Global E Axle Market

Market Size in USD Million

CAGR :

%

USD

13,354.00 Million

USD

63,000.00 Million

2022

2030

USD

13,354.00 Million

USD

63,000.00 Million

2022

2030

| 2023 –2030 | |

| USD 13,354.00 Million | |

| USD 63,000.00 Million | |

|

|

|

|

Global E-Axle Market Analysis and Size

E-axles are designed for seamless integration into the vehicle's drivetrain. They often replace or augment traditional internal combustion engine components, such as the transmission and differential.

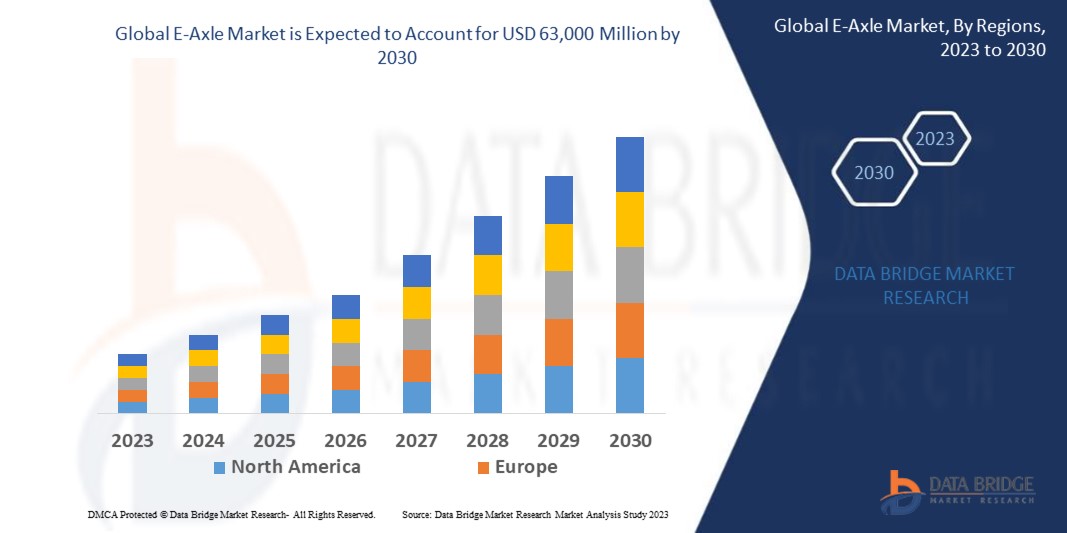

Data Bridge Market Research analyses that the global E-Axle market which was USD 13,354 million in 2022, is expected to reach USD 63,000 million by 2030, and is expected to undergo a CAGR of 21.4% during the forecast period 2023-2030. The “passenger vehicle” dominates the vehicle type segment of the global E-Axle market because more people are purchasing cars, which are growing more and more popular in both developed and developing countries. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

E-Axle Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Drive Type (Forward Wheel Drive, Rear Wheel Drive, All-wheel Drive), Component (Combining Motors, Power Electronics, Transmission, Others), Vehicle Type (Passenger Vehicle, Commercial vehicle, Electric Vehicle) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

AxleTech International LLC (U.S.), BorgWarner Inc.(U.S.), Continental AG (Germany), Dana Limited. (U.S.), GKN (U.K.), Schaeffler AG (Germany), Robert Bosch GmbH (Germany), NIDEC CORPORATION (Japan), ZF Friedrichshafen AG (Germany), AVL (Austria), Linamar Corporation (Canada), Magna International Inc.(Canada), Loccioni (Italy), Meritor Inc. (Canada), and Automotive Axles Limited (India) |

|

Market Opportunities |

|

Market Definition

E-Axle refers to the electric axles, which are a key component in electric and hybrid vehicles. E-Axles are integrated systems that combine the electric motor, power electronics, and sometimes the gearbox into a single unit. These axles are used in various types of electric vehicles, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). They play a crucial role in providing propulsion and improving the efficiency of electric vehicles.

Global E-Axle Market Dynamics

Drivers

- Increasing Demand of Electric Vehicle

As more consumers and businesses transition to electric vehicles to reduce their carbon footprint and lower operating costs, the demand for E-axles has surged. Many automakers are expanding their electric vehicle portfolios, leading to a higher need for E-axles.

Opportunities

- Growing Adoption of Self-Driving Vehicles

Self-driving or autonomous vehicles are becoming more prevalent in various transportation sectors, including ride-sharing and delivery services. These vehicles rely on advanced electric powertrains, including E-axles, to operate efficiently and safely. As the demand for autonomous vehicles increases, so does the need for reliable and high-performance E-axle systems. This trend presents a substantial growth opportunity for the E-axle market, as manufacturers seek to supply the components needed for this emerging technology.

- Increasing Adoption of Battery-Powered Trucks and Buses

The push for sustainability and stricter emissions regulations has led to a significant shift towards electric-powered commercial vehicles, such as trucks and buses. E-axles play a crucial role in these heavy-duty applications, providing the necessary torque and power distribution for efficient and eco-friendly operations. The rising adoption of battery-powered trucks and buses worldwide creates a substantial market for E-axle manufacturers to cater to the unique needs of these vehicles.

Restraints/ Challenges

- High Cost Associated with Electric Vehicle

The high cost of electric vehicle (EV) components, particularly E-axles, is a significant impediment to the growth of the global E-axle market. This cost challenge limits the affordability of EVs and hinders their mass adoption, which in turn affects the demand for E-axle systems. Reducing the cost of E-axles will be crucial for overcoming this resistance and promoting widespread EV adoption.

- Variations in Raw Materials

the price volatility of raw materials like copper, steel, and aluminum is a critical challenge faced by automobile axle manufacturers. It can impact production costs, profit margins, supply chain stability, and overall competitiveness.

This global E-Axle market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global E-Axle market Contact the Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In May 2023, ZF launched AxTrax 2 electric axle platform. This launch helped and supported the industry’s transformation to become more sustainable in the future

- In May 2019, Dana Incorporated provided driveline innovations to General Motors Vehicle in South and North America, including Spicer prop shafts and rear and front Spicer AdvanTEK axles

Global E-Axle Market Scope

The global E-Axle market is segmented on the basis of drive type, vehicle type, and component. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Drive Type

- Forward Wheel Drive

- Rear Wheel Drive

- All-wheel Drive

Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

Component

- Combining Motors

- Power Electronics

- Transmission

- Others

Global E-Axle Market Analysis/Insights

The global E-Axle market is analyzed and market size insights and trends are provided by drive type, vehicle type, and component as referenced above.

The regions covered in the global E-Axle market are North America, South America, Europe, Asia-Pacific, and the Middle East and Africa. The countries covered in the global E-Axle market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa.

The Asia Pacific dominates the global E-Axle market due developing nations like India and China to reduse carbon footprint demand of electric vehicles increase, as well as developed nations such as Japan and South Korea, are likely to support the region in sustaining its supremacy during the course of the anticipated era. Europe was one of the first continents to embrace electric cars. The production of conventional fuel vehicles has also been steadily rising in the area recently.

The region section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Global E-Axle Market Share Analysis

The global E-Axle market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to global E-Axle market.

Some of the major players operating in the global E-Axle market are:

- AxleTech International LLC (U.S.)

- BorgWarner Inc.(U.S.)

- Continental AG (Germany)

- Dana Limited. (U.S.)

- GKN (U.K.)

- Schaeffler AG (Germany)

- Robert Bosch GmbH (Germany)

- NIDEC CORPORATION (Japan)

- ZF Friedrichshafen AG (Germany)

- AVL (Austria)

- Linamar Corporation (Canada)

- Magna International Inc. (Canada)

- Loccioni (Italy)

- Meritor Inc. (Canada)

- Automotive Axles Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.