Global Elastic Bonding Adhesive Sealant Market

Market Size in USD Billion

CAGR :

%

USD

26.19 Billion

USD

37.42 Billion

2024

2032

USD

26.19 Billion

USD

37.42 Billion

2024

2032

| 2025 –2032 | |

| USD 26.19 Billion | |

| USD 37.42 Billion | |

|

|

|

|

Elastic Bonding Adhesive and Sealant Market Size

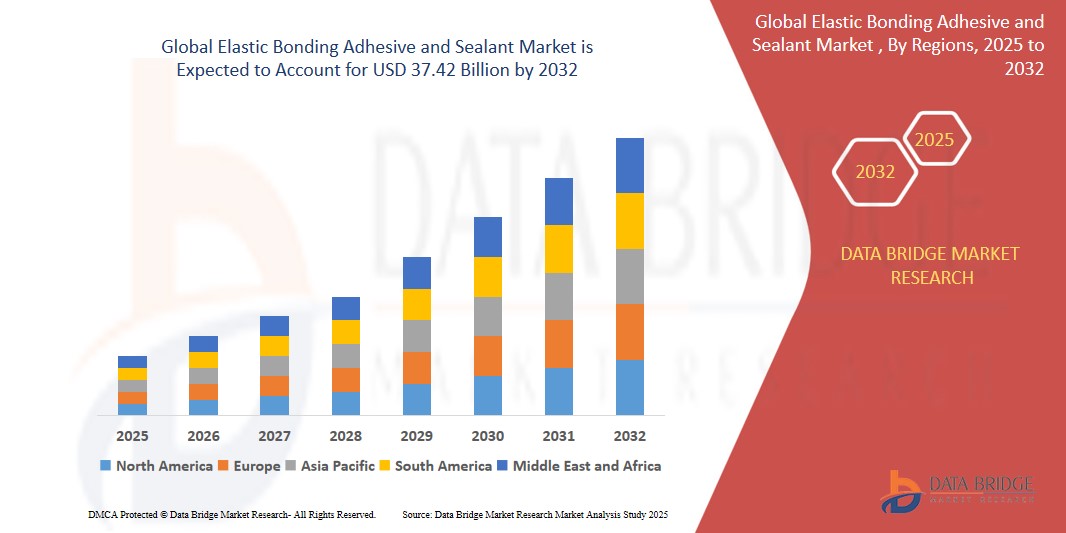

- The Global Elastic Bonding Adhesive and Sealant Market size was valued at USD 26.19 billion in 2024 and is expected to reach USD 37.42 billion by 2032, at a CAGR of 4.59 % during the forecast period

- This growth is driven by factors such as Growing Demand from the Construction Industry and Rising Adoption in Automotive and Transportation

Elastic Bonding Adhesive and Sealant Market Analysis

- The elastic bonding adhesive and sealant market is expanding rapidly due to rising demand across construction, automotive, and industrial sectors, offering flexibility, strength, and environmental resistance in diverse applications.

- Key drivers include increasing infrastructure projects, lightweight vehicle production, and environmental regulations promoting low-VOC adhesives. Growing electric vehicle (EV) adoption further fuels demand for high-performance bonding solutions.

- Asia-Pacific dominates due to industrial growth in China and India. Europe follows, driven by green building codes, while North America sees steady demand from automotive and aerospace innovations.

- Companies focus on innovation, sustainability, and expanding global footprints through mergers, acquisitions, and product development to meet evolving customer needs.

- The market is set to grow steadily with increased R&D in bio-based adhesives, expanding applications in aerospace and marine, and rising demand for sustainable, high-durability bonding technologies across industries.

Report Scope and Elastic Bonding Adhesive and Sealant Market Segmentation

|

Attributes |

Elastic Bonding Adhesive and Sealant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Elastic Bonding Adhesive and Sealant Market Trends

“Rise of Prefabricated Construction”

- Manufacturers are increasingly developing bio-based and low-VOC elastic adhesives. This trend is fueled by global sustainability goals, green building codes, and consumer demand for environmentally responsible construction and industrial materials.

For instance,

- In March 2024, Sika AG announced the launch of Sikaflex®-553, a high-performance, solvent-free elastic adhesive targeting the automotive and prefabrication sectors. The product reflects the growing demand for sustainable and efficient bonding technologies.

- Automotive OEMs prioritize elastic adhesives to reduce vehicle weight and improve fuel efficiency. Adhesives replace welds and rivets, especially in EVs, where battery safety and lightweight structures are critical priorities.

- Elastic sealants play a key role in modular and prefab construction. Their flexibility, easy application, and bonding strength enhance construction speed and quality in off-site manufactured building components.

- Innovations like hybrid polymer adhesives and UV-curable sealants are gaining traction. These offer faster curing, stronger bonding, and better resistance to environmental stress, driving adoption in aerospace, marine, and electronics.

Elastic Bonding Adhesive and Sealant Market Dynamics

Driver

“Growing Demand from the Construction Industry”

- Elastic bonding adhesives and sealants are widely used in construction for joint sealing, panel bonding, and facade applications. Their flexibility, strength, and ability to absorb vibrations make them essential for modern infrastructure.

- In emerging economies, rapid urbanization and increasing infrastructure investments are significantly driving product demand. High-rise buildings, smart city developments, and prefabricated construction are fueling consumption.

- Moreover, sustainable construction practices favor low-VOC, solvent-free, and energy-efficient adhesive formulations. Manufacturers are aligning their portfolios accordingly to comply with global green building codes.

- These factors, coupled with rising renovation activities in developed countries, are contributing to market growth. Government incentives and regulations aimed at sustainable development are further propelling demand.

For Instance,

- In January 2024, Bostik, a subsidiary of Arkema, announced its adhesive solutions were selected for a major smart city housing project in Dubai. The elastic bonding adhesives were used for facade panels and joint sealing, showcasing their growing role in high-performance, sustainable construction under extreme climate conditions.

Opportunity

“Advancements in Bio-based and Sustainable Adhesives”

- Consumer demand and regulatory pressure are pushing the industry toward greener alternatives. Bio-based elastic adhesives offer low toxicity and a smaller environmental footprint. They also reduce reliance on finite petroleum resources.

- Innovations in green chemistry have led to the development of high-performance, renewable adhesive formulations that rival conventional counterparts. Bio-polymers and recyclable additives are now being integrated into commercial products.

- Governments and institutions are funding research to commercialize these eco-friendly solutions, opening doors for new product segments. Tax incentives and carbon credits support innovation in sustainable adhesives.

- Adoption of sustainable adhesives enhances brand value and provides companies with a competitive edge, particularly in environmentally-conscious markets like Europe and North America. Green procurement practices are further driving uptake in industrial and commercial projects

Restraint/Challenge

“Fluctuating Raw Material Prices”

- Elastic bonding adhesives rely heavily on petroleum-based raw materials such as polyurethanes, silicones, and acrylics. Volatile crude oil prices directly affect production costs. Exchange rate fluctuations further compound price volatility across international markets.

- Frequent changes in prices create budgeting uncertainties for manufacturers and buyers. This unpredictability can result in reduced profit margins and hinder long-term planning. Contracts with fixed pricing terms are at higher risk in volatile environments.

- Global supply chain disruptions, such as those experienced during pandemics or geopolitical conflicts, further exacerbate raw material shortages and pricing instability. Natural disasters also disrupt chemical production and logistics chains.

- This economic volatility poses a significant restraint, particularly for small and medium-sized enterprises (SMEs) that lack the leverage to absorb such cost fluctuations. Their limited inventory and financial buffers make them more vulnerable to price shocks.

Elastic Bonding Adhesive and Sealant Market Scope

The market is segmented on the basis product type, application and end- user industry.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By End User Industry |

|

In 2025, the Silicone is projected to dominate the market with a largest share in Global Electric Bonding Adhesive and Sealant Market

The Silicone segment is projected to dominate the market with the largest share, owing to its excellent flexibility, weather resistance, and durability, making it ideal for high-performance applications in construction, automotive, and industrial sectors globally.

Polyurethane is expected to account for the largest share during the forecast period in Global Electric Bonding Adhesive and Sealant Market

In 2025, The Polyurethane segment is expected to account for the largest share during the forecast period due to its excellent bonding strength, flexibility, and durability. Polyurethane-based adhesives are widely used in construction, automotive, and industrial applications, driving this segment's growth.

Elastic Bonding Adhesive and Sealant Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Elastic Bonding Adhesive and Sealant Market”

-

Asia-Pacific dominates due to industrial growth in China and India. Europe follows, driven by green building codes, while North America sees steady demand from automotive and aerospace innovations.

- China holds the largest share in the Asian Elastic Bonding Adhesive and Sealant Market due to rapid industrialization, large-scale construction projects, and the country’s position as the world’s largest automotive producer. Demand is particularly strong in the automotive and construction sectors.

- China’s robust infrastructure development, including smart cities, high-speed rail, and urban housing, significantly drives the adhesive and sealant market. The government’s focus on sustainable and energy-efficient building solutions further increases demand for elastic bonding materials.

- China is a global leader in electric vehicle (EV) production, creating significant opportunities for elastic bonding adhesives. Adhesives used in lightweight vehicle structures and battery assembly are essential for meeting energy efficiency and safety standards in the rapidly growing EV sector.

“Asia-Pacific is Projected to Register the Highest CAGR in the Elastic Bonding Adhesive and Sealant Market”

-

The Asia-Pacific region is projected to register the highest CAGR in the Elastic Bonding Adhesive and Sealant Market due to rapid industrialization and significant investments in infrastructure development across emerging economies.

- Countries like China, India, and Japan are key contributors to this growth, with expanding automotive, construction, and manufacturing industries driving demand for high-performance adhesives in various applications like bonding and sealing.

- The growing electric vehicle (EV) production in the region further boosts market demand. As automakers emphasize lightweighting and safety, elastic bonding adhesives are increasingly used in vehicle assembly and battery pack bonding.

Elastic Bonding Adhesive and Sealant Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Akzo Nobel N.V. (Netherlands)

- Henkel Adhesives Technologies India Private Limited (India)

- PPG Industries Inc. (U.S.)

- Wacker Chemie AG (Germany)

- Axalta Coating Systems (U.S.)

- Dow (U.S.)

- Clariant AG (Switzerland)

- 3M (U.S.)

- Sika AG (Switzerland)

- H.B. Fuller Company (U.S.)

- Bostik (France)

- WEICON GmbH & Co. KG (Germany)

- RPM International Inc. (U.S.)

- ThreeBond Holdings Co. Ltd. (Japan)

- Huntsman International LLC (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- CEMEDINE Co. Ltd. (Japan)

- MAPEI S.p.A. (Italy)

- Illinois Tool Works Inc. (U.S.)

Latest Developments in Global Elastic Bonding Adhesive and Sealant Market

- In November 2024, a study introduced a machine learning-based tool to optimize the distribution of fibril compliance in adhesives. This approach significantly reduces test error and accelerates the optimization process, offering a high-performance solution for designing fibrillar adhesives and micro-architected materials aimed at fracture resistance.

- In October 2024 marked a rise in the adoption of pressure-sensitive adhesives, known for their versatility and ease of use. These adhesives can bond a wide variety of substrates without the need for heat or additional curing time, making them ideal for applications in packaging and automotive sectors.

- In September 2024, the development of hybrid adhesives combining epoxies and silicones gained traction. These adhesives offer superior performance in high-strength, flexible applications, such as automotive body panels and construction joints, meeting the increasingly complex demands of today's manufacturing.

- In January 2024, researchers introduced a solvent-free dual-network adhesive combining poly(methyl methacrylate) and poly(n-butyl acrylate). This environmentally friendly adhesive offers high strength and stretchability, suitable for flexible applications like soft robotics and sports apparel. Its design eliminates solvent evaporation steps, enhancing efficiency.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Elastic Bonding Adhesive Sealant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Elastic Bonding Adhesive Sealant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Elastic Bonding Adhesive Sealant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.