Global Endoscopic Retrograde Cholangiopancreatography Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.40 Billion

USD

3.94 Billion

2024

2032

USD

2.40 Billion

USD

3.94 Billion

2024

2032

| 2025 –2032 | |

| USD 2.40 Billion | |

| USD 3.94 Billion | |

|

|

|

|

Endoscopic Retrograde Cholangiopancreatography Devices Market Size

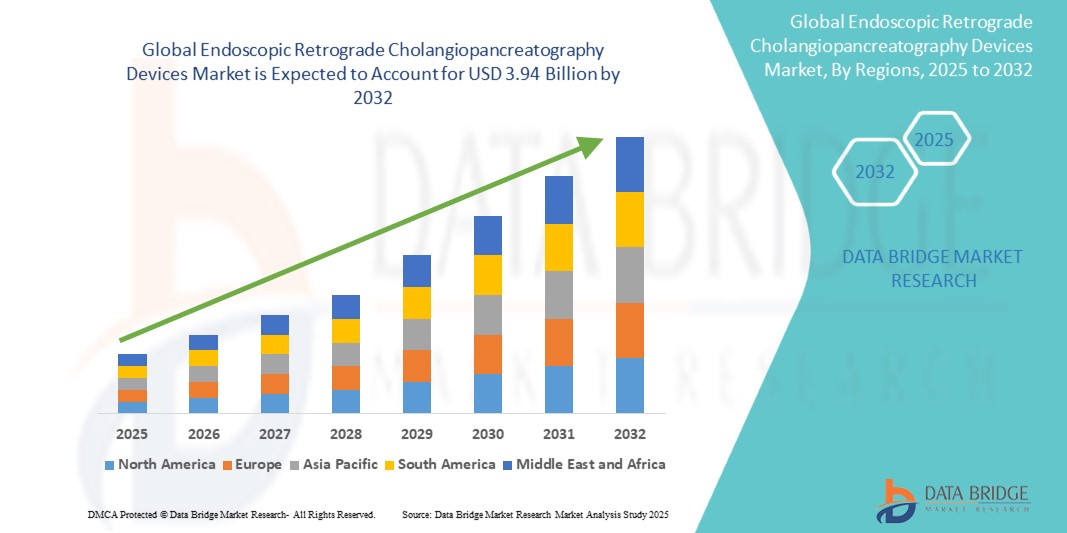

- The global endoscopic retrograde cholangiopancreatography devices market size was valued at USD 2.40 billion in 2024 and is expected to reach USD 3.94 Billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely fueled by the rising adoption and technological progress in minimally invasive procedures, coupled with the increasing preference for early diagnosis and treatment of pancreatic and biliary disorders. These advancements are driving the demand for sophisticated ERCP devices across healthcare facilities globally

- Furthermore, rising patient demand for safer, less invasive, and cost-effective treatment options is establishing endoscopic retrograde cholangiopancreatography devices as a preferred solution in gastrointestinal procedures. These converging factors are accelerating the uptake of ERCP device solutions, thereby significantly boosting the industry's growth

Endoscopic Retrograde Cholangiopancreatography Devices Market Analysis

- Endoscopic retrograde cholangiopancreatography (ERCP) devices, designed for the diagnosis and treatment of biliary and pancreatic ductal systems, are increasingly vital components of modern gastroenterology practices in both hospital and specialty clinic settings due to their enhanced precision, minimal invasiveness, and ability to combine diagnostic imaging with therapeutic intervention

- The escalating demand for ERCP devices is primarily fueled by the rising prevalence of pancreatic and biliary diseases, increasing geriatric population, and growing preference for minimally invasive procedures among patients and healthcare providers

- North America dominated the endoscopic retrograde cholangiopancreatography devices market with the largest revenue share of 41.6% in 2024, characterized by early adoption of advanced endoscopic technologies, high healthcare expenditure, and a strong presence of leading manufacturers. The U.S. experienced substantial growth in ERCP procedures, particularly within outpatient surgical centers and specialty hospitals, driven by innovations in device design and integration with imaging technologies

- Asia-Pacific is expected to be the fastest growing region in the endoscopic retrograde cholangiopancreatography devices market during the forecast period, with a projected CAGR of 8.9%, fueled by improving healthcare infrastructure, rising medical tourism, and increased awareness regarding gastrointestinal health in countries such as China, India, and Japan

- The bile duct segment dominated the endoscopic retrograde cholangiopancreatography devices with a market revenue share of 41.3% in 2024, driven by high procedure volumes for gallstone removal and malignancy treatments

Report Scope and Endoscopic Retrograde Cholangiopancreatography Devices Market Segmentation

|

Attributes |

Endoscopic Retrograde Cholangiopancreatography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Endoscopic Retrograde Cholangiopancreatography Devices Market Trends

“Rising Integration of Advanced Technologies in ERCP Procedures”

- A significant and accelerating trend in the global endoscopic retrograde cholangiopancreatography (ercp) devices market is the increasing integration of advanced technologies such as artificial intelligence (AI), high-definition imaging, and robotic assistance to enhance precision and procedural efficiency. This technological evolution is substantially improving the capabilities of endoscopy systems in complex biliary and pancreatic procedures

- For instance, Olympus Corporation launched EVIS X1, a next-generation endoscopy system that enhances image quality and provides real-time lesion recognition support. This advancement empowers healthcare professionals with better visualization and more accurate diagnostics during ERCP procedures

- AI-enabled ERCP systems are also being developed to assist in identifying abnormalities such as strictures, stones, and tumors in the bile or pancreatic ducts. By learning from extensive procedural data, AI algorithms support clinicians in making faster and more informed decisions, thereby improving patient outcomes

- Moreover, the integration of high-definition video imaging, real-time navigation, and 3D mapping systems in ERCP devices allows for minimally invasive yet highly accurate interventions. These features significantly reduce procedure times and enhance safety for both patients and medical staff

- In addition, interoperability with hospital information systems and digital health platforms is growing, enabling clinicians to access procedural data and patient records seamlessly. This facilitates post-procedure monitoring and optimizes clinical workflows in hospitals and ambulatory surgical centers

- The push towards smarter, data-driven, and highly integrated endoscopic systems is fundamentally reshaping the ERCP devices landscape. Companies such as Boston Scientific and Medtronic are increasingly investing in smart ERCP platforms with advanced sensors and cloud-based analytics to provide better clinical insights and procedural support

- As healthcare providers strive for improved procedural outcomes, reduced hospital stays, and enhanced diagnostic accuracy, the demand for technologically advanced ERCP devices continues to surge across both developed and emerging markets

Endoscopic Retrograde Cholangiopancreatography Devices Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Gastrointestinal Disorders and Advanced Diagnostic Demands”

- The increasing prevalence of gastrointestinal, pancreatic, and biliary disorders, coupled with the rising demand for minimally invasive diagnostic and therapeutic procedures, is a significant driver for the heightened adoption of Endoscopic Retrograde Cholangiopancreatography (ERCP) devices

- For instance, in March 2024, Olympus Corporation launched advanced imaging upgrades to its ERCP platform, enhancing visualization and maneuverability to support complex interventions. Such advancements are expected to drive the ERCP devices market growth during the forecast period

- As healthcare providers aim to reduce patient recovery times and minimize procedural complications, ERCP devices offer real-time imaging, precision-guided access, and therapeutic capabilities that significantly improve outcomes compared to traditional surgical methods

- Furthermore, the rising global burden of diseases such as gallstones, bile duct strictures, and pancreatic tumors is pushing hospitals and diagnostic centers to invest in high-performance ERCP systems. These systems provide efficient and cost-effective solutions for both diagnostic and interventional procedures

- The demand is further bolstered by an aging population, particularly in developed regions, where older adults are more susceptible to conditions such as chronic pancreatitis and biliary obstructions. Enhanced procedural success rates and lower patient morbidity are making ERCP the preferred technique in gastroenterology

Restraint/Challenge

“High Procedural Cost and Limited Accessibility in Low-Income Regions”

- Despite their clinical effectiveness, the high cost associated with ERCP devices, infrastructure, and skilled personnel poses a significant barrier to widespread adoption, especially in developing and under-resourced healthcare settings

- For instance, advanced ERCP equipment integrating fluoroscopy, endotherapy tools, and real-time imaging systems can be financially out of reach for smaller diagnostic centers or public hospitals in low-income countries

- The procedure also requires a team of specialized gastroenterologists, radiologists, and support staff, further elevating operational costs and limiting availability to urban tertiary care centers

- Moreover, patient awareness and early diagnosis remain limited in several regions, resulting in delayed or missed opportunities for intervention. The complexity of the procedure and its reliance on advanced imaging also contribute to reluctance among less-equipped facilities

- Overcoming these challenges requires increased investment in healthcare infrastructure, training programs for ERCP specialists, and the development of cost-effective, portable ERCP devices. Innovations targeting affordability and accessibility will be key to unlocking growth in emerging markets and achieving broader procedural equity globally

Endoscopic Retrograde Cholangiopancreatography Devices Market Scope

The market is segmented on the basis of product type, modality, procedure, application, end user, facility type, and distribution channel.

- By Product Type

On the basis of product type, the endoscopic retrograde cholangiopancreatography devices market is segmented into endotherapy devices, endoscopes, imaging devices, and others. The endotherapy devices segment dominated the largest market revenue share of 39.8% in 2024, attributed to their essential role in therapeutic interventions such as stenting and sphincterotomy during ERCP procedures.

The imaging devices segment is expected to witness the fastest CAGR of 10.6% from 2025 to 2032, due to technological advancements enhancing procedural precision and diagnostic capabilities.

- By Modality

On the basis of modality, the endoscopic retrograde cholangiopancreatography devices market is segmented into single use, standalone, and handheld. The standalone segment held the largest market revenue share of 46.2% in 2024, driven by comprehensive ERCP capabilities in full hospital settings.

The single use segment is expected to witness the fastest CAGR of 12.4% from 2025 to 2032, fueled by infection control needs and regulatory shifts favoring disposable scopes.

- By Procedure

On the basis of procedure, the endoscopic retrograde cholangiopancreatography devices market is segmented into biliary sphincterotomy, biliary stenting, biliary dilation, pancreatic duct stenting, and pancreatic sphincterotomy. The biliary stenting segment captured the largest market share of 32.5% in 2024, owing to its widespread use in relieving obstructions and treating biliary tract diseases.

The pancreatic duct stenting segment is projected to grow at the fastest CAGR of 11.9%, during the forecast period, supported by increasing cases of pancreatitis and related disorders.

- By Application

On the basis of application, the endoscopic retrograde cholangiopancreatography devices market is segmented into bile duct, pancreas, gall bladder, liver, and others. The bile duct segment dominated with a revenue share of 41.3% in 2024, driven by high procedure volumes for gallstone removal and malignancy treatments.

The pancreas segment is anticipated to witness the fastest CAGR of 9.7% from 2025 to 2032, as pancreatic diagnostics and interventions become more common in clinical protocols.

- By End User

On the basis of end user, the endoscopic retrograde cholangiopancreatography devices market is segmented into hospitals, ambulatory surgical centers, diagnostic laboratories, and others. The hospitals segment accounted for the largest market revenue share of 58.6% in 2024, due to advanced infrastructure and high ERCP procedure throughput.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of 10.3% through 2032, driven by cost-efficiency and growing preference for outpatient care.

- By Facility Type

On the basis of facility type, the endoscopic retrograde cholangiopancreatography devices market is segmented into large, medium, and small. The large facilities segment led with a market share of 49.1% in 2024, owing to procedural volume and access to state-of-the-art ERCP systems.

The medium facility segment is expected to grow at the highest CAGR of 10.2% from 2025 to 2032, due to increasing adoption of ERCP in private and regional hospitals.

- By Distribution Channel

On the basis of distribution channel, the endoscopic retrograde cholangiopancreatography devices market is segmented into direct tenders, third party distribution, and retail sales. The direct tenders segment held the largest revenue share of 52.7% in 2024, reflecting institutional procurement patterns for bulk and long-term contracts.

The third party distribution segment is projected to grow at the fastest CAGR of 11.5% from 2025 to 2032, particularly in developing markets where regional distributors play a key role in market access.

Endoscopic Retrograde Cholangiopancreatography Devices Market Regional Analysis

- North America dominated the endoscopic retrograde cholangiopancreatography (ERCP) devices market with the largest revenue share of 41.6% in 2024

- Driven by the rising burden of pancreatic and biliary disorders, advanced healthcare infrastructure, and the presence of leading medical device companies

- The region’s growth is further supported by increasing adoption of minimally invasive surgeries, favorable reimbursement policies, and strong investment in endoscopy technologies

U.S. Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

The U.S. endoscopic retrograde cholangiopancreatography devices market accounted for 81.5% of the North American market in 2024. Growth is fueled by high procedure volumes, robust healthcare spending, and strong distribution networks of key players such as Boston Scientific and Medtronic. Hospitals and outpatient centers are increasingly adopting ERCP tools for biliary and pancreatic interventions, contributing to sustained market expansion.

Europe Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

The Europe endoscopic retrograde cholangiopancreatography devices market is projected to expand at a substantial CAGR throughout the forecast period. The market is driven by a rising elderly population, growing demand for early diagnosis, and increasing adoption of single-use ERCP devices to prevent infections. Major contributors include Germany, France, Italy, and the U.K.

U.K. Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

The U.K. endoscopic retrograde cholangiopancreatography devices market is anticipated to grow at a noteworthy CAGR during the forecast period. Key growth factors include a rising incidence of gastrointestinal diseases, improved hospital infrastructure, and increasing reliance on day-case endoscopic procedures.

Germany Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

The Germany endoscopic retrograde cholangiopancreatography devices market is expected to expand at a considerable CAGR during the forecast period. Growth is driven by a well-established medical technology industry, rising endoscopic procedure rates, and the high adoption of minimally invasive diagnostics for hepatobiliary diseases.

Asia-Pacific Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

The Asia-Pacific endoscopic retrograde cholangiopancreatography devices market is expected to grow at the fastest CAGR of 8.9% from 2025 to 2032. In 2024, the region held a market share of 21.9%. Growth is fueled by rising healthcare investments, government initiatives in China and India, growing medical tourism in Thailand and Singapore, and expanding hospital capacities across developing economies.

Japan Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

The Japan endoscopic retrograde cholangiopancreatography devices market contributed 28.1% to the Asia-Pacific market in 2024. Key drivers include the aging population, strong emphasis on diagnostic precision, and growing integration of ERCP with other imaging modalities.

China Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

The China endoscopic retrograde cholangiopancreatography devices market held the largest share of 39.3% in the Asia-Pacific ERCP market in 2024. The country benefits from rapid urbanization, high disease burden, favorable government support for digital healthcare, and a robust manufacturing base for endoscopy tools.

Endoscopic Retrograde Cholangiopancreatography Devices Market Share

The endoscopic retrograde cholangiopancreatography devices industry is primarily led by well-established companies, including:

- Olympus Corporation (Japan)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- BD (U.S.)

- Ambu Inc. (Denmark)

- CONMED Corporation (U.S.)

- HOBBS MEDICAL, INC. (U.S.)

- FUJIFILM Corporation (Japan)

- TeleMed Systems, Inc. (U.S.)

- Merit Medical Systems (U.S.)

- Cook (U.S.)

- KARL STORZ SE & Co. KG (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- HOYA Corporation (Japan)

- Medi-Globe GmbH (Germany)

- STERIS (U.K.)

- Shaili Endoscopy (India)

- HOSPI LINE EQUIPMENTS PVT. LTD (India)

Latest Developments in Global Endoscopic Retrograde Cholangiopancreatography Devices Market

- In February 2025, Boston Scientific Corporation announced the global launch of its SpyGlass Discover Digital Catheter, a single-use, digital cholangioscope designed for ERCP procedures. This next-generation device enhances image clarity and access to difficult ductal areas, improving diagnostic and therapeutic accuracy for biliary and pancreatic disorders. The launch represents Boston Scientific’s continued focus on advancing minimally invasive endoscopic technology

- In January 2025, Olympus Corporation introduced its EVIS X1 Duodenoscope, featuring advanced imaging capabilities and improved ergonomics to support complex ERCP interventions. This innovation aims to reduce infection risks and elevate procedural efficiency, aligning with global trends toward device sterilization and single-use components

- In December 2024, Medtronic plc revealed plans to expand its ERCP product portfolio by investing in the development of robot-assisted endoscopic platforms. The company is working toward integrating AI-driven navigation for real-time imaging during ERCP procedures, highlighting its commitment to precision and automation in endoscopy

- In October 2024, FUJIFILM Holdings Corporation launched a strategic collaboration with several European hospitals to conduct clinical trials of its new ELUXEO Lite ERCP System, which includes multi-light imaging for improved visualization of bile duct lesions. The project emphasizes FUJIFILM’s push to capture more market share in Europe by offering physician-friendly tools for complex endoscopic procedures

- In September 2024, Ambu A/S gained FDA clearance for its Ambu aScope Duodeno, a single-use duodenoscope designed to eliminate cross-contamination risks associated with reusable scopes. The approval is a significant milestone in the U.S. ERCP devices space, supporting hospitals in complying with stringent infection control standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.