Global Driveline Market

Market Size in USD Billion

CAGR :

%

USD

307.66 Billion

USD

1,044.65 Billion

2024

2032

USD

307.66 Billion

USD

1,044.65 Billion

2024

2032

| 2025 –2032 | |

| USD 307.66 Billion | |

| USD 1,044.65 Billion | |

|

|

|

|

Driveline Market Analysis

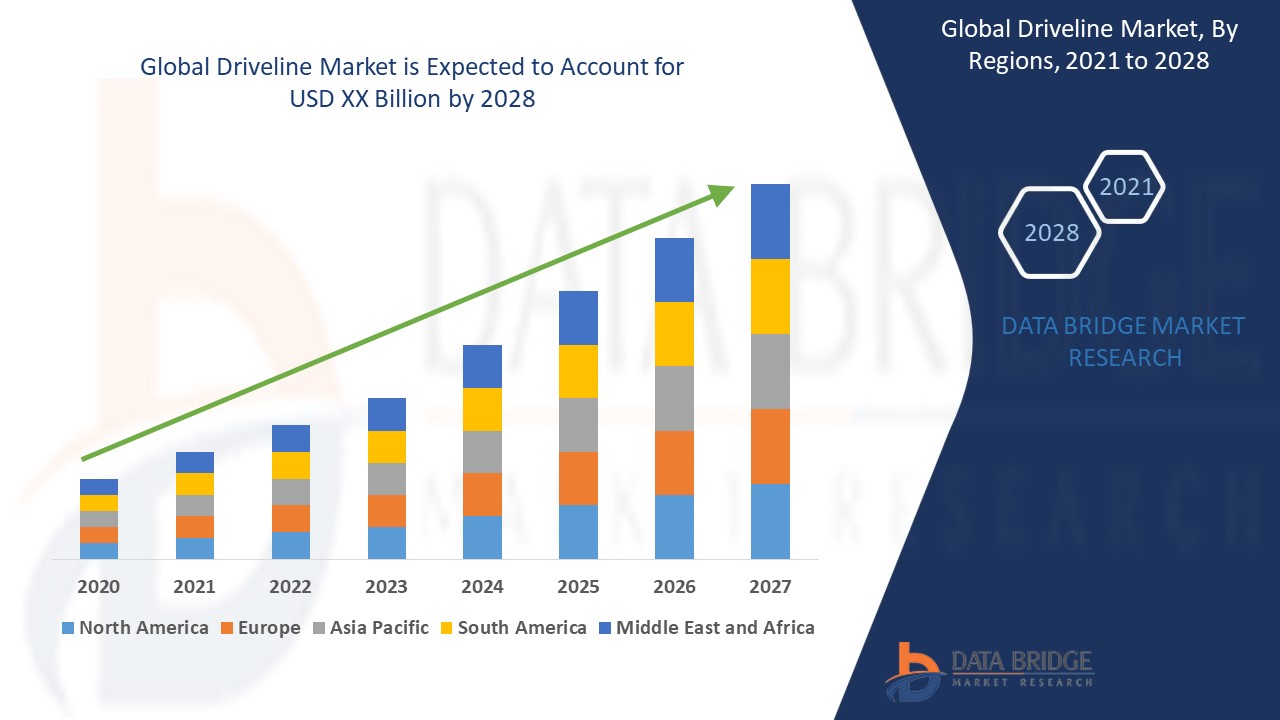

The driveline market is a critical segment of the automotive industry, encompassing components that transmit power from the engine to the wheels, ensuring efficient vehicle performance. Increasing demand for fuel efficiency, electrification, and enhanced driving dynamics are key factors propelling market growth. Hybrid and electric vehicles significantly contribute to advancements in driveline technologies, driving demand for innovative solutions such as e-axles and lightweight components. Recent developments, such as ZF Friedrichshafen AG’s launch of modular electric drivelines, highlight the market's focus on sustainable and energy-efficient systems. The rise in automotive production, coupled with the adoption of advanced drivelines in passenger and commercial vehicles, further fuels market expansion. In addition, the integration of smart driveline systems with real-time monitoring capabilities is transforming the market landscape. With a growing emphasis on electrification and sustainability, the driveline market is poised for substantial growth, particularly in regions such as Asia-Pacific and North America.

Driveline Market Size

The global driveline market size was valued at USD 307.66 Million in 2024 and is projected to reach USD 1044.65 Million by 2032, with a CAGR of 16.51% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Driveline Market Trends

“Innovations in Electric Drivelines”

The driveline market is evolving rapidly, driven by technological advancements and the automotive industry's shift toward electrification and sustainability. Innovations in electric drivelines, such as e-axles and integrated systems, are reshaping the market by offering lightweight, energy-efficient solutions tailored to hybrid and electric vehicles. A key trend is the adoption of modular driveline systems, enabling manufacturers to streamline production and customize designs for various vehicle types. These systems enhance performance and align with the industry's push for reduced emissions. The market’s growth is further fueled by rising demand for smart drivelines that incorporate real-time monitoring and predictive maintenance capabilities, ensuring efficiency and reliability across passenger and commercial vehicle segments.

Report Scope and Driveline Market Segmentation

|

Attributes |

Driveline Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Melrose Industries PLC (U.K.), Schaeffler AG (Germany), ZF Friedrichshafen AG (Germany), Bosch Limited (Germany), Xlerate Driveline India Ltd. (U.S.), American Axle & Manufacturing, Inc. (U.S.), BorgWarner Inc. (U.S.), Hitachi, Ltd. (Japan), Continental AG (Germany), DENSO CORPORATION (Japan), Valeo (France), AVTEC (India), Mahindra & Mahindra Ltd (India), BISHOP-WISECARVER (U.S.), TOYOTA MOTOR CORPORATION (Japan), MSL Driveline Systems Limited (India), KNL Driveline Parts Private Limited (India), Ford Motor Company (U.S.), AVL (Austria), and Volkswagen (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Driveline Market Definition

A driveline, also known as a drivetrain, refers to the collection of components that work together to transmit power from a vehicle's engine or motor to its wheels. This system includes parts such as the transmission, driveshaft, differentials, axles, and in some cases, electric motors or e-axles in hybrid and electric vehicles. The driveline is essential for ensuring smooth power delivery, efficient energy transfer, and optimal vehicle performance across various terrains and driving conditions.

Driveline Market Dynamics

Drivers

- Rising Adoption of Electric and Hybrid Vehicles

The shift toward electrification in the automotive industry has significantly increased the demand for advanced driveline components, such as e-axles and integrated driveline systems. These components play a crucial role in enhancing the efficiency, performance, and overall energy management of electric and hybrid vehicles. E-axles, which combine electric motors, transmission, and power electronics into a single unit, are particularly important for reducing weight and improving vehicle performance. As automakers transition to electric vehicles to meet environmental regulations and consumer preferences, the need for these sophisticated driveline solutions continues to grow, driving the overall expansion of the driveline market.

- Increasing Demand for Fuel-Efficient Solutions

Automakers are increasingly focusing on developing lightweight drivelines and energy-efficient designs to meet stringent fuel economy standards and reduce vehicle emissions. By using materials such as aluminum and high-strength steel, manufacturers can reduce the weight of driveline components, which in turn improves fuel efficiency and performance. In addition, optimizing driveline systems for energy efficiency ensures that less power is wasted, contributing to lower emissions and better overall vehicle performance. This growing emphasis on fuel efficiency is driven by both government regulations and consumer demand for greener, more sustainable transportation options, thus fueling the continued growth of the driveline market.

Opportunities

- Advancements in Smart Driveline Technology

The integration of smart technologies, such as real-time monitoring and predictive maintenance, presents significant opportunities for innovation in driveline systems. These technologies enable manufacturers to enhance the performance, efficiency, and reliability of driveline components by providing valuable insights into system performance and potential failures before they occur. Real-time monitoring helps optimize the operation of driveline systems, improving energy management and reducing wear and tear. Predictive maintenance can reduce downtime and repair costs by identifying issues early, leading to more efficient operations. As the demand for advanced, reliable driveline solutions grows, the adoption of smart technologies presents a promising market opportunity.

- Rising Demand for Lightweight Components

The increasing demand for lightweight driveline components presents significant growth opportunities for manufacturers, driven by the need for better fuel efficiency and enhanced vehicle performance. Lightweight materials such as aluminum, carbon fiber, and advanced composites are being increasingly used to reduce the overall weight of driveline systems, contributing to improved fuel economy and lower emissions. As consumers and regulatory bodies demand more sustainable and fuel-efficient vehicles, automakers are turning to lightweight driveline components to meet these expectations. This trend creates opportunities for manufacturers to innovate and provide high-performance, energy-efficient driveline solutions using cutting-edge materials, driving the growth of the market.

Restraints/Challenges

- Lack of Skilled Workforce

The rapid advancement of driveline technology presents a significant challenge for the industry, as it requires a skilled workforce capable of managing new innovations. As automakers and manufacturers continue to develop more complex driveline systems, such as electric drivetrains and advanced hybrid solutions, the need for specialized expertise becomes more critical. However, the industry is facing difficulties in recruiting and retaining employees with the necessary technical skills to handle these cutting-edge technologies. This skills gap can hinder the development and innovation of advanced driveline systems, slowing down progress and limiting the market’s potential growth.

- High Production Costs

The development and manufacturing of advanced driveline components, especially for electric and hybrid vehicles, come with significant costs due to the use of specialized materials such as aluminum, carbon fiber, and rare-earth metals, along with sophisticated technology and high manufacturing standards. These elevated production costs can increase the overall price of vehicles, making it challenging for manufacturers to offer these advanced driveline systems at competitive prices, particularly in price-sensitive markets. As a result, the high cost of production can limit the widespread adoption of advanced driveline technologies, especially in developing regions or for consumers seeking more affordable options.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Driveline Market Scope

The market is segmented on the basis of vehicle type, transmission type, final drive, motor output, drive type, and architecture. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Vehicle Type

- Hybrid Vehicles

- Plug-In Electric Hybrid

- Battery Electric Vehicle

- ICE Vehicles

Transmission Type

- Automatic Transmission (AT)

- Dual Clutch Transmission (DCT)

- Electronic Continuously Variable Transmission

Final Drive

- Differential

- E-Axle

Motor Output

- 45–100 kW

- 101–250 kW

- 250 kW

Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

Architecture

- Series

- Parallel

- Power Split

- EV Driveline

Driveline Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, vehicle type, transmission type, final drive, motor output, drive type, and architecture as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to dominate and be the fastest growing in the driveline market due to rising per capita income and a large consumer base, which has fostered a favorable market environment. The region's substantial production and sales of hybrid and electric vehicles further boost the demand for advanced driveline technologies. These factors combined make Asia-Pacific a key player in driving growth in the global driveline market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Driveline Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Driveline Market Leaders Operating in the Market Are:

- Melrose Industries PLC (U.K.)

- Schaeffler AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Bosch Limited (Germany)

- Xlerate Driveline India Ltd. (U.S.)

- American Axle & Manufacturing, Inc. (U.S.)

- BorgWarner Inc. (U.S.)

- Hitachi, Ltd. (Japan)

- Continental AG (Germany)

- DENSO CORPORATION (Japan)

- Valeo (France)

- AVTEC (India)

- Mahindra & Mahindra Ltd (India)

- BISHOP-WISECARVER (U.S.)

- TOYOTA MOTOR CORPORATION (Japan)

- MSL Driveline Systems Limited (India)

- KNL Driveline Parts Private Limited (India)

- Ford Motor Company (U.S.)

- AVL (Austria)

- Volkswagen (Germany)

Latest Developments in Driveline Market

- In May 2023, ABC Drivelines, in collaboration with a major automotive manufacturer, introduced an innovative hybrid driveline solution. This advanced system integrates an internal combustion engine with an electric motor, ensuring a smooth transition between power sources. The result is enhanced fuel efficiency and a reduced carbon footprint, offering a sustainable solution for the automotive industry

- In April 2023, Global Driveline Innovations (GDI) revealed the development of a fully autonomous driveline platform. This cutting-edge system incorporates advanced sensors, artificial intelligence, and connectivity, allowing vehicles to independently navigate complex road conditions and traffic situations. The platform represents a significant leap forward in autonomous driving technology, offering enhanced safety and efficiency without the need for human intervention

- In October 2022, Infineum and Entegris, Inc. announced a definitive agreement for Infineum to acquire Entegris' Pipeline and Industrial Materials (PIM) business. The PIM division, part of Entegris' Specialty Chemicals and Engineered Materials (SCEM) sector, includes well-known brands such as Flowchem, Val-Tex, and Sealweld. This acquisition also includes a range of Drag Reducing Agents (DRAs) used in pipeline operations, marking a significant expansion for Infineum in the industrial materials sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DRIVELINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DRIVELINE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DRIVELINE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 SUPPLY CHAIN ANALYSIS

5.6 TRADE ANALYSIS: IMPORT & EXPORT SCENARIO

5.7 CASE STUDY ANALYSIS

5.8 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

5.9 PRICING ANALYSIS

5.1 CONSUMER BUYING BEHAVIOUR

6 GLOBAL DRIVELINE MARKET, BY DRIVETRAINS TYPE

6.1 OVERVIEW

6.2 ALL-WHEEL DRIVE (AWD)

6.3 FOUR-WHEEL DRIVE (4WD)

6.4 FOUR-WHEEL DRIVE (4WD)

6.5 REAR-WHEEL DRIVE (RWD)

7 GLOBAL DRIVELINE MARKET, BY ARCHITECTURE

7.1 OVERVIEW

7.2 SERIES DRIVELINE

7.3 PARALLEL DRIVELINE

7.4 POWER SPLIT DRIVELINE

7.5 ELECTRIC DRIVELINE

8 GLOBAL DRIVELINE MARKET, BY PROPULSION SYSTEM

8.1 OVERVIEW

8.2 HYBRID VEHICLES

8.3 PLUG-IN ELECTRIC HYBRID

8.4 BATTERY ELECTRIC VEHICLE

8.5 ICE VEHICLES

9 GLOBAL DRIVELINE MARKET, BY TRANSMISSION TYPE

9.1 OVERVIEW

9.2 AUTOMATIC TRANSMISSION (AT)

9.3 DUAL CLUTCH TRANSMISSION (DCT)

9.4 ELECTRONIC CONTINUOUSLY VARIABLE TRANSMISSION

10 GLOBAL DRIVELINE MARKET, BY COMPONENT

10.1 OVERVIEW

10.2 DRIVESHAFT/PTO SHAFT.

10.2.1 TYPES

10.2.1.1. NON SHEAR

10.2.1.2. SHEAR PIN

10.2.1.3. SLIP CLUTCH

10.3 DIFFERENTIALS

10.4 AXLE SHAFTS

10.4.1 TYPES

10.4.1.1. SEMI-FLOATING AXLE SHAFTS

10.4.1.2. FULLY FLOATING AXLE SHAFTS

10.4.1.3. THREE-QUARTER FLOATING AXLE SHAFTS

10.5 U-JOINTS(UNIVERSAL JOINT)

10.5.1 TYPES

10.5.1.1. CROSS-TYPE UNIVERSAL JOINT

10.5.1.2. RING TYPE

10.5.1.3. BALL TRUNNION TYPE UNIVERSAL JOINT

10.5.1.4. CONSTANT VELOCITY TYPE UNIVERSAL JOINT

10.5.1.4.1. RZEPPA

10.5.1.4.2. TRACTA

10.5.1.4.3. BENDIX WEISS

10.5.2 PARTS

10.5.2.1. YOKES

10.5.2.2. SPIDER

10.6 CV JOINTS

10.7 OTHERS

11 GLOBAL DRIVELINE MARKET, BY FINAL DRIVE

11.1 OVERVIEW

11.2 DIFFERENTIAL

11.3 E- AXLE

12 GLOBAL DRIVELINE MARKET, BY MOTOR OUTPUT

12.1 OVERVIEW

12.2 BELOW 100 KW

12.3 101–250 KW

12.4 ABOVE 250 KW

13 GLOBAL DRIVELINE MARKET, BY VEHICLE TYPE

13.1 OVERVIEW

13.2 CAR

13.2.1 TYPE

13.2.1.1. HATCHBACK

13.2.1.2. SEDAN

13.2.1.3. SUV

13.2.1.4. MUV

13.2.1.5. COUPE

13.2.1.6. CONVERTIBLES

13.2.1.7. PICKUP TRUCKS

13.2.1.8. OTHERS

13.2.2 FUNCTIONALITY

13.2.2.1. PASSENGER CAR

13.2.2.2. COMMERCIAL CAR

13.3 BUS

13.3.1 TYPE

13.3.1.1. COACH / MOTOR COACH.

13.3.1.2. SCHOOL BUS.

13.3.1.3. SHUTTLE BUS.

13.3.1.4. MINIBUS.

13.3.1.5. MINICOACH.

13.3.1.6. DOUBLE-DECKER BUS.

13.3.1.7. SINGLE-DECKER BUS.

13.3.1.8. LOW-FLOOR BUS

13.4 TRUCK

13.4.1 LCV

13.4.2 HCV

13.5 OTHERS

14 GLOBAL DRIVELINE MARKET, BY END USER

14.1 OVERVIEW

14.2 OEM

14.2.1 BY DRIVETRAINS TYPE

14.2.1.1. ALL-WHEEL DRIVE (AWD)

14.2.1.2. FOUR-WHEEL DRIVE (4WD)

14.2.1.3. FOUR-WHEEL DRIVE (4WD)

14.2.1.4. REAR-WHEEL DRIVE (RWD

14.3 AFTERMARKET

14.3.1 BY DRIVETRAINS TYPE

14.3.1.1. ALL-WHEEL DRIVE (AWD)

14.3.1.2. FOUR-WHEEL DRIVE (4WD)

14.3.1.3. FOUR-WHEEL DRIVE (4WD)

14.3.1.4. REAR-WHEEL DRIVE (RWD

15 GLOBAL DRIVELINE MARKET, BY REGION

GLOBAL DRIVELINE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 FRANCE

15.2.3 U.K.

15.2.4 ITALY

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 TURKEY

15.2.8 BELGIUM

15.2.9 NETHERLANDS

15.2.10 SWITZERLAND

15.2.11 REST OF EUROPE

15.3 ASIA PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 AUSTRALIA

15.3.6 SINGAPORE

15.3.7 THAILAND

15.3.8 MALAYSIA

15.3.9 INDONESIA

15.3.10 PHILIPPINES

15.3.11 REST OF ASIA PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 EGYPT

15.5.3 SAUDI ARABIA

15.5.4 U.A.E

15.5.5 ISRAEL

15.5.6 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL DRIVELINE MARKET,COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL DRIVELINE MARKET, SWOT AND DBMR ANALYSIS

18 GLOBAL DRIVELINE MARKET, COMPANY PROFILE

18.1 MELROSE INDUSTRIES PLC

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 SCHAEFFLER TECHNOLOGIES AG & CO. KG

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 ZF FRIEDRICHSHAFEN AG

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 ROBERT BOSCH GMBH

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 JTEKT

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 HARVAN MANUFACTURING LTD.,

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 XLERATE DRIVELINE INDIA LTD.

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 AMERICAN AXLE & MANUFACTURING, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 BORGWARNER INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 HITACHI ASTEMO, LTD.

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 CONTINENTAL ENGINEERING SERVICES

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 DENSO CORPORATION.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 VALEO SERVICE

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 AVTEC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 TOYOTA MOTOR CORPORATION

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 BISHOP-WISECARVER

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 AVL

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 FORD MOTOR COMPANY

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 PHINIA INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 THE VW ONLINE STORE AND CATALOG

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 MARK WILLIAMS ENTERPRISES INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 JOHNSON POWER, LTD.

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 STROMAG

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENTS

18.24 CYNER INDUSTRIAL CO., LTD

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 COMER INDUSTRIES SPA

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

19 CONCLUSION

20 QUESTIONNAIRE

21 RELATED REPORTS

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.