Global Energy and Utility Analytics Market Segmentation, By Component (Solutions and Services), Deployment Mode (Cloud and On-Premises), Cloud Type (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size (Small and Medium-Sized Enterprises (SMEs) and Large Enterprises), Application (Upstream, Midstream, and Downstream), Vertical (Oil and Gas, Renewable Energy, Nuclear Power, Electricity, Water, and Others) – Industry Trends and Forecast to 2031

Energy and Utility Analytics Market Analysis

The energy and utility analytics market is experiencing significant growth due to advancements in technology and methods aimed at optimizing resource management and enhancing operational efficiency. Recent developments in artificial intelligence (AI) and machine learning (ML) are revolutionizing data analysis, enabling utilities to predict demand fluctuations, identify anomalies, and improve maintenance schedules. These technologies facilitate real-time monitoring of energy consumption, which empowers utilities to offer tailored solutions to customers, ultimately leading to reduced energy costs and improved sustainability.

The integration of IoT devices has further enhanced data collection capabilities, allowing for more granular insights into energy usage patterns. As utilities adopt predictive analytics, they can better manage grid reliability and address potential outages proactively. Additionally, the rise of cloud computing is providing utilities with scalable and cost-effective platforms to process vast amounts of data efficiently.

As a result, the energy and utility analytics market is projected to grow significantly, driven by the increasing demand for efficient energy management solutions and the ongoing transition toward renewable energy sources. This growth is expected to be accompanied by enhanced regulatory compliance and customer engagement, reinforcing the value of advanced analytics in the sector.

Energy and Utility Analytics Market Size

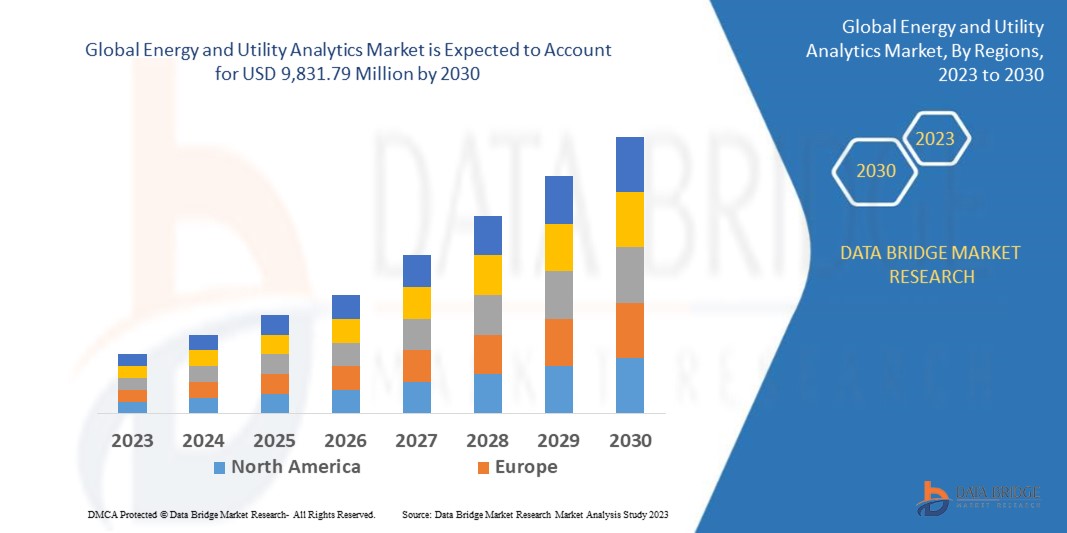

The global energy and utility analytics market size was valued at USD 3.30 billion in 2023 and is projected to reach USD 11.49 billion by 2031, with a CAGR of 16.88% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Energy and Utility Analytics Market Trends

“Growth of AI and Machine Learning Integration”

One specific trend propelling growth in the energy and utility analytics market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advanced analytical tools enable utilities to process vast amounts of data from smart meters and IoT devices, leading to enhanced operational efficiency and predictive maintenance. For instance, in August 2022, mCloud Technologies Corp., a leader in AI-powered asset management and ESG solutions, announced a technology continuation agreement with Agnity Global Inc. This agreement aims to build upon their successful partnership, focusing on enhancing the delivery of innovative asset management solutions. By leveraging AI and advanced analytics, mCloud and Agnity will collaborate to develop cutting-edge technologies that drive operational efficiency and promote sustainable practices within the industry.

Report Scope and Energy and Utility Analytics Market Segmentation

|

Attributes

|

Energy and Utility Analytics Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

IBM Corporation (U.S.), SAP SE (Germany), Oracle (U.S.), Cisco (U.S.), Google (U.S.), Siemens (Germany), General Electric (U.S.), Microsoft (U.S.), Eaton (Ireland), Amazon Web Services, Inc. (U.S.), Schneider Electric (France), SAS Institute Inc. (U.S.), Salesforce.com, inc. (U.S.), Open Text Corporation (Canada), Teradata (U.S.), Intel Corporation (U.S.), Atos SE (France), MICROSTRATEGY INCORPORATED (U.S.), ALTERYX, INC. (U.S.), TIBCO Software Inc. (U.S.) and Infor (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Energy and Utility Analytics Market Definition

Energy and utility analytics involves the use of data analysis and visualization techniques to optimize energy production, consumption, and distribution within the energy and utility sectors. It leverages advanced technologies such as big data, machine learning, and the Internet of Things (IoT) to analyze vast amounts of data from smart meters, sensors, and grid systems. This analytics process enables utilities to enhance operational efficiency, reduce costs, predict demand, and improve customer service. By identifying patterns and trends in energy usage, companies can implement more effective strategies for resource management and sustainability, ultimately leading to a smarter energy ecosystem.

Energy and Utility Analytics Market Dynamics

Drivers

- Smart Grid Implementation

The deployment of smart grids significantly enhances data collection capabilities for utilities, integrating smart meters, IoT devices, and advanced communication technologies. For instance, In May 2022, Siemens introduced its renowned transmission grid simulation software, PSS-E, to the cloud, offering enhanced capabilities for grid operators. The cloud-based solution retains the familiar user interface while providing access to over 2,000 APIs and existing scripts, enabling seamless integration. With scalable computational power and a secure collaboration environment, the platform enhances remote working capabilities and is currently available in the United States and Canada, with plans for global rollout.

- Focus on Sustainability and Carbon Reduction

The growing emphasis on sustainability and carbon reduction significantly drives the energy and utility analytics market. Utilities are increasingly adopting analytics to monitor and track greenhouse gas emissions, enabling them to develop targeted strategies for emission reductions. For instance, Duke Energy employs advanced analytics to optimize energy generation from renewable sources, reducing its carbon footprint. Additionally, analytics facilitate energy efficiency initiatives, such as predictive maintenance and demand response programs, which lower overall consumption. By leveraging data-driven insights, utilities align with global sustainability goals, enhance regulatory compliance, and improve their public image, ultimately fostering a more sustainable energy landscape and contributing to market growth.

Opportunities

- Investment in Infrastructure Upgrades

The increasing focus on upgrading aging infrastructure presents significant opportunities in the energy and utility analytics market. Utilities are investing heavily in modernizing their systems to enhance reliability and efficiency. For instance, In May 2024, Honeywell launched Honeywell Forge Performance+, an advanced platform aimed at optimizing utility grid asset operations and improving IT investment performance. This innovative solution integrates real-time data analytics and AI-driven insights, allowing utilities to enhance efficiency, reduce downtime, and drive cost savings. The platform is designed to support utilities in their digital transformation journeys while promoting sustainable operational practices.

- Advanced Metering Infrastructure (AMI)

The rise of Advanced Metering Infrastructure (AMI) systems presents significant opportunities in the energy and utility analytics market. By leveraging real-time data on energy consumption, utilities can enhance operational efficiency and customer engagement. For instance, analytics tools can detect trends in consumption patterns, enabling utilities to forecast demand more accurately and optimize resource allocation. Moreover, AMI can identify anomalies such as energy theft or faulty meters, leading to improved revenue protection. Companies such as Itron and Landis+Gyr are already capitalizing on these advancements, offering innovative solutions that empower utilities to harness data effectively, thereby driving market growth and enhancing customer service.

Restraints/Challenges

- High Implementation Costs

High implementation costs significantly hinder the energy and utility analytics market. Advanced analytics technologies often require substantial initial investments in software, hardware, and training, which can be prohibitive for smaller utilities. These organizations may find it challenging to allocate the necessary budget, resulting in limited access to cutting-edge analytics solutions. Consequently, their inability to harness data effectively restricts operational efficiency and strategic decision-making. This financial barrier not only affects smaller players but also stifles overall market growth, as a lack of widespread adoption of analytics technologies limits innovation and the potential for industry-wide improvements in efficiency and performance.

- Data Security and Privacy Concerns

Data security and privacy concerns significantly hinder the energy and utility analytics market. As these companies gather extensive amounts of data for analysis, the risk of data breaches and misuse looms large. This fear of compromised sensitive information can deter organizations from fully adopting advanced analytics solutions. To mitigate these risks, energy and utility firms must invest heavily in robust security measures, which can be both costly and complex. The financial burden associated with implementing these protective measures, alongside the ongoing challenges of maintaining compliance with evolving regulations, can slow market growth and restrict innovation in analytics technologies.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Energy and Utility Analytics Market Scope

The market is segmented on the basis of component, deployment mode, cloud type, organization size, application, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solutions

- Platform

- Software

- Asset Management Analytics

- Collection Analytics

- Smart Meter Analytics

- Customer Analytics

- Others

- Services

- Managed Services

- Professional Services

- Consulting

- Deployment and Integration

- Support and Maintenance

Deployment Mode

- Cloud

- On-Premises

Cloud Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Application

- Upstream

- Midstream

- Downstream

Vertical

- Oil and Gas

- Renewable Energy

- Nuclear Power

- Electricity

- Water

- Others

Energy and Utility Analytics Market Regional Analysis

The market is analyzed and market size insights and trends are provided by component, deployment mode, cloud type, organization size, application, and vertical as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the energy and utility analytics market, driven by significant investments in technological development and a growing demand for analytics solutions. The region's increasing reliance on data-driven decision-making in energy management, coupled with the rise in the number of analytics providers, enhances market growth. As companies seek improved operational efficiency and sustainability, North America remains a key player in this evolving landscape.

Europe is expected to show significant growth in the energy and utility analytics market, driven by the rising adoption of analytical solutions. Key benefits include enhanced energy risk management, grid analytics, and demand forecasting, leading to improved revenue assurance. Countries such as the U.K., Germany, France, Italy, and Spain are pivotal in this expansion, collectively contributing to a substantial market share in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Energy and Utility Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Energy and Utility Analytics Market Leaders Operating in the Market Are:

- IBM Corporation (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Cisco (U.S.)

- Google (U.S.)

- Siemens (Germany)

- General Electric (U.S.)

- Microsoft (U.S.)

- Eaton (Ireland)

- Amazon Web Services, Inc. (U.S.)

- Schneider Electric (France)

- SAS Institute Inc. (U.S.)

- Salesforce.com, inc. (U.S.)

- Open Text Corporation (Canada)

- Teradata (U.S.)

- Intel Corporation (U.S.)

- Atos SE (France)

- MICROSTRATEGY INCORPORATED (U.S.)

- ALTERYX, INC. (U.S.)

- TIBCO Software Inc. (U.S.)

- Infor (U.S.)

Latest Developments in Energy and Utility Analytics Market

- In March 2024, Amperon, an AI-driven utility and energy analytics firm, announced its re-platforming onto Microsoft Azure, enhancing its technological capabilities for the energy sector. This transition enables Amperon to leverage Azure's robust cloud infrastructure, facilitating advanced data analytics and AI applications. As a result, utilities can gain deeper insights into energy consumption patterns, improve forecasting accuracy, and optimize their operational strategies in a rapidly evolving energy landscape

- In March 2024, Ascend Analytics, a prominent provider of energy transition analytics solutions, secured a significant growth investment led by Rubicon Technology Partners. This investment aims to expand Ascend's suite of innovative analytics tools, enabling utilities and energy providers to navigate the complexities of the energy transition. The enhanced analytics solutions will help clients make data-driven decisions, optimize energy resources, and achieve sustainability goals effectively

- In September 2022, Itron and SmartThings joined forces to deliver comprehensive energy analytics solutions to the utility sector, focusing on carbon reduction initiatives. By leveraging Itron’s Industrial Internet of Things (IIoT) solutions alongside SmartThings’ energy services, the collaboration aims to provide actionable insights and optimize energy management for utilities. This partnership underscores the commitment of both companies to promote sustainable energy practices and enhance operational efficiency

- In July 2020, HEXStream and Disaster Tech formed a strategic partnership to offer innovative emergency solutions tailored for the utility sector. This collaboration utilizes Disaster Tech’s comprehensive data aggregation platform to enhance decision-making capabilities for utilities during critical situations. By integrating advanced analytics and real-time data, the partnership aims to improve emergency response strategies, ensure system resilience, and support utilities in navigating unforeseen challenges effectively

SKU-