Global Endoscope Reprocessing Market

Market Size in USD Billion

CAGR :

%

USD

1.76 Billion

USD

3.30 Billion

2024

2032

USD

1.76 Billion

USD

3.30 Billion

2024

2032

| 2025 –2032 | |

| USD 1.76 Billion | |

| USD 3.30 Billion | |

|

|

|

|

Endoscope Reprocessing Market Size

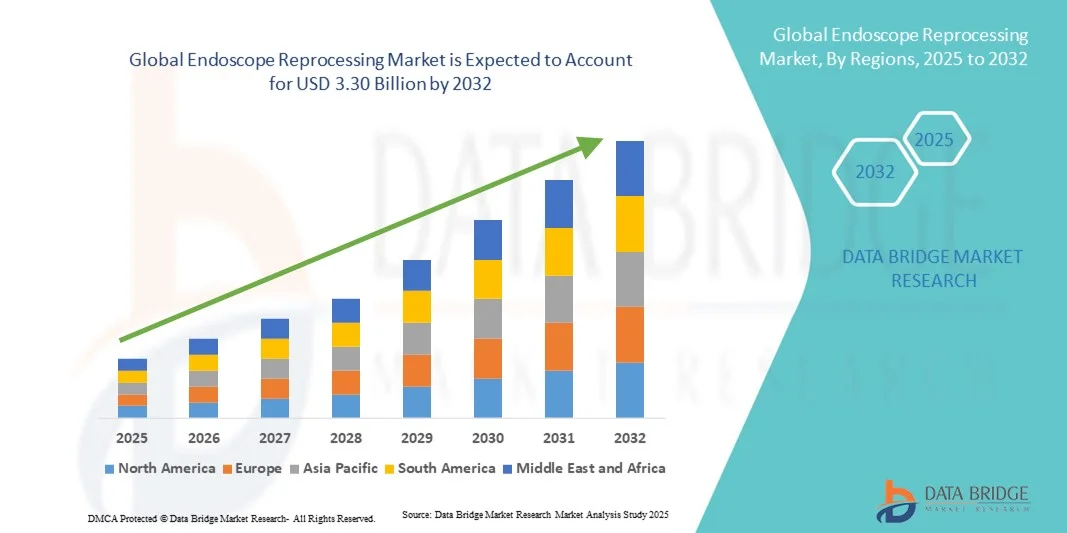

- The global endoscope reprocessing market size was valued at USD 1.76 billion in 2024 and is expected to reach USD 3.30 billion by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is largely driven by the increasing number of endoscopic procedures, rising awareness about infection control, and stringent regulatory guidelines for medical device reprocessing, fueling demand for efficient and standardized endoscope cleaning and sterilization solutions

- Furthermore, technological advancements in automated endoscope reprocessors (AERs), along with rising investments in hospital infrastructure and patient safety initiatives, are encouraging healthcare providers to adopt advanced reprocessing solutions, thereby significantly accelerating the market’s growth

Endoscope Reprocessing Market Analysis

- Endoscope reprocessing, involving the thorough cleaning, disinfection, and sterilization of endoscopic instruments, is a critical aspect of infection control in healthcare settings, ensuring patient safety and operational efficiency in hospitals, clinics, and ambulatory surgical centers.

- The growing demand for endoscope reprocessing solutions is primarily driven by rising awareness of hospital-acquired infections (HAIs), stringent regulatory guidelines, and the increasing number of endoscopic procedures worldwide, coupled with the need for cost-effective and time-efficient reprocessing workflows

- North America dominated the endoscope reprocessing market with the largest revenue share of 38.5% in 2024, attributed to the presence of advanced healthcare infrastructure, high adoption of automated endoscope reprocessors (AERs), and stringent compliance requirements, with the U.S. leading in hospital and ambulatory care facility implementations of state-of-the-art reprocessing technologies

- Asia-Pacific is expected to be the fastest growing region in the endoscope reprocessing market during the forecast period due to expanding healthcare facilities, rising patient volumes, increasing awareness of infection prevention, and growing investments in modern endoscopy centers

- Automated Endoscope Reprocessors (AERs) segment dominated the endoscope reprocessing market with a market share of 45.6% in 2024, driven by enhanced safety, reduced human error, and the ability to standardize cleaning and disinfection protocols across multiple endoscopic devices

Report Scope and Endoscope Reprocessing Market Segmentation

|

Attributes |

Endoscope Reprocessing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Endoscope Reprocessing Market Trends

Automation and IoT-Enabled Tracking Integration

- A significant and accelerating trend in the global endoscope reprocessing market is the integration of automated reprocessors (AERs) with IoT-enabled tracking and monitoring systems, enhancing workflow efficiency and patient safety

- For instance, the Olympus Automated Endoscope Reprocessor features built-in connectivity for tracking each endoscope’s cleaning and disinfection cycle, ensuring compliance with hospital protocols

- IoT-enabled systems allow real-time monitoring of endoscope location, reprocessing status, and usage history, reducing human error and optimizing instrument turnaround times

- The seamless combination of automation and digital monitoring facilitates centralized control of reprocessing workflows, enabling hospitals to manage multiple endoscopes and locations from a single interface

- This trend towards more intelligent, connected, and automated reprocessing solutions is reshaping hospital operational standards, with companies such as Medivators and Steris developing smart systems with cycle optimization, remote alerts, and integration with electronic medical records

- The demand for endoscope reprocessing solutions with automated and IoT tracking integration is growing rapidly as healthcare providers increasingly prioritize infection control, operational efficiency, and regulatory compliance

Endoscope Reprocessing Market Dynamics

Driver

Rising Infection Control Awareness and Regulatory Mandates

- The increasing focus on hospital-acquired infection (HAI) prevention and stringent reprocessing guidelines is a major driver for the adoption of advanced endoscope reprocessing solutions

- For instance, in March 2024, Steris launched an upgraded AER system with enhanced cycle verification features to support compliance with FDA and CDC guidelines for flexible endoscope reprocessing

- As hospitals become more vigilant about infection outbreaks, the need for standardized, automated, and traceable reprocessing methods becomes critical for patient safety

- Furthermore, growing procedural volumes and endoscope usage in hospitals and ambulatory centers are increasing demand for efficient and reliable reprocessing workflows

- Automated solutions combined with digital monitoring provide hospitals with consistent disinfection outcomes, reducing manual errors, saving time, and ensuring regulatory adherence across multiple devices and locations

Restraint/Challenge

High Costs and Complex Regulatory Compliance

- The relatively high cost of advanced AER systems, consumables, and integrated tracking solutions poses a challenge for widespread adoption, particularly in smaller hospitals or developing regions

- For instance, procuring a fully automated system with IoT-enabled monitoring can require significant capital investment and ongoing maintenance expenses, limiting affordability for budget-conscious healthcare providers

- In addition, the need to comply with complex international, national, and local reprocessing guidelines can slow adoption, as facilities must ensure adherence to multiple regulatory frameworks

- Hospitals and clinics may face operational challenges integrating new systems with existing workflows, requiring staff training and process standardization before full-scale deployment

- Overcoming these challenges through cost optimization, simplified integration, and robust staff training programs will be essential for sustained growth in the endoscope reprocessing market

Endoscope Reprocessing Market Scope

The market is segmented on the basis of product and end-user.

- By Product

On the basis of product, the endoscope reprocessing market is segmented into high-level disinfectants & test strips, detergents & wipes, automated endoscope reprocessors (AERs), endoscope drying, storage & transport systems, endoscope tracking systems, and others. The Automated Endoscope Reprocessors (AERs) segment dominated the market with the largest market revenue share of 45.6% in 2024, driven by their ability to standardize cleaning, disinfection, and sterilization processes while reducing human error. Hospitals and ambulatory surgery centers prioritize AERs for their reliability, compliance with regulatory guidelines, and enhanced patient safety. In addition, AERs save significant operational time, increase workflow efficiency, and reduce cross-contamination risks compared to manual reprocessing methods. The segment’s popularity is further supported by advancements in automation, real-time monitoring, and integration with digital tracking systems, which ensure complete visibility of reprocessing cycles. Continuous innovations by key companies such as Steris, Olympus, and Medivators strengthen the segment’s dominance, positioning AERs as the preferred choice in modern healthcare facilities.

The Endoscope Tracking Systems segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of IoT-enabled monitoring and hospital compliance requirements. Tracking systems allow real-time monitoring of each endoscope’s location, usage history, and reprocessing status, significantly reducing human error and enhancing operational efficiency. The growing emphasis on infection control, regulatory compliance, and data-driven decision-making in healthcare facilities is accelerating the adoption of tracking solutions. Moreover, integration with automated reprocessors and hospital information systems provides centralized control over multiple endoscopes and facilities. Healthcare providers increasingly value the ability to generate detailed audit trails, verify reprocessing cycles, and optimize instrument utilization. The market for tracking systems is further strengthened by rising investments in smart hospital infrastructure, particularly in North America and Asia-Pacific.

- By End-User

On the basis of end-user, the market is segmented into Hospitals, Ambulatory Surgery Centers, and Others. The Hospitals segment dominated the market with the largest revenue share in 2024, driven by the high volume of endoscopic procedures performed in hospitals and their need for robust infection prevention protocols. Hospitals prefer automated and integrated reprocessing solutions to maintain patient safety, comply with regulatory standards, and optimize operational workflows. The segment’s growth is supported by increasing awareness of hospital-acquired infections (HAIs) and the rising adoption of advanced AERs and tracking systems. Hospitals also benefit from economies of scale, allowing them to invest in high-capacity reprocessing equipment and staff training programs, which further solidifies their dominant position.

The Ambulatory Surgery Centers (ASCs) segment is expected to witness the fastest growth rate during the forecast period due to the rising number of outpatient procedures and smaller-scale healthcare facilities seeking efficient reprocessing solutions. ASCs are increasingly adopting compact, automated systems and high-level disinfectants to ensure quick turnaround times while maintaining safety standards. The convenience, cost-effectiveness, and scalability of modern reprocessing solutions make them attractive for ASCs looking to expand procedural capacity without compromising infection control. In addition, growing patient volumes and the trend toward minimally invasive procedures contribute to the accelerating adoption of reprocessing technologies in this segment.

Endoscope Reprocessing Market Regional Analysis

- North America dominated the endoscope reprocessing market with the largest revenue share of 38.5% in 2024, attributed to the presence of advanced healthcare infrastructure, high adoption of automated endoscope reprocessors (AERs), and stringent compliance requirements, with the U.S. leading in hospital and ambulatory care facility implementations of state-of-the-art reprocessing technologies

- Healthcare providers in the region prioritize patient safety and infection control, leading to widespread use of automated endoscope reprocessors (AERs), IoT-enabled tracking systems, and high-level disinfectants across hospitals and ambulatory surgery centers

- This strong adoption is further supported by well-established hospital networks, high procedural volumes, and growing awareness of hospital-acquired infections (HAIs), positioning endoscope reprocessing solutions as essential for maintaining operational efficiency and regulatory adherence

U.S. Endoscope Reprocessing Market Insight

The U.S. endoscope reprocessing market captured the largest revenue share of 42% in 2024 within North America, driven by the high volume of endoscopic procedures and the strong emphasis on infection prevention in healthcare facilities. Hospitals and ambulatory surgery centers are increasingly adopting automated endoscope reprocessors (AERs), high-level disinfectants, and tracking systems to ensure compliance with CDC and FDA guidelines. The growing awareness of hospital-acquired infections (HAIs) and stringent regulatory standards is further propelling market growth. In addition, technological advancements in IoT-enabled monitoring and data-driven reprocessing solutions are enhancing operational efficiency and patient safety, contributing significantly to market expansion.

Europe Endoscope Reprocessing Market Insight

The Europe endoscope reprocessing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and rising awareness of infection control in hospitals and clinics. The adoption of automated AERs, disinfectants, and endoscope tracking systems is growing across hospitals and ambulatory surgery centers. Increasing urbanization and the expansion of healthcare infrastructure are fostering the uptake of advanced reprocessing solutions. European healthcare providers are also motivated by the need for operational efficiency, regulatory compliance, and the reduction of cross-contamination risks, which collectively drive market growth across the region.

U.K. Endoscope Reprocessing Market Insight

The U.K. endoscope reprocessing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising number of endoscopic procedures and heightened focus on patient safety. Healthcare facilities are adopting automated systems, high-level disinfectants, and endoscope tracking solutions to comply with national guidelines and reduce hospital-acquired infections. The country’s strong healthcare infrastructure, combined with investments in modern endoscopy centers, supports market growth. In addition, the integration of digital monitoring systems and workflow optimization tools in hospitals and ambulatory surgery centers is expected to drive demand for efficient, compliant reprocessing solutions.

Germany Endoscope Reprocessing Market Insight

The Germany endoscope reprocessing market is expected to expand at a considerable CAGR during the forecast period, driven by increasing awareness of infection prevention and stringent healthcare standards. Hospitals and surgical centers are implementing automated reprocessors, disinfectants, and tracking systems to ensure compliance and enhance operational efficiency. Germany’s well-established healthcare infrastructure, focus on technological innovation, and adherence to high-quality patient safety standards promote the adoption of advanced reprocessing solutions. The growing trend of integrating automated reprocessing with hospital management systems is further strengthening market growth in the country.

Asia-Pacific Endoscope Reprocessing Market Insight

The Asia-Pacific endoscope reprocessing market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rapid expansion of healthcare infrastructure, rising patient volumes, and increasing awareness of infection control. Countries such as China, Japan, and India are witnessing growing adoption of automated endoscope reprocessors, high-level disinfectants, and tracking systems. Government initiatives promoting digital healthcare and smart hospital infrastructure are accelerating market growth. In addition, the region’s status as a manufacturing hub for medical devices and cost-effective solutions is increasing accessibility and adoption of reprocessing technologies across hospitals and ambulatory surgery centers.

Japan Endoscope Reprocessing Market Insight

The Japan endoscope reprocessing market is gaining momentum due to the country’s advanced healthcare system, high technological adoption, and increasing number of endoscopic procedures. Hospitals and outpatient surgical centers are investing in automated reprocessors, disinfectants, and endoscope tracking systems to improve patient safety and workflow efficiency. Integration of digital monitoring systems with hospital management software further enhances compliance with infection control standards. The growing elderly population is expected to increase demand for safe, reliable, and efficient endoscope reprocessing solutions in both residential care and clinical settings.

India Endoscope Reprocessing Market Insight

The India endoscope reprocessing market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to expanding healthcare infrastructure, increasing endoscopic procedures, and rising awareness of infection prevention. Hospitals and ambulatory surgery centers are adopting automated AERs, disinfectants, and tracking systems to ensure patient safety and regulatory compliance. Government initiatives promoting smart hospitals and infection control, coupled with the availability of cost-effective solutions and strong domestic manufacturing, are key factors propelling market growth. The growing middle class and increased healthcare spending further support the adoption of advanced reprocessing technologies across the country.

Endoscope Reprocessing Market Share

The Endoscope Reprocessing industry is primarily led by well-established companies, including:

- Advanced Sterilization Products Services Inc (U.S.)

- Ecolab Inc. (U.S.)

- Getinge AB (Sweden)

- Olympus (Japan)

- STERIS (Ireland)

- ARC Healthcare Solutions (Canada)

- Belimed AG (Switzerland)

- BES Healthcare Ltd (U.K.)

- Creo Medical GmbH (Germany)

- Envista Holdings Corporation (U.S.)

- HOYA Corporation (Japan)

- Matachana Group (Spain)

- Shinva Medical Instrument Co., Ltd (China)

- Steelco S.p.A. (Italy)

- UV Smart BV (Netherlands)

- Wassenburg Medical B.V. (Netherlands)

- FUJIFILM Holdings Corporation (Japan)

- CONMED Corporation (U.S.)

- Miele Professional (Germany)

- Tuttner (Netherlands)

What are the Recent Developments in Global Endoscope Reprocessing Market?

- In September 2025, Olympus introduced the OER-Elite, a next-generation automated endoscope reprocessor designed to streamline the cleaning and disinfection process for flexible endoscopes. The system offers enhanced efficiency and safety features, aligning with the company's commitment to advancing infection control in healthcare settings

- In August 2025, Nanosonics introduced the trophon®3 device and trophon2 Plus software upgrade in the U.S. and Canada. The trophon®3 offers faster high-level disinfection cycles, enhanced digital integration, and improved traceability through DICOM connectivity. The trophon2 Plus software upgrade brings these advanced features to existing trophon2 devices, facilitating seamless upgrades for healthcare facilities

- In June 2025, STERIS announced the discontinuation of the Reliance EPS Endoscope Processing System. This move reflects the company's strategic shift towards more advanced endoscope reprocessing technologies, ensuring enhanced performance and compliance with evolving healthcare standards

- In March 2025, The FDA cleared Nanosonics' Coris system, marking the first automated endoscope cleaning system approved by the agency. This innovative platform is designed to clean the complex inner channels of flexible endoscopes, a notorious source of hospital-acquired infections

- In July 2023, STERIS introduced the enspire 300 Series Automated Endoscope Reprocessor, utilizing Revital-Ox PAA High-Level Disinfectant for efficient disinfection of flexible endoscopes. This system aims to enhance workflow efficiency and compliance with infection control standards in healthcare facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.