Global Electrical Wiring Interconnect System Ewis Market

Market Size in USD Billion

CAGR :

%

USD

9.40 Billion

USD

13.57 Billion

2024

2032

USD

9.40 Billion

USD

13.57 Billion

2024

2032

| 2025 –2032 | |

| USD 9.40 Billion | |

| USD 13.57 Billion | |

|

|

|

|

What is the Global Electrical Wiring Interconnect System (EWIS) Market Size and Growth Rate?

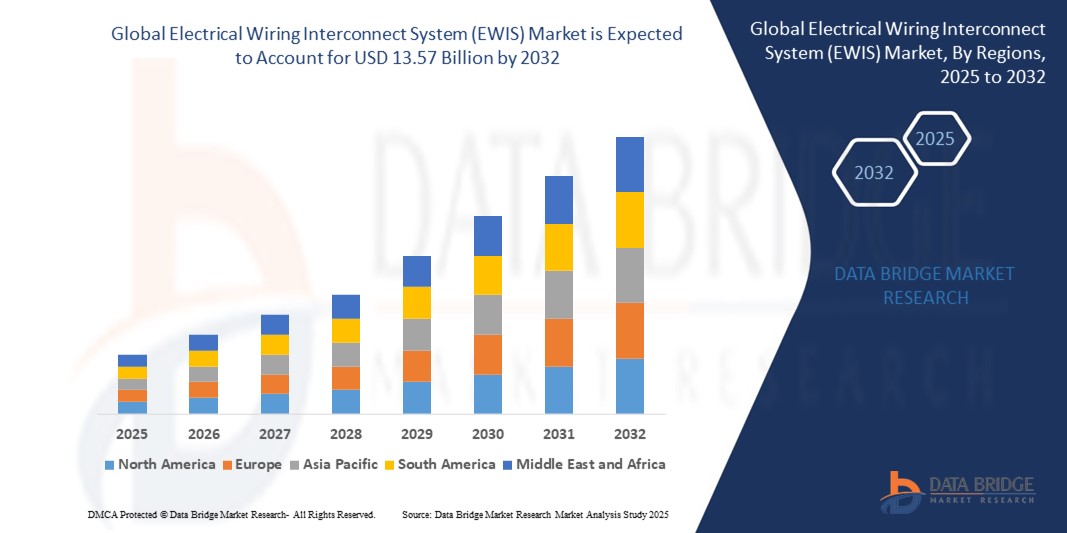

- The global electrical wiring interconnect system (EWIS) market size was valued at USD 9.40 billion in 2024 and is expected to reach USD 13.57 billion by 2032, at a CAGR of 4.70% during the forecast period

- The electrical wiring interconnect system (EWIS) market is pivotal in the aerospace and automotive sectors, ensuring reliable and efficient connectivity in modern vehicles and aircraft

- EWIS encompasses various components, including wires, connectors, and insulation materials, essential for transmitting power and data. Recent innovations in the market include the development of lightweight and high-performance materials that enhance durability while reducing overall weight crucial for improving fuel efficiency in aircraft and vehicles

What are the Major Takeaways of Electrical Wiring Interconnect System (EWIS) Market?

- Advancements in smart wiring systems with integrated sensors and connectivity features enable real-time monitoring of electrical systems, enhancing safety and maintenance. As stringent regulatory requirements for safety and performance continue to drive demand, the EWIS market is expected to witness significant growth.

- This upward trend is supported by the increasing adoption of electric vehicles and advanced aerospace technologies, highlighting the critical role of EWIS in enhancing connectivity and performance across industries

- North America dominated the electrical wiring interconnect system (EWIS) market with the largest revenue share of 42.01% in 2024, driven by the high concentration of aircraft manufacturers, a robust aerospace ecosystem, and growing investments in next-generation aircraft programs by major OEMs and defense organizations

- Asia-Pacific electrical wiring interconnect system market is set to grow at the fastest CAGR of 7.25% from 2025 to 2032, propelled by rapid fleet expansion, urban air mobility initiatives, and growing aerospace investments in countries such as China, Japan, and India

- The Commercial Aviation segment dominated the market with the largest revenue share of 54.6% in 2024, driven by the rising demand for new-generation aircraft and the rapid expansion of airline fleets, particularly in Asia-Pacific and the Middle East

Report Scope and Electrical Wiring Interconnect System (EWIS) Market Segmentation

|

Attributes |

Electrical Wiring Interconnect System (EWIS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electrical Wiring Interconnect System (EWIS) Market?

“Lightweight Materials and High-Speed Data Capabilities Drive Innovation”

- A pivotal trend shaping the global electrical wiring interconnect system (EWIS) market is the shift toward lightweight wiring architectures and high-speed data transmission to meet the evolving demands of next-generation aircraft. This is driven by the aerospace industry’s need to reduce fuel consumption, increase payload capacity, and support the growing number of electronic systems onboard

- Lightweight electrical wiring interconnect system components including aluminum wiring, composite brackets, and miniaturized connectors are increasingly being adopted in both commercial and military aviation. These innovations help manufacturers reduce aircraft weight without compromising safety or performance

- In addition, modern aircraft systems such as fly-by-wire controls, in-flight entertainment, and avionics require high-speed data transmission. Electrical wiring interconnect system components are now being designed to support Ethernet and fiber-optic protocols, enabling faster and more reliable communication across subsystems

- For instance, TE Connectivity has introduced next-gen EWIS solutions that offer improved electromagnetic shielding, higher bandwidth, and resistance to harsh aerospace environments. These advancements are helping OEMs meet the connectivity demands of increasingly digital cockpits and cabin systems

- Moreover, modular and pre-terminated EWIS solutions are gaining traction to improve assembly efficiency and reduce installation time during aircraft manufacturing and retrofitting processes

- As a result, electrical wiring interconnect system manufacturers are focusing on creating lightweight, high-performance, and scalable wiring systems that align with industry trends such as electrification and autonomous flight, ultimately reshaping the future of aircraft design and functionality

What are the Key Drivers of Electrical Wiring Interconnect System (EWIS) Market?

- The rising demand for new-generation aircraft, coupled with increasing electrification of aircraft systems, is significantly driving the EWIS market forward. As OEMs strive to reduce emissions and improve fuel efficiency, modern aircraft are being equipped with more electrical systems, increasing the need for advanced EWIS integration

- For instance, in March 2024, Safran Electrical & Power launched a new line of electrical wiring interconnect system harnesses tailored for hybrid-electric aircraft, supporting the global shift toward sustainable aviation technologies

- The commercial aviation boom—particularly in emerging economies such as India and Southeast Asia—has led to a surge in aircraft deliveries, directly translating into greater demand for electrical wiring interconnect system components during production

- The stringent safety regulations enforced by aviation authorities such as the FAA and EASA also necessitate robust and reliable wiring systems that meet performance and safety standards, driving further investments in high-quality electrical wiring interconnect system designs

- In addition, technological advancements in aircraft manufacturing, including the adoption of digital twins and automated assembly, are encouraging the development of modular and intelligent electrical wiring interconnect system solutions that improve diagnostics, reduce downtime, and streamline maintenance

Which Factor is challenging the Growth of the Electrical Wiring Interconnect System (EWIS) Market?

- One of the key challenges facing the electrical wiring interconnect system market is the complexity and cost associated with EWIS installation and maintenance in modern aircraft. The intricate routing and vast quantity of cables in advanced aviation platforms require precise design, skilled labor, and lengthy installation times, which can drive up manufacturing costs

- For instance, aircraft such as the Boeing 787 contain over 100 kilometers of wiring, making the integration of EWIS systems labor-intensive and highly specialized

- In addition, failure or degradation in EWIS components can result in serious safety risks, such as arcing or system malfunctions, leading to expensive inspections and grounding of aircraft. This necessitates the use of premium materials and robust testing, further adding to production costs

- Moreover, the lack of standardization in electrical wiring interconnect system components across platforms increases design complexity for OEMs and suppliers. Compatibility challenges and limited interchangeability hinder economies of scale and complicate logistics

- While digital tools such as CAD automation and AI-based routing optimization are emerging to address these issues, high development costs and long certification timelines continue to restrict innovation speed in this market

- Overcoming these barriers through automation, improved material science, and collaboration across the supply chain will be essential for scaling the electrical wiring interconnect system industry to meet future aviation demands

How is the Electrical Wiring Interconnect System (EWIS) Market Segmented?

The market is segmented on the basis of aviation type, application, and sales channel.

- By Aviation Type

On the basis of aviation type, the electrical wiring interconnect system (EWIS) market is segmented into Military Aviation, Commercial Aviation, and General Aviation. The Commercial Aviation segment dominated the market with the largest revenue share of 54.6% in 2024, driven by the rising demand for new-generation aircraft and the rapid expansion of airline fleets, particularly in Asia-Pacific and the Middle East. The increasing need for advanced onboard systems and lightweight, efficient wiring networks in commercial aircraft continues to fuel EWIS adoption.

The Military Aviation segment is projected to witness the fastest CAGR from 2025 to 2032, propelled by growing investments in defense modernization programs, next-generation fighter jets, and unmanned aerial vehicles (UAVs). Enhanced requirements for electronic warfare, radar systems, and mission-critical communication systems are driving the integration of advanced EWIS solutions in military platforms.

- By Application

On the basis of application, the electrical wiring interconnect system (EWIS) market is segmented into Avionics, Interiors, Airframe, and Propulsion. The Avionics segment accounted for the largest market revenue share of 38.2% in 2024, owing to the increasing reliance on electronic systems for navigation, communication, flight control, and surveillance. The complexity and density of wiring required in avionics subsystems make EWIS a crucial component in ensuring aircraft safety and performance.

The Airframe segment is expected to register the fastest growth rate during the forecast period due to the rising use of composite materials and the push for weight reduction in aircraft structures. EWIS integration into the airframe is becoming more modular and pre-engineered, which enhances installation efficiency and reduces maintenance requirements.

- By Sales Channel

On the basis of sales channel, the electrical wiring interconnect system (EWIS) market is segmented into OEMs and Aftermarket. The OEMs segment held the largest revenue share of 67.5% in 2024, driven by the continuous increase in new aircraft production and rising orders from global airline carriers. Aircraft manufacturers are integrating custom-designed EWIS solutions into new builds to meet specific customer requirements, reduce weight, and improve system performance.

The Aftermarket segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by the need for regular maintenance, retrofitting, and system upgrades across aging aircraft fleets. Regulatory mandates for safety compliance and digital modernization are further bolstering the demand for EWIS components in the aftermarket.

Which Region Holds the Largest Share of the Electrical Wiring Interconnect System (EWIS) Market?

- North America dominated the electrical wiring interconnect system (EWIS) market with the largest revenue share of 42.01% in 2024, driven by the high concentration of aircraft manufacturers, a robust aerospace ecosystem, and growing investments in next-generation aircraft programs by major OEMs and defense organizations

- The region’s leadership is further fueled by strong government spending on military aviation upgrades and a rapid increase in air travel, prompting new aircraft deliveries across the U.S. and Canada

- In addition, technological advancements in avionics, propulsion, and aircraft electrification are prompting the integration of advanced EWIS solutions, positioning North America as a hub for high-value aerospace component manufacturing

U.S. Electrical Wiring Interconnect System (EWIS) Market Insight

The U.S. captured the largest revenue share within North America in 2024, driven by a surge in commercial aircraft production and the modernization of military aviation programs such as F-35 and unmanned aerial systems (UAS). The U.S. market benefits from the presence of key OEMs such as Boeing, Lockheed Martin, and Raytheon Technologies, which are accelerating the demand for lightweight and high-performance EWIS systems. Furthermore, initiatives promoting electric propulsion and green aviation are also contributing to increased investment in electrical wiring interconnect system innovation.

Europe Electrical Wiring Interconnect System (EWIS) Market Insight

Europe market is projected to expand at a significant CAGR throughout the forecast period, supported by strong civil and defense aviation manufacturing across countries such as Germany, France, and the U.K. The region is witnessing steady growth in commercial aircraft deliveries, with Airbus playing a central role in driving demand for EWIS components. In addition, increased defense budgets and pan-European projects such as FCAS (Future Combat Air System) are contributing to greater adoption of sophisticated electrical wiring interconnect system systems across new platforms.

U.K. Electrical Wiring Interconnect System (EWIS) Market Insight

The U.K. electrical wiring interconnect system market is expected to grow at a notable CAGR during the forecast period, attributed to its strong aerospace engineering base and focus on defense aviation. The presence of major suppliers and integration centers, along with participation in multi-national programs such as Tempest, enhances the U.K.'s market position. Rising emphasis on modular electrical architecture and the integration of smart sensors and autonomous flight systems are also fueling EWIS demand in the region.

Germany Electrical Wiring Interconnect System (EWIS) Market Insight

The Germany electrical wiring interconnect system market is anticipated to expand at a steady CAGR, driven by its reputation as a global leader in aerospace technology and precision engineering. Key players in aircraft interiors, avionics, and propulsion systems are integrating advanced wiring harnesses to improve efficiency and reduce aircraft weight. Germany’s efforts toward sustainable aviation and lightweight material adoption are creating opportunities for EWIS suppliers specializing in high-performance, eco-friendly interconnect solutions.

Which Region is the Fastest Growing in the Electrical Wiring Interconnect System (EWIS) Market?

Asia-Pacific electrical wiring interconnect system market is set to grow at the fastest CAGR of 7.25% from 2025 to 2032, propelled by rapid fleet expansion, urban air mobility initiatives, and growing aerospace investments in countries such as China, Japan, and India. Rising domestic aircraft manufacturing, along with a surge in defense procurements, is driving demand for cost-effective and scalable EWIS technologies across the region.

Japan Electrical Wiring Interconnect System (EWIS) Market Insight

The Japan market is witnessing increased traction due to advancements in aerospace electronics, rising defense modernization efforts, and strong demand for precision manufacturing. With a strong culture of miniaturization and system reliability, electrical wiring interconnect system providers in Japan are focusing on developing compact and high-density wiring systems for both military and commercial applications. Japan’s focus on next-gen air mobility and disaster response aircraft is expected to further fuel electrical wiring interconnect system demand.

China Electrical Wiring Interconnect System (EWIS) Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, thanks to its booming commercial aviation sector and heavy investments in indigenous aircraft programs such as COMAC’s C919 and ARJ21. The growing number of MRO (Maintenance, Repair, and Overhaul) facilities and local production of aircraft components are enhancing electrical wiring interconnect system adoption. In addition, China’s drive to establish itself as a global aviation leader is fostering partnerships between state-backed firms and international suppliers to scale up EWIS capabilities.

Which are the Top Companies in Electrical Wiring Interconnect System (EWIS) Market?

The electrical wiring interconnect system (EWIS) industry is primarily led by well-established companies, including:

- Safran (France)

- GKN Aerospace (U.K.)

- Latecoere (France)

- TE Connectivity (Switzerland)

- Ducommun Incorporated (U.S.)

- Co-Operative Industries Aerospace & Defense (U.S.)

- Elektro-Metall Export GmbH (Germany)

- InterConnect Wiring, L.L.P. (U.S.)

- Amphenol Corporation (U.S.)

What are the Recent Developments in Global Electrical Wiring Interconnect System (EWIS) Market?

- In April 2024, Safran Electrical & Power introduced GENeUSCONNECT, a new series of high-power electrical harnesses tailored for the next generation of all-electric and hybrid aircraft. This product expansion strengthens Safran’s position in the aerospace industry by providing cutting-edge electrical system solutions that cater to the rising demand for energy-efficient aviation technologies. This strategic launch reinforces Safran’s commitment to innovation in sustainable aerospace power systems

- In July 2023, TE Connectivity played a pivotal role in advancing the adoption of Single Pair Ethernet (SPE) by driving the development of the international electrotechnical standard IEC 63171-7. This initiative has significantly boosted industry-wide confidence and accelerated the integration of SPE interconnect technologies. This contribution further establishes TE Connectivity as a leader in setting global connectivity standards

- In March 2023, Linx Technologies, a subsidiary of TE Connectivity, launched new surface-mount RF switch connectors that offer superior isolation between ports, improving overall data precision and transmission quality. These components are designed to meet the evolving needs of high-performance electronic applications. This release underscores TE’s ongoing innovation in advanced connector solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.