Global Drug Device Combination Market

Market Size in USD Billion

CAGR :

%

USD

17.22 Billion

USD

37.46 Billion

2024

2032

USD

17.22 Billion

USD

37.46 Billion

2024

2032

| 2025 –2032 | |

| USD 17.22 Billion | |

| USD 37.46 Billion | |

|

|

|

|

Drug Device Combination Market Size

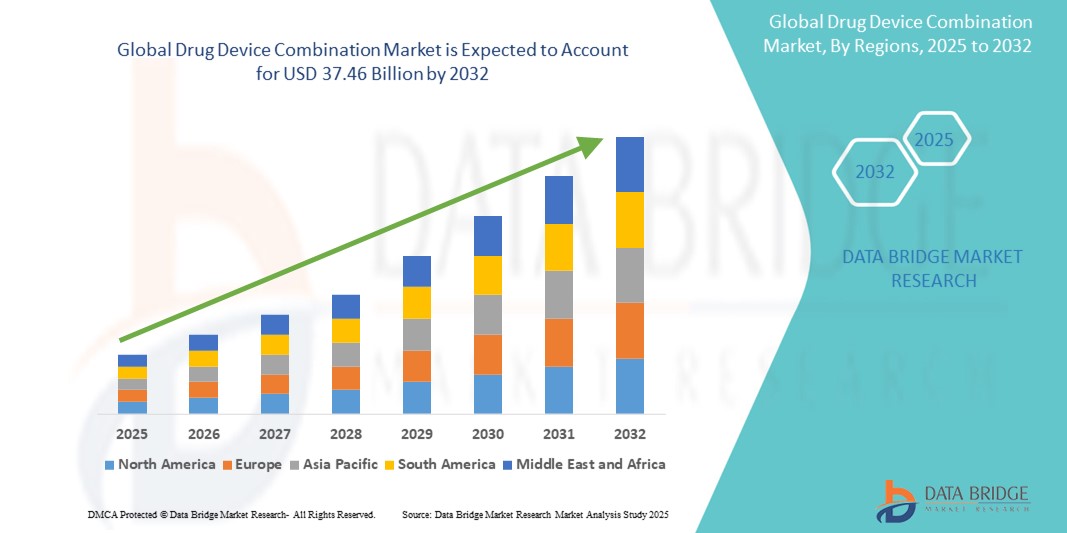

- The global drug device combination market size was valued at USD 17.22 billion in 2024 and is expected to reach USD 37.46 billion by 2032, at a CAGR of 10.20% during the forecast period

- The market expansion is primarily driven by the increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, which demand advanced therapeutic solutions that combine both drug delivery and device technologies for enhanced efficacy and patient compliance

- In addition, technological innovations in targeted delivery systems, minimally invasive devices, and patient-friendly formats such as auto-injectors, drug-eluting stents, and inhalers—are further strengthening adoption. These synergistic developments are reshaping modern treatment paradigms and catalyzing the market's robust growth trajectory

Drug Device Combination Market Analysis

- Drug device combination products, integrating medical devices with pharmaceutical or biologic components, are becoming critical to modern healthcare delivery across therapeutic areas due to their improved treatment efficacy, targeted delivery, and enhanced patient adherence

- The accelerating demand for combination products is primarily fueled by the rising burden of chronic diseases, the shift toward self-administration therapies, and the growing need for precision medicine in managing complex conditions

- North America dominated the drug device combination market with the largest revenue share of 41.36% in 2024, characterized by mature regulatory framework, advanced healthcare infrastructure, and the strong presence of leading pharmaceutical and medtech companies investing heavily in innovation, particularly in areas such as insulin delivery systems, prefilled syringes, and drug-eluting stents

- Asia-Pacific is expected to be the fastest growing region in the drug device combination market during the forecast period due to increasing healthcare expenditure, expanding access to medical devices, and rising awareness of advanced treatment modalities

- Transdermal patches segment dominated the drug device combination market with a market share of 23.6% in 2024, driven by its non-invasive drug delivery, sustained release capabilities, and improved patient compliance for chronic conditions such as pain and hormone therapy

Report Scope and Drug Device Combination Market Segmentation

|

Attributes |

Drug Device Combination Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drug Device Combination Market Trends

“Technological Convergence for Targeted and Patient-Centric Therapies”

- A major and accelerating trend in the global drug device combination market is the integration of advanced delivery technologies with biologics and pharmaceuticals to create highly targeted and patient-friendly therapies, enhancing treatment precision and adherence

- For instance, wearable injectors such as Amgen’s Neulasta Onpro enable patients to receive biologic drugs subcutaneously at home, eliminating the need for clinic visits. Similarly, YpsoMate autoinjectors are increasingly adopted for self-administration of chronic disease medications, offering convenience and ease of use

- These combination products leverage innovations such as micro-needles, smart sensors, and controlled-release mechanisms to optimize drug bioavailability and patient experience. Some smart inhalers now include digital tracking and Bluetooth connectivity, allowing for real-time monitoring of usage patterns and adherence

- The integration of digital health features with drug delivery devices enables remote patient management and personalized therapy adjustments. Devices equipped with sensors can collect data on dosage, timing, and adherence, which can then be analyzed through AI-enabled platforms for more informed clinical decisions

- Companies such as Insulet, Medtronic, and Enable Injections are actively developing next-gen drug device combinations that support minimal invasiveness, connected care, and higher therapeutic effectiveness in areas such as diabetes, oncology, and autoimmune diseases

- The growing demand for combination products that align with value-based healthcare and empower patients with self-administration options is reshaping drug delivery models and fostering widespread adoption across both developed and emerging healthcare systems

Drug Device Combination Market Dynamics

Driver

“Rising Demand for Targeted, Convenient, and Patient-Centric Therapies”

- The growing prevalence of chronic conditions such as diabetes, cancer, and cardiovascular diseases, combined with a shift towards more personalized and efficient healthcare delivery, is significantly driving the demand for drug device combination products

- For instance, in March 2024, Medtronic introduced a next-generation insulin infusion set capable of seven-day wear, aimed at improving patient compliance and reducing the frequency of insertions—an advancement expected to positively influence market growth in the forecast period

- As patients and providers seek more convenient and effective treatment methods, combination products offer superior therapeutic outcomes by integrating precise drug delivery mechanisms with user-friendly designs such as wearable injectors, autoinjectors, and prefilled syringes

- Furthermore, the trend toward self-administration and at-home care is making these products indispensable in chronic disease management, allowing patients to maintain treatment regimens with minimal clinical intervention

- Technological enhancements, including smart features such as dose tracking, digital connectivity, and real-time monitoring, are reinforcing the value of these products in modern healthcare, enabling better adherence and remote therapeutic oversight

- The ongoing innovation by leading industry players, increased regulatory support for combination product approvals, and growing consumer demand for advanced yet accessible treatment solutions continue to propel market expansion across global healthcare systems

Restraint/Challenge

“Skin Irritation Issues and Regulatory Compliance Hurdle”

- Skin irritation and adverse reactions caused by prolonged use of transdermal patches, wearable injectors, or adhesive-based drug device products remain a significant restraint, affecting patient adherence and limiting the usability of certain combination therapies across all demographics

- For instance, some patients using nicotine or hormone replacement patches have reported skin sensitivities or dermatitis, which can necessitate discontinuation or switching to alternative therapies, impacting market retention and product perception

- In addition, the complex and evolving global regulatory landscape for drug device combinations presents a challenge to manufacturers, as these products must comply with both pharmaceutical and medical device regulations, often requiring dual submissions and extended approval timelines

- Regulatory bodies such as the U.S. FDA and EMA demand rigorous evidence of safety, efficacy, and compatibility between the drug and device components, which increases development costs and can delay time-to-market for new products

- Moreover, navigating varying international regulatory standards complicates global market entry and scale-up, particularly for smaller companies or startups with limited resources

- Addressing these challenges through improved biocompatible materials, enhanced patch design, strategic regulatory planning, and early engagement with health authorities will be critical for overcoming product adoption barriers and ensuring long-term market sustainability

Drug Device Combination Market Scope

The market is segmented on the basis of product, application type, end user, and distribution channel.

- By Product

On the basis of product, the drug device combination market is segmented into auto-injectors, infusion pumps, photosensitizers, wound care combination products, transdermal patches, microneedle patches, digital pills, smart inhalers, drug delivery hydrogels, drug-eluting lenses, and others. The transdermal patches segment dominated the market with the largest revenue share of 23.6% in 2024, driven by their ability to provide non-invasive, sustained drug delivery and enhance patient compliance, especially in managing chronic conditions such as pain and hormone-related disorders. Their ease of application and elimination of gastrointestinal side effects have made them a widely accepted form of therapy.

The smart inhalers segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising respiratory disease prevalence and the integration of digital technologies that track inhaler usage and improve adherence. The growing availability of Bluetooth-enabled inhalers that sync with mobile apps for real-time monitoring further drives demand across both developed and emerging healthcare markets.

- By Application Type

On the basis of application type, the market is segmented into orthopedic diseases, respiratory diseases, diabetes, oncology, cardiovascular diseases, and others. The diabetes segment led the market in 2024, driven by the high global burden of diabetes and the widespread use of insulin pens, wearable insulin pumps, and continuous glucose monitoring devices that form integrated therapeutic systems.

The oncology segment is projected to grow at the highest CAGR from 2025 to 2032 due to the increased use of drug-eluting implants and combination therapies aimed at targeted cancer treatment, improving drug efficacy while minimizing systemic side effects.

- By End User

On the basis of end user, the market is categorized into clinics, hospitals, home care settings, ambulatory care centers, and others. The hospitals segment held the largest market share in 2024, owing to their extensive use of infusion pumps, smart delivery systems, and drug-device technologies for acute and chronic treatment across a wide range of therapeutic areas.

The home care settings segment is anticipated to grow at the fastest pace during forecast period, propelled by the growing trend toward home-based care, self-administration, and the adoption of user-friendly, compact, and smart combination products that reduce hospital dependency and improve quality of life.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment accounted for the largest revenue share in 2024, primarily driven by bulk procurement of combination products by hospitals and government health systems through centralized purchasing models.

The retail sales segment is expected to witness the fastest growth from 2025 to 2032, supported by increasing over-the-counter availability of consumer-friendly products such as autoinjectors, transdermal patches, and digital pills through pharmacies and e-commerce platforms, enabling wider accessibility for patients.

Drug Device Combination Market Regional Analysis

- North America dominated the drug device combination market with the largest revenue share of 41.36% in 2024, driven by mature regulatory framework, advanced healthcare infrastructure, and the strong presence of leading pharmaceutical and medtech companies investing heavily in innovation, particularly in areas such as insulin delivery systems, prefilled syringes, and drug-eluting stents

- The region’s market leadership is supported by widespread usage of products such as auto-injectors, insulin pumps, and drug-eluting stents, along with growing investments in personalized medicine and digital health integration

- Favorable regulatory support from agencies such as the U.S. FDA, increasing demand for home-based treatment options, and a tech-savvy patient population further accelerate adoption, positioning drug device combinations as a preferred solution for chronic disease management and precision therapy delivery across clinical and home settings

U.S. Drug Device Combination Market Insight

The U.S. drug device combination market captured the largest revenue share within North America in 2024, driven by a mature healthcare ecosystem, strong regulatory support from the FDA, and high adoption of self-administered therapies. The widespread use of auto-injectors, insulin pumps, and smart inhalers is supported by growing demand for chronic disease management solutions. In addition, robust investments in R&D and increasing consumer preference for digital health-enabled combination devices continue to accelerate market growth in both hospital and home care settings.

Europe Drug Device Combination Market Insight

The Europe drug device combination market is projected to grow steadily throughout the forecast period, fueled by an aging population, high prevalence of chronic conditions, and strong emphasis on innovation and patient safety. Regulatory frameworks such as the MDR (Medical Device Regulation) ensure product safety and performance, encouraging innovation in areas such as drug-eluting stents and microneedle patches. The region is also witnessing increased use of combination products in outpatient and home-based settings, especially for long-term therapies.

U.K. Drug Device Combination Market Insight

The U.K. drug device combination market is expected to grow at a healthy CAGR during the forecast period, supported by a well-established healthcare system and rising demand for self-care solutions. National Health Service (NHS) initiatives promoting digital health and home-based care are driving adoption of smart delivery systems such as auto-injectors and wearable injectors. Moreover, a growing emphasis on reducing hospital burden and improving patient outcomes is fostering greater integration of these technologies into routine care.

Germany Drug Device Combination Market Insight

The Germany’s drug device combination market is expected to expand at a considerable CAGR during the forecast period, driven by a strong focus on innovation, efficient regulatory pathways, and high healthcare spending. The market is benefiting from the country’s demand for advanced, eco-conscious, and digitally integrated health technologies. The integration of drug delivery devices with electronic monitoring systems and Germany’s robust clinical trial infrastructure support the development and adoption of cutting-edge combination products for chronic and complex conditions.

Asia-Pacific Drug Device Combination Market Insight

The Asia-Pacific drug device combination market is projected to grow at the fastest CAGR during 2025 to 2032, driven by rising healthcare expenditure, expanding access to advanced therapies, and strong government support for healthcare modernization. Countries such as China, Japan, and India are witnessing rapid adoption of wearable drug delivery systems, smart inhalers, and digital pills. Local manufacturing, along with favorable policy initiatives and demand for cost-effective solutions, is propelling regional market growth.

Japan Drug Device Combination Market Insight

The Japan’s drug device combination market is experiencing strong momentum due to its aging population, demand for home-based care, and emphasis on technological innovation. High patient compliance and preference for discreet, efficient drug delivery solutions are driving the use of smart autoinjectors and transdermal patches. Integration with digital health platforms and the country’s advanced infrastructure are further supporting market expansion, especially in chronic disease therapy and elderly care.

India Drug Device Combination Market Insight

The India captured the largest revenue share in Asia Pacific’s drug device combination market in 2024, driven by rapid urbanization, growing middle-class healthcare demand, and increasing access to affordable combination products. The market is supported by strong domestic manufacturing capabilities and initiatives such as Ayushman Bharat promoting universal health coverage. Growing prevalence of diabetes and respiratory conditions, alongside technological adoption in home care, are key factors contributing to India’s rising share in this sector.

Drug Device Combination Market Share

The drug device combination industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Amgen Inc. (U.S.)

- Insulet Corporation (U.S.)

- Ypsomed AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- BD (U.S.)

- Gerresheimer AG (Germany)

- West Pharmaceutical Services, Inc. (U.S.)

- SCHOTT AG (Germany)

- Enable Injections Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- 3M (U.S.)

- Elcam Medical (Israel)

- Bespak Limited (U.K.)

- Nemera (France)

- Owen Mumford Ltd. (U.K.)

- Stevanato Group (Italy)

What are the Recent Developments in Global Drug Device Combination Market?

- In April 2023, Medtronic plc launched its next-generation extended-wear insulin infusion set in select markets, offering up to seven days of use. This innovation is aimed at improving patient convenience and reducing the frequency of device changes for individuals with diabetes. The product reflects Medtronic’s continued focus on advancing drug delivery systems for chronic conditions and enhancing patient adherence through wearable technologies

- In March 2023, Amgen Inc. announced the global expansion of its Neulasta Onpro kit, a wearable injector designed to deliver pegfilgrastim automatically after chemotherapy. The move supports the growing shift toward at-home cancer care and reinforces Amgen’s leadership in self-administered drug-device combinations for oncology patients, enhancing both comfort and clinical outcomes

- In March 2023, Insulet Corporation received expanded regulatory approval for its Omnipod 5 Automated Insulin Delivery System across multiple regions, including Europe. The system features smartphone connectivity and adaptive algorithms, representing a major step in integrating digital health with drug delivery for personalized diabetes management

- In February 2023, Ypsomed AG partnered with a major pharmaceutical firm to co-develop a next-generation autoinjector platform. This partnership emphasizes the growing demand for customizable, patient-centric combination products that enable self-injection therapies for conditions such as rheumatoid arthritis and multiple sclerosis

- In January 2023, Teva Pharmaceuticals collaborated with Digital Health Technologies to integrate sensor-enabled smart inhalers into its respiratory therapy portfolio. This development aims to provide real-time data on medication adherence and usage patterns, supporting better disease management and reducing healthcare costs associated with asthma and COPD

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DRUG DEVICE COMBINATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DRUG DEVICE COMBINATION MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DRUG DEVICE COMBINATION MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES

5.3 PATENT ANALYSIS

5.4 GLOBAL DRUG DEVICE COMBINATION MARKET ANALYSIS

6 EPIDEMOLOGY

6.1 EPIDEMOLOGY OF CANCER

6.2 EPIDEMOLOGY OF DIABETES DISORDERS

6.3 EPIDEMOLOGY OF CARDIOVASCULAR DISORDERS

6.4 EPIDEMOLOGY OF RESPIRATORY DISORDERS

7 INDUSTRY INSIGHTS

7.1 DEMOGRAPHIC TRENDS

7.2 KEY PRICING STRATEGIES

7.3 KEY PATIENT ENROLLMENT STRATEGIES

7.4 INTERVIEWS WITH MANUFACTURING COMPANIES

7.5 OTHER KOL SNAPSHOTS

8 REGULATORY FRAMWORK

9 GLOBAL DRUG DEVICE COMBINATION MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 TRANSDERMAL PATCHES

9.2.1 BY TYPE

9.2.1.1. RESERVOIR

9.2.1.2. MATRIX

9.2.1.3. OTHERS

9.2.2 BY TECHNOLOGY

9.2.2.1. ELECTRIC CURRENT

9.2.2.2. MECHANICAL ARRAYS

9.2.2.3. THERMAL ABLATION

9.2.2.4. CHEMICAL ENHANCERS

9.2.2.5. OTHERS

9.3 INHALERS

9.3.1 DRY POWDER

9.3.2 NEBULIZERS

9.3.2.1. ULTRASONIC

9.3.2.2. COMPRESSOR

9.3.2.3. MESH

9.3.3 METERED DOSE

9.3.3.1. BY TYPE

9.3.3.1.1. MANNUALY ACTIVATED PRESSSURIZED

9.3.3.1.2. BREATH ACTUATED PRESSURIZED INHALERS

9.4 INFUSION PUMPS

9.4.1 VOLUMETRIC

9.4.2 DISPOSABLES

9.4.3 SYRINGES

9.4.3.1. SINGLE CHAMBER PREFILLED SYRINGE

9.4.3.2. DUAL CHAMBER PREFILLED SYRINGE

9.4.3.3. CUSTOMIZED PREFILLED SYRINGE

9.4.3.4. OTHERS

9.4.4 AMBULATORY

9.4.5 IMPLANTABLES

9.4.5.1. BIODEGRADABLE IMPLANTS

9.4.5.1.1. POLYESTERAMIDE

9.4.5.1.2. POLY LACTIC-CO-GLYCOLIC ACID

9.4.5.2. NO BIODEGRADABLE IMPLANTS

9.4.5.2.1. ETHYLENE-VINYL ACETATE

9.4.5.2.2. SILICONE

9.4.5.2.3. THERMOPLASTIC POLYURETHANE

9.4.6 INSULIN

9.4.6.1. LONG ACTING

9.4.6.2. REGULAR/SHORT ACTING

9.4.6.3. INTERMEDIATE ACTING

9.4.6.4. RAPID ACTING

9.4.6.5. PREMIX

9.4.7 OTHERS

9.5 DRUG ELUTING STENTS

9.5.1 BY COATING

9.5.1.1. POLYMER BASED COATING

9.5.1.2. POLYMER FREE COATING

9.5.2 BY USAGE

9.5.2.1. CORONARY STENTS

9.5.2.2. PERIPHERALVASCULAR STENTS

9.5.3 BY GENERATION

9.5.3.1. 1ST GENERATION

9.5.3.2. 2ND GENERATION

9.5.3.3. 3RD GENERATION

9.5.3.4. 4 TH GENERATION

9.5.4 BY PLATFORM

9.5.4.1. STAINLESS STEEL

9.5.4.2. COBALT CHROMIUM

9.5.4.3. PLATANIUM CHROMIUM

9.5.4.4. NITINOL

9.5.4.5. OTHERS

9.6 ANTIMICROBIAL CATHETERS

9.6.1 UROLOGICAL

9.6.2 CARDIOVASCULAR

9.6.3 OTHERS

9.7 DIGITAL PILL

9.7.1 TABLET

9.7.2 CAPSULES

9.7.3 MICROCHIP

9.7.4 DELIVERY DEVICE

9.8 WOUND CARE COMBINATION PRODUCTS

9.9 DRUG DELIVERY HYDROGELS

9.9.1 BY SOURCE

9.9.1.1. NATURAL

9.9.1.2. SYNTHETHIC

9.9.1.3. HYBRID

9.9.2 BY DELIVERY ROUTE

9.9.2.1. OCULAR

9.9.2.2. SUBCUTANEOUS

9.9.2.3. ORAL CAVITY

9.9.2.4. TOPICAL

9.9.2.5. OTHERS

9.1 PHOTODYNAMIC THERAPY DEVICES

9.10.1 BY USAGE

9.10.1.1. CANCER

9.10.1.2. ACTINIC KERATOSIS

9.10.1.3. PSORIASIS

9.10.1.4. ACNE

9.10.1.5. OTHERS

9.11 ORTHOPEDIC COMBINATION PRODUCTS

9.11.1 BONE GRAFT IMPLANTS

9.11.2 ANTIBIOTIC BONE CEMENT

9.11.2.1. GENTAMICIN

9.11.2.2. GENTAMICIN PLUS VANCOMYCIN

9.11.2.3. GENTAMICIN PLUS CLINDAMYCIN

9.12 OTHERS

10 GLOBAL DRUG DEVICE COMBINATION MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CARDIOVASCULAR DISEASES

10.3 DIABETES

10.4 RESPIRATORY DISEASES

10.5 ORTHOPEDIC DISEASES

10.6 PAIN MANAGEMENT

10.7 DERMATOLOGY

10.8 CANCER

10.9 OTHERS

11 GLOBAL DRUG DEVICE COMBINATION MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 CLINICS

11.4 AMBULATORY SURGERY CENTERS

11.5 HOME CARE SETTINGS

11.6 OTHERS

12 GLOBAL DRUG DEVICE COMBINATION MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.3.1 HOSPITAL PHARMACY

12.3.2 ONLINE PHARMACY

12.3.3 RETAIL PHARMACY

13 GLOBAL DRUG DEVICE COMBINATION MARKET, BY REGION

13.1 GLOBAL DRUG DEVICE COMBINATION MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 FRANCE

13.3.3 U.K.

13.3.4 ITALY

13.3.5 SPAIN

13.3.6 RUSSIA

13.3.7 TURKEY

13.3.8 BELGIUM

13.3.9 NETHERLANDS

13.3.10 SWITZERLAND

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 AUSTRALIA

13.4.6 SINGAPORE

13.4.7 THAILAND

13.4.8 MALAYSIA

13.4.9 INDONESIA

13.4.10 PHILIPPINES

13.4.11 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 SAUDI ARABIA

13.6.3 UAE

13.6.4 EGYPT

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AFRICA

13.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL DRUG DEVICE COMBINATION MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL DRUG DEVICE COMBINATION MARKET, COMPANY PROFILE

15.1 JANSSEN PHARMACEUTICA NV

15.1.1 COMPANY OVERVIEW

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPEMENTS

15.2 AMGEN INC.

15.2.1 COMPANY OVERVIEW

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPEMENTS

15.3 GSK PLC

15.3.1 COMPANY OVERVIEW

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPEMENTS

15.4 BD

15.4.1 COMPANY OVERVIEW

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPEMENTS

15.5 MEDTRONIC

15.5.1 COMPANY OVERVIEW

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPEMENTS

15.6 BAYER AG

15.6.1 COMPANY OVERVIEW

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPEMENTS

15.7 THE LUBRIZOL CORPORATION

15.7.1 COMPANY OVERVIEW

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPEMENTS

15.8 COSMED PHARMACEUTICAL CO.LTD.

15.8.1 COMPANY OVERVIEW

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPEMENTS

15.9 CGBIO

15.9.1 COMPANY OVERVIEW

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPEMENTS

15.1 E3D ELCAM DRUG DELIVERY DEVICES

15.10.1 COMPANY OVERVIEW

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPEMENTS

15.11 EITAN MEDICAL LTD.

15.11.1 COMPANY OVERVIEW

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPEMENTS

15.12 EOFLOW CO., LTD.

15.12.1 COMPANY OVERVIEW

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPEMENTS

15.13 FINDAIR SP. Z O. O.

15.13.1 COMPANY OVERVIEW

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPEMENTS

15.14 INSULET CORPORATION.

15.14.1 COMPANY OVERVIEW

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPEMENTS

15.15 MEDIPRINT

15.15.1 COMPANY OVERVIEW

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPEMENTS

15.16 METP® PHARMA AG

15.16.1 COMPANY OVERVIEW

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPEMENTS

15.17 MICRON BIOMEDICAL, INC.

15.17.1 COMPANY OVERVIEW

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPEMENTS

15.18 MICRONJET

15.18.1 COMPANY OVERVIEW

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPEMENTS

15.19 OCUMEDIC, INC.

15.19.1 COMPANY OVERVIEW

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPEMENTS

15.2 OTSUKA AMERICA PHARMACEUTICAL, INC

15.20.1 COMPANY OVERVIEW

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPEMENTS

15.21 PROPELLER HEALTH

15.21.1 COMPANY OVERVIEW

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPEMENTS

15.22 RAPHAS CO., LTD.

15.22.1 COMPANY OVERVIEW

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPEMENTS

15.23 SENSIRION AG

15.23.1 COMPANY OVERVIEW

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPEMENTS

15.24 SONCEBOZ

15.24.1 COMPANY OVERVIEW

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPEMENTS

15.25 SUBCUJECT APS

15.25.1 COMPANY OVERVIEW

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPEMENTS

15.26 VAXESS TECHNOLOGIES INC

15.26.1 COMPANY OVERVIEW

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPEMENTS

15.27 VAXXAS

15.27.1 COMPANY OVERVIEW

15.27.2 REVENUE ANALYSIS

15.27.3 GEOGRAPHIC PRESENCE

15.27.4 PRODUCT PORTFOLIO

15.27.5 RECENT DEVELOPEMENTS

15.28 YPSOMED AG

15.28.1 COMPANY OVERVIEW

15.28.2 REVENUE ANALYSIS

15.28.3 GEOGRAPHIC PRESENCE

15.28.4 PRODUCT PORTFOLIO

15.28.5 RECENT DEVELOPEMENTS

15.29 TERUMO CORPORATION

15.29.1 COMPANY OVERVIEW

15.29.2 REVENUE ANALYSIS

15.29.3 GEOGRAPHIC PRESENCE

15.29.4 PRODUCT PORTFOLIO

15.29.5 RECENT DEVELOPEMENTS

15.3 TELEFLEX INCORPORATED

15.30.1 COMPANY OVERVIEW

15.30.2 REVENUE ANALYSIS

15.30.3 GEOGRAPHIC PRESENCE

15.30.4 PRODUCT PORTFOLIO

15.30.5 REVENUE ANALYSIS

16 CONCLUSION

17 QUESTIONNAIRE

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.