hearing aids

- This widespread adoption is further supported by high healthcare expenditure, a technologically inclined population, and the presence of major domestic and international industry players who continuously invest in research and development, solidifying North America's position as a leader in both residential and commercial ENT device utilization

U.S. ENT Devices Market Insight

The U.S. ENT devices market captured the largest revenue share in 2024. This is fueled by the high prevalence of ENT disorders, advanced healthcare infrastructure, and the swift uptake of innovative medical devices. Consumers and healthcare providers increasingly prioritize the use of advanced diagnostic tools and surgical systems, driven by a focus on improved patient outcomes and minimally invasive procedures. The robust demand for technologically advanced hearing aids and implants, coupled with significant investments in R&D by key players, further propels the ENT devices industry. Moreover, the increasing integration of digital health technologies and favorable reimbursement policies are significantly contributing to the market's expansion

Europe ENT Devices Market Insight

The Europe ENT devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing incidence of hearing loss, chronic sinusitis, and other ENT disorders, especially within its aging population. Stringent regulatory frameworks ensure high-quality devices, fostering trust and driving adoption. European healthcare systems are also increasingly adopting advanced diagnostic and surgical ENT devices to enhance treatment efficiency and patient care. The region is experiencing significant growth across hospitals and ENT clinics, with a rising demand for innovative solutions for diagnosis and treatment

U.K. ENT Devices Market Insight

The U.K. ENT devices market is anticipated to grow at a noteworthy CAGR, driven by the escalating prevalence of hearing loss (affecting around 11 million people, projected to reach 13 million by 2035, and a desire for heightened precision and less invasive procedures. In addition, concerns regarding the burden of ENT disorders on the healthcare system are encouraging investment in advanced diagnostic and treatment solutions. The UK's well-developed healthcare infrastructure, coupled with technological advancements in digital hearing aids and minimally invasive surgical equipment, is expected to continue to stimulate market growth

Germany ENT Devices Market Insight

The Germany ENT devices market is expected to expand at a considerable CAGR (~6.593% from 2025-2035), fueled by increasing awareness of ENT health and the demand for technologically advanced, patient-centric solutions. Germany’s robust healthcare infrastructure, combined with its emphasis on innovation and high-quality medical technology, promotes the adoption of advanced ENT devices, particularly in hospitals and specialized clinics. The integration of cutting-edge diagnostic and surgical systems is becoming increasingly prevalent, with a strong preference for precise, effective, and patient-friendly solutions aligning with local healthcare expectations

Asia-Pacific ENT Devices Market Insight

The Asia-Pacific ENT devices market is poised to grow at the fastest CAGR of 6.72 during 2025-2032, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards improving healthcare infrastructure, supported by government initiatives promoting digitalization and accessible healthcare, is driving the adoption of ENT devices. Furthermore, as APAC becomes a significant manufacturing hub for medical devices, the affordability and accessibility of advanced ENT solutions are expanding to a wider patient base

Japan ENT Devices Market Insight

The Japan ENT devices market is gaining momentum due to the country’s high-tech healthcare culture, a rapidly aging population (leading to increased prevalence of hearing loss and other age-related ENT conditions), and a strong demand for advanced diagnostic and treatment convenience. The Japanese market places a significant emphasis on precision and quality, and the adoption of ENT devices is driven by the increasing number of technologically advanced medical facilities. The integration of advanced imaging and surgical navigation systems with other medical technologies is fueling growth

India ENT Devices Market Insight

The India ENT devices market accounted for a significant market revenue share within Asia Pacific, attributed to the country's expanding middle class, rapid urbanization, and high rates of healthcare technological adoption. India stands as a rapidly growing market for medical devices, and ENT devices are becoming increasingly popular in hospitals and specialized clinics. The government's push towards improving healthcare access and infrastructure, coupled with the availability of increasingly affordable ENT device options, alongside a growing domestic manufacturing base, are key factors propelling the market in India

ENT Devices Market Share

The ENT devices industry is primarily led by well-established companies, including:

- Cochlear Ltd. (Australia)

- Sonova (Switzerland)

- GN Store Nord A/S (Denmark)

- Demant A/S (Denmark)

- Medtronic (Ireland)

- Stryker Corporation (U.S.)

- Olympus Corporation (Japan)

- KARL STORZ SE & Co. KG (Germany)

- Smith+Nephew (U. K.)

- Hoya Corporation (Japan)

- Boston Scientific Corporation (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Acclarent, Inc. (U.S.)

- WS Audiology (Denmark)

- Amplifon (Italy)

- ResMed (U.S.)

- Natus Medical Incorporated (U.S.)

- Atos Medical (Sweden)

- Bien-Air Medical Technologies (Switzerland)

- Baxter (U.S.)

Latest Developments in Global ENT Devices Market

- In April 2025, MED-EL Medical Electronics officially introduced its SONNET 3 Audio Processor, featuring integrated direct streaming capabilities. This allows users to stream audio directly from compatible Android and iPhone devices, smart TVs, and digital media players to their cochlear implants via Bluetooth Low Energy

- In May 2024, Cochlear Limited finalized its acquisition of Oticon Medical's cochlear implant business from Demant. This strategic move aims to strengthen Cochlear's market position and ensure continued support for existing Oticon Medical users

- In November 2023, GN Hearing, in collaboration with Soundly and artist Design Cells, launched a digital art campaign called "Inside the Ear." This initiative aims to increase awareness and education surrounding hearing health and demystify hearing loss through engaging animated videos

- In May 2023, Olympus announced FDA clearance for its new EVIS X1 endoscopy system. This system offers advanced imaging capabilities for gastrointestinal examinations, which directly benefits ENT diagnostics and minimally invasive surgical procedures by providing enhanced visualization

- In February 2023, KARL STORZ, a prominent medical technology company, acquired AventaMed DAC, an Irish medical technologies firm. This acquisition aimed to bolster KARL STORZ's ENT product portfolio by incorporating AventaMed's innovative Solo+ TTD device, which enhances tympanostomy procedures

- In November 2022, Cochlear Limited received U.S. FDA approval for its Nucleus 8 Sound Processor. This device is touted as the smallest and lightest behind-the-ear cochlear implant sound processor and the first ready to provide direct audio connectivity using the next-generation Bluetooth LE Audio technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL ENT DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING PREVALENCE OF ENT DISORDERS

5.1.2 GROWING ELDERLY POPULATION

5.1.3 RISING REIMBURSEMENT TRENDS

5.1.4 GROWING DEMAND FOR MINIMALLY INVASIVE PROCEDURES

5.2 RESTRAINTS

5.2.1 HIGH INITIAL COST FOR ENT LASER DEVICES

5.2.2 COMPLICATIONS AND RISKS ASSOCIATED WITH ENT PROCEDURES

5.3 OPPORTUNITIES

5.3.1 RISE IN PROCEDURE NUMBERS FOR ENT TREATMENT

5.3.2 STRATEGIC PARTNERSHIPS AND COLLABORATIONS IN THE ENT DEVICE INDUSTRY

5.3.3 CONTINUOUS TECHNOLOGICAL ADVANCEMENT IN ENT PROCEDURES

5.4 CHALLENGES

5.4.1 LACK OF SKILLED AND CERTIFIED PROFESSIONALS IN DEVELOPING COUNTRIES

5.4.2 PRESENCE OF NUMEROUS PLAYERS IN THE MARKET

6 GLOBAL ENT DEVICES MARKET, BY PROCEDURE TYPE

6.1 OVERVIEW

6.2 TONSILLECTOMY & ADENOIDECTOMY

6.2.1 POWERED INSTRUMENTS

6.2.2 ELECTROCAUTERY DEVICES

6.2.3 RADIO FREQUENCY WANDS

6.2.4 COLD STEEL

6.3 TYMPANOSTOMY TUBE INSERTIONS

6.4 SEPTOPLASTY

6.4.1 SEPTAL STAPLER

6.4.2 OTHER MODALITY/SUTURES

6.5 TURBINATE REDUCTION

6.5.1 RADIO FREQUENCY WANDS

6.5.2 POWERED INSTRUMENTS (SHAVER)

6.5.3 COLD STEEL

6.5.4 OTHER

6.6 EPISTAXIS

6.6.1 SILVER NITRATE

6.6.2 NASAL TAMPONADES

6.6.3 COAGULANTS

6.6.4 OTHERS

6.7 LARYNGEAL

6.7.1 LASER

6.7.2 POWERED INSTRUMENTS

6.7.3 RADIO FREQUENCY WANDS

6.7.4 COLD STEEL

7 GLOBAL ENT DEVICES MARKET, BY END USER

7.1 OVERVIEW

7.2 ENT CLINICS

7.3 HOSPITALS

7.4 AMBULATORY SETTINGS

7.5 OTHERS

8 GLOBAL ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 RETAIL SALES

8.4 ONLINE SALES

9 GLOBAL ENT DEVICES MARKET, BY REGION

9.1 OVERVIEW

9.2 NORTH AMERICA

9.2.1 U.S.

9.2.2 CANADA

9.3 LATIN AMERICA

9.3.1 BRAZIL

9.3.2 MEXICO

9.3.3 COLUMBIA

9.3.4 CHILE

9.4 EUROPE AND MIDDLE EAST & AFRICA

9.4.1 GERMANY

9.4.2 U.K.

9.4.3 FRANCE

9.4.4 SOUTH AFRICA

9.4.5 SAUDI ARABIA

9.5 ASIA-PACIFIC

9.5.1 CHINA

9.5.2 INDIA

9.5.3 JAPAN

9.5.4 AUSTRALIA

9.5.5 SOUTH KOREA

10 GLOBAL ENT DEVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EMEA

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 SMITH+NEPHEW

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 MEDTRONIC

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 BOSTON SCIENTIFIC CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 KARL STORZ SE & CO. KG, TUTTLINGEN

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

1.1.1 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENT

12.5 OLYMPUS CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 A.R.C. LASER GMBH

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 ADVIN HEALTH CARE

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 ASCLEPION

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 BIOLITEC GMBH & CO KG

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 DIMED LASER

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 ECO MEDICAL

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 IRIDEX CORPORATION

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 KLS MARTIN GROUP.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 MEDENCY

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 NARANG MEDICAL LIMITED.

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 STRYKER

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENT

12.17 SUTTER MEDICAL TECHNOLOGY GMBH

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 SYMMETRY SURGICAL INC.

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 GLOBAL ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 2 GLOBAL TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 3 GLOBAL TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 4 GLOBAL TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 5 GLOBAL TYMPANOSTOMY TUBE INSERTIONS IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 GLOBAL SEPTOPLASTY IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 GLOBAL SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 8 GLOBAL SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 9 GLOBAL TURBINATE REDUCTION IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 GLOBAL TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 11 GLOBAL TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 12 GLOBAL EPISTAXIS IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 GLOBAL EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 14 GLOBAL EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 15 GLOBAL LARYNGEAL IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 GLOBAL LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 17 GLOBAL LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 18 GLOBAL ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 19 GLOBAL ENT CLINICS IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 GLOBAL HOSPITALS IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 GLOBAL AMBULATORY SETTINGS IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 GLOBAL OTHERS IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 23 GLOBAL ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 24 GLOBAL DIRECT TENDER IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 GLOBAL RETAIL SALES IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 GLOBAL ONLINE SALES IN ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 GLOBAL ENT DEVICES MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 28 NORTH AMERICA ENT DEVICES MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 29 NORTH AMERICA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 30 NORTH AMERICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 31 NORTH AMERICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 32 NORTH AMERICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 33 NORTH AMERICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 34 NORTH AMERICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 35 NORTH AMERICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 36 NORTH AMERICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 37 NORTH AMERICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 38 NORTH AMERICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 39 NORTH AMERICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 40 NORTH AMERICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 41 NORTH AMERICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 42 NORTH AMERICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 43 NORTH AMERICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 44 NORTH AMERICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 45 NORTH AMERICA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 46 NORTH AMERICA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 47 U.S. ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 48 U.S. TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 49 U.S. TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 50 U.S. TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 51 U.S. SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 52 U.S. SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 53 U.S. SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 54 U.S. TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 55 U.S. TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 56 U.S. TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 57 U.S. EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 58 U.S. EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 59 U.S. EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 60 U.S. LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 61 U.S. LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 62 U.S. LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 63 U.S. ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 64 U.S. ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 65 CANADA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 66 CANADA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 67 CANADA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 68 CANADA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 69 CANADA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 70 CANADA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 71 CANADA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 72 CANADA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 73 CANADA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 74 CANADA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 75 CANADA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 76 CANADA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 77 CANADA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 78 CANADA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 79 CANADA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 80 CANADA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 81 CANADA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 82 CANADA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 83 LATIN AMERICA ENT DEVICES MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 84 LATIN AMERICA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 85 LATIN AMERICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 86 LATIN AMERICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 87 LATIN AMERICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 88 LATIN AMERICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 89 LATIN AMERICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 90 LATIN AMERICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 91 LATIN AMERICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 92 LATIN AMERICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 93 LATIN AMERICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 94 LATIN AMERICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 95 LATIN AMERICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 96 LATIN AMERICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 97 LATIN AMERICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 98 LATIN AMERICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 99 LATIN AMERICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 100 LATIN AMERICA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 101 LATIN AMERICA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 BRAZIL ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 103 BRAZIL TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 104 BRAZIL TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 105 BRAZIL TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 106 BRAZIL SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 107 BRAZIL SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 108 BRAZIL SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 109 BRAZIL TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 110 BRAZIL TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 111 BRAZIL TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 112 BRAZIL EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 113 BRAZIL EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 114 BRAZIL EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 115 BRAZIL LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 116 BRAZIL LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 117 BRAZIL LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 118 BRAZIL ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 119 BRAZIL ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 120 MEXICO ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 121 MEXICO TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 122 MEXICO TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 123 MEXICO TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 124 MEXICO SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 125 MEXICO SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 126 MEXICO SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 127 MEXICO TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 128 MEXICO TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 129 MEXICO TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 130 MEXICO EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 131 MEXICO EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 132 MEXICO EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 133 MEXICO LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 134 MEXICO LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 135 MEXICO LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 136 MEXICO ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 137 MEXICO ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 138 COLUMBIA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 139 COLUMBIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 140 COLUMBIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 141 COLUMBIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 142 COLUMBIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 143 COLUMBIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 144 COLUMBIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 145 COLUMBIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 146 COLUMBIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 147 COLUMBIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 148 COLUMBIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 149 COLUMBIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 150 COLUMBIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 151 COLUMBIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 152 COLUMBIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 153 COLUMBIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 154 COLUMBIA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 155 COLUMBIA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 156 CHILE ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 157 CHILE TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 158 CHILE TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 159 CHILE TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 160 CHILE SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 161 CHILE SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 162 CHILE SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 163 CHILE TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 164 CHILE TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 165 CHILE TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 166 CHILE EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 167 CHILE EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 168 CHILE EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 169 CHILE LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 170 CHILE LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 171 CHILE LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 172 CHILE ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 173 CHILE ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 174 EMEA ENT DEVICES MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 175 EMEA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 176 EMEA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 177 EMEA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 178 EMEA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 179 EMEA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 180 EMEA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 181 EMEA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 182 EMEA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 183 EMEA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 184 EMEA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 185 EMEA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 186 EMEA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 187 EMEA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 188 EMEA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 189 EMEA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 190 EMEA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 191 EMEA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 192 EMEA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 193 GERMANY ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 194 GERMANY TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 195 GERMANY TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 196 GERMANY TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 197 GERMANY SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 198 GERMANY SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 199 GERMANY SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 200 GERMANY TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 201 GERMANY TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 202 GERMANY TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 203 GERMANY EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 204 GERMANY EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 205 GERMANY EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 206 GERMANY LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 207 GERMANY LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 208 GERMANY LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 209 GERMANY ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 210 GERMANY ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 211 U.K. ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 212 U.K. TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 213 U.K. TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 214 U.K. TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 215 U.K. SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 216 U.K. SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 217 U.K. SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 218 U.K. TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 219 U.K. TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 220 U.K. TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 221 U.K. EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 222 U.K. EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 223 U.K. EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 224 U.K. LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 225 U.K. LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 226 U.K. LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 227 U.K. ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 228 U.K. ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 229 FRANCE ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 230 FRANCE TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 231 FRANCE TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 232 FRANCE TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 233 FRANCE SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 234 FRANCE SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 235 FRANCE SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 236 FRANCE TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 237 FRANCE TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 238 FRANCE TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 239 FRANCE EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 240 FRANCE EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 241 FRANCE EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 242 FRANCE LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 243 FRANCE LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 244 FRANCE LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 245 FRANCE ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 246 FRANCE ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 247 SOUTH AFRICA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 248 SOUTH AFRICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 249 SOUTH AFRICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 250 SOUTH AFRICA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 251 SOUTH AFRICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 252 SOUTH AFRICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 253 SOUTH AFRICA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 254 SOUTH AFRICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 255 SOUTH AFRICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 256 SOUTH AFRICA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 257 SOUTH AFRICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 258 SOUTH AFRICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 259 SOUTH AFRICA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 260 SOUTH AFRICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 261 SOUTH AFRICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 262 SOUTH AFRICA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 263 SOUTH AFRICA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 264 SOUTH AFRICA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 265 SAUDI ARABIA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 266 SAUDI ARABIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 267 SAUDI ARABIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 268 SAUDI ARABIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 269 SAUDI ARABIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 270 SAUDI ARABIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 271 SAUDI ARABIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 272 SAUDI ARABIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 273 SAUDI ARABIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 274 SAUDI ARABIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 275 SAUDI ARABIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 276 SAUDI ARABIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 277 SAUDI ARABIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 278 SAUDI ARABIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 279 SAUDI ARABIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 280 SAUDI ARABIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 281 SAUDI ARABIA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 282 SAUDI ARABIA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 283 ASIA-PACIFIC ENT DEVICES MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 284 ASIA-PACIFIC ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 285 ASIA-PACIFIC TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 286 ASIA-PACIFIC TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 287 ASIA-PACIFIC TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 288 ASIA-PACIFIC SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 289 ASIA-PACIFIC SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 290 ASIA-PACIFIC SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 291 ASIA-PACIFIC TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 292 ASIA-PACIFIC TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 293 ASIA-PACIFIC TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 294 ASIA-PACIFIC EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 295 ASIA-PACIFIC EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 296 ASIA-PACIFIC EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 297 ASIA-PACIFIC LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 298 ASIA-PACIFIC LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 299 ASIA-PACIFIC LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 300 ASIA-PACIFIC ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 301 ASIA-PACIFIC ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 302 CHINA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 303 CHINA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 304 CHINA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 305 CHINA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 306 CHINA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 307 CHINA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 308 CHINA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 309 CHINA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 310 CHINA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 311 CHINA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 312 CHINA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 313 CHINA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 314 CHINA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 315 CHINA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 316 CHINA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 317 CHINA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 318 CHINA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 319 CHINA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 320 INDIA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 321 INDIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 322 INDIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 323 INDIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 324 INDIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 325 INDIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 326 INDIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 327 INDIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 328 INDIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 329 INDIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 330 INDIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 331 INDIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 332 INDIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 333 INDIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 334 INDIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 335 INDIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 336 INDIA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 337 INDIA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 338 JAPAN ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 339 JAPAN TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 340 JAPAN TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 341 JAPAN TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 342 JAPAN SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 343 JAPAN SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 344 JAPAN SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 345 JAPAN TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 346 JAPAN TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 347 JAPAN TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 348 JAPAN EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 349 JAPAN EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 350 JAPAN EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 351 JAPAN LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 352 JAPAN LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 353 JAPAN LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 354 JAPAN ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 355 JAPAN ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 356 AUSTRALIA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 357 AUSTRALIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 358 AUSTRALIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 359 AUSTRALIA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 360 AUSTRALIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 361 AUSTRALIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 362 AUSTRALIA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 363 AUSTRALIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 364 AUSTRALIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 365 AUSTRALIA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 366 AUSTRALIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 367 AUSTRALIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 368 AUSTRALIA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 369 AUSTRALIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 370 AUSTRALIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 371 AUSTRALIA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 372 AUSTRALIA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 373 AUSTRALIA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 374 SOUTH KOREA ENT DEVICES MARKET, BY PROCEDURE TYPE, 2022-2031 (USD MILLION)

TABLE 375 SOUTH KOREA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 376 SOUTH KOREA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 377 SOUTH KOREA TONSILLECTOMY & ADENOIDECTOMY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 378 SOUTH KOREA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 379 SOUTH KOREA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 380 SOUTH KOREA SEPTOPLASTY IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 381 SOUTH KOREA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 382 SOUTH KOREA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 383 SOUTH KOREA TURBINATE REDUCTION IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 384 SOUTH KOREA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 385 SOUTH KOREA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 386 SOUTH KOREA EPISTAXIS IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 387 SOUTH KOREA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 388 SOUTH KOREA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 389 SOUTH KOREA LARYNGEAL IN ENT DEVICES MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 390 SOUTH KOREA ENT DEVICES MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 391 SOUTH KOREA ENT DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 GLOBAL ENT DEVICES MARKET: SEGMENTATION

FIGURE 2 GLOBAL ENT DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ENT DEVICES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ENT DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL ENT DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ENT DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL ENT DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 GLOBAL ENT DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL ENT DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL ENT DEVICES MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR MINIMALLY INVASIVE PROCEDURES IS DRIVING THE GROWTH OF THE GLOBAL ENT DEVICES MARKET FROM 2024 TO 2031

FIGURE 12 THE PROCEDURE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ENT DEVICES MARKET IN 2024 AND 2031

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL ENT DEVICES MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 14 NORTH AMERICA IS THE FASTEST-GROWING REGION FOR ENT DEVICES MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL ENT DEVICES MARKET

FIGURE 16 GLOBAL ENT DEVICES MARKET: BY PROCEDURE TYPE, 2023

FIGURE 17 GLOBAL ENT DEVICES MARKET: BY PROCEDURE TYPE, 2024-2031 (USD MILLION)

FIGURE 18 GLOBAL ENT DEVICES MARKET: BY PROCEDURE TYPE, CAGR (2024-2031)

FIGURE 19 GLOBAL ENT DEVICES MARKET: BY PROCEDURE TYPE, LIFELINE CURVE

FIGURE 20 GLOBAL ENT DEVICES MARKET: BY END USER, 2023

FIGURE 21 GLOBAL ENT DEVICES MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 22 GLOBAL ENT DEVICES MARKET: END USER, CAGR (2024-2031)

FIGURE 23 GLOBAL ENT DEVICES MARKET: END USER, LIFELINE CURVE

FIGURE 24 GLOBAL ENT DEVICES MARKET: BY DISTRIBUTION CHANNEL 2023

FIGURE 25 GLOBAL ENT DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 26 GLOBAL ENT DEVICES MARKET: DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 27 GLOBAL ENT DEVICES MARKET: DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 28 GLOBAL ENT DEVICES MARKET: SNAPSHOT (2023)

FIGURE 29 GLOBAL ENT DEVICES MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 NORTH AMERICA ENT DEVICES MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 EMEA ENT DEVICES MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 ASIA-PACIFIC ENT DEVICES MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.