Global Electric Vehicles Battery Market

Market Size in USD Billion

CAGR :

%

USD

49.22 Billion

USD

206.61 Billion

2022

2030

USD

49.22 Billion

USD

206.61 Billion

2022

2030

| 2023 –2030 | |

| USD 49.22 Billion | |

| USD 206.61 Billion | |

|

|

|

|

Electric Vehicles Battery Market Analysis and Sizes

Electronic vehicles battery is a pollution-free or eco-friendly fuelling system, electric vehicle batteries are substituting fossil fuels such as petrol and diesel. The old fuelling system is a non-renewable source of energy and it creates heavy pollution. Electric batteries can be charged with renewable energy sources which makes them eco-friendly. The road tax and registration fees related to electric vehicles are relatively low, which is probable to impact market growth.

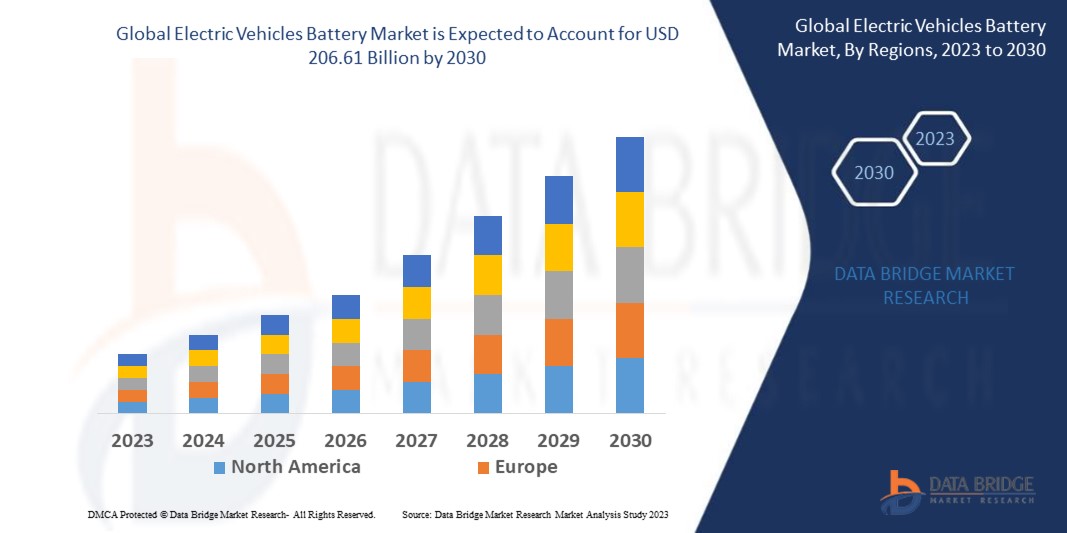

Data Bridge Market Research analyses that the electric vehicles battery market which was USD 49.22 billion in 2022, would rocket up to USD 206.61 billion by 2030, and is expected to undergo a CAGR of 19.64% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Electric Vehicles Battery Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Lithium-Ion Batteries, Sealed Lead Acid Batteries, Nickel-Metal Hydride Batteries, Ultra-capacitors, Solid-State Batteries, Other Batteries), Form (Prismatic, Cylindrical, Pouch), Application (Electric Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two Wheeler, Others), Capacity (50 kWh, 51-100 kWh, 101-300 kWh, 300 kWh), Bonding Type (Wire, Laser), Vehicle Type (Passenger Car, Commercial Vehicle), End-User (OEMs, Aftermarket, Battery Swapping Stations), Material (Lithium, Magnesium, Cobalt, Natural Graphite) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

ENERSYS (U.S.), BYD Motors Inc.(China), Panasonic Corporation (Japan), LG Energy Solution.(South korea), PRIDE EV(China), Wanxiang,(China), GS Yuasa International Ltd (Japan), Tianneng (China), Contemporary Amperex Technology Co Limited (China), SAMSUNG SDI CO.,LTD.(South Korea), Hankook & Company Co., Ltd.(South Korea), Bloomberg L.P.(India), C&D Technologies, Inc (U.S.), CROWN BATTERY(U.S), Duracell Batteries BV and Duracell U.S. Operations, Inc.,(U.S.), East Penn Manufacturing Company (U.S), EXIDE INDUSTRIES LTD(India), HUAYU(NINGBO)NEW ENERGY TECHNOLOGIES CO., LTD(China), onal Ltd (Japan), Huanyu New Energy Technology (China) |

|

Market Opportunities |

|

Market Definition

EV battery is the power generator for electric vehicles which can be reused and it depends upon the charging system. Without electric batteries there are no electric vehicles, so EV batteries is the major asset for EV vehicle because electric batteries are the fulling system for such vehicle. Once after using electric vehicle batteries customers can charge it and use it multiple times. It is an environmentally friendly product, which encourages people to substitute old fulling system with new power pack system

Global Electric Vehicles Battery Market Dynamics

Drivers

- Growing demand for electronic vehicle

Customer are preferring electric vehicle because of their friendly, traditional vehicles produce a lot of emissions which create pollution in the environment, whereas electric vehicles produce zero emission which make them more acceptable to the customer. Governments in several countries are promoting the use of EV vehicles, facility such as tax deductions, subsidies, decreased parking rates, and toll rates for EVs, which will help to grow the electric vehicles market and drive the market growth of the electric vehicle battery market

- Reduction of battery cost

The huge manufacture of electric vehicle batteries has reduced the cost of electric vehicle and also decreases the cost of EV batteries over a few years, 30%– 40% of electric vehicles cost is dependent upon electric batteries. Ultimately the cost reduction of EV batteries will make vehicles more affordable for customers, and advanced technology used for battery manufacturing reduce the material cost and grow the volume of production. This will lead to driving the market growth of electric vehicles batteries cost.

Opportunities

- Self-battery changing service save time for users

Battery swapping and battery-as-a-service (BaaS) allow users to change/swap EV batteries when discharged. This battery swapping system saves users valuable time which was spent on recharging the batteries. Battery swapping came up as an alternative for fast charging stations and its demand has grown over the world, which creates an opportunity for the electric vehicles battery market to grow

- Evolution of lithium-ion technology

The development of lithium-ion technology has powered the growth rate for batteries over the last few years. The high energy density and charge holding capacity with low maintenance of lithium-ion batteries has become the primary solution for automakers to power plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) which create an opportunity for electric vehicle battery to grow.

Restraints/Challenges

- The fluctuating prices of the raw materials

Raw materials such as lithium, cobalt, and lead are used to make batteries, these material prices always fluctuate in the market which leads to the shortage and wastage of electric vehicle batteries. The improper use of raw materials is responsible for the fluctuating price of batteries in the market, which will hamper the growth of the EV batteries market.

- High cost of rechargeable batteries and the making of EV vehicle

The cost of EV batteries is high as compared to the ICE vehicle fuelling system, due to the high cost of lithium-ion batteries which is used to run EV vehicle. The cost of the electronic vehicle is also high as compared to ICE vehicle because expensive material is used to develop EV vehicle and advanced technology which increase the cost of EVs. Which can restrain the market growth electric vehicle battery market.

This electric vehicles battery market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the electric vehicles battery market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In July 2022, Samsung SDI began the construction of its second battery production facility in Seremban, Malaysia. This plant will executed producing PRiMX 21700 cylindrical batteries in 2024. The invest USD 1.4 billion in stages till 2025. The major use of battery production will be for electric vehicles and various other applications.it was announced in July 2022.

- In June 2022, Heilongjiang Transport Development Co., Ltd. (Heilongjiang Transport) announced a partnership with Contemporary Amperex Technology Co., Ltd. (CATL). Both are working together for battery charging and swapping for heavy trucks, battery swapping for online ride-hailing cabs, battery charging and swapping for cruising cabs.

Global Electric Vehicles Battery Market Scope

The electric vehicles battery market is segmented on the basis of type, form, application, capacity, bonding type, vehicle type, end-user, and material. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Lithium-Ion Batteries

- Sealed Lead Acid Batteries

- Nickel-Metal Hydride Batteries

- Ultra-Capacitors

- Solid-State Batteries

- Other Batteries

Form

- Prismatic

- Cylindrical

- Pouch

Application

- Electric Cars

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Pure Hybrid Electric Vehicles

- Plug-In Hybrid Electric Vehicles

- Light Commercial Vehicles

- Vans and Light Trucks

- Heavy Commercial Vehicles

- Heavy Trucks

- Buses

- Two Wheeler

- E-Scooters & Motorcycles

- E-Bikes

- Others

- Off-Highway Vehicles

Capacity

- 50 kWh

- 51-100 kWh

- 101-300 kWh

- 300 kWh

Bonding Type

- Wire

- Laser

Vehicle Type

- Passenger Car

- Commercial Vehicle

End-User

- OEMs

- Aftermarket

- Battery Swapping Stations

Material

- Lithium

- Magnesium

- Cobalt

- Natural Graphite

Global Electric Vehicles Battery Market Regional Analysis/Insights

The electric vehicles battery market is analysed and market size insights and trends are provided by type, form, application, capacity, bonding type, vehicle type, end-user, and material as referenced above.

The countries covered in electric vehicles battery market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the global electric vehicles battery market because of its strong base in industrialization, availability of raw materials strong presence of major players in the market and good foreign policy, and high demand for EVs.

North America is expected to witness significant growth during the forecast period of 2023 to 2030 due to the increase in the demand for EVs, the presence of a strong electronic market such as Tesla. Availability of growing market, growing demand for quality electric vehicles battery.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Electric Vehicles Battery Share Analysis

The electric vehicle battery market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to electric vehicle battery market.

Some of the major players operating in the electric vehicles battery market are:

- ENERSYS (U.S.)

- BYD Motors Inc.(China)

- Panasonic Corporation (Japan)

- LG Energy Solution.(South korea)

- PRIDE EV(China)

- Wanxiang,(China)

- GS Yuasa International Ltd (Japan)

- Tianneng (China)

- Contemporary Amperex Technology Co Limited (China)

- SAMSUNG SDI CO.,LTD.(South Korea)

- Hankook & Company Co., Ltd.(South Korea)

- Bloomberg L.P.(India)

- C&D Technologies, Inc (U.S.)

- CROWN BATTERY(U.S)

- Duracell Batteries BV (U.S.)

- East Penn Manufacturing Company (U.S)

- EXIDE INDUSTRIES LTD(India)

- HUAYU(NINGBO)NEW ENERGY TECHNOLOGIES CO., LTD(China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ELECTRIC VEHICLES BATTERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ELECTRIC VEHICLES BATTERY MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ELECTRIC VEHICLES BATTERY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATIONS STANDARDS

5.2.1 EV BATTERY PERFORMANCE

5.2.2 EV BATTERY SAFETY

5.2.3 EV BATTERY RECYCLING

5.3 VALUE CHAIN ANALYSIS

5.4 TECHNOLOGICAL TRENDS

5.5 COMPANY COMPARITIVE ANALYSIS

5.6 CONSUMER BEHAVIOUR ANALYSIS

5.7 ENVIRONMENTAL SCENARIO AND GOVERNMENT POLICIES

5.8 DETAIL LIST OF PROJECTS

5.9 PRICING ANALYSIS

6 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY BATTERY TYPE

6.1 OVERVIEW

6.2 LEAD ACID

6.2.1 BY PRODUCT

6.2.1.1. SLI BATTERIES

6.2.1.2. MICRO HYBRID BATTERIES

6.2.2 BY TYPE

6.2.2.1. FLODED BATTERIES

6.2.2.2. VRLA BATTERIES

6.3 NICKEL METAL HYRDIDE

6.4 LITHIUM ION

6.4.1 BY TYPE

6.4.1.1. LITHIUM NICKEL MANGANESE COBALT (LI-NMC)

6.4.1.2. LITHIUM IRON PHOSPHATE (LFP)

6.4.1.3. LITHIUM COBALT OXIDE (LCO)

6.4.1.4. LITHIUM TITANATE OXIDE (LTO)

6.4.1.5. LITHIUM MANGANESE OXIDE (LMO)

6.4.1.6. LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA)

6.5 SODIUM ION

6.6 SOLID STATE BATTERY

6.7 OTHERS

7 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY BATTERY CAPACITY

7.1 OVERVIEW

7.2 LESS THAN 50 KWH

7.3 50 TO 100 KWH

7.4 101 TO 200 KWH

7.5 201 -300 KWH

7.6 MORE THAN 300 KWH

8 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY METHOD

8.1 OVERVIEW

8.2 WIRE BONDING

8.3 LASER BONDING

9 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY BATTERY FORM

9.1 OVERVIEW

9.2 PRISMATIC

9.3 CYLINDRICAL

9.4 POUCH

10 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY MATERIAL TYPE

10.1 OVERVIEW

10.2 LITHIUM

10.3 COBALT

10.4 MANGANESE

10.5 NATURAL GRAPHITE

10.6 PHOSPHATE

10.7 IRON

10.8 NICKEL

10.9 OTHERS

11 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY TRAY MATERIAL

11.1 OVERVIEW

11.2 ALUMINUM

11.3 STAINLESS STEEL

11.4 CARBON FIBER-REINFORCED PLASTIC (CFRP)

11.5 GLASS FIBER REINFORCED PLASTIC (GFRP)

12 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY VEHICLE TYPE

12.1 OVERVIEW

12.2 PASSENGER CAR

12.2.1 BY BODY TYPE

12.2.1.1. HATCHBACKS

12.2.1.2. SEDANS

12.2.1.3. SPORT UTILITY VEHICLE (SUV)

12.2.1.4. MULTY UTILITY VEHICLE (MUV)

12.2.1.5. COUPES

12.2.1.6. OTHERS

12.3 COMMERCIAL VEHICLE

12.3.1 LIGHT COMMERCIAL VEHICLE

12.3.1.1. PICKUP VAN

12.3.1.2. MINI TRUCK

12.3.1.3. MINI VAN

12.3.1.4. OTHERS

12.3.2 HEAVY COMMERCIAL VEHICLE

12.3.2.1. TRUCK

12.3.2.2. BUSES

12.3.2.3. OTHERS

12.4 OFF HIGHWAY VEHICLES

12.4.1 AGRICULTURE

12.4.2 CONSTRUCTION

12.5 TWO WHEELER

12.5.1 SCOOTER

12.5.2 MOTOR CYCLE

12.6 THREE WHEELER

13 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY PROPULSION TYPE

13.1 OVERVIEW

13.2 BATTERY ELECTRIC VEHICLE (BEV)

13.2.1 PASSENGER CARS

13.2.2 LIGHT COMMERCIAL VEHICLE

13.2.3 HEAVY COMMERCIAL VEHICLE

13.2.4 TWO WHEELER

13.2.5 THREE WHEELER

13.2.6 OFF HIGHWAY VEHICLES

13.3 PLUG-IN-HYBRID ELECTRIC VEHICLES (PHEV )

13.3.1 PASSENGER CARS

13.3.2 LIGHT COMMERCIAL VEHICLE

13.3.3 HEAVY COMMERCIAL VEHICLE

13.3.4 TWO WHEELER

13.3.5 THREE WHEELER

13.3.6 OFF HIGHWAY VEHICLES

13.4 HYBRID ELECTRIC VEHICLE (HEV)

13.4.1 PASSENGER CARS

13.4.2 LIGHT COMMERCIAL VEHICLE

13.4.3 HEAVY COMMERCIAL VEHICLE

13.4.4 TWO WHEELER

13.4.5 THREE WHEELER

13.4.6 OFF HIGHWAY VEHICLES

13.5 FUEL CELL VEHICLE (FCEV)

13.5.1 PASSENGER CARS

13.5.2 LIGHT COMMERCIAL VEHICLE

13.5.3 HEAVY COMMERCIAL VEHICLE

13.5.4 TWO WHEELER

13.5.5 THREE WHEELER

13.5.6 OFF HIGHWAY VEHICLES

14 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY SALES CHANNEL

14.1 OVERVIEW

14.2 OEM

14.3 AFTERMARKET

15 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, BY GEOGRAPHY

15.1 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1.1 NORTH AMERICA

15.1.1.1. U.S.

15.1.1.2. CANADA

15.1.1.3. MEXICO

15.1.2 EUROPE

15.1.2.1. GERMANY

15.1.2.2. FRANCE

15.1.2.3. U.K.

15.1.2.4. ITALY

15.1.2.5. SPAIN

15.1.2.6. RUSSIA

15.1.2.7. TURKEY

15.1.2.8. BELGIUM

15.1.2.9. NETHERLANDS

15.1.2.10. SWITZERLAND

15.1.2.11. REST OF EUROPE

15.1.3 ASIA PACIFIC

15.1.3.1. JAPAN

15.1.3.2. CHINA

15.1.3.3. SOUTH KOREA

15.1.3.4. INDIA

15.1.3.5. AUSTRALIA

15.1.3.6. SINGAPORE

15.1.3.7. THAILAND

15.1.3.8. MALAYSIA

15.1.3.9. INDONESIA

15.1.3.10. PHILIPPINES

15.1.3.11. REST OF ASIA PACIFIC

15.1.4 SOUTH AMERICA

15.1.4.1. BRAZIL

15.1.4.2. ARGENTINA

15.1.4.3. REST OF SOUTH AMERICA

15.1.5 MIDDLE EAST AND AFRICA

15.1.5.1. SOUTH AFRICA

15.1.5.2. EGYPT

15.1.5.3. SAUDI ARABIA

15.1.5.4. U.A.E

15.1.5.5. ISRAEL

15.1.5.6. REST OF MIDDLE EAST AND AFRICA

15.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL ELECTRIC VEHICLES BATTERY MARKET,COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL ELECTRIC VEHICLES BATTERY MARKET , SWOT & DBMR ANALYSIS

18 GLOBAL ELECTRIC VEHICLES BATTERY MARKET, COMPANY PROFILE

18.1 LG CHEM

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 BYD COMPANY LTD.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 PANASONIC HOLDINGS CORPORATION

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 SAMSUNG SDI CO. LTD.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 FARASIS ENERGY GMBH

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 SK INNOVATION CO. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 CHINA AVIATION BATTERY CO. LTD. (CALB)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 CONTEMPORARY AMPEREX TECHNOLOGY CO. LTD. (CATL)

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 AESC GROUP

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EVE ENERGY CO. LTD.

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 TOSHIBA CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 GUOXUAN HIGH-TECH CO. LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 SVOLT ENERGY TECHNOLOGY CO. LTD. (SVOLT)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 MITSUBISHI CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 ENERSYS

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 GOTIAN HI-TECH CO. LTD.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 EXIDE INDUSTRIES LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 CLARIOS

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 TESLA MOTORS

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 HITACHI

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 FURUKAWA ELECTRIC CO., LTD

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

19 CONCLUSION

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.