Global Eclinical Solutions Market

Market Size in USD Billion

CAGR :

%

USD

9.36 Billion

USD

25.79 Billion

2024

2032

USD

9.36 Billion

USD

25.79 Billion

2024

2032

| 2025 –2032 | |

| USD 9.36 Billion | |

| USD 25.79 Billion | |

|

|

|

|

E-Clinical Solutions Market Size

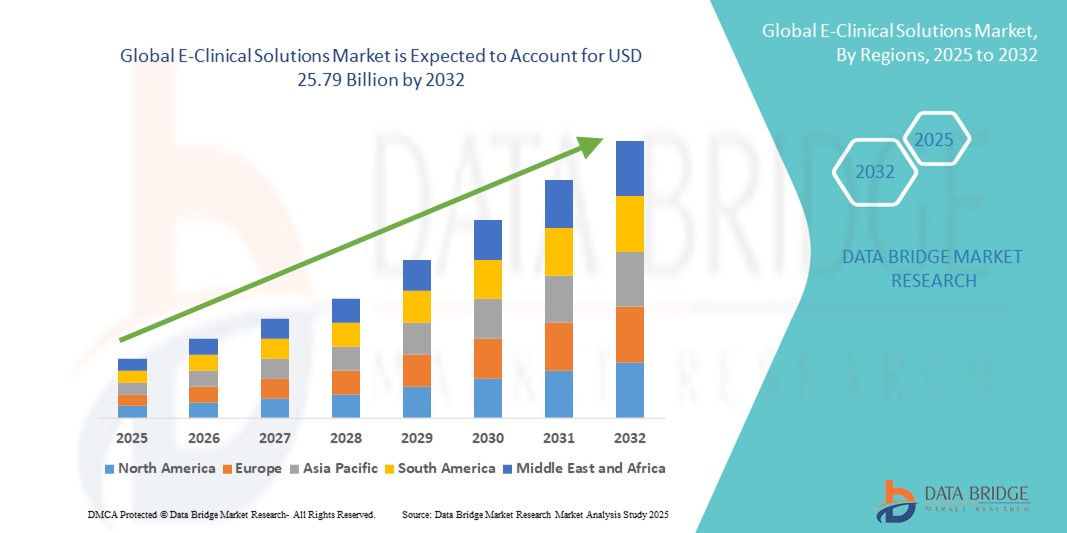

- The global e-clinical solutions market size was valued at USD 9.36 billion in 2024 and is expected to reach USD 25.79 billion by 2032, at a CAGR of 13.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital technologies and technological progress within clinical research and healthcare systems, leading to enhanced data management, trial efficiency, and real-time decision-making across pharmaceutical and biotechnology companies

- Furthermore, rising demand for secure, user-friendly, and integrated platforms for clinical trials is establishing e-Clinical Solutions as the preferred choice for data collection, monitoring, and analysis. These converging factors are accelerating the uptake of e-Clinical Solutions, thereby significantly boosting the industry’s growth

E-Clinical Solutions Market Analysis

- E-Clinical Solutions, encompassing digital platforms such as CTMS, EDC, eCOA, and RTSM, are becoming increasingly essential in clinical trials due to their role in data management, operational efficiency, and regulatory compliance. The market’s expansion is driven by the urgency to streamline complex trials and support decentralized and virtual trial models

- The growing demand for e-Clinical Solutions is primarily fueled by factors such as the rising number of global clinical trials, increasing R&D investments by pharmaceutical and biotech companies, the shift toward cloud-based/mobile-enabled systems, and the imperative to accelerate drug development timelines through automation and data integration

- North America dominated the e-Clinical solutions market with the largest revenue share of 49.38% in 2024, supported by a robust healthcare infrastructure, well-established pharmaceutical and biotechnology industries, and favorable regulatory frameworks encouraging digital adoption. This dominance is particularly driven by advanced adoption in the U.S., which held approximately 41.4% of the global market in 2024

- Asia-Pacific is expected to register strong growth in the e-Clinical solutions market, with a projected CAGR of 11.8%, due to increasing outsourcing of clinical trials, expanding healthcare and R&D infrastructure, and rising trial activity in countries such as China, India, Japan, and South Korea

- The Large Enterprise segment dominated the e-Clinical solutions market with 63.4% market share in 2024, reflecting their extensive investment in research and development, global clinical trial operations, and the critical need for fully integrated platforms to manage regulatory compliance, complex workflows, and multi-country study coordination

Report Scope and E-Clinical Solutions Market Segmentation

|

Attributes |

E-Clinical Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

E-Clinical Solutions Market Trends

Enhanced Convenience Through Integrated E-Clinical Platforms

- A significant and accelerating trend in the global e-clinical solutions market is the deepening integration of clinical trial management systems, electronic data capture (EDC), and clinical trial management systems (CTMS) into unified digital platforms. This convergence is significantly enhancing operational efficiency, data quality, and decision-making across the clinical research ecosystem

- For instance, modern e-Clinical platforms seamlessly integrate EDC with clinical trial management functionalities, enabling sponsors and contract research organizations (CROs) to monitor trial progress in real time, manage patient enrollment, and ensure regulatory compliance through a single interface. Similarly, advanced solutions now incorporate randomization and trial supply management (RTSM), reducing delays and improving overall trial coordination

- The integration of e-Clinical solutions further enables automation of data entry, advanced data validation, and real-time reporting. For instance, platforms are increasingly incorporating adaptive trial design features and automated query resolution systems, thereby minimizing manual intervention and enhancing accuracy in patient data handling. Furthermore, advanced analytics and predictive modeling capabilities allow trial managers to forecast patient recruitment rates and identify potential bottlenecks in advance

- The seamless integration of E-Clinical platforms with electronic health records (EHRs), laboratory information systems (LIS), and other digital health ecosystems facilitates centralized access to diverse clinical data sources. Through a single unified platform, researchers can manage patient records, adverse event reporting, trial documentation, and regulatory submissions, creating a streamlined and compliant clinical trial process

- This trend towards more intelligent, interconnected, and user-friendly e-Clinical ecosystems is fundamentally reshaping expectations for clinical trial management. Consequently, companies such as Medidata, Oracle Health Sciences, and Veeva Systems are developing next-generation e-Clinical solutions with enhanced interoperability, cloud-based deployment models, and mobile accessibility to support both global and decentralized clinical trials

- The demand for e-Clinical solutions offering integrated functionality is growing rapidly across pharmaceutical, biotechnology, and medical device sectors, as stakeholders increasingly prioritize operational efficiency, regulatory compliance, and accelerated time-to-market for novel therapies

E-Clinical Solutions Market Dynamics

Driver

Growing Need for Efficient Clinical Trial Management and Rising Adoption of Digital Solutions

- The increasing complexity and cost of clinical trials, coupled with the rising number of drug and biologic candidates in development, is driving significant demand for advanced e-Clinical Solutions. These platforms enable efficient data management, seamless patient engagement, and regulatory compliance across geographically diverse trial sites

- For instance, in June 2024, Medidata (Dassault Systèmes) introduced enhancements in its AI-driven Decentralized Clinical Trials (DCT) platform, aimed at improving patient recruitment and real-time trial monitoring. Such technological advancements are accelerating the adoption of e-Clinical platforms across pharmaceutical and biotech industries

- As sponsors and CROs strive to reduce trial timelines and improve decision-making, solutions such as electronic data capture (EDC), clinical trial management systems (CTMS), eCOA, and remote monitoring tools are becoming indispensable. These systems offer automation, data accuracy, and real-time insights, thereby ensuring operational efficiency

- Furthermore, the growing shift towards patient-centric trials and the expansion of hybrid and decentralized trial models is making e-Clinical platforms an integral part of the clinical research ecosystem, allowing for improved patient retention and compliance

- The integration of advanced analytics, cloud computing, and mobile-based interfaces further enhances the value proposition of e-Clinical Solutions, making them critical in addressing the increasing demand for faster, safer, and more efficient drug development processes

Restraint/Challenge

Concerns Regarding Data Security, Integration Complexities, and High Implementation Costs

- Concerns surrounding data privacy and security vulnerabilities pose a major restraint for the e-Clinical Solutions market. As these systems handle sensitive patient and trial data, they remain susceptible to cybersecurity threats, unauthorized access, and potential breaches, raising concerns among sponsors, CROs, and regulatory authorities

- For instance, high-profile incidents of cyberattacks on healthcare and clinical research organizations have heightened awareness around the risks of adopting cloud-based digital platforms without robust safeguards

- Addressing these concerns through advanced encryption, multi-factor authentication, GDPR/HIPAA compliance, and regular system audits is essential to maintain user trust. Vendors such as Oracle Health Sciences and Veeva Systems emphasize their data protection capabilities to reassure stakeholders

- In addition, the integration challenges of aligning e-Clinical Solutions with existing legacy systems and diverse trial management workflows often delay adoption, especially among mid- and small-sized CROs

- The high initial costs of implementation, including licensing, customization, and staff training, remain another barrier to adoption, particularly in developing regions or for budget-conscious trial sponsors. While SaaS-based subscription models are reducing upfront expenses, advanced platforms with AI, analytics, and interoperability features still demand a premium

- Overcoming these barriers through affordable modular solutions, better interoperability standards, and stronger cybersecurity frameworks will be vital for achieving sustained global adoption of e-Clinical Solutions

E-Clinical Solutions Market Scope

The market is segmented on the basis of product, delivery mode, clinical trial phase, organization size, user device, and end user.

- By Product

On the basis of product, the e-Clinical solutions market is segmented into electronic data capture and clinical trial data management systems, clinical trial management systems, clinical analytics platforms, care coordination medical records (CCMR), randomization and trial supply management, clinical data integration platforms, electronic clinical outcome assessment solutions, safety solutions, electronic trial master file systems, regulatory information management solutions, and others. The data management systems segment dominated the market with the largest revenue share of 28.6% in 2024, owing to its central role in collecting, cleaning, and managing clinical trial data efficiently. These systems are crucial for maintaining data integrity, regulatory compliance, and accurate reporting, making them indispensable in both small and large-scale clinical trials. Rising volumes of trial data in multi-site and global studies are increasing demand for robust data management. Integration with electronic health records (EHR) and other trial platforms further strengthens their adoption. Advanced analytics and real-time monitoring capabilities also make Data Management Systems a backbone for efficient clinical operations.

The clinical analytics platforms segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by increasing adoption of AI-powered analytics, machine learning, and predictive modeling within clinical research. These platforms enable stakeholders to extract actionable insights from complex trial datasets, optimize patient recruitment, and improve trial outcomes in real time. Analytics solutions also support risk-based monitoring, identify protocol deviations, and enhance regulatory compliance. The ability to integrate diverse data sources, including eCOA, wearable devices, and laboratory systems, fuels their growth. Advanced visualization tools and dashboards help trial managers make informed decisions quickly. Increasing focus on adaptive and precision medicine trials further accelerates adoption of Clinical Analytics Platforms.

- By Delivery Mode

On the basis of delivery mode, the e-Clinical solutions market is segmented into web-hosted (on-demand) solutions, licensed enterprise (on-premises) solutions, and cloud-based (software-as-a-service/SAAS) solutions. The Web-Hosted (On-Demand) Solutions segment held the largest market share of 41.3% in 2024, due to its scalability, cost-effectiveness, and ease of deployment. These solutions allow users to access trial data and management tools remotely without the need for complex IT infrastructure, particularly benefiting small and medium-sized research organizations. Ease of integration with existing IT systems and minimal maintenance requirements further strengthen adoption. The flexibility to scale resources based on trial needs also drives preference for this segment. Centralized data access and real-time monitoring capabilities enhance operational efficiency.

The Cloud-Based (SaaS) Solutions segment is projected to grow at the fastest CAGR of 21.4% from 2025 to 2032, fueled by the increasing prevalence of decentralized and hybrid clinical trial models. Cloud platforms provide secure, real-time access to trial data across multiple sites and countries, enabling better collaboration among sponsors, CROs, and clinical sites. Automated workflows, data standardization, and regulatory compliance features support efficient trial operations. Cloud adoption also reduces IT infrastructure costs and accelerates deployment timelines. The integration of advanced analytics and mobile access within cloud platforms strengthens operational oversight. Increasing regulatory encouragement for digital trial management solutions further accelerates market growth.

- By Clinical Trial Phase

On the basis of clinical trial phase, the e-Clinical solutions market is segmented into Phase I, Phase II, Phase III, and Phase IV. The Phase III segment accounted for the largest revenue share of 46.7% in 2024, driven by complex trial protocols, large patient populations, and stringent regulatory requirements in late-stage studies. Phase III trials generate substantial data, necessitating advanced e-Clinical solutions for efficient data management, patient monitoring, and regulatory compliance. Integration of trial management systems, analytics platforms, and eCOA tools enhances operational accuracy. Sponsors rely heavily on Phase III systems to ensure timely study completion and minimize delays. The increasing focus on global multi-center trials reinforces the segment’s dominance.

The Phase II segment is expected to grow at the fastest CAGR of 19.6% from 2025 to 2032, supported by the rising number of mid-stage trials in oncology, targeted therapies, and precision medicine. Phase II studies require adaptive designs, detailed patient monitoring, and seamless data integration from multiple sources. e-Clinical solutions streamline these processes, providing real-time insights and improving trial efficiency. Enhanced patient engagement tools and integration with wearable devices accelerate adoption. Regulatory emphasis on patient safety and data accuracy also contributes to growth. The need for rapid decision-making in mid-stage trials further fuels demand for sophisticated e-Clinical platforms.

- By Organization Size

On the basis of organization size, the e-Clinical solutions market is segmented into small & medium enterprises (SMEs) and large enterprises. The Large Enterprises segment dominated with a 63.4% market share in 2024, reflecting their extensive R&D investment, global trial operations, and need for fully integrated platforms to manage regulatory compliance, multi-country studies, and complex workflows. Large enterprises leverage e-Clinical solutions to reduce operational errors, streamline data collection, and ensure standardized processes across trials. Centralized monitoring and analytics support decision-making at scale. Integration with EHR and other hospital systems enhances efficiency. High adoption of cloud-enabled and web-hosted solutions further consolidates their dominance.

The SME segment is expected to register the fastest CAGR of 20.2% from 2025 to 2032, driven by the growing adoption of scalable, affordable, and cloud-based e-Clinical solutions. SMEs benefit from automated workflows, remote access, and reduced infrastructure costs, allowing them to conduct efficient trials with limited resources. Rapid deployment of SaaS platforms accelerates adoption. These solutions enable regulatory compliance without heavy IT investments. The need to compete with large enterprises in drug development timelines further propels market growth. Integration with mobile and analytics tools enhances operational efficiency for smaller organizations.

- By User Device

On the basis of user device, the e-Clinical solutions market is segmented into desktop, tablet, handheld PDA device, smartphone, and others. The desktop segment held the largest share of 37.9% in 2024, as desktops remain the primary tool for trial managers, data analysts, and clinical coordinators to perform complex data entry, analytics, and regulatory reporting. Their robust computational power, large display interfaces, and secure environment make them ideal for managing sensitive trial data. Desktops also support integration with multiple trial platforms and EHR systems. Reliability and stability are critical for handling large-scale, multi-site trial operations.

The Smartphone segment is anticipated to grow at the fastest CAGR of 23.5% from 2025 to 2032, fueled by the adoption of mobile-compatible eCOA solutions, patient engagement applications, and remote monitoring tools. Smartphones provide real-time trial updates, improve patient adherence, and enable clinicians, monitors, and sponsors to access data anytime, anywhere. Mobile accessibility enhances decentralized and hybrid trial models. Integration with cloud platforms and wearable devices supports continuous data collection. The increasing need for flexible, patient-centric trial management accelerates adoption of smartphone-based solutions. Smartphones also reduce delays in data reporting and monitoring, enhancing operational efficiency.

- By End User

On the basis of end user, the e-Clinical solutions market is segmented into pharmaceutical and biopharmaceutical companies, contract research organizations (CROs), consulting service companies, medical device manufacturers, hospitals, and academic research institutes. The pharmaceutical and biopharmaceutical companies segment dominated with a market share of 51.8% in 2024, driven by the adoption of e-Clinical platforms to manage complex, multi-site trials, ensure regulatory compliance, and accelerate drug development timelines. Large pharmaceutical companies rely on these solutions for integrated trial management, real-time data access, and standardized workflows to reduce errors and improve efficiency.

The CROs segment is expected to witness the fastest CAGR of 21.9% from 2025 to 2032, fueled by the growing trend of outsourcing clinical trial operations and the need for cost-effective, efficient trial management. CROs use e-Clinical platforms to manage multiple client trials, streamline workflows, optimize resources, and ensure accurate reporting across global studies. Real-time access to data, centralized monitoring, and improved collaboration among stakeholders enhance trial efficiency. Increasing adoption of decentralized trials and hybrid models accelerates growth. The segment also benefits from technological innovations such as AI-based analytics and mobile monitoring solutions.

E-Clinical Solutions Market Regional Analysis

- North America dominated the e-clinical solutions market with the largest revenue share of 49.38% in 2024, supported by a robust healthcare infrastructure, well-established pharmaceutical and biotechnology industries, and favorable regulatory frameworks encouraging digital adoption

- This dominance is particularly driven by advanced adoption in the U.S., fueled by increasing implementation of electronic data capture systems, clinical trial management platforms, and analytics-driven solutions

- The region’s emphasis on regulatory compliance, patient safety, and operational efficiency continues to drive widespread adoption of e-Clinical platforms across hospitals, CROs, and research institutes

U.S. E-Clinical Solutions Market Insight

The U.S. e-clinical solutions market captured the largest revenue share within North America, driven by high adoption of digital clinical trial solutions, increasing outsourcing of trial operations, and strong investment in clinical research infrastructure. Advanced technologies such as cloud-based platforms, electronic clinical outcome assessment (eCOA) tools, and integrated trial management systems are enabling faster patient recruitment, efficient data management, and improved trial transparency. The growing focus on decentralized and hybrid trials further propels the adoption of comprehensive e-Clinical solutions across pharmaceutical and biotechnology companies.

Europe E-Clinical Solutions Market Insight

The Europe e-clinical solutions market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing outsourcing of clinical trial operations, regulatory support for digital health technologies, and the adoption of advanced trial management systems. Countries such as Germany, France, and the U.K. are witnessing significant growth due to strong pharmaceutical R&D ecosystems, increasing trial complexity, and the need for integrated, real-time trial management solutions. European stakeholders are leveraging cloud-based, analytics-driven, and mobile-compatible e-Clinical platforms to enhance operational efficiency and ensure compliance across multi-site studies.

U.K. E-Clinical Solutions Market Insight

The U.K. e-clinical solutions market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s strong clinical research infrastructure and increasing adoption of digital trial platforms. Sponsors and CROs are investing in integrated e-Clinical solutions to streamline patient monitoring, manage trial data centrally, and accelerate drug development processes. In addition, the rise in decentralized and hybrid trial models is encouraging the adoption of cloud-based and mobile-accessible systems, supporting real-time decision-making and efficient trial oversight.

Germany E-Clinical Solutions Market Insight

The Germany e-clinical solutions market is expected to expand at a considerable CAGR during the forecast period, fueled by growing clinical trial activity, high regulatory standards, and increasing adoption of advanced digital platforms. Germany’s strong pharmaceutical and biotechnology sectors, coupled with its focus on innovation and data integrity, promote the use of comprehensive e-Clinical solutions, including electronic data capture, clinical trial management systems, and integrated analytics platforms. The region is witnessing robust growth across academic research institutes, CROs, and pharmaceutical organizations.

Asia-Pacific E-Clinical Solutions Market Insight

The Asia-Pacific e-clinical solutions market is poised to grow at a strong CAGR of 11.8% during the forecast period, driven by the increasing outsourcing of clinical trials, expanding healthcare and R&D infrastructure, and rising trial activity in countries such as China, India, Japan, and South Korea. The region is witnessing growing demand for cloud-based trial management systems, analytics platforms, and mobile-compatible e-Clinical solutions to support decentralized studies, optimize patient recruitment, and enhance data collection. Increasing investments by pharmaceutical and biotechnology companies in APAC are further supporting the adoption of advanced e-Clinical technologies.

Japan E-Clinical Solutions Market Insight

The Japan e-clinical solutions market is gaining momentum due to the country’s advanced healthcare infrastructure, high-quality clinical research standards, and increasing use of technology-driven trial solutions. Sponsors and CROs are leveraging integrated trial management platforms, eCOA tools, and cloud-based systems to improve patient monitoring, enhance trial efficiency, and ensure regulatory compliance. The growing focus on precision medicine and complex clinical studies is further accelerating market growth.

China E-Clinical Solutions Market Insight

he China e-clinical solutions market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding clinical trial activities, robust pharmaceutical R&D investment, and increasing regulatory support for digital health technologies. China is witnessing rapid adoption of electronic data capture systems, clinical trial management solutions, and real-time analytics platforms to support multi-center trials, improve patient recruitment, and streamline trial operations. Government initiatives promoting digitalization in healthcare and life sciences further strengthen market expansion in the region.

E-Clinical Solutions Market Share

The e-Clinical Solutions industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- Signant Health (U.S.)

- MaxisIT (U.S.)

- Parexel International Corporation (U.S.)

- Dassault Systèmes (France)

- Clario (U.S.)

- Mednet (U.S.)

- OpenClinica, LLC (U.S.)

- 4G Clinical (U.S.)

- Veeva Systems (U.S.)

- Saama Technologies, LLC (U.S.)

- Anju (U.S.)

- Castor (Netherlands)

- Medrio, Inc. (U.S.)

- ArisGlobal (U.S.)

- Merative (U.S.)

- Advarra (U.S.)

- eClinical Solutions, LLC (U.S.)

- Y-Prime LLC (U.S.)

- RealTime Software Solutions LLC (U.S.)

- Quretec (Estonia)

- Research Manager (Netherlands)

- Datatrack Int. (Netherlands)

- IQVIA Inc. (U.S.)

Latest Developments in Global E-Clinical Solutions Market

- In December 2021, Oracle Corporation announced its acquisition of Cerner Corporation, a leading provider of electronic health record (EHR) systems, for approximately $28.3 billion in cash. This strategic move aimed to enhance Oracle's presence in the healthcare sector and accelerate digital transformation in clinical settings

- In July 2025, eClinicalWorks, a prominent ambulatory cloud EHR provider, became an active participant in the Centers for Medicare & Medicaid Services (CMS) Digital Health Tech Ecosystem. This initiative, announced by top health officials at the White House, focuses on promoting seamless healthcare data sharing and establishing new industry interoperability standards

- In August 2023, OceanMD, a cloud-based platform offering patient engagement and clinical workflow solutions, signed a $38.5 million contract with British Columbia's Provincial Health Services Authority. The agreement aimed to provide digital services such as eReferrals, eConsults, and eOrders, enhancing healthcare delivery across the province

- In March 2025, the European Union's Regulation (EU) 2025/327, establishing the European Health Data Space, entered into force. This regulation aimed to provide EU citizens with better control over their personal health data and to enhance the interoperability of electronic health records across member states

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.