Global Endotoxin And Pyrogen Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.27 Billion

USD

2.98 Billion

2024

2032

USD

1.27 Billion

USD

2.98 Billion

2024

2032

| 2025 –2032 | |

| USD 1.27 Billion | |

| USD 2.98 Billion | |

|

|

|

|

Endotoxin and Pyrogen Testing Market Size

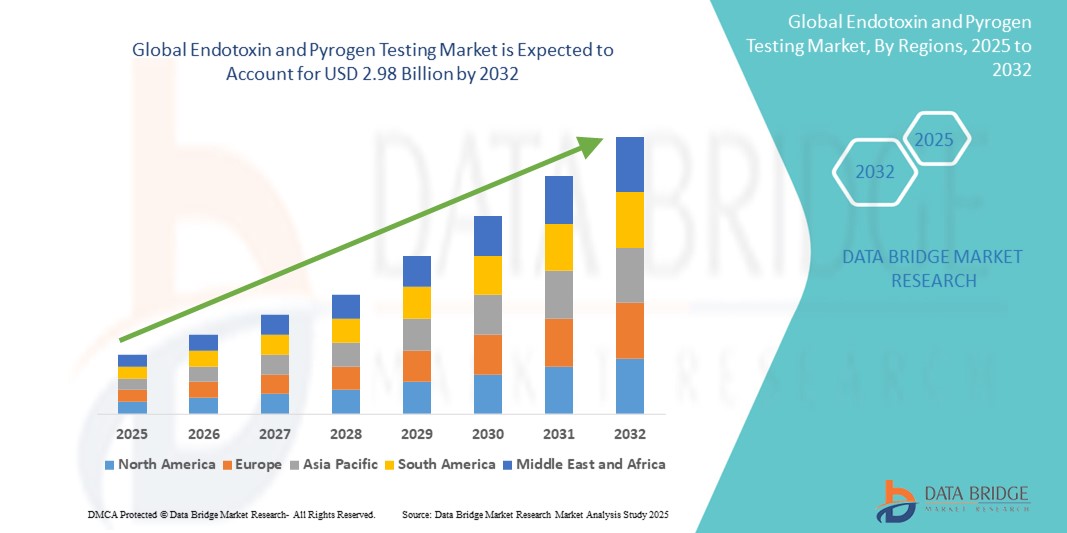

- The global endotoxin and pyrogen testing market size was valued at USD 1.27 billion in 2024 and is expected to reach USD 2.98 billion by 2032, at a CAGR of 11.3% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancement in pharmaceutical quality control and biosafety processes, leading to greater digitalization and automation in pharmaceutical, biotechnology, and medical device manufacturing

- Furthermore, rising demand for accurate, rapid, and regulatory-compliant endotoxin and pyrogen detection methods is establishing Endotoxin and Pyrogen Testing as a critical component of modern pharmaceutical and medical device production workflows. These converging factors are accelerating the uptake of Endotoxin and Pyrogen Testing solutions, thereby significantly boosting the industry's growth

Endotoxin and Pyrogen Testing Market Analysis

- Endotoxin and Pyrogen Testing, offering critical biological safety assurance through the detection of harmful bacterial endotoxins and pyrogens in pharmaceutical and medical products, is increasingly vital in modern healthcare, biopharmaceutical, and device manufacturing due to its role in ensuring regulatory compliance and patient safety

- The escalating demand for Endotoxin and Pyrogen Testing is primarily fueled by the expanding biopharmaceutical industry, rising incidence of chronic diseases requiring injectable therapies, and heightened regulatory scrutiny surrounding contamination control in injectable drugs, vaccines, and implantable devices

- North America dominated the endotoxin and pyrogen testing market with the largest revenue share of 40.01% in 2024, characterized by early regulatory adoption, strong investment in biotechnology research, and the presence of major players offering advanced testing solutions. The U.S. captured 81% of the regional market, driven by a surge in biologics production and increasing adoption of automated and recombinant testing technologies across GMP-certified labs

- Asia-Pacific is projected to be the fastest-growing region in the endotoxin and pyrogen testing market during the forecast period, with a CAGR of 24.02% from 2025 to 2032, fueled by rapid industrialization, expanding pharmaceutical manufacturing capacity, and growing government support for quality control infrastructure in countries such as China, India, and Japan

- The detection kits and reagents segment dominated the endotoxin and pyrogen testing market with a share of 46.8% in 2024, owing to their widespread application, ease of use, and crucial role in routine quality assurance protocols across pharmaceutical and biotechnology companies

Report Scope and Endotoxin and Pyrogen Testing Market Segmentation

|

Attributes |

Endotoxin and Pyrogen Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Endotoxin and Pyrogen Testing Market Trends

“Growing Demand for Accuracy, Compliance, and Rapid Testing Solutions”

- A significant and accelerating trend in the Asia-Pacific endotoxin and pyrogen testing market is the increased emphasis on accuracy, rapid turnaround, and regulatory compliance in pharmaceutical and medical device manufacturing. This demand is driving the development and adoption of highly sensitive and standardized testing solutions

- For instance, leading players are introducing recombinant Factor C (rFC)-based endotoxin tests that eliminate the use of animal-derived reagents while ensuring precise and consistent results—addressing both ethical and regulatory concerns

- Technological advancements in automated systems are also enabling labs to streamline endotoxin detection processes, reduce manual intervention, and improve reproducibility. Automated plate readers and cartridge-based detection kits are gaining popularity for their user-friendly operation and minimal error margins

- The integration of advanced software with testing equipment allows for better traceability, real-time monitoring, and easier data reporting, all of which are critical for GMP compliance. This is especially relevant for pharmaceutical companies scaling production of sterile injectables, vaccines, and biologics

- Furthermore, the increasing collaboration between regional governments and pharmaceutical manufacturers to improve healthcare infrastructure—particularly post-COVID-19—has accelerated the need for reliable endotoxin and pyrogen testing protocols across the supply chain

- As a result, manufacturers are focusing on producing compact, automated, and highly sensitive test systems tailored to high-volume labs, which is reshaping expectations for efficiency, compliance, and scalability in quality control environments

Endotoxin and Pyrogen Testing Market Dynamics

Driver

“Growing Need Due to Rising Contamination Risks and Regulatory Stringency”

- The increasing prevalence of contamination risks in pharmaceutical, biotechnology, and medical device production, coupled with stricter regulatory frameworks, is a significant driver for the heightened demand for endotoxin and pyrogen testing solutions

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced advancements in biopharmaceutical safety technologies, aiming to integrate real-time detection sensors into aseptic manufacturing environments. Such developments by key players are expected to boost the growth of the endotoxin and pyrogen testing market across the Asia-Pacific region

- As companies prioritize patient safety and regulatory compliance, tests such as the Limulus Amebocyte Lysate (LAL) and Monocyte Activation Test (MAT) are increasingly being adopted for their ability to detect minute endotoxin levels in injectable drugs, vaccines, and implantable devices

- Furthermore, the growth of biologics and personalized medicines is fueling the need for reliable, high-throughput testing methods that can integrate seamlessly into quality assurance processes. Automated test platforms and rapid kits are becoming critical components of modern production lines

- The convenience of automation, reduced manual errors, and the capability to handle high-volume testing with accuracy are major factors propelling the adoption of these solutions across pharmaceutical companies, contract manufacturing organizations (CMOs), and research laboratories. The trend toward decentralizing manufacturing and expanding regional biotech hubs is further contributing to market growth in Asia-Pacific

Restraint/Challenge

“Concerns Regarding High Costs and Regulatory Harmonization”

- The high cost of recombinant or alternative endotoxin detection systems, along with the need for specialized instruments, can be a barrier for small and mid-sized companies in emerging economies within Asia-Pacific

- For instance, while traditional gel-clot LAL tests are relatively economical, more advanced kinetic chromogenic and turbidimetric methods, as well as MAT-based systems, come with significantly higher initial costs and training requirements

- Further, inconsistent regulatory adoption across countries in Asia-Pacific—such as varying acceptance levels of rFC or MAT methods—creates uncertainty among manufacturers looking to streamline their validation processes regionally

- Addressing these challenges through cost optimization, regional regulatory harmonization, and expanded training initiatives is crucial for boosting adoption. Leading players are increasingly offering bundled hardware-software solutions and technical support to mitigate these entry barriers and drive sustained market growth

Endotoxin and Pyrogen Testing Market Scope

The market is segmented on the basis of product & services, test type, type, product category, form, application, method, mode of purchase, end product, and end user.

• By Product and Services

On the basis of product and services, the endotoxin and pyrogen testing market is segmented into detection kits and reagents, instruments and systems, endotoxin and pyrogen testing services, and consumables and accessories. The detection kits and reagents segment dominated the market with the largest revenue share of 46.8% in 2024, driven by their high demand in pharmaceutical and biotechnology industries due to ease of use and reliable performance in endotoxin detection.

The endotoxin and pyrogen testing services segment is expected to grow at the highest CAGR of 11.2% from 2025 to 2032, due to increased outsourcing by pharma and biotech companies.

• By Test Type

On the basis of test type, the endotoxin and pyrogen testing market is segmented into Limulus Amoebocyte Lysate (LAL) Test, TAL Tests, Monocyte Activation Test (MAT), Recombinant Factor C (rFC) Assay, In-Vitro, and Rabbit Pyrogen Test. The LAL Test segment held the largest market share of 41.2% in 2024, owing to its regulatory acceptance and high sensitivity.

The Recombinant Factor C (rFC) Assay segment is projected to expand at a CAGR of 12.7% from 2025 to 2032, driven by animal-free testing demand and sustainability considerations.

• By Type

On the basis of type, the endotoxin and pyrogen testing market is segmented into pre-formed endotoxin and pyrogen testing, proendotoxin and pyrogen testing, and combined endotoxin and pyrogen testing. The combined endotoxin and pyrogen testing segment accounted for the largest market share of 38.5% in 2024, due to its capability to detect multiple contaminants efficiently.

The proendotoxin and pyrogen testing segment is expected to grow at a CAGR of 10.6% from 2025 to 2032, driven by demand for early-stage predictive testing.

• By Product Category

On the basis of product category, the endotoxin and pyrogen testing market is segmented into clean labelled ingredient and conventional. The conventional segment led the market with 58.1% share in 2024, as it includes widely used reagents and systems.

The clean labelled ingredient segment is projected to grow at a CAGR of 9.3% from 2025 to 2032, owing to transparency-driven regulatory shifts and consumer preferences.

• By Form

On the basis of form, the endotoxin and pyrogen testing market is segmented into powder and liquid. The liquid segment held the dominant share of 63.9% in 2024, due to ease of automation and direct usage.

The powder segment is expected to grow at a CAGR of 8.8% from 2025 to 2032, benefiting from longer shelf life and transportability.

• By Application

On the basis of application, the endotoxin and pyrogen testing market is segmented into pharmaceutical manufacturing, medical device manufacturing, raw materials production, and packaging manufacture. The pharmaceutical manufacturing segment accounted for the largest share of 49.5% in 2024, due to high sterility compliance needs.

The medical device manufacturing segment is projected to grow at a CAGR of 10.1% from 2025 to 2032, due to growing regulatory testing of implants and surgical equipment.

• By Method

On the basis of method, the endotoxin and pyrogen testing market is segmented into gel clot endotoxin and pyrogen test, chromogenic endotoxin and pyrogen test, and turbidimetric endotoxin and pyrogen test. The gel clot method dominated the market with 42.7% share in 2024, due to cost-effectiveness and regulatory approval.

The chromogenic method is anticipated to grow at the fastest CAGR of 11.4% from 2025 to 2032, supported by its quantitative accuracy and automation compatibility.

• By Mode of Purchase

On the basis of mode of purchase, the endotoxin and pyrogen testing market is segmented into large group, mid and small group, and individual. The large group segment held the largest market share of 55.2% in 2024, due to large-scale procurement by pharma and CDMOs.

The mid and small group segment is projected to grow at a CAGR of 9.9% from 2025 to 2032, with increasing demand from SMEs and academic institutions.

• By End Product

On the basis of end product, the endotoxin and pyrogen testing market is segmented into vaccines and/or CGT, biologics, injectables, and others. The biologics segment accounted for the largest share of 38.9% in 2024, driven by rising demand for monoclonal antibodies and biosimilars.

The vaccines and/or CGT segment is expected to grow at a CAGR of 12.1% from 2025 to 2032, due to increasing approvals in advanced therapies and vaccine development.

• By End User

On the basis of end user, the endotoxin and pyrogen testing market is segmented into pharmaceutical companies, biotechnology companies, biomedical companies, medical device companies, CROs, CMOs, and others. The pharmaceutical companies segment dominated the market with a share of 40.4% in 2024, due to consistent investment in quality control and compliance testing.

The contract research organizations (CROs) segment is expected to register the fastest CAGR of 11.6% from 2025 to 2032, fueled by increasing outsourcing and growing drug discovery pipelines.

Endotoxin and Pyrogen Testing Market Regional Analysis

- North America dominated the global endotoxin and pyrogen testing market with the largest revenue share of 40.01% in 2024, driven by increasing regulatory stringency, strong biopharmaceutical production pipelines, and widespread use of injectable drugs and biologics

- The region benefits from advanced healthcare infrastructure, a high volume of clinical trials, and a growing shift toward recombinant and animal-free testing methods. Leading companies in the U.S. and Canada are investing in automated endotoxin detection systems and sustainable testing solutions

- The growing preference for faster and compliant quality control protocols further strengthens the market presence in this region

U.S. Endotoxin and Pyrogen Testing Market Insight

The U.S. endotoxin and pyrogen testing market accounted for 83% of the North American market share in 2024. The country leads due to its large-scale biologics and vaccine manufacturing, heavy investment in pharmaceutical R&D, and swift adoption of recombinant factor C (rFC) assays and Monocyte Activation Tests (MAT). Regulatory alignment with the FDA’s push for alternatives to animal-based testing is further accelerating market expansion.

Europe Endotoxin and Pyrogen Testing Market Insight

The Europe endotoxin and pyrogen testing market is projected to grow at a notable CAGR during the forecast period due to rising awareness of product safety, strict EU pharmacopoeial requirements, and increased biologic product approvals. Countries such as Germany, the U.K., and France are emphasizing sustainable testing alternatives. Strong growth in contract manufacturing and R&D outsourcing is also contributing to market demand across drug development and medical device testing.

U.K. Endotoxin and Pyrogen Testing Market Insight

The U.K. endotoxin and pyrogen testing market is expected to grow steadily over the forecast period, supported by MHRA regulations aligned with global GMP standards, a mature biopharmaceutical sector, and growing investments in clinical research infrastructure. The demand for rapid endotoxin testing methods in sterility assurance and injectable drug production is a key growth driver.

Germany Endotoxin and Pyrogen Testing Market Insight

The Germany endotoxin and pyrogen testing market is expected to witness significant growth due to its robust pharmaceutical manufacturing base, automation in QC labs, and support for recombinant testing technologies. Regulatory adherence and a strong focus on product safety and efficiency are shaping procurement trends.

Asia-Pacific Endotoxin and Pyrogen Testing Market Insight

The Asia-Pacific endotoxin and pyrogen testing market is forecast to grow at the fastest CAGR of 24.02% (2025–2032), driven by growing pharmaceutical exports, rising demand for biologics, and government support for localized drug manufacturing in countries such as China, Japan, and India. The rapid expansion of clinical trial activity and greater awareness of contamination control standards are promoting the adoption of MAT and rFC assays in the region.

Japan Endotoxin and Pyrogen Testing Market Insight

The Japan endotoxin and pyrogen testing market is witnessing increased demand for pyrogen and endotoxin testing due to its high innovation in cell and gene therapies and its well-regulated pharmaceutical landscape. Regulatory bodies are encouraging non-animal-based testing alternatives, while the country’s aging population is increasing the need for injectable drugs.

China Endotoxin and Pyrogen Testing Market Insight

The China endotoxin and pyrogen testing market captured the largest market share within Asia-Pacific in 2024, driven by its vast pharmaceutical manufacturing capacity, strong government support for local biologics production, and increasing adoption of sustainable quality control solutions. The rise of domestic players offering cost-effective testing kits and services is further propelling market growth.

Endotoxin and Pyrogen Testing Market Share

The endotoxin and pyrogen testing industry is primarily led by well-established companies, including:

- Pall Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Charles River Laboratories (U.S.)

- Eurofins Scientific (Luxembourg)

- SGS Société Générale de Surveillance SA (Switzerland)

- Lonza (Switzerland)

- Merck KGaA (Germany)

- STERIS (Ireland)

- Sartorius AG (Germany)

- BIOMÉRIEUX (France)

- Ellab A/S (Denmark)

- ASSOCIATES OF CAPE COD, INC. (U.S.)

- WuXi AppTec (China)

- Microcoat Biotechnologie GmbH (Germany)

Latest Developments in Global Endotoxin and Pyrogen Testing Market

- In March 2024, Lonza Group announced the expansion of its endotoxin and pyrogen testing capabilities by launching a new recombinant factor C (rFC)-based assay kit. This development aligns with growing regulatory acceptance of animal-free testing methods and supports sustainability goals by reducing reliance on horseshoe crab blood

- In February 2024, Charles River Laboratories introduced enhanced Monocyte Activation Test (MAT) platforms through automation integration, aiming to improve the throughput and reproducibility of pyrogen detection in biologics and cell therapies. The innovation is targeted at streamlining workflows for pharmaceutical companies complying with stringent global regulations

- In January 2024, FUJIFILM Wako Chemicals USA Corporation upgraded its Limulus Amebocyte Lysate (LAL) reagent portfolio with increased sensitivity and reduced variability, enhancing the reliability of endotoxin testing in parenteral drugs and medical devices. The company also announced new distribution partnerships to expand its reach across Southeast Asia

- In December 2023, Associates of Cape Cod, Inc. (ACC) received additional approvals from Asian regulatory authorities for its PyroSmart NextGen rFC assay. The approval is expected to accelerate the adoption of sustainable, animal-free endotoxin testing methods across biopharma manufacturers in Japan, China, and South Korea

- In October 2023, Merck KGaA (MilliporeSigma) introduced a new high-throughput turbidimetric endotoxin testing solution designed for vaccine and biologics production. The launch is part of the company’s initiative to support faster lot-release testing while meeting evolving GMP standar

- In September 2023, Thermo Fisher Scientific revealed the development of an integrated LAL test automation platform in collaboration with global CDMOs. This solution combines LAL testing with real-time data capture, aiming to reduce human error, improve efficiency, and ensure audit-readiness in regulatory submissions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 COST ANALYSIS BREAKDOWN

8 TECHNONLOGY ROADMAP

9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

9.1.1 JOINT VENTURES

9.1.2 MERGERS AND ACQUISITIONS

9.1.3 LICENSING AND PARTNERSHIP

9.1.4 TECHNOLOGY COLLABORATIONS

9.1.5 STRATEGIC DIVESTMENTS

9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

9.3 STAGE OF DEVELOPMENT

9.4 TIMELINES AND MILESTONES

9.5 INNOVATION STRATEGIES AND METHODOLOGIES

9.6 RISK ASSESSMENT AND MITIGATION

9.7 FUTURE OUTLOOK

10 REGULATORY COMPLIANCE

10.1 REGULATORY AUTHORITIES

10.2 REGULATORY CLASSIFICATIONS

10.2.1 CLASS I

10.2.2 CLASS II

10.2.3 CLASS III

10.3 REGULATORY SUBMISSIONS

10.4 INTERNATIONAL HARMONIZATION

10.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

10.6 REGULATORY CHALLENGES AND STRATEGIES

11 REIMBURSEMENT FRAMEWORK

12 VALUE CHAIN ANALYSIS

13 HEALTHCARE ECONOMY

13.1 HEALTHCARE EXPENDITURE

13.2 CAPITAL EXPENDITURE

13.3 CAPEX TRENDS

13.4 CAPEX ALLOCATION

13.5 FUNDING SOURCES

13.6 INDUSTRY BENCHMARKS

13.7 GDP RATION IN OVERALL GDP

13.8 HEALTHCARE SYSTEM STRUCTURE

13.9 GOVERNMENT POLICIES

13.1 ECONOMIC DEVELOPMENT

14 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY PRODUCT AND SERVICES

14.1 OVERVIEW

14.2 DETECTION KITS & REAGENTS

14.2.1 LAL TEST REAGENTS

14.2.2 MYCOPLASMA DETECTION & REMOVAL

14.2.3 PCR MYCOPLASMA DETECTION KIT

14.2.4 MYCOPLASMA ELIMINATION COCKTAIL

14.2.5 OTHERS

14.3 INSTRUMENTS & SYSTEMS

14.3.1 SERIES TUBE READER

14.3.2 MICROPLATE READER

14.3.3 LOW ENDOTOXIN RECOVERY (LER)

14.3.4 ENDOTOXIN REMOVAL

14.3.5 LOW ENDOTOXIN RECOVERY (LER)

14.3.6 OTHERS

14.4 CONSUMABLES & ACCESSORIES

14.5 SOFTWARE AND SERVICES

14.6 OTHERS

15 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY TEST TYPE

15.1 OVERVIEW

15.2 LIMULUS AMOEBOCYTE LYSATE (LAL) TEST

15.3 MONOCYTE ACTIVATION TEST (MAT) TEST

15.4 RECOMBINANT FACTOR C (RFC) ASSAY

15.5 RABBIT PYROGEN TEST

16 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY TYPE

16.1 OVERVIEW

16.2 PRE-FORMED ENDOTOXIN AND PYROGEN TESTING

16.3 PROENDOTOXIN AND PYROGEN TESTING

16.4 COMBINE ENDOTOXIN AND PYROGEN TESTING

17 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY FORM

17.1 OVERVIEW

17.2 POWDER

17.3 LIQUID

18 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY PRODUCT CATEGORY

18.1 OVERVIEW

18.2 CLEAN LABELED INGREDIENT

18.3 CONVENTIONAL

19 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 PHARMACEUTICAL MANUFACTURING

19.3 MEDICAL DEVICE MANUFACTURING

19.4 RAW MATERIALS PRODUCTION

19.5 PACKAGING MANUFACTURE

20 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY METHOD

20.1 OVERVIEW

20.2 GEL CLOT ENDOTOXIN AND PYROGEN TEST

20.3 CHROMOGENIC ENDOTOXIN AND PYROGEN TEST

20.4 TURBIDIMETRIC ENDOTOXIN AND PYROGEN TEST

21 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY MODE OF PURCHASE

21.1 OVERVIEW

21.2 LARGE GROUP

21.3 MID AND SMALL GROUP

21.4 INDIVIDUAL

22 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY END PRODUCT

22.1 OVERVIEW

22.2 BIOLOGICS

22.3 VACCINES AND/ OR CGT

22.4 INJECTABLES

22.5 OTHERS

22.5.1 ENDOSCOPES

22.5.2 REUSABLE BIOMEDICAL DEVICES

22.5.3 OTHERS

23 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, BY END USER

23.1 OVERVIEW

23.2 PHARMACEUTICAL COMPANIES

23.3 BIOTECHNOLOGY COMPANIES

23.4 BIOMEDICAL COMPANIES

23.5 MEDICAL DEVICE COMPANIES

23.6 CONTRACT RESEARCH ORGANIZATION (CRO)

23.7 CONTRACT MANUFACTURING ORGANIZATION (CMO)

24 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, GEOGRAPHY

24.1 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.2 NORTH AMERICA

24.2.1 U.S.

24.2.2 CANADA

24.2.3 MEXICO

24.3 EUROPE

24.3.1 GERMANY

24.3.2 FRANCE

24.3.3 U.K.

24.3.4 ITALY

24.3.5 SPAIN

24.3.6 RUSSIA

24.3.7 BELGIUM

24.3.8 NETHERLANDS

24.3.9 SWITZERLAND

24.3.10 REST OF EUROPE

24.4 ASIA-PACIFIC

24.4.1 JAPAN

24.4.2 CHINA

24.4.3 SOUTH KOREA

24.4.4 INDIA

24.4.5 AUSTRALIA

24.4.6 SINGAPORE

24.4.7 MALAYSIA

24.4.8 REST OF ASIA-PACIFIC

24.5 SOUTH AMERICA

24.5.1 BRAZIL

24.5.2 ARGENTINA

24.5.3 REST OF SOUTH AMERICA

24.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL ENDOTOXIN AND PYROGEN TESTING MARKET, COMPANY PROFILE

27.1 PALL EUROPE LIMITED (DANAHER CORPORATION)

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 THERMO FISHER SCIENTIFIC INC.

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 CHARLES RIVER LABORATORIES

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 EUROFINS SCIENTIFIC

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA.

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 PACIFIC BIOLABS

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 LONZA

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 MERCK KGAA

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 STERIS

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 SARTORIUS AG

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 BIOMÉRIEUX

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 FUJIFILM WAKO PURE CHEMICAL CORPORATION

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 ELLAB A/S.

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 ASSOCIATES OF CAPE COD, INC (SEIKAGAKU CORPORATION)

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 WUXI APPTEC

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 GENSCRIPT

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 MICROCOAT BIOTECHNOLOGIE GMBH

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 SANQUIN

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 READING SCIENTIFIC SERVICES LTD

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 NANOCOMPOSIX

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 ZWISLER LABORATORIUM GMBH

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 NELSON LABORATORIES, LLC – A SOTERA HEALTH COMPANY

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 NORTH AMERICAN SCIENCE ASSOCIATES, LLC

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 PROMEGA CORPORATION

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 HYCULT BIOTECH INC.

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 ALMAC GROUP

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPMENTS

27.27 MAT BIOTECH

27.27.1 COMPANY OVERVIEW

27.27.2 REVENUE ANALYSIS

27.27.3 GEOGRAPHIC PRESENCE

27.27.4 PRODUCT PORTFOLIO

27.27.5 RECENT DEVELOPMENTS

27.28 SOLVIAS

27.28.1 COMPANY OVERVIEW

27.28.2 REVENUE ANALYSIS

27.28.3 GEOGRAPHIC PRESENCE

27.28.4 PRODUCT PORTFOLIO

27.28.5 RECENT DEVELOPMENTS

27.29 WICKHAM MICRO LIMITED

27.29.1 COMPANY OVERVIEW

27.29.2 REVENUE ANALYSIS

27.29.3 GEOGRAPHIC PRESENCE

27.29.4 PRODUCT PORTFOLIO

27.29.5 RECENT DEVELOPMENTS

27.3 CREATIVE BIOLABS

27.30.1 COMPANY OVERVIEW

27.30.2 REVENUE ANALYSIS

27.30.3 GEOGRAPHIC PRESENCE

27.30.4 PRODUCT PORTFOLIO

27.30.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

28 RELATED REPORTS

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.