Global Encoder Market

Market Size in USD Billion

CAGR :

%

USD

3.10 Billion

USD

6.90 Billion

2024

2032

USD

3.10 Billion

USD

6.90 Billion

2024

2032

| 2025 –2032 | |

| USD 3.10 Billion | |

| USD 6.90 Billion | |

|

|

|

|

Encoder Market Size

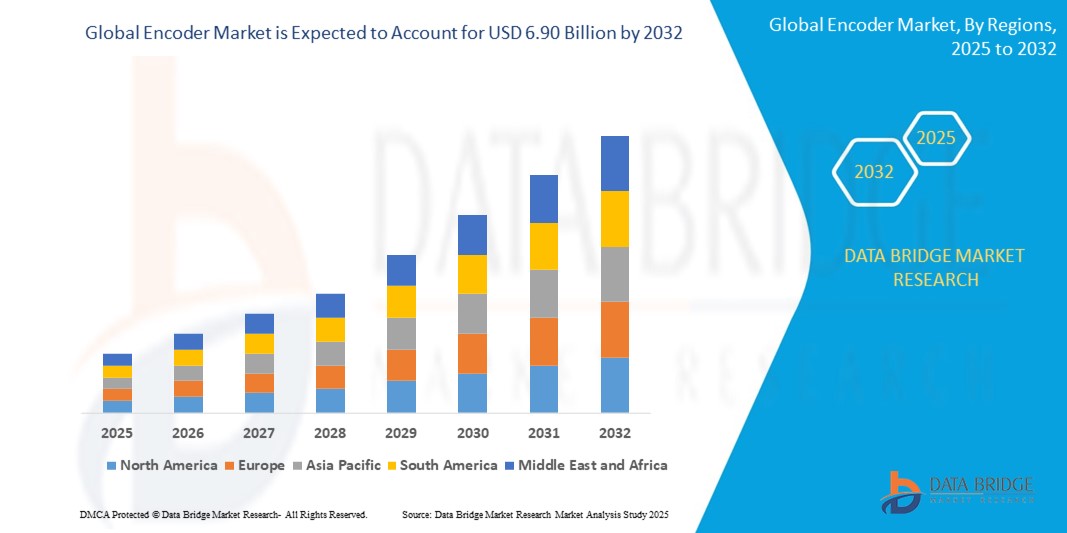

- The global encoder market size was valued at USD 3.10 billion in 2024 and is expected to reach USD 6.90 billion by 2032, at a CAGR of 10.50% during the forecast period

- The market growth is largely fueled by increasing automation across industries such as automotive, electronics, and robotics, along with rising demand for high-precision motion control in industrial applications

- Furthermore, the surge in adoption of encoders in medical devices, aerospace, and consumer electronics for real-time feedback and monitoring is significantly driving market expansion. Advancements in optical and magnetic encoder technologies are also contributing to enhanced performance and wider application scopes, thereby propelling the industry's growth

Encoder Market Analysis

- Encoders, which convert motion or position to an electrical signal for monitoring and control, are becoming essential components across automation systems in industrial, automotive, robotics, and consumer electronics applications due to their precision, reliability, and real-time feedback capabilities

- The rising demand for encoders is primarily driven by the accelerating pace of industrial automation, the need for high-accuracy positioning in manufacturing processes, and the growing adoption of robotics in sectors such as automotive and electronics

- North America dominates the encoder market with the largest revenue share of 38.5% in 2025, characterized by the presence of major automation companies, strong investment in Industry 4.0 technologies, and robust demand for encoders in automotive assembly lines and semiconductor manufacturing equipment. The U.S. leads the region’s growth, propelled by innovations in motion control systems and widespread adoption of advanced robotics

- Asia-Pacific is expected to be the fastest-growing region in the encoder market during the forecast period due to expanding industrialization, supportive government initiatives for smart manufacturing, and rising demand from electronics and automotive sectors in countries such as China, Japan, and India

- The rotary encoder segment is expected to dominate the encoder market with a market share of 47.8% in 2025, owing to its wide use in applications requiring speed, rotation, and angular position measurement, particularly in industrial machinery and automation systems

Report Scope and Encoder Market Segmentation

|

Attributes |

Encoder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Encoder Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A notable and growing trend in the global encoder market is the increasing integration of encoders with artificial intelligence (AI), voice-enabled systems, and smart automation frameworks. This synergy is driving the development of more intelligent motion control and feedback systems across industries such as manufacturing, robotics, healthcare, and smart home devices

- For instance, in March 2024, Renishaw introduced its new RESOLUTE™ encoder systems with integrated AI-based diagnostic tools, offering real-time performance data, predictive maintenance, and enhanced error detection capabilities, which reduce downtime and improve operational efficiency in automated production environments

- Voice and AI integration in encoders is enabling smarter control systems, particularly in collaborative robots (cobots) and smart medical devices. AI-enhanced encoders can analyze motion data trends to adapt operations in real time. For example, Omron’s smart encoder line is designed to work with AI-driven motion controllers to fine-tune motor performance and reduce mechanical wear

- In industrial automation, voice-controlled interfaces powered by AI are emerging in smart manufacturing setups where encoder-equipped machinery responds to vocal instructions. This enhances operational convenience, especially in environments where physical interaction with machinery is limited or hazardous

- Moreover, encoders integrated with AI are being used in autonomous vehicles and drones to interpret real-time positional data, optimize navigation, and improve safety. Companies such as Heidenhain are advancing AI-integrated encoders to support ultra-precise positioning required for semiconductor manufacturing and satellite systems

- The trend of embedding encoders into connected, intelligent ecosystems allows centralized monitoring and control of multiple machines or devices via cloud platforms or smart interfaces. This aligns with Industry 4.0 goals, wherein digital twin models and AI-based analytics rely on high-precision encoder feedback for simulation and optimization

- As demand rises for high-resolution, intelligent, and user-friendly motion feedback solutions, manufacturers are innovating encoders with features such as auto-calibration, self-learning behavior, and compatibility with voice-controlled environments. For instance, in October 2023, Sick AG expanded its DFS2x incremental encoder family with enhanced AI compatibility and plug-and-play features for predictive diagnostics

- The growing reliance on smart automation, coupled with the convenience of AI and voice integration, is reshaping user expectations in industries from consumer electronics to industrial robotics—accelerating the development of next-generation encoders that combine precision, intelligence, and ease of control

Encoder Market Dynamics

Driver

“Growing Need Due to Rising Automation, Precision Control, and Industry 4.0 Integration”

- The expanding demand for automation, precision control, and data-driven operations across manufacturing, robotics, automotive, and electronics sectors is a significant driver for the global encoder market. Encoders play a critical role in providing accurate motion feedback, which is essential for real-time control in automated systems

- For instance, in March 2024, Panasonic Industry Co., Ltd. launched its new PM2 Series magnetic rotary encoders designed for compact industrial machinery, supporting high-resolution feedback to meet the growing automation needs in production environments. This launch is aligned with the rising demand for compact, reliable encoders in smart factories

- As industries adopt Industry 4.0 technologies, including robotics, predictive maintenance, and digital twin frameworks, the role of encoders in delivering high-precision positional data and feedback has become indispensable. Their ability to enhance performance, reduce errors, and improve efficiency makes them a foundational component in advanced automation

- Moreover, the increasing use of autonomous machines and robotics in logistics, healthcare, and agriculture—each requiring precise position and motion control—is further fueling the adoption of rotary and linear encoders. For example, encoder-integrated motors are widely used in robotic arms, CNC machines, and AGVs (automated guided vehicles)

- The need for real-time monitoring and adaptive control in smart manufacturing and motion-intensive applications is also pushing the integration of encoders with edge computing and AI platforms. These capabilities allow dynamic system adjustments and continuous operational optimization

- In addition, the transition towards electric vehicles (EVs) and the proliferation of advanced driver-assistance systems (ADAS) have created new opportunities for encoders to support precise motor control, steering systems, and brake position sensing. Companies such as TE Connectivity and Heidenhain are advancing encoders to meet these automotive demands.

- The broader emphasis on operational efficiency, safety, and digital transformation in industrial and commercial environments is expected to continue driving encoder market growth in the coming years

Restraint/Challenge

“Concerns Regarding High Cost and Integration Complexity in Legacy Systems”

- The relatively high initial cost of precision encoders and the complexity involved in integrating them into existing legacy systems pose significant challenges to broader adoption across small and mid-sized enterprises (SMEs). Unlike basic sensors, high-performance encoders—especially those used in robotics, aerospace, and semiconductor manufacturing—require precise installation, calibration, and configuration, which can be technically demanding and costly

- For instance, high-end optical encoders from companies such as Renishaw or Heidenhain are known for their accuracy but often come at a premium due to advanced features such as nanometer-level resolution and real-time diagnostics. This can deter price-sensitive industries from upgrading older systems, particularly in developing regions or among manufacturers with limited capital budgets

- In addition, compatibility issues with older machinery, control systems, or communication protocols (such as integrating encoders with outdated PLCs) can require custom interfaces or converters, adding to both the time and cost of deployment. In many cases, companies face downtime during retrofitting, which further disincentivizes transition

- While encoder technologies are becoming more modular and easier to integrate with modern Industry 4.0 platforms, industries with large fleets of legacy equipment may still find it difficult to justify the investment without a clear and immediate return on efficiency or precision

- Furthermore, maintenance and calibration of high-resolution encoders often require skilled personnel, which may be lacking in smaller operations. The lack of technical expertise in encoder configuration and troubleshooting can lead to improper usage and system inefficiencies

- Overcoming these restraints will require encoder manufacturers to provide more plug-and-play solutions, develop cost-effective models with sufficient accuracy for general applications, and offer integration support services. Growing partnerships between encoder providers and automation firms are expected to gradually ease these challenges, but they remain a barrier to widespread deployment in certain market segments

Encoder Market Scope

The market is segmented on the basis type, product type, output, size, design, and end user.

By Type

On the basis of type, the encoder market is segmented into rotary and linear. The segment dominates the largest market revenue share in 2025, driven by its extensive use in industrial machinery, robotics, and automotive applications requiring precise angular position measurement.

The linear segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in semiconductor manufacturing, CNC machines, and automation industries requiring accurate linear position feedback.

By Product Type

On the basis of product type, the encoder market is segmented into non-contacting and contacting. The non-contacting segment held the largest market revenue share in 2025 due to its durability, longer lifespan, and suitability for harsh environments such as aerospace and automotive sectors.

The contacting segment is expected to grow steadily, supported by cost-effective applications in consumer electronics and basic automation systems.

By Output

On the basis of output, the encoder market is segmented into digital and analog. The digital segment held the largest market revenue share in 2025, driven by the increasing adoption of Industry 4.0 and smart manufacturing systems that require precise and noise-immune digital feedback.

The analog segment maintains significant presence in legacy systems and applications with simpler feedback requirements.

By Size

On the basis of size, the encoder market is segmented into less than 30 mm, 31 mm–70 mm, 71 mm–100 mm, and more than 100 mm. The 31 mm–70 mm segment holds the largest market revenue share in 2025, favored for its optimal balance between compactness and performance across various industries.

The less than 30 mm segment is gaining traction in consumer electronics and robotics, while larger sizes are preferred for heavy machinery and aerospace applications.

By Design

On the basis of design, the encoder market is segmented into hollow shaft encoders and solid shaft encoders. Solid shaft encoders accounted for the largest market revenue share in 2025, owing to their versatile application in industrial automation and machinery.

Hollow shaft encoders are anticipated to grow rapidly, supported by their space-saving design and ease of mounting in conveyor and printing systems.

By End User

On the basis of end user, the encoder market is segmented into industrial, automotive, aerospace, medical, printing, food and beverage, oil and gas, consumer electronics, textile, and others. The industrial segment accounted for the largest market revenue share in 2025, driven by rising automation and robotics adoption

The automotive segment is projected to witness the fastest CAGR from 2025 to 2032 due to growing electric vehicle production and advanced driver-assistance system.

Encoder Market Regional Analysis

- North America holds a significant share of the global encoder market in 2024, driven by rapid industrial automation across manufacturing, automotive, and aerospace sectors. The region accounts for approximately 35-40% of the market revenue, supported by advanced technology adoption and strong presence of key encoder manufacturers

- The demand in North America is fueled by the increasing implementation of robotics, CNC machines, and industrial automation solutions that rely heavily on precise position and motion control enabled by encoders

- High investment in R&D, robust industrial infrastructure, and regulatory support for smart manufacturing further propel market growth in this region

U.S. Encoder Market Insight

The U.S. encoder market captured the largest revenue share of approximately 38% within North America in 2025, driven by widespread adoption of automation and robotics across manufacturing, aerospace, and automotive industries. The demand for high-precision encoders is fueled by the growing need for accurate position sensing and motion control in CNC machines, industrial robots, and medical devices. Additionally, advancements in smart manufacturing and Industry 4.0 initiatives are accelerating encoder integration with IoT and AI-enabled systems. Strong government support for automation technologies and a robust industrial base further propel market growth.

Europe Encoder Market Insight

The European encoder market is projected to grow steadily throughout the forecast period, supported by extensive adoption in automotive production lines, aerospace, and renewable energy sectors. Stringent quality and safety regulations in countries such as Germany, France, and the UK promote the use of advanced encoders for precision control and monitoring. The region is witnessing increasing investments in smart factory initiatives, driving the integration of encoders into Industry 4.0 environments. Expansion in electric vehicle manufacturing and automation of logistics and packaging sectors are also key contributors to market growth.

U.K. Encoder Market Insight

The U.K. encoder market is expected to grow at a notable CAGR driven by increased automation in manufacturing, particularly in pharmaceuticals, automotive, and food processing industries. The rise of smart factories and emphasis on reducing operational downtime fuel the demand for reliable encoder technologies. The U.K.’s strong industrial and technological infrastructure, along with government incentives for digitization and innovation, are accelerating the adoption of encoders integrated with IoT and predictive maintenance systems.

Germany Encoder Market Insight

Germany’s encoder market is anticipated to expand significantly during the forecast period, driven by the country’s leadership in industrial automation and automotive manufacturing. The high demand for precision and durability in encoders aligns with Germany’s stringent industrial standards. Furthermore, the focus on sustainable and energy-efficient manufacturing processes supports the adoption of advanced encoders compatible with Industry 4.0 and smart factory solutions. Increasing integration of encoders in robotics and additive manufacturing further boosts the market.

Asia-Pacific Encoder Market Insight

The Asia-Pacific encoder market is poised for the fastest growth, with a CAGR exceeding 25% in 2025, propelled by rapid industrialization, urbanization, and expanding manufacturing capabilities in China, Japan, India, and South Korea. The region’s surge in automation adoption, supported by government initiatives promoting “Smart Manufacturing” and Industry 4.0, is driving demand for cost-effective and high-performance encoders. Asia-Pacific is also emerging as a major manufacturing hub for encoder components, which improves product availability and affordability for local and export markets.

Japan Encoder Market Insight

Japan’s encoder market is witnessing strong growth due to the country’s advanced industrial base, technological innovation, and high demand for precision equipment in robotics, automotive, and electronics manufacturing. The integration of encoders with IoT-enabled smart factory solutions and predictive maintenance systems is becoming increasingly prevalent. Japan’s aging population and increasing automation in healthcare devices further spur demand for encoders in specialized applications requiring accuracy and reliability.

China Encoder Market Insight

China dominates the Asia-Pacific encoder market revenue share in 2025, driven by its large-scale manufacturing ecosystem and increasing automation in automotive, electronics, and industrial sectors. The country’s robust domestic production capabilities and government policies fostering smart manufacturing facilitate widespread encoder adoption. The growth of smart factories, expansion of electric vehicle manufacturing, and smart infrastructure projects contribute to escalating demand. Additionally, competitive pricing and the presence of key domestic encoder manufacturers help strengthen China’s position in the global market.

Encoder Market Share

The encoder industry is primarily led by well-established companies, including:

- Rockwell Automation, Inc. (U.S.)

- Dynapar (U.S.)

- OMRON Corporation (Japan)

- Baumer (Switzerland)

- ifm electronic gmbh (Germany)

- Sensata Technologies, Inc. (U.S.)

- FAULHABER GROUP (U.S.)

- Pilz GmbH & Co. KG (Germany)

- YUEQING YUMO ELECTRIC CO.,LTD (China)

- Hans Turck GmbH & Co. KG (Germany)

- Hengstler GmbH (Germany)

- POSIC (Switzerland)

- Micronor Sensors (U.S.)

- Wachendorff Automation GmbH & Co. KG (Germany)

- Renishaw plc. (U.K.)

- HEIDENHAIN (Germany)

- Celera Motion (U.S.)

- maxon. (Switzerland)

- HONTKO CO., LTD. (Taiwan)

- FRABA B.V. (Netherlands)

- Pepperl+Fuchs (Germany)

- SIKO GmbH (Germany)

Latest Developments in Global Encoder Market

-

In 2024, Heidenhain, a leading encoder manufacturer, showcased its advanced encoder technology for robotics at SPS 2024 in Nuremberg, Germany. The company introduced dual encoders and secondary encoders designed to enhance cobot accuracy and enable collision monitoring without additional torque sensors. These innovations reflect the growing demand for high-performance encoders in automation, improving precision and efficiency in robotic systems. Heidenhain also unveiled vibration analysis-enabled encoders, allowing predictive maintenance and optimized machine servicing

- In November 2023, Nikon unveiled the MAR-M700MFA, the world's first multi-turn external battery-free absolute encoder powered by an all-solid-state battery. This breakthrough technology extends the operating temperature range while ensuring maintenance-free functionality. The encoder introduces predictive maintenance and angular precision self-correction, optimizing industrial robot applications with enhanced motion control precision and operational consistency. Nikon showcased this innovation at iREX2023, reinforcing its commitment to advancing automation technology

- In August 2023, Dynapar launched the HS35iQ Encoder with PulseIQ Technology, a programmable hollow shaft encoder designed for heavy-duty machine applications. This innovative device features self-diagnosing capabilities, providing real-time encoder health status via digital output and color-coded LEDs. The HS35iQ helps OEMs and end-users troubleshoot faulty encoders efficiently, reducing downtime and improving operational reliability. With programmable resolution up to 20,000 PPR, fault event logging, and overspeed alerts, this encoder enhances machine performance and predictive maintenance

- In January 2023, SICK AG launched the DAX® linear encoder product family, designed for precise piston position detection in hydraulic cylinders and machine motion monitoring. The family includes three designs with industry-specific measuring ranges, ensuring adaptability across various applications. An online configurator simplifies selection, guiding users to the most suitable DAX® model. The system’s smart and flexible architecture allows for efficient customization, optimizing performance for specialized needs. This innovation enhances contactless detection, reducing wear and maintenance while supporting condition monitoring for industrial automation

- In November 2022, Renishaw expanded its ATOM DX encoder series with the introduction of the CENTRUM CSF40 metal rotary scale. This innovative scale features self-aligning technology, eliminating the need for manual encoder disc alignment. Its spring-like flexures automatically center the scale when mounted, ensuring quick and precise installation. The CENTRUM CSF40 is made from robust stainless steel, offering durability and ease of cleaning. Designed for high-performance rotary encoding, this addition streamlines assembly processes while maintaining accuracy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Encoder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Encoder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Encoder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.