Global Endosulphane Market

Market Size in USD Million

CAGR :

%

USD

276.76 Million

USD

479.10 Million

2025

2033

USD

276.76 Million

USD

479.10 Million

2025

2033

| 2026 –2033 | |

| USD 276.76 Million | |

| USD 479.10 Million | |

|

|

|

|

Endosulphane Market Size

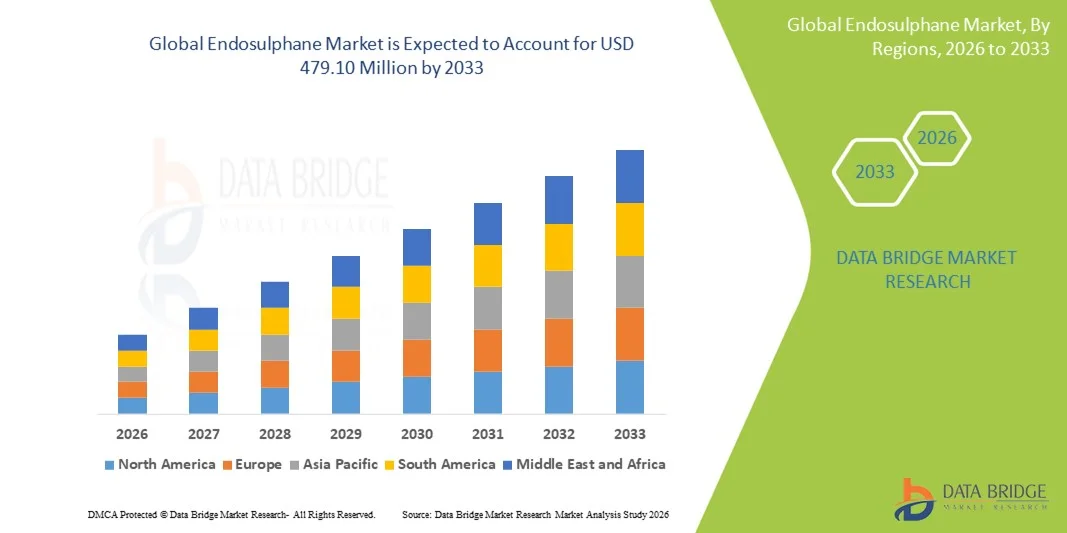

- The global endosulphane market size was valued at USD 276.76 million in 2025 and is expected to reach USD 479.10 million by 2033, at a CAGR of 7.10% during the forecast period

- The market growth is largely fueled by the increasing demand for effective pest control solutions in agriculture and wood preservation, which is driving the adoption of Endosulfan across major farming regions and industrial applications

- Furthermore, rising concerns over crop yield optimization, pest infestations, and the need for high-efficiency insecticides are establishing Endosulfan as a preferred chemical solution for farmers and agrochemical companies. These converging factors are accelerating the uptake of Endosulfan, thereby significantly boosting the industry's growth

Endosulphane Market Analysis

- Endosulfan is a chlorinated insecticide used to control a wide range of pests in crops such as cotton, tea, and vegetables, as well as in wood preservation applications. Its high efficacy, residual activity, and compatibility with integrated pest management systems make it a versatile chemical for agricultural and industrial use

- The escalating demand for Endosulfan is primarily fueled by large-scale cultivation in developing regions, increasing investments in agrochemical production, and ongoing regulatory approvals for controlled usage in certain countries, supporting steady market adoption

- Asia-Pacific dominated the endosulphane market in 2025, due to extensive agricultural activities, increasing pest infestations, and high adoption of chemical pesticides in key farming regions

- North America is expected to be the fastest growing region in the endosulphane market during the forecast period due to demand in agriculture, forestry, and industrial wood preservation

- Agriculture sector segment dominated the market with a market share of around 70% in 2025, due to extensive use in controlling pests across crops such as cotton, tea, and vegetables. Endosulfan provides high efficacy against a broad spectrum of insect pests, helping farmers minimize crop losses and maintain high productivity levels. Its ability to integrate into conventional and modern pest management programs enhances its utility in large-scale farming operations

Report Scope and Endosulphane Market Segmentation

|

Attributes |

Endosulphane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Endosulphane Market Trends

Rising Demand for High-Efficacy Chemical Pesticides in Agriculture

- A significant trend in the Endosulfan market is the increasing reliance on high-efficacy chemical pesticides to protect crops from pests and enhance agricultural productivity. This demand is driven by the need for rapid pest control solutions in regions facing intensive farming pressures and pest outbreaks

- For instance, companies such as Bayer CropScience have historically supplied Endosulfan-based formulations to manage a wide range of pests in cotton, rice, and tea crops. Such products have been crucial in regions where crop loss due to insects directly impacts farmer income and food supply

- The rising cultivation of cash crops and high-value agricultural produce is intensifying the use of chemical pesticides, including Endosulfan, to ensure consistent yields and quality. This is positioning Endosulfan as a preferred solution in crop protection strategies where immediate efficacy is required

- In emerging markets, farmers are increasingly seeking cost-effective pesticides that provide broad-spectrum pest control. Endosulfan’s longstanding availability and proven results are making it a widely adopted chemical in staple and commercial crops

- In sectors such as horticulture and plantation crops, Endosulfan is being applied to control pests that threaten fruit, tea, and coffee plantations. This trend is reinforcing the role of chemical pesticides in maintaining crop health and maximizing economic returns

- The market continues to witness attention toward Endosulfan for specific pest infestations despite regulatory scrutiny, as it offers rapid action and targeted control. Its effectiveness against resistant pests sustains its adoption in regions with intensive farming practices

Endosulphane Market Dynamics

Driver

Increasing Need for Effective Pest Control to Improve Crop Yield

- The demand for Endosulfan is being driven by the growing need to protect crops from destructive pests and maintain high agricultural output. Effective pest control measures are critical in regions where crop losses can severely affect food security and farmer livelihoods

- For instance, Syngenta has supplied Endosulfan formulations to manage pests in cotton-growing regions of India, contributing to improved yield and reduced infestation rates. These products provide rapid knockdown of pests, supporting timely harvesting and high-quality output

- The rise in global food demand due to population growth is pressuring farmers to adopt proven chemical solutions for pest management. Endosulfan’s ability to control multiple pest species makes it an important tool in integrated pest management programs

- Intensive farming and monoculture practices are increasing the vulnerability of crops to pest outbreaks, driving the reliance on Endosulfan for quick and effective protection. This demand is particularly strong in tropical and subtropical regions where pest proliferation is high

- The need for stable and predictable crop yields is prompting governments and agricultural organizations to support the availability of effective chemical pesticides. This trend is positioning Endosulfan as a valuable option in maintaining production consistency and economic sustainability

Restraint/Challenge

Regulatory Restrictions and Phase-Out Policies in Key Markets

- The Endosulfan market faces significant challenges due to regulatory bans and phase-out policies implemented in several countries over health and environmental concerns. These restrictions are limiting production, sales, and application, impacting market growth and farmer access

- For instance, the Stockholm Convention on Persistent Organic Pollutants has called for the global phase-out of Endosulfan, and companies such as Bayer have had to discontinue its production in compliance with international agreements. This has created supply gaps and shifted demand toward alternative pesticides

- Increasing scrutiny from government agencies and stricter residue limits in food products are reducing the permissible usage of Endosulfan in agriculture. Farmers face compliance challenges and potential legal implications when using restricted chemicals

- The market is also constrained by the rising adoption of integrated pest management (IPM) and organic farming practices, which favor reduced chemical input. This is limiting the traditional market for Endosulfan in regions prioritizing sustainable agriculture

- Ongoing environmental and health concerns related to Endosulfan exposure are further restricting its usage, prompting regulatory authorities to enforce stringent safety protocols. These combined factors are shaping the market landscape and accelerating the transition toward safer alternatives

Endosulphane Market Scope

The market is segmented on the basis of chemical forms and applications.

- By Chemical Forms

On the basis of chemical forms, the Endosulfan market is segmented into Alpha and Beta Endosulfan. The Alpha Endosulfan segment dominated the largest market revenue share in 2025, driven by its higher efficacy in pest control and longer residual activity compared to the Beta form. Farmers and agricultural companies often prefer Alpha Endosulfan for its proven effectiveness against a wide spectrum of insect pests, providing better crop protection and yield. The segment also benefits from widespread availability and established usage patterns in key agricultural regions. In addition, regulatory approvals in several countries favor the controlled use of Alpha Endosulfan, supporting its sustained market demand. Its formulation versatility, enabling application in sprays, powders, and emulsions, further reinforces its market dominance.

The Beta Endosulfan segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand in niche agricultural applications and rising awareness of selective pest management. For instance, manufacturers such as Excel Crop Care have introduced refined Beta formulations designed for targeted pest control with lower environmental impact. The growth is supported by its compatibility with integrated pest management practices and blending with other active ingredients to enhance efficiency. Farmers are gradually adopting Beta Endosulfan due to its reduced volatility and better stability under varying climatic conditions. Its emerging usage in specialty crops and controlled-environment agriculture is expected to accelerate adoption across regions with stringent pesticide regulations.

- By Applications

On the basis of applications, the Endosulfan market is segmented into Agriculture Sector and Wood Preservatives. The Agriculture Sector segment dominated the largest market revenue share of around 70% in 2025, driven by extensive use in controlling pests across crops such as cotton, tea, and vegetables. Endosulfan provides high efficacy against a broad spectrum of insect pests, helping farmers minimize crop losses and maintain high productivity levels. Its ability to integrate into conventional and modern pest management programs enhances its utility in large-scale farming operations. In addition, widespread familiarity among farmers and easy availability in agrochemical supply chains reinforce its strong market presence. The segment’s dominance is also supported by seasonal demand peaks during sowing and pest outbreak periods.

The Wood Preservatives segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for treated timber in construction, furniture, and infrastructure. For instance, companies such as Syngenta have developed formulations specifically for wood protection against termites, fungi, and decay, driving market adoption. Growth is also supported by rising awareness of the benefits of chemical-treated wood for longevity and durability. The segment sees increasing application in commercial and industrial construction projects where pest-resistant timber is critical. Advancements in eco-friendly Endosulfan-based preservatives are expected to further boost adoption, particularly in regions with strict quality and safety regulations.

Endosulphane Market Regional Analysis

- Asia-Pacific dominated the endosulphane market with the largest revenue share in 2025, driven by extensive agricultural activities, increasing pest infestations, and high adoption of chemical pesticides in key farming regions

- The region’s cost-effective agrochemical production, favorable government policies for crop protection, and rising exports of pesticides are accelerating market growth

- Availability of skilled labor, rapid modernization of agriculture, and growing awareness of crop yield optimization are contributing to increased consumption of Endosulfan across major Asia-Pacific countries

India Endosulfan Market Insight

India held the largest share in the Asia-Pacific Endosulfan market in 2025, owing to its status as a leading agricultural economy with high pesticide demand. The country’s extensive cultivation of cotton, tea, and vegetables, along with government initiatives to improve crop protection, are key growth drivers. Rising investments in agrochemical manufacturing, local production facilities, and growing export opportunities are further boosting market demand. In addition, adoption of modern pest management practices and increasing awareness among farmers about crop protection solutions are contributing to India’s dominant position.

China Endosulfan Market Insight

China is witnessing steady growth in the Asia-Pacific Endosulfan market, supported by its strong agricultural base, large-scale farming operations, and growing exports of pesticides. The country benefits from a well-established chemical production infrastructure and favorable government regulations for agrochemicals. Demand is further strengthened by investments in research and development for effective pest control solutions and integration with modern farming practices.

Europe Endosulfan Market Insight

The Europe Endosulfan market is expanding moderately, driven by demand in controlled agricultural applications and wood preservation. Strict regulatory frameworks, emphasis on environmental safety, and adoption of sustainable pesticide alternatives influence market dynamics. The region focuses on high-quality chemical standards, integrated pest management practices, and niche industrial applications.

Germany Endosulfan Market Insight

Germany’s Endosulfan market is primarily supported by its precision agricultural sector, adherence to stringent pesticide regulations, and use in specialty applications such as wood preservation. Strong R&D collaboration between agrochemical companies and academic institutions fosters innovation in pest control solutions. Demand remains concentrated in controlled usage for high-value crops and timber protection.

U.K. Endosulfan Market Insight

The U.K. market benefits from advanced agricultural practices, emphasis on safe pesticide application, and demand for effective pest management in horticulture and forestry. Increasing focus on compliance with environmental standards and growing adoption of integrated pest control strategies support stable market growth.

North America Endosulfan Market Insight

North America is projected to witness the fastest CAGR from 2026 to 2033, driven by demand in agriculture, forestry, and industrial wood preservation. Farmers and manufacturers are increasingly relying on chemical pesticides for effective pest management and crop yield optimization. Expansion of controlled application technologies and growing awareness of product efficacy are supporting market growth.

U.S. Endosulfan Market Insight

The U.S. accounted for the largest share in the North America Endosulfan market in 2025, underpinned by high-value crop cultivation, strong agrochemical R&D infrastructure, and demand for pest control solutions. Regulatory compliance, safe application practices, and advanced distribution networks are further strengthening the U.S.'s position in the regional market.

Endosulphane Market Share

The endosulphane industry is primarily led by well-established companies, including:

- Coromandel International (India)

- Excel Crop Care Ltd (India)

- HIL (Hindustan Insecticides Ltd) (India)

- Indichem Specialty Fertilizers/Indichem (India)

- Syngenta AG (Switzerland)

- Bayer CropScience (Germany)

- Adama Agricultural Solutions Ltd (Israel)

- UPL Limited (India)

- BASF SE (Germany)

- Sumitomo Chemical Co., Ltd (Japan)

- Dow AgroSciences LLC (U.S.)

- Nufarm Limited (Australia)

- PI Industries (India)

- Dhanuka Agritech Ltd (India)

- Heranba Industries Ltd (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.