Global Drug Discovery Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

4.03 Billion

USD

7.88 Billion

2024

2032

USD

4.03 Billion

USD

7.88 Billion

2024

2032

| 2025 –2032 | |

| USD 4.03 Billion | |

| USD 7.88 Billion | |

|

|

|

|

Drug Discovery Outsourcing Market Size

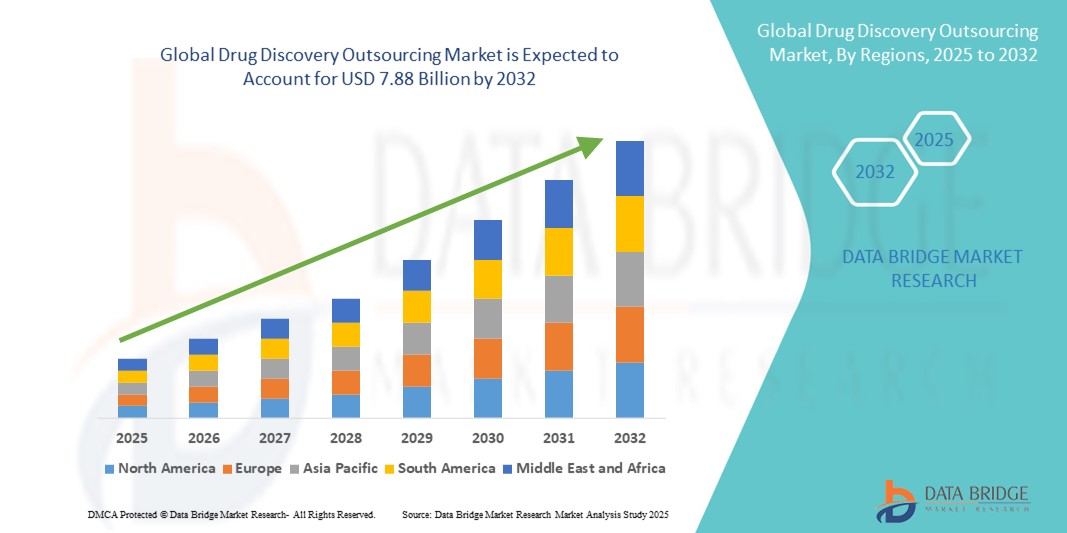

- The global drug discovery outsourcing market size was valued at USD 4.03 billion in 2024 and is expected to reach USD 7.88 billion by 2032, at a CAGR of 8.75% during the forecast period

- The market growth is primarily driven by the increasing demand for cost-effective and efficient research and development solutions in the pharmaceutical and biotechnology sectors, prompting companies to outsource drug discovery processes

- In addition, advancements in high-throughput screening, computational drug design, and bioinformatics are enhancing the capabilities of contract research organizations (CROs), making drug discovery outsourcing an attractive option for accelerating drug development timelines and reducing operational costs

Drug Discovery Outsourcing Market Analysis

- Drug Discovery Outsourcing, involving the delegation of research and development activities to external specialized service providers, is increasingly critical for pharmaceutical and biotechnology companies aiming to accelerate drug development timelines, reduce costs, and access cutting-edge technologies

- The rising demand for drug discovery outsourcing is primarily driven by the growing complexity of drug development, increasing R&D expenditure, and the need for efficient resource allocation by pharmaceutical companies worldwide

- North America dominated the drug discovery outsourcing market with the largest revenue share of 42% in 2024, characterized by the presence of numerous pharmaceutical giants, advanced research infrastructure, and a strong regulatory framework supporting clinical trials and research collaborations. The U.S. witnessed significant growth due to substantial investments in biopharmaceutical innovation and outsourcing partnerships

- Asia-Pacific is expected to be the fastest-growing region in the drug discovery outsourcing market during the forecast period, driven by rapid urbanization, rising disposable incomes, government support for biotechnology, and the expanding CRO (Contract Research Organization) landscape in countries such as China, India, and Japan

- The Small Molecules segment dominated the drug discovery outsourcing market with a revenue share of 62.7% in 2024, largely due to their established role in conventional drug development processes and their widespread use across multiple therapeutic areas

Report Scope and Drug Discovery Outsourcing Market Segmentation

|

Attributes |

Drug Discovery Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drug Discovery Outsourcing Market Trends

Growing Importance of Advanced Computational Tools and Collaborative Platforms

- A significant and accelerating trend in the global drug discovery outsourcing market is the increasing adoption of advanced computational tools, including bioinformatics, molecular modeling, and high-throughput screening platforms. These technologies are significantly enhancing the efficiency and accuracy of drug discovery processes

- For instance, companies are leveraging cloud-based collaborative platforms that enable seamless data sharing and integration between pharmaceutical companies and contract research organizations (CROs). This facilitates faster decision-making and accelerates drug candidate identification

- Advanced analytics and machine learning models are increasingly employed to predict drug-target interactions, optimize lead compounds, and minimize trial-and-error experiments, thereby reducing time and costs associated with early drug discovery phase

- The growing trend towards integrated outsourcing services, which combine target identification, screening, validation, and preclinical development under one roof, is helping pharma companies streamline operations and improve productivity

- These technological and collaborative advancements are reshaping expectations for drug discovery efficiency and quality, driving innovation within outsourcing service providers. Consequently, companies such as Thermo Fisher Scientific and Charles River Laboratories are expanding their service portfolios with cutting-edge computational and lab automation capabilities

- The demand for comprehensive, technology-driven, and scalable drug discovery outsourcing solutions is rising rapidly across pharmaceutical and biotechnology sectors, as organizations aim to accelerate pipeline development and reduce R&D expenditure

Drug Discovery Outsourcing Market Dynamics

Driver

Growing Need Due to Increasing Demand for Cost-Effective and Efficient Drug Development Solutions

- The escalating demand for faster, more cost-effective drug development processes among pharmaceutical and biotechnology companies is a primary driver fueling the growth of the Drug Discovery Outsourcing market

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced advancements in IoT-based self-storage security technologies, reflecting how leading companies are embracing innovative solutions to enhance operational efficiency—similar trends are expected to boost investments and collaborations in the drug discovery outsourcing sector

- Pharmaceutical firms are increasingly outsourcing key components of drug discovery, such as target identification, screening, and preclinical testing, to external service providers to reduce costs, mitigate risks, and accelerate time-to-market

- Furthermore, rising R&D costs, stringent regulatory requirements, and the complexity of novel drug candidates are driving companies to seek specialized expertise and advanced technological platforms available through outsourcing

- The growing prevalence of complex diseases and precision medicine also necessitates sophisticated discovery platforms, thereby propelling demand for outsourced services in genomics, proteomics, and bioinformatics. These factors combined with the trend towards strategic partnerships and collaborations are significantly contributing to the market’s expansion

Restraint/Challenge

Concerns Regarding Regulatory Compliance and High Initial Investment Costs

- The drug discovery outsourcing market faces challenges related to stringent regulatory requirements and compliance complexities, which can delay project timelines and increase operational costs for service providers and their clients

- For instance, varying regulatory frameworks across regions impose additional hurdles on outsourced drug discovery projects, requiring extensive documentation and validation that can slow development processes

- Ensuring data security and intellectual property protection remains a critical concern for pharmaceutical companies when outsourcing discovery activities, leading to cautious adoption in some cases

- In addition, the high initial investment needed for setting up state-of-the-art facilities, advanced technologies, and skilled workforce by outsourcing providers can act as a barrier, particularly for smaller players

- While technological advancements and process optimizations are helping to reduce costs over time, the perceived premium associated with high-quality, specialized outsourcing services may limit widespread adoption in price-sensitive markets

- Addressing these challenges through improved regulatory harmonization, robust data protection protocols, and cost-effective service models will be essential to sustaining long-term growth in the drug discovery outsourcing market

Drug Discovery Outsourcing Market Scope

The market is segmented on the basis of drug type, work flow and therapeutic area.

- By Drug Type

On the basis of drug type, the global drug discovery outsourcing market is segmented into small molecules and large molecules. The small molecules segment held the largest market revenue share of 62.7% in 2024, largely due to their established role in conventional drug development processes and their widespread use across multiple therapeutic areas. Small molecules benefit from well-understood chemistry, scalable manufacturing, and lower development costs, making them a preferred choice for many pharmaceutical companies.

In contrast, the large molecules segment is anticipated to witness the fastest CAGR of 12.4% between 2025 and 2032. This rapid growth is driven by the increasing focus on biologics and biosimilars, which are gaining prominence due to their targeted therapeutic benefits and growing demand in treating complex diseases such as cancer, autoimmune disorders, and rare diseases.

- By Workflow

On the basis of workflow, the global drug discovery outsourcing market is segmented into target identification and screening, target validation and functional informatics, lead identification and candidate optimization, preclinical development, and others. The target identification and screening segment accounted for the largest revenue share of 29.5% in 2024, reflecting its critical role as the foundational step in drug discovery where potential drug candidates are first identified through advanced screening technologies. This segment benefits from technological innovations such as high-throughput screening and bioinformatics tools that improve accuracy and reduce time to identify viable targets.

The lead identification and candidate optimization segment is projected to record the fastest CAGR of 11.7% during the forecast period, driven by the industry's emphasis on improving drug efficacy and safety profiles early in development to reduce late-stage failures and accelerate time-to-market.

- By Therapeutic Area

On the basis of therapeutic area, the global drug discovery outsourcing market is segmented into respiratory system, pain and anaesthesia, oncology, ophthalmology, haematology, cardiovascular, endocrine, gastrointestinal, immunomodulation, anti-infective, central nervous system, dermatology, and genitourinary system. Oncology emerged as the leading therapeutic segment with a revenue share of 23.4% in 2024, propelled by the rising global cancer burden and increased investment in oncology research and novel therapies. The segment is expected to sustain strong growth with a CAGR of 10.5% from 2025 to 2032, as pharmaceutical companies focus on developing precision medicines and immunotherapies.

The central nervous system segment is forecasted to grow rapidly at a CAGR of 11.2%, supported by increasing prevalence of neurological disorders and the ongoing need for innovative treatments addressing diseases such as Alzheimer's, Parkinson’s, and multiple sclerosis.

Drug Discovery Outsourcing Market Regional Analysis

- North America dominated the drug discovery outsourcing market with the largest revenue share of 42% in 2024, driven by a robust pharmaceutical industry presence, high R&D expenditure, and growing demand for cost-effective and efficient drug development processes

- The region benefits from advanced healthcare infrastructure, availability of skilled scientific talent, and a strong focus on innovation and biopharmaceutical collaborations, further propelling market growth

- This widespread adoption is supported by favorable government policies, strategic partnerships, and increased investment in outsourced drug discovery services to accelerate the drug development pipeline and reduce operational costs

U.S. Drug Discovery Outsourcing Market Insight

The U.S. drug discovery outsourcing market captured the largest revenue share of 54% within North America in 2024, fueled by substantial investments in biotechnology research, a large number of clinical trials, and the presence of numerous contract research organizations (CROs) offering comprehensive drug discovery services. Pharmaceutical companies are increasingly leveraging outsourcing to enhance operational efficiency and focus on core competencies. Furthermore, the U.S. market is witnessing rapid adoption of cutting-edge technologies, such as high-throughput screening, genomics, and bioinformatics, which are driving growth in outsourced drug discovery.

Europe Drug Discovery Outsourcing Market Insight

The Europe drug discovery outsourcing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong pharmaceutical and biotech sectors in countries like Germany, France, and the U.K. Increasing R&D investments, coupled with stringent regulatory requirements and the need for specialized expertise, are encouraging companies to outsource drug discovery processes. The region also benefits from government initiatives promoting innovation and collaboration among academia, industry, and contract service providers.

U.K. Drug Discovery Outsourcing Market Insight

The U.K. drug discovery outsourcing market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s robust life sciences ecosystem and strong government support for pharmaceutical R&D. The demand for precision medicine and biologics has led to an increase in outsourcing activities focused on genomics and proteomics research. Additionally, Brexit-related regulatory changes have prompted companies to seek efficient outsourcing partners to navigate the evolving landscape.

Germany Drug Discovery Outsourcing Market Insight

The Germany drug discovery outsourcing market is expected to expand at a considerable CAGR during the forecast period, driven by the country's emphasis on innovation, advanced research infrastructure, and strong pharmaceutical industry. The demand for sustainable and eco-friendly drug development processes, combined with Germany's strategic location in Europe, makes it a preferred outsourcing hub. Integration of digital technologies and AI in drug discovery is further accelerating market growth.

Asia-Pacific Drug Discovery Outsourcing Market Insight

The Asia-Pacific drug discovery outsourcing market is poised to grow at the fastest CAGR of 24% during the forecast period from 2025 to 2032, propelled by rising investments in healthcare infrastructure, expanding pharmaceutical manufacturing capabilities, and supportive government policies in countries such as China, India, and Japan. The region offers cost advantages, access to a large patient pool for clinical research, and a growing talent base, making it an attractive destination for outsourcing drug discovery activities.

Japan Drug Discovery Outsourcing Market Insight

The Japan drug discovery outsourcing market is gaining momentum due to the country’s advanced technological capabilities, well-established pharmaceutical sector, and increasing demand for novel therapeutics. The aging population and focus on personalized medicine are driving demand for innovative drug discovery services. Collaboration between local research institutes and global pharma companies further boosts outsourcing growth.

China Drug Discovery Outsourcing Market Insight

The China drug discovery outsourcing market accounted for the largest revenue share in the Asia-Pacific region in 2024, attributed to rapid urbanization, government initiatives supporting biopharmaceutical innovation, and a growing domestic pharmaceutical industry. China’s emphasis on expanding its R&D ecosystem and improving regulatory frameworks is attracting global outsourcing investments. The availability of cost-effective services and advanced technology platforms is facilitating the expansion of the drug discovery outsourcing market across residential, commercial, and institutional sectors.

Drug Discovery Outsourcing Market Share

The drug discovery outsourcing industry is primarily led by well-established companies, including:

- Charles River Laboratories (U.S.)

- Albany Molecular Research Inc. (U.S.)

- Thermo Fisher Scientific (U.S.)

- Jubilant Biosys (India)

- Eurofins Scientific (Luxembourg)

- GVK Biosciences Private Limited (India)

- Aurigene Pharmaceutical Services Ltd. (India)

- Selvita (Poland)

- Dalton Pharma Services (Canada)

- QIAGEN (Netherlands)

- Syngene International Limited (India)

- SRI INTERNATIONAL (U.S.)

- Merck KGaA (Germany)

- Covance Inc. (U.S.)

- Nanosyn (U.S.)

- Bioduro (China)

- Sygnature Discovery (U.K.)

- Laboratory Corporation of America Holdings (U.S.)

- Domainnex (U.K.)

- GenScript (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.