Global Endpoint Detection Response Market

Market Size in USD Billion

CAGR :

%

USD

4.22 Billion

USD

23.83 Billion

2024

2032

USD

4.22 Billion

USD

23.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.22 Billion | |

| USD 23.83 Billion | |

|

|

|

|

Endpoint Detection and Response Market Size

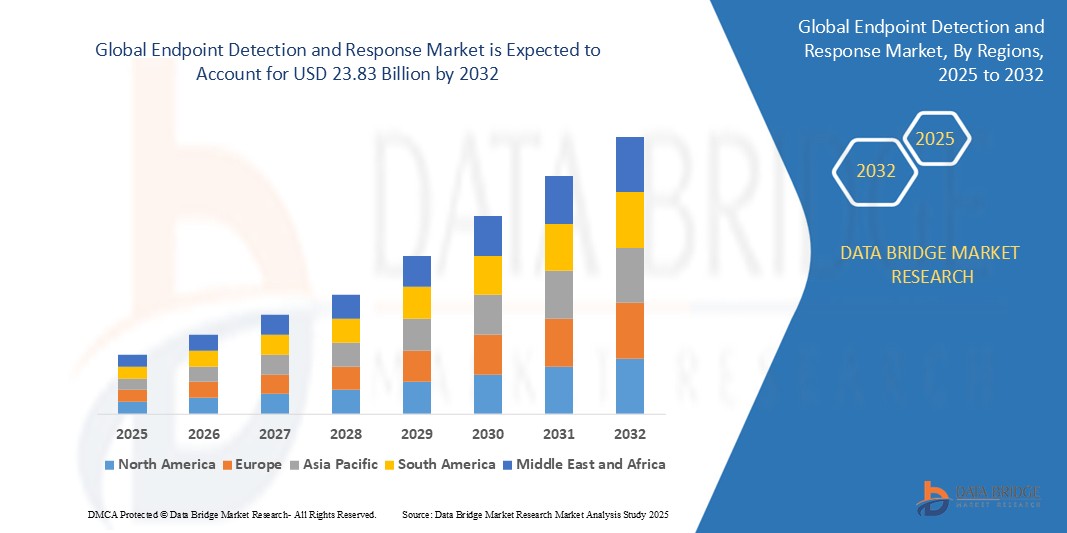

- The global endpoint detection and response market size was valued at USD 4.22 billion in 2024 and is expected to reach USD 23.83 billion by 2032, at a CAGR of 24.16% during the forecast period

- This growth is driven by factors such as rising frequency of cyber threats, growth in remote work, and increasing regulatory compliance needs

Endpoint Detection and Response Market Analysis

- Endpoint detection and response (EDR) refers to a cybersecurity solution that continuously monitors endpoint devices to detect, investigate, and respond to potential threats in real time. It integrates threat intelligence, behavioral analysis, and automated response to protect against evolving cyberattacks across desktops, laptops, mobile devices, and servers

- The EDR market is experiencing strong growth driven by the surge in sophisticated cyber threats, rising adoption of remote and hybrid work models, increasing regulatory pressures for data protection, rapid cloud adoption, and growing enterprise focus on real-time threat detection and mitigation across diverse endpoints

- North America is expected to dominate the endpoint detection and response market with a share of 32.9%, due to the early technology adoption across industries and a strong presence of cybersecurity solution providers

- Asia-Pacific is expected to be the fastest growing region in the endpoint detection and response market during the forecast period due to rapid digital transformation and growing awareness of cybersecurity risks across various sectors

- Software segment is expected to dominate the market with a market share of 65% due to the growing demand for scalable, cloud-based EDR solutions that offer real-time threat detection, investigation, and automated response capabilities. This shift is driven by the increasing sophistication of cyberattacks and the need for agile, easily deployable security tools across diverse endpoints

Report Scope and Endpoint Detection and Response Market Segmentation

|

Attributes |

Endpoint Detection and Response Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Endpoint Detection and Response Market Trends

“Increasing Adoption of Cloud-Based Solutions”

- One prominent trend in the global endpoint detection and response market is the increasing adoption of cloud-based solutions

- This trend is driven by the growing need for scalable, cost-effective cybersecurity tools, the rise of remote workforces, and the demand for centralized threat monitoring across distributed environments

- For instance, leading providers such as CrowdStrike, Microsoft, and SentinelOne offer cloud-native EDR platforms that enable real-time analytics, automated threat detection, and rapid incident response across global endpoints

- Cloud-based deployment is gaining traction among both large enterprises and small to mid-sized businesses due to easier integration, reduced infrastructure costs, and improved accessibility

- As digital transformation accelerates and organizations prioritize agility and resilience, cloud-based EDR solutions are expected to play a central role in shaping the market's future growth trajectory

Endpoint Detection and Response Market Dynamics

Driver

“Rise of Managed Security Service Providers (MSSPs)”

- The rise of managed security service providers (MSSPs) is a major driver of growth in the endpoint detection and response (EDR) market, as organizations seek cost-effective, expert-driven solutions to handle complex cybersecurity challenges

- This shift is particularly evident among small and mid-sized enterprises that lack in-house cybersecurity teams and require continuous threat monitoring and response capabilities

- As cyberattacks grow in frequency and sophistication, businesses are increasingly outsourcing EDR functions to MSSPs for real-time protection, faster incident response, and regulatory compliance

- Service providers are enhancing their offerings with advanced analytics, AI-driven threat detection, and cloud-based EDR platforms to meet evolving enterprise needs

- The growing reliance on MSSPs is expanding the reach of EDR solutions across industries such as healthcare, finance, and manufacturing

For instance,

- Secureworks offers managed EDR with behavioral analytics and real-time detection; AT&T Cybersecurity integrates EDR with its unified security management platform for enhanced threat response

- IBM Security provides managed EDR as part of its X-Force Threat Management services, helping enterprises detect advanced threats across global endpoints

- As businesses prioritize operational efficiency and threat resilience, the demand for MSSP-led EDR solutions is expected to be a key force driving market growth through 2032

Opportunity

“Integration with Security Tools”

- Integration with broader security tools presents a significant opportunity for the endpoint detection and response (EDR) market, enabling enhanced threat visibility, faster incident response, and more cohesive cybersecurity operations

- EDR vendors are increasingly aligning with SIEM, SOAR, and XDR platforms to offer seamless data sharing, automated workflows, and centralized threat management across diverse security environments

- This opportunity supports the growing need for unified cybersecurity solutions that reduce alert fatigue, streamline remediation, and enable faster decision-making across enterprise security teams

For instance,

- CrowdStrike Falcon integrates with SIEM tools such as Splunk and IBM QRadar to deliver real-time endpoint telemetry and contextual threat insights across security layers

- Microsoft Defender for Endpoint works with Azure Sentinel and Microsoft 365 Defender to enable automated detection and response using preconfigured playbooks

- As organizations prioritize unified and scalable security architectures, integration with existing tools is expected to be a key factor driving EDR solution adoption and long-term market expansion through 2032

Restraint/Challenge

“High Implementation Costs”

- High implementation costs present a significant challenge for the endpoint detection and response (EDR) market, as the expense of advanced software, skilled personnel, and integration with existing IT infrastructure creates substantial financial barriers

- These costs are particularly prohibitive for small and medium-sized enterprises (SMEs) that lack dedicated cybersecurity budgets and in-house expertise to manage complex EDR deployments

- The challenge is compounded by the need for continuous updates, system tuning, and security analyst training, which further increases total cost of ownership and limits broader adoption

For instance,

- Enterprise-grade EDR platforms from vendors such as CrowdStrike, Palo Alto Networks, and VMware Carbon Black often require upfront licensing fees, annual subscriptions, and additional spending on integration and monitoring services

- Without more affordable pricing models or simplified deployment options, high implementation costs may hinder adoption in budget-constrained industries and developing markets, potentially slowing the overall growth of the EDR market through 2032

Endpoint Detection and Response Market Scope

The market is segmented on the basis of solution, endpoint device, deployment, enterprise size, and vertical.

|

Segmentation |

Sub-Segmentation |

|

By Solution |

|

|

By Endpoint Device |

|

|

By Deployment |

|

|

By Enterprise Size

|

|

|

By Vertical |

|

In 2025, the software is projected to dominate the market with a largest share in solution segment

The software segment is expected to dominate the endpoint detection and response market with the largest share of 65% in 2025 due to the growing demand for scalable, cloud-based EDR solutions that offer real-time threat detection, investigation, and automated response capabilities. This shift is driven by the increasing sophistication of cyberattacks and the need for agile, easily deployable security tools across diverse endpoints.

The cloud-based is expected to account for the largest share during the forecast period in deployment segment

In 2025, the cloud-based segment is expected to dominate the market with the largest market share of 55.3% due to its cost-effectiveness, ease of deployment, and ability to provide real-time threat intelligence and centralized management across geographically dispersed endpoints. The rising adoption of remote work and hybrid environments further accelerates demand for flexible, scalable cloud-based EDR solutions.

Endpoint Detection and Response Market Regional Analysis

“North America Holds the Largest Share in the Endpoint detection and response Market”

- North America dominates the endpoint detection and response market with a share of 32.9%, driven by the early technology adoption across industries and a strong presence of cybersecurity solution providers

- U.S. holds a significant share due to high adoption among small and medium-sized enterprises (SMEs), substantial investments in cybersecurity infrastructure, and a proactive regulatory environment focused on data protection

- Market growth is further supported by extensive research and development activities, public-private partnerships, and a well-established ecosystem of managed security service providers

- With continued innovation, rising cyber threats, and strong enterprise demand for advanced endpoint protection, North America is expected to maintain its leading position in the global EDR market through 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Endpoint detection and response Market”

- Asia-Pacific is expected to witness the highest growth rate in the endpoint detection and response market, driven by rapid digital transformation and growing awareness of cybersecurity risks across various sectors

- China holds a significant share due to government-led initiatives in digital security, expansion of cloud infrastructure, and increased enterprise spending on threat detection technologies

- Regional momentum is further boosted by increasing internet penetration, growing adoption of mobile and IoT devices, and a surge in cyberattacks targeting businesses and government entities

- With expanding demand for scalable, next-generation security solutions, Asia-Pacific is poised to become the fastest-growing region in the global endpoint detection and response market through 2032

Endpoint Detection and Response Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cisco Systems, Inc. (U.S.)

- Broadcom (U.S.)

- Belden Inc. (U.S.)

- Sophos Ltd. (U.K.)

- F-Secure (Finland)

- McAfee, LLC (U.S.)

- Trend Micro Incorporated (Japan)

- NortonLifeLock Inc. (U.S.)

- Symantec Corporation (U.S.)

- VMware, Inc. (U.S.)

- CrowdStrike (U.S.)

- Palo Alto Networks (U.S.)

- Forcepoint (U.S.)

- InfraRed Integrated Systems Ltd (U.K.)

- Digital Guardian (U.S.)

- Cybereason (U.S.)

- Open Text Corporation (Canada)

- FireEye, Inc. (U.S.)

- RSA Security LLC (U.S.)

- Intel Corporation (U.S.)

Latest Developments in Global Endpoint Detection and Response Market

- In October 2023, HarfangLab, a French cybersecurity firm specializing in endpoint detection and response, secured EUR 25 million in Series A funding. This investment will facilitate the company’s expansion in Europe, enabling it to enhance its capabilities in identifying and neutralizing cyberattacks. HarfangLab’s growth reflects the increasing demand for robust cybersecurity solutions in a rapidly evolving threat landscape

- In August 2023, Fortinet was recognized as the Google Cloud Technology Partner of the Year for Security, particularly for its FortiEDR solution. This accolade acknowledges Fortinet’s effectiveness in real-time breach identification and prevention, which is crucial for organizational resilience against cyber threats. The recognition strengthens Fortinet’s reputation and also supports its future growth in the security market through enhanced integration capabilities

- In October 2022, SyncDog, Inc. partnered with 3Eye Technologies to enhance its mobility and cloud strategy, focusing on a more secure solution for mobile device usage. Their Secure Systems Workspace aims to address the complexities of enabling employee access on mobile platforms. This collaboration seeks to bolster sales targets by offering enterprises and government agencies a scalable and secure environment for mobile operations

- In July 2022, Raytheon Intelligence & Space teamed up with CrowdStrike to bolster its managed detection and response (MDR) services. By integrating CrowdStrike’s advanced endpoint security technologies, the collaboration aims to enhance threat detection and response capabilities. This partnership highlights the importance of combining resources to provide comprehensive security solutions, positioning Raytheon as a stronger contender in the cybersecurity landscape

- In June 2021, Cisco acquired Kenna Security, Inc. to enhance its endpoint security capabilities significantly. This strategic acquisition aims to consolidate Cisco's security portfolio, creating a comprehensive endpoint security framework. By integrating Kenna's technologies, Cisco seeks to offer more robust solutions against cyber threats, strengthening its position as a leader in the cybersecurity industry while improving overall organizational protection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.