Global Energy And Utility Analytics Market

Market Size in USD Billion

CAGR :

%

USD

3.85 Billion

USD

13.43 Billion

2024

2032

USD

3.85 Billion

USD

13.43 Billion

2024

2032

| 2025 –2032 | |

| USD 3.85 Billion | |

| USD 13.43 Billion | |

|

|

|

|

Energy and Utility Analytics Market Size

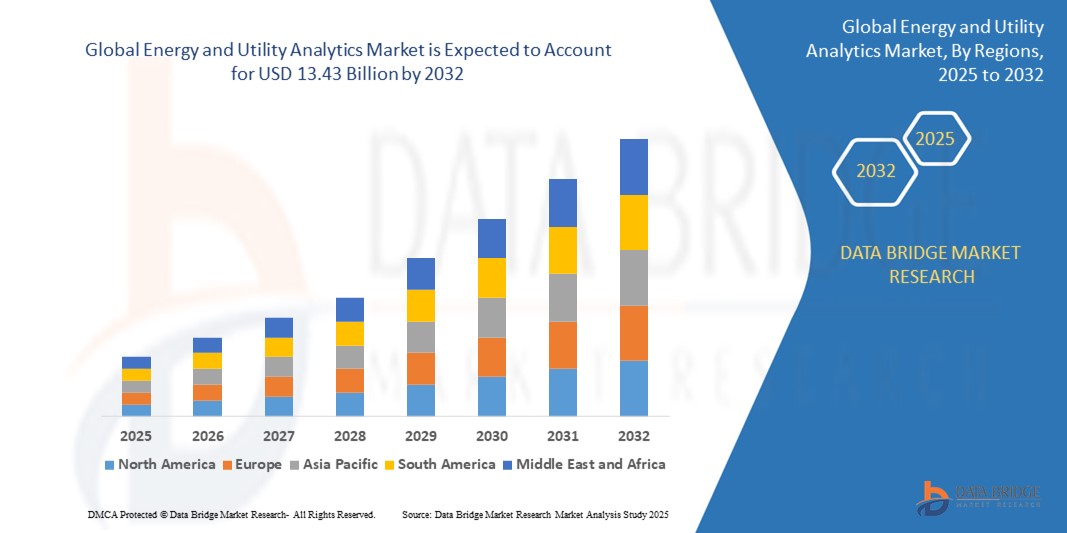

- The global energy and utility analytics market size was valued at USD 3.85 billion in 2024 and is expected to reach USD 13.43 billion by 2032, at a CAGR of 16.88% during the forecast period

- The market growth is largely fueled by the increasing digital transformation of the energy sector, where utilities are adopting advanced analytics to enhance operational efficiency, optimize asset performance, and meet regulatory requirements for energy efficiency and sustainability

- Furthermore, the growing integration of renewable energy sources, smart grids, and IoT-enabled infrastructure is creating a pressing need for real-time data insights, predictive maintenance, and demand forecasting, thereby significantly accelerating the adoption of energy and utility analytics solutions across global markets

Energy and Utility Analytics Market Analysis

- Energy and utility analytics refers to the application of data analytics tools to monitor, optimize, and manage energy generation, distribution, and consumption. These solutions enable utilities to gain actionable insights, improve grid reliability, reduce operational costs, and support environmental goals

- The rising demand for analytics in this sector is driven by the need to handle large volumes of data generated by smart meters, sensors, and connected devices, along with the growing emphasis on grid resilience, regulatory compliance, and the efficient management of distributed energy resources

- North America dominated the energy and utility analytics market with a share of 40.5% in 2024, due to the region's advanced infrastructure, high energy consumption, and increasing investment in grid modernization and smart utilities

- Europe is expected to be the fastest growing region in the energy and utility analytics market during the forecast period due to strong policy frameworks, aggressive sustainability goals, and rising energy costs

- Solutions segment dominated the market with a market share of 69.5% in 2024, due to the growing need for real-time insights and predictive analytics across critical utility operations. Solutions such as asset performance analytics, load forecasting, grid optimization, and demand-side management are increasingly adopted to enhance operational efficiency, minimize outages, and ensure regulatory compliance. Utilities are leveraging these tools to transition from reactive to proactive management strategies, particularly in power distribution and renewable integration

Report Scope and Energy and Utility Analytics Market Segmentation

|

Attributes |

Energy and Utility Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Energy and Utility Analytics Market Trends

“Growing Integration of AI and Machine Learning”

- The energy and utility analytics market is undergoing a significant transformation as utilities and energy providers increasingly leverage artificial intelligence (AI) and machine learning to optimize every facet of their operations—from power generation and grid management to customer service and renewable integration

- For instance, companies such as IBM, Siemens, and Oracle are embedding AI-driven analytics into their platforms, enabling predictive maintenance, real-time demand forecasting, outage detection, and the seamless integration of distributed energy resources. These technologies empower utilities to analyze massive data sets from smart meters, IoT devices, and SCADA systems, turning them into actionable insights for operational efficiency and sustainability

- The proliferation of smart meters and IoT-enabled sensors is generating unprecedented volumes of data, which, when combined with advanced analytics, allows for granular monitoring of energy consumption, asset health, and network performance

- Cloud-based analytics solutions are seeing rapid adoption, with providers such as AWS and Google Cloud offering scalable platforms that support embedded AI, flexible deployment, and cost-effective infrastructure

- Regulatory mandates for decarbonization and grid modernization are further accelerating the adoption of analytics, as utilities seek to comply with evolving standards and improve their environmental footprint

- The convergence of AI, IoT, and cloud computing is positioning analytics as a cornerstone of the energy transition, enabling smarter, more resilient, and more sustainable utility operations

Energy and Utility Analytics Market Dynamics

Driver

“Smart Grid Implementation”

- The global push toward smart grid implementation is a primary driver for the energy and utility analytics market, as utilities aim to modernize infrastructure, enhance grid reliability, and manage the growing complexity of distributed energy resources

- For instance, North American utility companies such as TC Energy are collaborating with AWS to automate workflows, unlock operational data, and improve efficiency in pipeline and power generation businesses through advanced analytics solutions

- Smart grids rely on a network of IoT sensors, advanced metering infrastructure, and real-time analytics to enable two-way communication between utilities and customers, facilitating dynamic load management, predictive maintenance, and rapid response to outages or demand fluctuations

- The integration of renewable energy sources, such as wind and solar, increases the need for sophisticated analytics to forecast supply, balance loads, and ensure grid stability in the face of variable generation

- Regulatory incentives and government funding for grid modernization projects are further supporting the adoption of analytics, as utilities seek to maximize return on investment and comply with energy efficiency targets

Restraint/Challenge

“High Implementation Costs”

- Despite its transformative potential, the adoption of energy and utility analytics is often hampered by high implementation and integration costs, particularly for utilities with legacy operational technology and fragmented data systems

- For instance, utilities deploying analytics platforms from vendors such as Oracle and Siemens frequently encounter substantial upfront expenses related to integrating new solutions with existing infrastructure, cleansing and standardizing historical data, and training staff on advanced analytics tools

- The complexity of merging legacy OT (operational technology) and IT (information technology) systems, along with the need to harmonize disparate data formats, significantly increases both the time and resources required for successful deployment—often slowing the pace of analytics adoption and trimming overall market growth

- Ongoing maintenance, cybersecurity requirements, and the need for specialized expertise add further to the total cost of ownership, making it especially challenging for smaller utilities or those in developing regions to justify large-scale investments in analytics

- As a result, while the benefits of analytics are widely recognized, the financial and technical barriers remain a key challenge for the market, prompting vendors to develop more modular, cloud-based, and service-oriented solutions to lower adoption hurdles

Energy and Utility Analytics Market Scope

The market is segmented on the basis of component, deployment mode, cloud type, organization size, application, and vertical.

- By Component

On the basis of component, the energy and utility analytics market is segmented into solutions and services. The solutions segment dominated the largest market revenue share of 69.5% in 2024, driven by the growing need for real-time insights and predictive analytics across critical utility operations. Solutions such as asset performance analytics, load forecasting, grid optimization, and demand-side management are increasingly adopted to enhance operational efficiency, minimize outages, and ensure regulatory compliance. Utilities are leveraging these tools to transition from reactive to proactive management strategies, particularly in power distribution and renewable integration.

The services segment is projected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand for consulting, implementation, and managed services to support analytics deployment. As utility providers seek to modernize infrastructure and ensure data-driven decision-making, there is a rising reliance on specialized service providers for seamless integration, staff training, and ongoing technical support.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into cloud and on-premises. The cloud segment accounted for the largest revenue share in 2024, supported by the growing preference for scalable, cost-effective, and easily upgradable analytics platforms. Cloud-based deployments enable real-time data access across distributed assets and facilitate integration with advanced technologies such as AI, ML, and IoT. Utility companies favor cloud deployment for its ability to streamline energy management and support remote monitoring capabilities.

The on-premises segment is expected to register steady growth through 2032, particularly in regions with stringent data security and regulatory compliance requirements. Large utilities with legacy infrastructure often prefer on-premise analytics to retain full control over data and customize their solutions according to proprietary operational needs.

- By Cloud Type

On the basis of cloud type, the market is segmented into public cloud, private cloud, and hybrid cloud. The hybrid cloud segment held the largest revenue share in 2024, driven by its balanced approach combining the scalability of public cloud and the security of private cloud. Utilities use hybrid cloud models to manage sensitive operational data internally while utilizing public cloud infrastructure for less critical workloads.

The private cloud segment is anticipated to witness the fastest CAGR from 2025 to 2032, owing to its appeal among organizations that handle highly sensitive infrastructure and compliance-driven environments. The demand is especially strong among government-affiliated utilities and nuclear power operators seeking to maintain data sovereignty and operational integrity.

- By Organization Size

On the basis of organization size, the market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. Large enterprises accounted for the largest market share in 2024, attributed to their broader operational footprint, larger volumes of data generation, and the capacity to invest in comprehensive analytics platforms. These organizations are prioritizing grid modernization, renewable integration, and smart metering initiatives that demand advanced analytics tools.

The SMEs segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increasing digital transformation among smaller utility providers. As cloud-based and modular analytics solutions become more affordable and user-friendly, SMEs are adopting them to enhance service delivery, manage assets efficiently, and reduce energy losses.

- By Application

On the basis of application, the energy and utility analytics market is segmented into upstream, midstream, and downstream. The downstream segment dominated the revenue share in 2024, fueled by increasing adoption of customer analytics, load forecasting, and smart grid management solutions. Utilities are focusing on optimizing energy delivery, reducing outages, and improving billing accuracy, which enhances customer satisfaction and operational profitability.

The upstream segment is projected to exhibit the highest growth rate from 2025 to 2032, due to growing investments in exploration analytics, drilling optimization, and predictive maintenance. The integration of AI-driven insights is helping upstream operators reduce operational risks, improve resource allocation, and minimize environmental impact.

- By Vertical

On the basis of vertical, the market is categorized into oil and gas, renewable energy, nuclear power, electricity, water, and others. The electricity segment held the largest market revenue share in 2024, propelled by grid modernization initiatives, rising smart meter penetration, and increasing use of demand-response analytics. Utility companies are relying on data-driven insights to optimize electricity distribution, manage peak loads, and improve infrastructure resilience.

The renewable energy segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the rapid global shift toward sustainable energy sources and the need for advanced forecasting tools to manage intermittent energy generation. Analytics play a critical role in optimizing solar and wind operations, enhancing power output, and integrating renewable energy efficiently into the existing grid.

Energy and Utility Analytics Market Regional Analysis

- North America dominated the energy and utility analytics market with the largest revenue share of 40.5% in 2024, driven by the region's advanced infrastructure, high energy consumption, and increasing investment in grid modernization and smart utilities

- The presence of major analytics solution providers, along with regulatory mandates for energy efficiency and carbon footprint reduction, contributes to sustained demand for data-driven utility operations

- The focus on predictive maintenance, asset optimization, and real-time monitoring through AI and IoT platforms has significantly enhanced adoption across utilities in the U.S. and Canada

U.S. Energy and Utility Analytics Market Insight

The U.S. accounted for the largest share within North America's revenue share in 2024, driven by its focus on integrating renewable energy sources, electric vehicle infrastructure, and distributed energy resources (DERs) into the power grid. Utilities across the U.S. are leveraging advanced analytics to improve outage management, predict equipment failures, and balance real-time supply-demand variations. The Energy Department’s initiatives to support digital grid transformation and climate goals have further accelerated analytics adoption. In addition, the proliferation of smart meters and IoT devices is providing utilities with granular data, enhancing predictive capabilities and regulatory compliance.

Europe Energy and Utility Analytics Market Insight

Europe is projected to be the fastest-growing region in the energy and utility analytics market during the forecast period, supported by strong policy frameworks, aggressive sustainability goals, and rising energy costs. European nations are actively adopting advanced analytics to achieve decarbonization targets, integrate renewable energy into the grid, and enhance transparency in energy trading. The rollout of smart meters across the EU and a shift toward prosumer-based energy systems are driving the need for real-time data management. Countries such as the U.K., Germany, and the Netherlands are leading the way with high levels of digitalization, strong government support, and a focus on grid resilience amid changing climate conditions.

U.K. Energy and Utility Analytics Market Insight

The U.K. is experiencing significant growth in the adoption of energy and utility analytics, driven by its national smart meter rollout program and the growing need to balance intermittent renewable energy. With the shift towards electrification of transport and heating, utilities are under pressure to modernize infrastructure and make data-driven decisions to manage demand peaks and system flexibility. The integration of AI and machine learning tools for grid forecasting, asset optimization, and energy theft detection is gaining momentum. The U.K.’s robust digital infrastructure and proactive regulatory stance make it a favorable environment for analytics-driven transformation in the utility sector.

Germany Energy and Utility Analytics Market Insight

Germany is rapidly expanding its use of energy and utility analytics as part of its Energiewende policy aimed at transitioning to a low-carbon and sustainable energy system. The increasing deployment of wind and solar power requires sophisticated analytics to manage grid fluctuations and ensure system reliability. German utilities are using data analytics to optimize generation forecasting, manage decentralized energy sources, and improve consumer engagement through real-time usage insights. The country’s emphasis on innovation, industrial automation, and clean energy technologies is creating strong momentum for analytics solutions across both public and private utility providers.

Asia-Pacific Energy and Utility Analytics Market Insight

The Asia-Pacific region is witnessing substantial growth in the energy and utility analytics market, fueled by rising urbanization, population growth, and large-scale energy infrastructure development. Governments across China, India, and Japan are investing in smart grids and digital utilities to improve energy access and system efficiency. The need for energy conservation and real-time monitoring amid increasing demand is pushing utility companies to adopt predictive and prescriptive analytics. Rapid digitalization, along with the region’s emergence as a technology manufacturing hub, is supporting the proliferation of cost-effective analytics platforms tailored to utility needs.

China Energy and Utility Analytics Market Insight

China dominated the Asia-Pacific market in 2024, backed by its massive investments in renewable energy, grid digitization, and clean energy innovation. The government’s focus on building smart cities and integrating distributed renewable energy into the grid has created a strong demand for analytics to forecast consumption, detect anomalies, and improve load balancing. Domestic firms are developing AI-powered tools to support utility planning and operations. China’s large-scale deployment of smart meters and supportive energy regulations are expected to further boost the adoption of analytics solutions in both urban and rural utility sectors.

Japan Energy and Utility Analytics Market Insight

Japan is steadily expanding its energy and utility analytics market, supported by the country’s high level of technological advancement and growing need for energy security. Following the Fukushima disaster, Japan has prioritized smart energy management and real-time monitoring to ensure stable power supply and safety. Utilities are adopting analytics for demand forecasting, energy trading optimization, and grid maintenance. The integration of AI, IoT, and automation tools is helping to manage aging infrastructure while supporting the transition to low-carbon energy sources. As Japan’s energy mix shifts, analytics will play a pivotal role in driving efficiency and resilience across the utility value chain.

Energy and Utility Analytics Market Share

The energy and utility analytics industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Cisco (U.S.)

- Google (U.S.)

- Siemens (Germany)

- General Electric (U.S.)

- Microsoft (U.S.)

- Eaton (Ireland)

- Amazon Web Services, Inc. (U.S.)

- Schneider Electric (France)

- SAS Institute Inc. (U.S.)

- Salesforce.com, inc. (U.S.)

- Open Text Corporation (Canada)

- Teradata (U.S.)

- Intel Corporation (U.S.)

- Atos SE (France)

- MICROSTRATEGY INCORPORATED (U.S.)

- ALTERYX, INC. (U.S.)

- TIBCO Software Inc. (U.S.)

- Infor (U.S.)

Latest Developments in Global Energy and Utility Analytics Market

- In March 2024, Amperon, an AI-driven utility and energy analytics firm, announced its re-platforming onto Microsoft Azure, enhancing its technological capabilities for the energy sector. This transition enables Amperon to leverage Azure's robust cloud infrastructure, facilitating advanced data analytics and AI applications. As a result, utilities can gain deeper insights into energy consumption patterns, improve forecasting accuracy, and optimize their operational strategies in a rapidly evolving energy landscape

- In March 2024, Ascend Analytics, a prominent provider of energy transition analytics solutions, secured a significant growth investment led by Rubicon Technology Partners. This investment aims to expand Ascend's suite of innovative analytics tools, enabling utilities and energy providers to navigate the complexities of the energy transition. The enhanced analytics solutions will help clients make data-driven decisions, optimize energy resources, and achieve sustainability goals effectively

- In September 2022, Itron and SmartThings joined forces to deliver comprehensive energy analytics solutions to the utility sector, focusing on carbon reduction initiatives. By leveraging Itron’s Industrial Internet of Things (IIoT) solutions alongside SmartThings’ energy services, the collaboration aims to provide actionable insights and optimize energy management for utilities. This partnership underscores the commitment of both companies to promote sustainable energy practices and enhance operational efficiency

- In July 2020, HEXStream and Disaster Tech formed a strategic partnership to offer innovative emergency solutions tailored for the utility sector. This collaboration utilizes Disaster Tech’s comprehensive data aggregation platform to enhance decision-making capabilities for utilities during critical situations. By integrating advanced analytics and real-time data, the partnership aims to improve emergency response strategies, ensure system resilience, and support utilities in navigating unforeseen challenges effectively

- In May 2020, Itron and EDMI collaborated to launch the SMETS2 Gas Meter in the U.K., a move that significantly advanced smart metering capabilities and strengthened the adoption of energy and utility analytics across the region. This innovation enabled utilities and cities to gain more accurate, real-time insights into energy and water usage, thereby accelerating digital transformation in the U.K. utility sector and contributing to the broader growth of the analytics market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.