Global Drug Discovery Informatics Market

Market Size in USD Billion

CAGR :

%

USD

3.47 Billion

USD

8.46 Billion

2024

2032

USD

3.47 Billion

USD

8.46 Billion

2024

2032

| 2025 –2032 | |

| USD 3.47 Billion | |

| USD 8.46 Billion | |

|

|

|

|

Drug Discovery Informatics Market Size

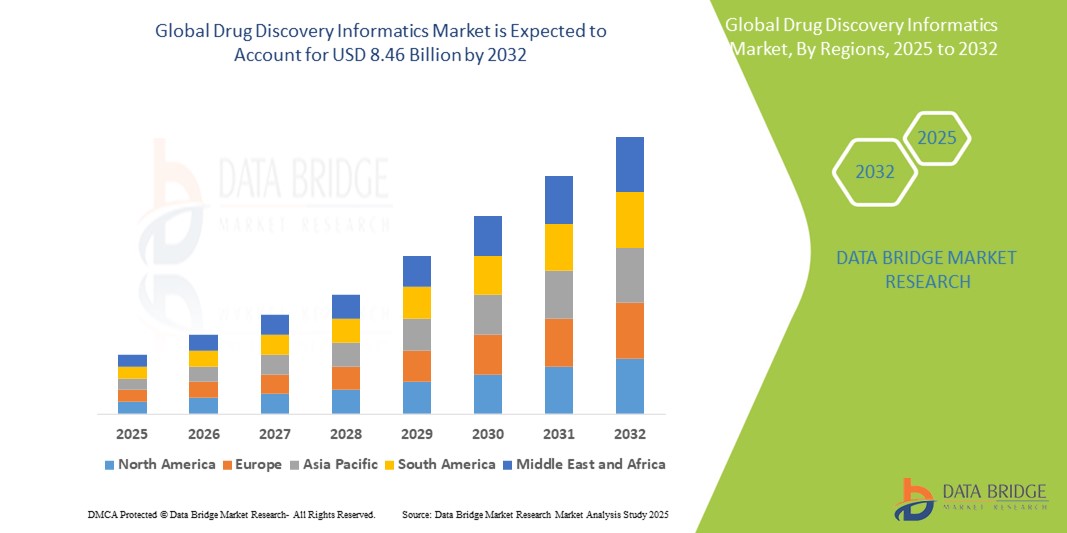

- The global drug discovery informatics market size was valued at USD 3.47 billion in 2024 and is expected to reach USD 8.46 billion by 2032, at a CAGR of 11.77% during the forecast period

- Market expansion is largely driven by increased investments in R&D, the rising application of AI and machine learning in drug development, and the growing demand for personalized medicine

- In addition, the need for faster, cost-effective, and efficient drug development processes is prompting pharmaceutical and biotech companies to adopt advanced informatics platforms, significantly fueling industry growth

Drug Discovery Informatics Market Analysis

- Drug Discovery Informatics refers to the use of computational tools and platforms to manage, analyze, and visualize biological and chemical data to accelerate drug discovery and development workflows

- The demand for these solutions is driven by the growing volume of biological data, the complexity of drug targets, and the necessity for better decision-making tools across early-stage drug development

- The increasing integration of cloud computing, AI, and big data analytics is transforming the landscape by enabling real-time collaboration, predictive modeling, and automation of repetitive tasks, resulting in enhanced R&D efficiency and reduced time-to-market for new drugs

- North America dominates the drug discovery informatics market with the largest revenue share of 43.5% in 2024, driven by strong investments in pharmaceutical R&D, early adoption of advanced analytics, and a robust presence of biotechnology and pharmaceutical companies

- Asia-Pacific drug discovery informatics market is expected to grow at the fastest CAGR of 15.6% during 2025–2032, driven by increasing R&D investments, favorable government policies, and rising adoption of AI-driven platforms in drug development

- The Sequencing and Target Data Analysis segment dominated the market in 2024 with the largest market revenue share of 34.6%, owing to the increasing reliance on genomics and proteomics for identifying novel drug targets

Report Scope and Drug Discovery Informatics Market Segmentation

|

Attributes |

Drug Discovery Informatics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drug Discovery Informatics Market Trends

“Accelerated Innovation through AI Integration and Cloud-Based Platforms”

- A major trend in the global drug discovery informatics market is the increasing adoption of artificial intelligence (AI) and cloud computing to accelerate drug discovery processes and enhance predictive analytics. These technologies help researchers identify novel drug candidates faster and more accurately by analyzing vast datasets from genomic, proteomic, and clinical studies

- AI algorithms are being used to predict molecular behavior, optimize compound screening, and even repurpose existing drugs. For instance, Atomwise uses AI-based deep learning models to predict molecule-target binding, thereby streamlining the hit-to-lead process in pharmaceutical R&D

- Cloud-based platforms are enabling real-time collaboration among global research teams by offering scalable data storage and advanced analytical tools. Companies such as Schrödinger and BenevolentAI provide platforms that allow teams to perform complex simulations and bioinformatics modeling from anywhere, eliminating infrastructure bottlenecks

- The fusion of AI and cloud platforms is also improving data integration across various research stages, including target identification, lead optimization, and preclinical trials. This shortens the drug development lifecycle and reduces R&D costs

- As pharmaceutical and biotech firms continue to invest heavily in digital transformation, the demand for AI-enabled and cloud-integrated drug discovery informatics solutions is expected to surge. This trend is reshaping the landscape of pharmaceutical research by making it faster, more data-driven, and more collaborative

Drug Discovery Informatics Market Dynamics

Driver

“Rising R&D Expenditures and Growing Focus on Precision Medicine”

- The rising R&D investments by pharmaceutical and biotechnology companies, along with the increasing shift toward precision medicine, are key drivers of the Drug Discovery Informatics market. As companies aim to discover safer and more effective drugs tailored to individual patient profiles, informatics tools become critical to manage and analyze the complex biological data involved

- For instance, in January 2024, AstraZeneca announced a multi-million dollar partnership with Illumina to integrate genomic data into drug development processes using advanced informatics platforms. This move underlines the growing reliance on informatics tools for personalized drug discovery

- Drug discovery informatics solutions facilitate high-throughput screening, molecular modeling, and predictive analytics, thereby significantly accelerating the development of new therapeutic agents. These platforms support data-driven decision-making by providing researchers with insights across the drug development value chain

- As precision medicine becomes more prevalent, the need for integrated informatics platforms that can handle large-scale multi-omic data and deliver actionable insights is increasing, especially in oncology, neurology, and rare diseases

- This rising demand for personalized treatments and efficient R&D processes will continue to propel the growth of the drug discovery informatics market over the forecast period

Restraint/Challenge

“Data Security Concerns and High Implementation Costs”

- Despite its advantages, the adoption of drug discovery informatics platforms is hindered by data security concerns and the high initial cost of implementation, particularly for small- and medium-sized biotech firms. Handling sensitive genomic and clinical data requires robust cybersecurity protocols to ensure compliance with data privacy regulations such as HIPAA and GDPR

- For instance, in 2022, a prominent biotech firm reported a data breach involving unauthorized access to preclinical trial data, raising concerns about the vulnerability of cloud-based informatics platforms. Such incidents have led to increased scrutiny of data governance practices in drug discovery systems

- Furthermore, the cost of deploying enterprise-scale informatics infrastructure—including software licenses, cloud subscriptions, and staff training—can be prohibitive. Startups and academic institutions often struggle with these costs, which slows down their adoption of advanced informatics tools

- Overcoming these challenges will require stronger data protection mechanisms, flexible pricing models, and greater regulatory clarity. Vendors who can offer scalable, secure, and affordable solutions will be better positioned to capitalize on the growing demand

- Addressing these barriers through public-private partnerships, investment in IT infrastructure, and broader awareness around cybersecurity best practices will be essential for sustained market expansion

Drug Discovery Informatics Market Scope

The market is segmented on the basis of function, solutions, technique, mode, and end user.

By Function

On the basis of function, the drug discovery informatics market is segmented into Sequencing and Target Data Analysis, Docking, Molecular Modeling, Library and Database Preparation, and Others. The Sequencing and Target Data Analysis segment dominated the market in 2024 with the largest market revenue share of 34.6%, owing to the increasing reliance on genomics and proteomics for identifying novel drug targets. This function plays a crucial role in understanding disease mechanisms and designing targeted therapies.

The Molecular Modeling segment is projected to witness the fastest CAGR from 2025 to 2032, driven by growing applications in computational drug design and simulation of drug-receptor interactions, which significantly reduce the time and cost of early-stage drug discovery.

• By Solutions

On the basis of solutions, the market is segmented into Software and Services. The Software segment dominated in 2024, accounting for the largest market share of 58.9%, due to the increasing adoption of AI-enabled and cloud-based software platforms by pharmaceutical companies for predictive analytics and virtual screening.

The Services segment is expected to register the fastest growth from 2025 to 2032, driven by the rise in outsourced research services, including custom informatics and data analysis, which allow companies to reduce operational burden and gain specialized expertise.

• By Technique

On the basis of technique, the market is segmented into drug discovery and drug development. The Drug Discovery segment led the market in 2024, contributing the largest share of 61.2%, supported by the early adoption of informatics tools to identify active compounds and optimize hits during the initial stages of R&D.

The Drug Development segment is projected to grow at the fastest rate from 2025 to 2032, as companies seek to leverage informatics for streamlining clinical trials, biomarker discovery, and toxicity prediction.

• By Mode

On the basis of mode, the market is divided into In-House Informatics and Outsourced Informatics. The In-House Informatics segment held the largest revenue share of 64.5% in 2024, driven by large pharmaceutical companies investing in proprietary informatics platforms for maintaining data security and gaining complete control over research processes.

The Outsourced Informatics segment is expected to experience the highest CAGR from 2025 to 2032, due to the increasing cost-effectiveness, flexibility, and scalability offered by contract research organizations (CROs) and specialized informatics service providers.

• By End User

On the basis of end user, the market is segmented into Pharmaceutical and Biotechnology Companies, Contract Research Organizations (CROs), and Others. The Pharmaceutical and Biotechnology Companies segment accounted for the largest market share of 68.3% in 2024, attributed to their significant R&D investments, growing pipelines, and need for efficient tools to enhance productivity.

The Contract Research Organizations (CROs) segment is expected to register the fastest growth rate between 2025 and 2032, as more pharma firms outsource drug discovery informatics functions to reduce cost and gain rapid access to specialized technologies and expertise.

Drug Discovery Informatics Market Regional Analysis

- North America dominates the drug discovery informatics market with the largest revenue share of 43.5% in 2024, driven by strong investments in pharmaceutical R&D, early adoption of advanced analytics, and a robust presence of biotechnology and pharmaceutical companies

- The region benefits from well-established infrastructure for digital technologies and a growing focus on precision medicine and AI-integrated drug development workflows

- The presence of key market players, rising demand for cost-effective drug discovery solutions, and government funding for life sciences research continue to support regional market leadership

U.S. Drug Discovery Informatics Market Insight

The U.S. drug discovery informatics market captured the largest revenue share in North America in 2024, owing to significant investments in genomics, AI, and cloud computing within drug discovery platforms. The country’s pharmaceutical giants and leading research institutions heavily rely on drug discovery informatics tools for target identification, molecular modeling, and preclinical trials. Government initiatives such as the NIH’s All of Us Research Program and partnerships with tech companies for AI-driven research further strengthen market momentum.

Europe Drug Discovery Informatics Market Insight

The Europe drug discovery informatics market is projected to expand at a strong CAGR during the forecast period, fueled by regulatory compliance needs, rising demand for efficient drug development pipelines, and the adoption of AI and ML tools in early-stage drug discovery. European Union funding for biomedical innovation and national health systems' focus on precision medicine create a fertile environment for informatics adoption. Countries such as Germany, the U.K., and France are actively adopting advanced bioinformatics and data integration platforms in pharmaceutical R&D.

U.K. Drug Discovery Informatics Market Insight

The U.K. drug discovery informatics market is expected to grow at a noteworthy CAGR, supported by the nation's thriving biotech ecosystem and strong government initiatives such as the Life Sciences Vision 2030 strategy. Pharmaceutical and academic institutions are increasingly adopting computational biology tools and cloud-based solutions for collaborative research. The integration of AI in early-stage drug design and a surge in genomics-based R&D are further propelling market growth in the U.K.

Germany Drug Discovery Informatics Market Insight

The Germany drug discovery informatics market is forecast to expand steadily due to the country’s well-established pharmaceutical industry and focus on high-tech healthcare solutions. Germany’s strong academic research infrastructure and government investments in digital transformation in healthcare are boosting the adoption of drug discovery informatics tools. In addition, the push for data security and integration of informatics in pharmaceutical compliance systems aligns with local market needs.

Asia-Pacific Drug Discovery Informatics Market Insight

The Asia-Pacific drug discovery informatics market is poised to grow at the fastest CAGR of 15.6% during 2025–2032, driven by increasing R&D investments, favorable government policies, and rising adoption of AI-driven platforms in drug development. Countries such as China, India, and Japan are leading the regional growth due to the expansion of pharmaceutical manufacturing and increased outsourcing from Western markets. Initiatives such as “Digital India” and China’s innovation-centric biotech policies are encouraging the deployment of advanced informatics platforms in research and clinical development.

Japan Drug Discovery Informatics Market Insight

The Japan drug discovery informatics market is gaining traction due to its focus on digital health and AI-based drug discovery tools. Japan’s pharmaceutical industry is emphasizing personalized medicine, and there is strong government backing for innovation in biopharmaceuticals and medical technology. The demand for secure, interoperable, and intelligent informatics systems is also rising due to the country’s aging population and precision healthcare initiatives.

China Drug Discovery Informatics Market Insight

The China drug discovery informatics market held the largest revenue share in Asia Pacific in 2024, fueled by a robust pharmaceutical sector, government support for biotech innovation, and the presence of leading local tech and life sciences firms. China's aggressive push for AI and cloud integration in healthcare, combined with its booming biotech startups, is accelerating market penetration. National initiatives such as the Healthy China 2030 Plan further encourage the adoption of digital platforms in life sciences, solidifying China's dominance in the region.

Drug Discovery Informatics Market Share

The drug discovery informatics industry is primarily led by well-established companies, including:

- Jubilant Biosys Ltd. (India)

- IBM (U.S.)

- Infosys Limited (India)

- Eurofins Scientific (Luxembourg)

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer Inc. (U.S.)

- Schrödinger, Inc. (U.S.)

- Dassault Systèmes (France)

- Charles River Laboratories (U.S.)

- Selvita (Poland)

- Certara, USA (U.S.)

- Aragen Life Sciences Ltd. (India)

- Collaborative Drug Discovery Inc. (U.S.)

- OpenEye, Cadence Molecular Sciences (U.S.)

- Albany Molecular Research Inc. (U.S.)

- Accenture (Ireland)

- Cognizant (U.S.)

- Insilico Medicine (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

Latest Developments in Global Drug Discovery Informatics Market

- In February 2023, Insilico Medicine, a clinical-stage end-to-end generative artificial intelligence (AI)-driven drug discovery company, received FDA Orphan Drug Designation for its AI-developed drug aimed at treating idiopathic pulmonary fibrosis, showcasing the transformative potential of AI in addressing rare and unmet medical needs

- In February 2023, Evotec SE expanded its strategic collaboration with Related Sciences, extending their integrated, multi-target drug discovery agreement through 2030, leveraging Evotec’s expertise across the drug development pipeline to accelerate a broad portfolio of innovative therapeutics

- In April 2022, Iktos, a key provider of artificial intelligence solutions for drug design, partnered with Teijin Pharma Limited to advance AI-driven approaches in small molecule drug discovery, emphasizing the growing role of AI in improving drug development speed and therapeutic efficacy

- In January 2022, Shanghai Fosun Pharmaceutical formed a partnership with Insilico Medicine to incorporate AI technologies into its drug discovery and development efforts, reflecting the industry's increasing embrace of AI to enhance pharmaceutical research and streamline the R&D process

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.