Global Electronic Data Capture Edc Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.88 Billion

USD

4.20 Billion

2024

2032

USD

1.88 Billion

USD

4.20 Billion

2024

2032

| 2025 –2032 | |

| USD 1.88 Billion | |

| USD 4.20 Billion | |

|

|

|

|

Electronic Data Capture (EDC) Systems Market Size

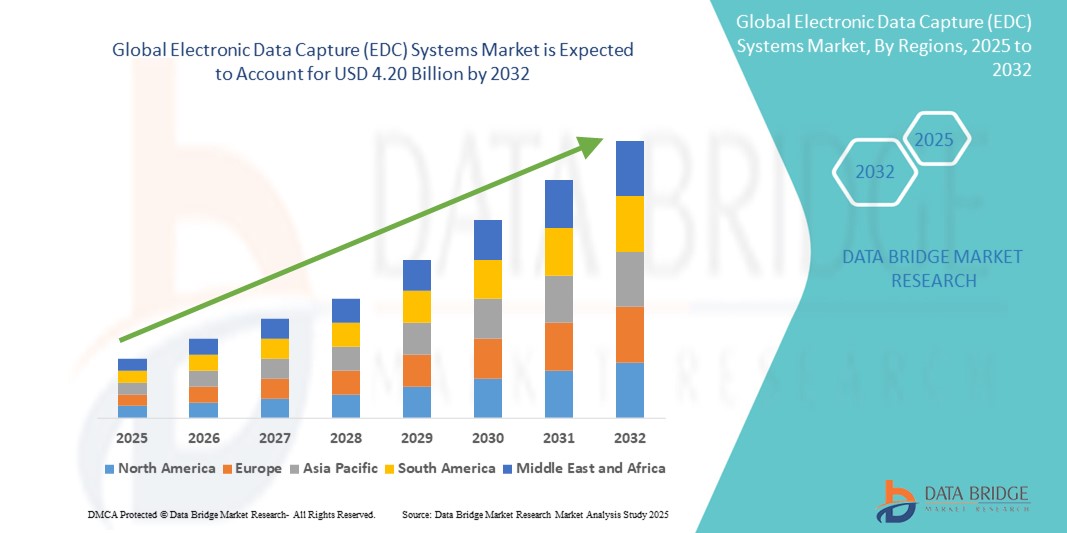

- The global electronic data capture (EDC) systems market size was valued at USD 1.88 billion in 2024 and is expected to reach USD 4.20 billion by 2032, at a CAGR of 10.60% during the forecast period

- The market growth is largely driven by the increasing digitization of clinical trials, demand for real-time data access, and the need for efficient regulatory compliance within life sciences and healthcare industries

- Furthermore, rising adoption of cloud-based platforms, integration of AI for smarter data management, and a growing emphasis on decentralized clinical trials are positioning EDC systems as a central component of modern clinical research infrastructure. These aligned developments are significantly accelerating market expansion and elevating the importance of robust EDC solutions across the research ecosystem

Electronic Data Capture (EDC) Systems Market Analysis

- EDC systems, designed to collect and manage clinical trial data electronically, are becoming indispensable tools in modern clinical research due to their real-time data access, improved data accuracy, and compatibility with remote and decentralized trial models in both academic and commercial settings

- The growing demand for EDC systems is primarily driven by increasing clinical trial activities, the need for streamlined regulatory compliance, and the industry-wide shift toward paperless and patient-centric trial operations

- North America dominated the electronic data capture (EDC) systems market with the largest revenue share of 41.8% in 2024, supported by robust healthcare infrastructure, high R&D investments, and early adoption of digital technologies, with the U.S. leading the trend through major pharmaceutical and biotech firms embracing cloud-based and AI-integrated platforms

- Asia-Pacific is expected to be the fastest growing region in the electronic data capture (EDC) systems market during the forecast period due to expanding clinical trial operations, regulatory modernization, and the growing presence of contract research organizations (CROs)

- Web-hosted segment dominated the electronic data capture (EDC) systems market with a market share of 52.9% in 2024, driven by its ease of deployment, cost-efficiency, and widespread accessibility for multi-site clinical trials

Report Scope and Electronic Data Capture (EDC) Systems Market Segmentation

|

Attributes |

Electronic Data Capture (EDC) Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electronic Data Capture (EDC) Systems Market Trends

“AI-Driven Optimization and Cloud Integration in Clinical Data Management”

- A significant and accelerating trend in the global Electronic Data Capture (EDC) systems market is the integration of artificial intelligence (AI) and advanced cloud-based technologies to streamline data collection, monitoring, and regulatory compliance in clinical trials. These technologies enhance data accuracy, reduce trial timelines, and support real-time decision-making

- For instance, companies such as Medidata and Veeva Systems have incorporated AI into their platforms to automate query management, identify data anomalies, and optimize protocol design. These AI-powered features are enabling trial sponsors to proactively address compliance issues and improve overall trial efficiency

- AI integration in EDC systems also allows for predictive analytics to identify patient dropout risks and optimize site performance. Cloud-hosted platforms further enable remote access and data synchronization across global trial sites, facilitating seamless collaboration and decentralized trial execution

- The fusion of AI and cloud technologies not only enhances scalability and flexibility but also improves data security through centralized control and automated audit trails

- This growing preference for intelligent, interoperable, and cloud-enabled EDC platforms is transforming clinical data management. Vendors such as Oracle Health Sciences and Castor EDC are launching solutions with AI-driven dashboards and real-time data analytics tailored for complex multi-phase trials

- The demand for such advanced systems is rising across pharmaceutical, biotechnology, and contract research organizations (CROs), driven by the need for faster insights, regulatory agility, and integrated digital workflows in clinical development

Electronic Data Capture (EDC) Systems Market Dynamics

Driver

“Rising Clinical Trial Complexity and Digital Transformation in Research”

- The increasing complexity of clinical trials and the industry's shift toward digital transformation are key drivers fueling the demand for EDC systems. With the rise of decentralized trials, adaptive designs, and real-time data requirements, traditional paper-based methods are no longer sustainable

- For instance, in February 2024, Veeva Systems introduced enhanced cloud-based tools within its Vault CDMS platform, supporting rapid mid-study changes and seamless protocol adjustments. Such innovations are becoming critical as trials grow in size and diversity

- EDC systems offer real-time access to patient data, streamlined data capture processes, and improved audit readiness, helping trial sponsors ensure regulatory compliance while reducing costs and cycle times

- The growing need for transparency, faster decision-making, and remote site access is making EDC systems indispensable in modern drug development, particularly in the post-COVID era, where hybrid and decentralized trials have gained traction

- In addition, increased R&D investments, government support for digital health technologies, and rising partnerships between tech providers and CROs are accelerating EDC system adoption across clinical research settings

Restraint/Challenge

“Data Privacy Concerns and Regulatory Complexity”

- Data privacy and regulatory compliance remain significant challenges for the EDC systems market. As systems handle sensitive patient health data, concerns about data breaches, cyberattacks, and cross-border data transfers can limit adoption, especially in regions with strict data protection laws such as GDPR in Europe or HIPAA in the U.S

- For instance, inconsistencies in data sharing and retention policies across countries create additional compliance burdens for global trials, requiring EDC providers to tailor their systems for multi-regulatory environments

- Building trust through secure encryption, role-based access control, and regular compliance audits is essential. Leading vendors such as Medrio and OpenClinica are investing in enhanced cybersecurity infrastructure and certifications such as ISO 27001 to reassure clients

- In addition, the cost and complexity of implementing sophisticated EDC platforms, particularly for smaller research organizations or those operating in low-resource settings, can hinder broader market penetration

- Addressing these barriers through flexible pricing models, user-friendly interfaces, and scalable solutions will be critical to expanding access to advanced EDC technologies globally

Electronic Data Capture (EDC) Systems Market Scope

The market is segmented on the basis of delivery mode, clinical trial phase, and end-user.

- By Delivery Mode

On the basis of delivery mode, the electronic data capture (EDC) systems market is segmented into web-hosted, cloud-based, and licensed enterprise. The web-hosted segment dominated the market with the largest revenue share of 52.9% in 2024, driven by its cost-efficiency, ease of implementation, and broad accessibility for clinical research organizations. These systems provide centralized data access, simplified maintenance, and compatibility with remote monitoring, making them a preferred choice for both sponsors and CROs conducting multi-site trials.

The cloud-based segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand for flexible, scalable, and real-time data capture platforms. Cloud-based EDC solutions facilitate decentralized trial models and global collaboration, particularly valuable in post-pandemic digital transformation of clinical trials. The increasing integration of AI and analytics in cloud-based systems also supports adaptive trial design and predictive insights.

- By Clinical Trial Phase

On the basis of clinical trial phase, the electronic data capture (EDC) systems market is segmented into Phase I, Phase II, Phase III, and Phase IV. The Phase III segment held the largest market share of 48.1% in 2024, primarily due to the complexity, scale, and regulatory demands of this phase. With thousands of patients and multiple trial sites, efficient data capture and real-time monitoring become critical, making robust EDC systems essential for accuracy and compliance.

The Phase I segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by a surge in early-stage research, especially in oncology, rare diseases, and gene therapies. Smaller trial populations and rapid iteration cycles in Phase I studies benefit significantly from flexible and agile EDC platforms that streamline data collection and protocol amendments.

- By End-User

On the basis of end-user, the electronic data capture (EDC) systems market is segmented into Contract Research Organizations (CROs), pharmaceutical and biotechnology companies, medical device companies, and hospitals. Contract Research Organizations (CROs) dominated the EDC systems market with a share of 39.7% in 2024, supported by increased outsourcing of clinical trial operations and the demand for cost-effective, scalable data management solutions. CROs benefit from EDC systems that enhance trial speed, accuracy, and regulatory readiness, especially in global, multi-center studies.

The pharmaceutical and biotechnology companies segment is expected to exhibit the fastest growth rate through 2032, driven by expanding R&D pipelines, the rise in biologics and personalized medicine, and the need for integrated platforms that support large-scale, data-intensive trials. These companies are increasingly adopting cloud-based and AI-enhanced EDC tools to accelerate time-to-market and ensure compliance with evolving global regulations.

Electronic Data Capture (EDC) Systems Market Regional Analysis

- North America dominated the electronic data capture (EDC) systems market with the largest revenue share of 41.8% in 2024, supported by robust healthcare infrastructure, high R&D investments, and early adoption of digital technologies

- Sponsors and research organizations in the region prioritize real-time data access, regulatory compliance, and operational efficiency, leading to widespread deployment of EDC platforms integrated with eClinical systems and AI-powered analytics

- This growth is further supported by the strong presence of major pharmaceutical and biotechnology companies, supportive regulatory frameworks, and increasing demand for decentralized and hybrid trial models, solidifying North America’s position as the global leader in EDC system adoption

U.S. Electronic Data Capture (EDC) Systems Market Insight

The U.S. electronic data capture (EDC) systems market captured the largest revenue share of 78.5% in 2024 within North America, fueled by the nation's robust pharmaceutical industry, high volume of clinical trials, and strong focus on regulatory compliance. The increasing adoption of decentralized and hybrid trials, alongside the integration of AI and cloud-based technologies in clinical research, is accelerating demand for advanced EDC solutions. Moreover, U.S.-based CROs and sponsors are prioritizing platforms that offer real-time analytics, interoperability, and secure remote data access to improve trial efficiency and patient outcomes.

Europe Electronic Data Capture (EDC) Systems Market Insight

The Europe electronic data capture (EDC) systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region’s growing clinical trial activity, strict data protection regulations (such as GDPR), and the push for digital transformation in healthcare. Increased investment in life sciences, especially in countries such as Germany and the U.K., is contributing to EDC adoption. Sponsors are increasingly leveraging EDC systems to ensure data accuracy, patient safety, and protocol compliance across complex, multi-country trials.

U.K. Electronic Data Capture (EDC) Systems Market Insight

The U.K. electronic data capture (EDC) systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a strong presence of clinical research organizations, academic institutions, and early-stage biotech firms. The post-Brexit regulatory restructuring and push toward innovation in drug development are leading to increased deployment of cloud-based and AI-enabled EDC platforms. In addition, government support for digital health research and real-time patient monitoring is expected to bolster growth.

Germany Electronic Data Capture (EDC) Systems Market Insight

The Germany electronic data capture (EDC) systems market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's reputation for innovation in medical technology, strong pharmaceutical industry, and emphasis on clinical data quality. With a growing number of early-phase and oncology trials, demand for scalable, compliant, and secure EDC platforms is rising. The integration of EDC with electronic health records (EHRs) and other digital trial tools is further enhancing operational efficiencies in German clinical research settings.

Asia-Pacific Electronic Data Capture (EDC) Systems Market Insight

The Asia-Pacific electronic data capture (EDC) systems market is poised to grow at the fastest CAGR of 23.6% during 2025 to 2032, driven by a surge in outsourced clinical trials, expanding healthcare infrastructure, and digitalization efforts across key countries such as China, India, and Japan. Government support for drug development, favorable regulations, and a growing CRO landscape are supporting the adoption of EDC systems. The affordability and scalability of cloud-based EDC platforms are making them accessible to a broader range of sponsors and research centers across the region.

Japan Electronic Data Capture (EDC) Systems Market Insight

The Japan electronic data capture (EDC) systems market is gaining momentum due to the country’s high standards for clinical data accuracy, well-established pharmaceutical sector, and government initiatives promoting digital health transformation. The rising number of oncology and rare disease trials, along with the need for precise patient data monitoring, is accelerating adoption. EDC platforms are being increasingly integrated with eConsent and ePRO tools, aligning with Japan’s push for more patient-centric, technologically advanced research models.

India Electronic Data Capture (EDC) Systems Market Insight

The India electronic data capture (EDC) systems market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to its rapidly growing clinical trial landscape, large patient pool, and cost-effective CRO services. As the country becomes a global hub for outsourced clinical research, both domestic and international sponsors are adopting EDC platforms to streamline data capture, ensure compliance, and support multilingual, multi-site studies. The rise of digital health startups and government-backed smart healthcare initiatives further propel EDC adoption across clinical research and public health trials.

Electronic Data Capture (EDC) Systems Market Share

The electronic data capture (EDC) systems industry is primarily led by well-established companies, including:

- Medidata Solutions, Inc. (U.S.)

- Veeva Systems Inc. (U.S.)

- Oracle Health Sciences (U.S.)

- Parexel International Corporation (U.S.)

- Clario (U.S.)

- Castor EDC (Netherlands)

- OpenClinica, LLC (U.S.)

- Medrio, Inc. (U.S.)

- Data MATRIX (Russia)

- eClinicalWorks, LLC (U.S.)

- Bio-Optronics, Inc. (U.S.)

- IQVIA Inc. (U.S.)

- Calyx (U.K.)

- ClinCapture, Inc. (U.S.)

- ArisGlobal LLC (U.S.)

- Kayentis (France)

- DATATRAK International, Inc. (U.S.)

- XClinical GmbH (Germany)

- Ennov (France)

What are the Recent Developments in Global Electronic Data Capture (EDC) Systems Market?

- In April 2023, Medidata Solutions, a Dassault Systèmes company, launched a next-generation AI-powered enhancement for its Rave EDC platform, aimed at improving protocol compliance and real-time patient monitoring. This upgrade leverages predictive analytics to optimize data quality and site performance, underscoring Medidata’s commitment to driving digital transformation in clinical trials through advanced automation and intelligent insights

- In March 2023, Veeva Systems Inc. introduced enhanced mid-study update capabilities within its Vault CDMS platform, enabling faster protocol amendments without disrupting ongoing trials. This innovation reflects Veeva’s focus on agility and operational efficiency in trial management, offering sponsors greater flexibility and reduced timelines in complex clinical studies

- In February 2023, Oracle Health Sciences announced the global expansion of its Clinical One Data Collection platform, designed to unify data capture across all trial phases. With increased global adoption, Oracle aims to streamline multi-regional studies and support decentralized trial models, reinforcing its role in advancing cloud-based EDC technologies that enable real-time collaboration and regulatory compliance

- In January 2023, Castor EDC secured a strategic investment from Two Sigma Ventures to accelerate product innovation and global expansion. The funding supports Castor’s mission to democratize clinical research through intuitive, affordable, and scalable EDC solutions, particularly for small-to-mid-sized sponsors and academic research institutions seeking to transition from paper-based to digital data capture

- In January 2023, ClinOne partnered with multiple CROs to integrate its EDC platform with eConsent and remote monitoring tools, supporting a seamless decentralized trial ecosystem. This development showcases ClinOne’s commitment to simplifying clinical trial execution through interoperable digital solutions, ensuring better patient engagement, data integrity, and trial accessibility worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.