Global Electrically Conductive Coating Market

Market Size in USD Billion

CAGR :

%

USD

24.11 Billion

USD

46.32 Billion

2024

2032

USD

24.11 Billion

USD

46.32 Billion

2024

2032

| 2025 –2032 | |

| USD 24.11 Billion | |

| USD 46.32 Billion | |

|

|

|

|

Electrically Conductive Coating Market Size

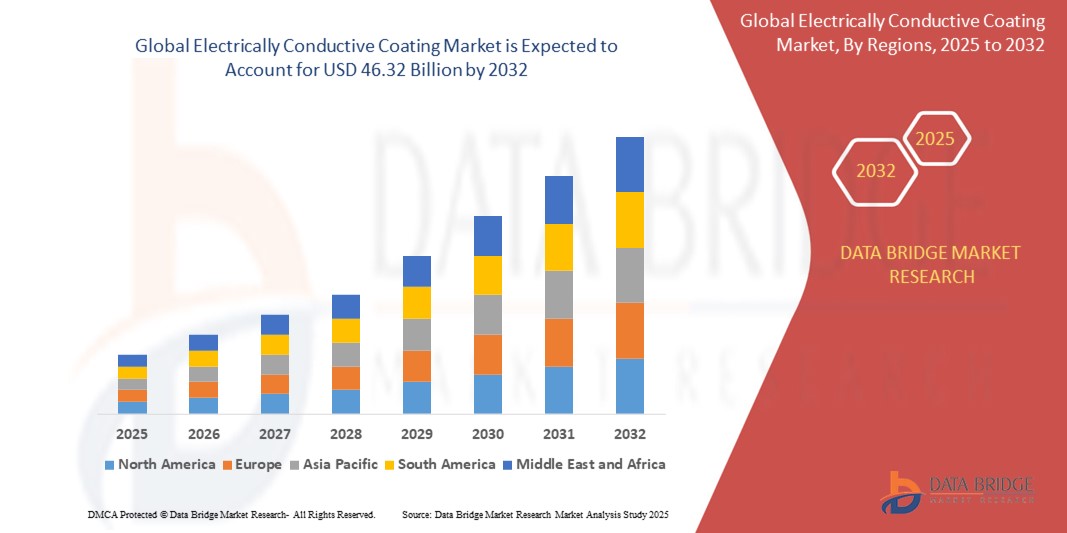

- The global electrically conductive coating market size was valued at USD 24.11 billion in 2024 and is expected to reach USD 46.32 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is largely fuelled by the rising demand for advanced electronic devices, increasing use of conductive coatings in 5G infrastructure, and expanding applications across automotive, aerospace, and energy sectors.

- In addition, the growing emphasis on electromagnetic interference (EMI) shielding solutions in consumer electronics, defense, and telecommunications is contributing significantly to the market expansion

Electrically Conductive Coating Market Analysis

- Electrically conductive coatings are critical in minimizing electromagnetic interference (EMI), improving static dissipation, and enhancing conductivity in devices and equipment

- These coatings are increasingly used in printed circuit boards (PCBs), smartphones, touch panels, antennas, and medical devices

- North America dominated the electrically conductive coating market with the largest revenue share of 38.4% in 2024, driven by the expanding consumer electronics sector and growing demand for electromagnetic interference (EMI) shielding across high-performance devices

- Asia-Pacific region is expected to witness the highest growth rate in the global electrically conductive coating market, driven by rapid industrialization, expanding electronics manufacturing hubs, and increasing demand for EVs, solar panels, and 5G infrastructure across China, India, Japan, and South Korea

- The epoxy segment accounted for the largest market revenue share in 2024, driven by its exceptional adhesion, chemical resistance, and electrical conductivity properties. Epoxy-based coatings are widely used in electronics and aerospace applications due to their superior durability and effectiveness in shielding electronic components from electromagnetic interference (EMI). Their ease of formulation and ability to perform in harsh environments further support their dominant position in the market

Report Scope and Electrically Conductive Coating Market Segmentation

|

Attributes |

Electrically Conductive Coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electrically Conductive Coating Market Trends

“Rising Adoption of Nanomaterial-Based Conductive Coatings”

- Nanomaterials such as graphene, carbon nanotubes (CNTs), and silver nanowires are being increasingly integrated into conductive coatings for superior performance

- These materials enhance conductivity, thermal stability, and EMI shielding while reducing coating thickness and weight

- Their flexibility and mechanical strength make them ideal for miniaturized electronics, wearables, and aerospace components

- Nanomaterial coatings support design innovation in lightweight, compact, and high-frequency devices

- For instance, Nanotech Energy has developed graphene-based EMI shielding coatings offering superior performance for electronics and aerospace

Electrically Conductive Coating Market Dynamics

Driver

“Expansion of the Consumer Electronics and 5G Infrastructure”

- Growing demand for smartphones, tablets, wearables, and IoT devices is accelerating the need for EMI shielding and ESD protection

- Electrically conductive coatings play a critical role in protecting high-frequency components in 5G devices and infrastructure

- Increased integration of smart technologies and miniaturization amplifies the need for compact, high-efficiency coatings

- The development of advanced 5G antennas and routers boosts demand for high-performance conductive coatings

- For instance, Samsung uses conductive coatings in its 5G network components to ensure signal integrity and EMI protection

Restraint/Challenge

“High Cost of Advanced Raw Materials and Complex Formulation”

- Premium raw materials such as silver flakes, graphene, and CNTs drive up the cost of conductive coatings

- Specialized equipment and expertise are needed for consistent formulation and application

- SMEs and cost-sensitive sectors face barriers to adoption due to high production and material costs

- Variability in material quality and availability affects scalability and performance consistency

- Instance: The commercial rollout of graphene-based coatings by Vorbeck Materials is limited by high production costs and technical complexity

Electrically Conductive Coating Market Scope

The market is segmented on the basis of resin type and application.

• By Resin Type

On the basis of resin type, the electrically conductive coating market is segmented into epoxy, polyesters, acrylics, and polyurethanes. The epoxy segment accounted for the largest market revenue share in 2024, driven by its exceptional adhesion, chemical resistance, and electrical conductivity properties. Epoxy-based coatings are widely used in electronics and aerospace applications due to their superior durability and effectiveness in shielding electronic components from electromagnetic interference (EMI). Their ease of formulation and ability to perform in harsh environments further support their dominant position in the market.

The acrylics segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand for eco-friendly and quick-drying coating solutions. Acrylic-based conductive coatings are gaining popularity in consumer electronics and automotive applications for their cost-effectiveness, transparency, and compatibility with plastic substrates. Their flexibility and ease of application make them an ideal choice for emerging technologies such as foldable displays and flexible circuits.

• By Application

On the basis of application, the electrically conductive coating market is segmented into consumer electronic displays, solar industry, automotive, aerospace, bioscience, and other applications. The consumer electronic displays segment dominated the market in 2024, driven by the growing usage of smartphones, tablets, and smart TVs that require conductive coatings for touchscreen panels and EMI shielding. The demand is further supported by continuous innovation in display technology and rising consumer electronics adoption worldwide.

The automotive segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising integration of advanced driver-assistance systems (ADAS), infotainment units, and electric vehicle components. Electrically conductive coatings in this segment enhance the electromagnetic compatibility (EMC) of systems and protect sensitive electronics from external disturbances, contributing to improved safety and performance.

Electrically Conductive Coating Market Regional Analysis

• North America dominated the electrically conductive coating market with the largest revenue share of 38.4% in 2024, driven by the expanding consumer electronics sector and growing demand for electromagnetic interference (EMI) shielding across high-performance devices.

• The region's mature aerospace and automotive industries are actively adopting these coatings to enhance conductivity, reduce static build-up, and improve product reliability in critical applications.

• Moreover, favorable government initiatives supporting technological advancement, combined with strong research capabilities and high investments in innovation, continue to support market growth across North America.

U.S. Electrically Conductive Coating Market Insight

The U.S. electrically conductive coating market held the dominant revenue share of 79.3% in 2024 within North America, backed by strong manufacturing activity in sectors such as aerospace, electronics, and defense. Rapid development of 5G infrastructure and increasing production of electric vehicles are further accelerating the adoption of conductive coatings in the country. In addition, the integration of nanomaterials for high-performance coatings is driving product innovations and expanding industrial usage across the nation.

Europe Electrically Conductive Coating Market Insight

The Europe electrically conductive coating market expected to witness the fastest growth rate from 2025 to 2032, propelled by rising applications in electric mobility and advanced electronics. Stricter environmental regulations are also pushing the adoption of coatings with improved durability and sustainability. With increasing investment in R&D and a growing focus on clean energy, the region is witnessing substantial growth, especially in automotive and renewable energy components.

U.K. Electrically Conductive Coating Market Insight

The U.K. electrically conductive coating market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s robust automotive and electronics sectors. Demand is also rising in sectors such as aerospace and renewable energy, where conductive coatings are used to enhance component performance. Government-led investments in green technologies and a shift towards electric mobility are key drivers fostering market expansion in the U.K.

Germany Electrically Conductive Coating Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, driven by its strong industrial base, especially in automotive engineering and electronics manufacturing. With growing adoption of electric vehicles and automation technologies, conductive coatings are gaining popularity to enhance device efficiency and safety. In addition, Germany’s emphasis on energy efficiency and sustainability supports innovation in coating technologies.

Asia-Pacific Electrically Conductive Coating Market Insight

The Asia-Pacific electrically conductive coating market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and the presence of major electronics manufacturing hubs in countries such as China, Japan, South Korea, and India. The increasing demand for smartphones, consumer electronics, solar panels, and EVs is creating high-volume opportunities for conductive coating applications across the region.

Japan Electrically Conductive Coating Market Insight

The Japan electrically conductive coating market is expected to witness the fastest growth rate from 2025 to 2032, backed by the nation’s leadership in miniaturized electronics and advanced robotics. Demand is growing for thin, highly conductive coatings that support high-frequency applications. The country’s emphasis on precision manufacturing and innovation is contributing to the rapid integration of these coatings in consumer electronics, medical devices, and automotive electronics.

China Electrically Conductive Coating Market Insight

The China held the largest market revenue share in Asia-Pacific in 2024, propelled by its massive electronics manufacturing ecosystem and the rapid expansion of the electric vehicle and solar energy markets. The country’s push for smart infrastructure, rising domestic demand for high-performance electronics, and favorable government subsidies for clean energy projects are significantly advancing the use of electrically conductive coatings across various sectors.

Electrically Conductive Coating Market Share

The Electrically Conductive Coating industry is primarily led by well-established companies, including:

- PPG Industries, Inc. (U.S.)

- Akzo Nobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- Valspar (U.S.)

- Axalta Coating Systems (U.S.)

- Jotun (Norway)

- BASF SE (Germany)

- 3M (U.S.)

- DuPont (U.S.)

- KCC Corporation (South Korea)

- Covestro AG (Germany)

- The Lubrizol Corporation (U.S.)

Latest Developments in Global Electrically Conductive Coating Market

- In November 2023, Sherwin-Williams Aerospace Coatings expanded its range of undercoats by introducing a new aerospace conductive coating (CM0485115). This innovative coating allows aircraft owners to apply conductivity to aluminum and composite substrates, delivering high conductivity to otherwise non-conductive surfaces

- In November 2021, nanotechnology developer Protectology Ltd launched its PureGRAPH enhanced line of conductive coatings. A representation agreement was signed with Protectology to exclusively promote these PureGRAPH coatings, thereby expanding their sales reach and representation within the coatings sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electrically Conductive Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electrically Conductive Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electrically Conductive Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.