Global Dredging Market

Market Size in USD Billion

CAGR :

%

USD

10.66 Billion

USD

13.14 Billion

2024

2032

USD

10.66 Billion

USD

13.14 Billion

2024

2032

| 2025 –2032 | |

| USD 10.66 Billion | |

| USD 13.14 Billion | |

|

|

|

|

Dredging Market Size

-

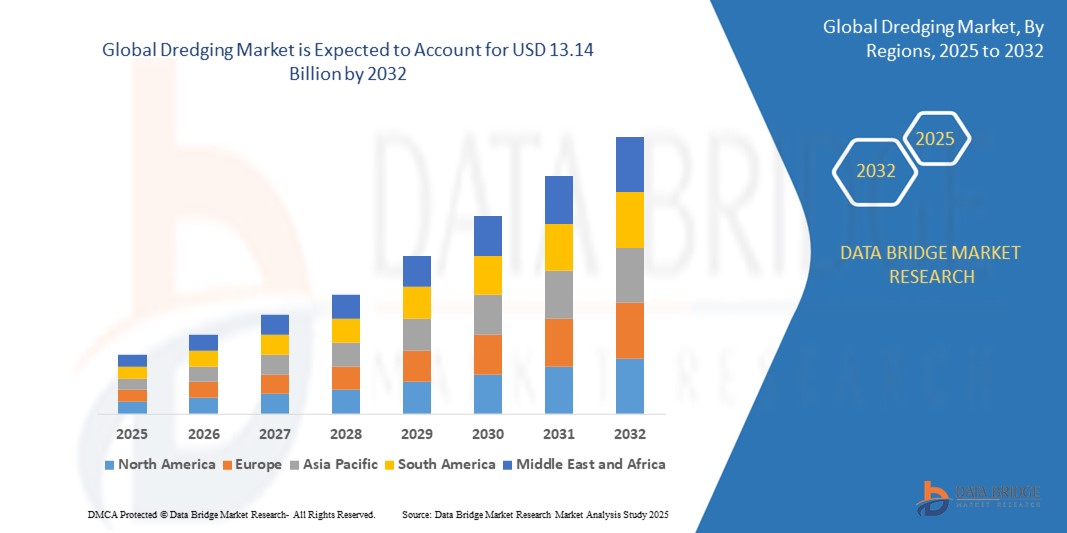

The global dredging market was valued at USD 10.66 billion in 2024 and is expected to reach USD 13.14 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 2.65%, primarily driven by the increasing demand for coastal protection and port expansion

- This growth is driven by factors such as the rising need for infrastructure development, increased maritime trade, and the need to address climate change-related issues such as rising sea levels

Dredging Market Analysis

- The dredging market is witnessing steady growth due to its importance in maintaining navigability for shipping and transportation routes. The need for deeper channels, especially in ports, is crucial for accommodating larger vessels and promoting international trade.

- Technological advancements in dredging equipment and techniques are helping to increase efficiency and reduce costs. Modern equipment, such as automated and eco-friendly dredgers, are making it easier to carry out projects with minimal environmental impact.

- As the demand for sustainable environmental practices rises, dredging activities are increasingly focused on supporting eco-friendly projects.

- For instance, dredging helps in the restoration of natural habitats, improving water quality and facilitating the creation of artificial islands or wetlands.

- The construction industry plays a significant role in the dredging market. As infrastructure projects expand, the need for dredging to create foundations for bridges, roads, and other structures near water bodies continues to grow.

- With growing global trade and shipping activities, the dredging market is expected to see an increase in demand for the expansion of existing ports and construction of new ones. The development of these facilities requires large-scale dredging projects to accommodate the growing size of commercial vessels.

Report Scope and Dredging Market Segmentation

|

Attributes |

Dredging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Dredging Market Trends

“Growing Adoption of Sustainable and Eco-Friendly Dredging Practices”

- As environmental concerns rise, the dredging industry is adopting more sustainable practices to minimize ecological disruption.

- For Instance, companies are now using closed-loop dredging systems that reduce sediment disturbance and water turbidity, helping protect local marine life

- Dredged materials are increasingly being used for land reclamation, wetland restoration, and coastal protection.

- For Instance, the Hong Kong-Zhuhai-Macao Bridge project involved significant dredging for land reclamation to create new islands while ensuring environmental safeguards were in place

- The development of energy-efficient, low-emission dredgers is helping reduce the environmental impact of dredging activities. Companies such as IHC Merwede are designing dredging vessels that not only optimize fuel consumption but also minimize CO2 emissions during operations

- To meet stringent environmental standards, dredging projects now include real-time monitoring systems to track water quality and ensure compliance with regulations.

- For Instance, can be seen in the Port of Rotterdam, where advanced monitoring systems are employed to minimize the ecological impact of dredging operations

Dredging Market Dynamics

Driver

“Increasing Global Trade and Port Expansion”

- The rise of Ultra Large Container Vessels (ULCVs) is a significant factor driving dredging activities. These vessels require deeper ports to accommodate their size, leading to a surge in dredging projects to deepen channels and harbors

- For Instance, the Panama Canal expansion project was designed to allow the passage of larger vessels, requiring extensive dredging to ensure sufficient depth

- Ports around the world, especially in key maritime hubs such as the United States, China, and Europe, are investing heavily in expansion projects to meet the increasing volume of goods being shipped globally

- For Instance, the Port of Rotterdam has been continuously upgrading its dredging operations to ensure access for larger vessels and maintain its position as one of Europe's busiest ports

- As global trade routes expand into emerging markets, the demand for dredging services in regions such as Southeast Asia and Africa is rising. Projects such as the expansion of the Port of Singapore and the Djibouti Port are instances of dredging efforts to support growing shipping traffic and establish new trade hubs

- Dredging is essential for maintaining the navigability of busy ports, preventing congestion, and ensuring the smooth passage of vessels

- For Instance, dredging at the Port of Los Angeles has helped accommodate increasing traffic while reducing congestion in one of the busiest trade routes in the world

Opportunity

“Sustainable Dredging and Environmental Restoration”

- The increasing demand for dredging projects that address both infrastructural needs and environmental protection is driving the adoption of sustainable dredging practices

- For Instance, dredged materials are being used in wetland restoration and coastal protection projects, turning what was once considered waste into valuable resources, such as creating artificial islands in the Dubai Waterfront Development Project

- Dredging is being utilized to create new habitats and restore natural ecosystems that help mitigate the effects of rising sea levels and habitat loss. In the Chesapeake Bay Restoration project in the United States, dredging has been focused on improving water quality and restoring vital aquatic habitats to support biodiversity

- Companies are developing environmentally friendly dredging techniques, such as energy-efficient dredgers and methods to reduce sediment suspension, to minimize the ecological impact of their operations

- For instance, modern dredging equipment used in the Port of Rotterdam is designed to be energy-efficient, reducing CO2 emissions and ensuring minimal environmental disruption

- The growing focus on sustainability has led to the use of dredged materials in construction, land reclamation, and environmental projects

- Governments and environmental organizations are pushing for stricter regulations and more sustainable practices in dredging. The European Union’s push for eco-friendly dredging practices in projects such as the Wadden Sea coastal protection emphasizes the growing importance of balancing infrastructure development with environmental preservation

Restraint/Challenge

“Environmental Concerns and Regulations”

- Dredging activities, particularly in sensitive marine ecosystems, can cause significant environmental harm such as habitat destruction, water pollution, and sediment dispersion, which disrupt local biodiversity

- For Instance, dredging in the Amazon River Basin has faced heavy scrutiny due to its negative impact on aquatic life and local ecosystems

- The increasing environmental concerns surrounding dredging have led to stricter regulations and the requirement for extensive Environmental Impact Assessments (EIAs) before projects can proceed. Countries such as the United States and those in the European Union now mandate these assessments to ensure dredging activities do not harm local ecosystems

- As dredging companies are required to comply with more stringent environmental laws, they face the challenge of balancing operational needs with environmental safeguards. This often leads to increased project costs and delays due to the need for additional measures to minimize environmental damage

- For instance, the Port of New York and New Jersey dredging project faced delays due to the need to meet environmental standards, adding significant costs to the operation

- Dredging projects are increasingly encountering opposition from environmental organizations and local communities concerned about their ecological impact. Legal challenges can further complicate dredging operations, as seen in the Chesapeake Bay dredging project, where environmental groups raised concerns about the project’s effect on the local environment, potentially slowing down progress

Dredging Market Scope

The market is segmented on the basis type, application, customer, product type, and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Customer |

|

|

By Product Type

|

|

|

By End User |

|

Dredging Market Regional Analysis

“Asia Pacific is the Dominant Region in the Dredging Market”

- The Asia-Pacific region dominates the global dredging market due to its rapidly expanding maritime trade, with major players such as China, Japan, and India investing heavily in port development projects.

- For instance, China's focus on expanding Shanghai Port and Hong Kong Port is aimed at accommodating larger vessels, showcasing the region's commitment to enhancing port infrastructure

- The region also plays a vital role in energy infrastructure, particularly with the development of offshore wind farms. These projects require specialized dredging to ensure stability and navigability, further driving the demand for dredging services in Asia-Pacific's growing energy sector

- The continued growth of trade and infrastructure projects, alongside the need for improved maritime safety and navigability, ensures that Asia-Pacific will remain a key player in the global dredging market for the foreseeable future

“Middle East and Africa is Projected to Register the Highest Growth Rate”

- The Middle East and Africa are seeing rapid growth in the dredging market, driven by significant investments in port expansions and infrastructure projects.

- For Instance, the UAE’s Dubai Waterfront Development is a major project contributing to the region’s rapid market growth, bolstering both urban development and tourism

- Africa, particularly in countries such as Nigeria, is investing heavily in dredging to enhance its trade capabilities. The Lagos Port expansion is one such project aimed at improving maritime traffic and increasing the region's competitiveness in global trade

- The region is increasingly focusing on improving its maritime infrastructure, attracting foreign investments to support dredging activities. This growing demand for modern ports and coastal developments is pushing the Middle East and Africa to become one of the fastest-growing regions in the global dredging market

Dredging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Royal Boskalis Westminster N.V. (Netherlands)

- DEME. (Belgium)

- Jan De Nul (Belgium)

- Penta-Ocean Construction Co. Ltd. (Japan)

- TOA Corporation. (Japan)

- CHINA HARBOUR ENGINEERING CO. LTD (China)

- NMDC Limited. (India)

- HYUNDAI E&C. (South Korea)

- Van Oord (Netherlands)

- Weeks Marine, Inc. (U.S.)

- NMDC. (U.A.E.)

- Dock Labs AG (Switzerland)

- VOSTA LMG B.V. (Netherlands)

- Royal IHC (Netherlands)

- CASHMAN DREDGING, INC. (U.S.)

- Manson Construction Co. (U.S.)

- TAMS Group Pty Ltd (Australia)

- JT Cleary, Inc. (U.S.)

- Callan Marine Ltd (U.S.)

Latest Developments in Global Dredging Market

- In April 2024, Shandong Haohai Dredging Equipment Co. Ltd (HID) launched a heavy-duty, large-capacity cutter suction dredger CSD750 at clients' working sites. The precision-engineered dredger can dredge to depths of up to -22 meters, showcasing a cutter power of 700KW. The dredger is equipped with dual marine dredging pumps, ensuring a dredging capacity of 7000m3/h

- In December 2022, Royal IHC, a leading supplier of maritime technology, announced the successful supply of two cutter suction dredgers, namely IHC Beaver 70 and IHC Beaver 45, to Xuan Thien Group, a prominent construction and infrastructure development company. These dredgers were deployed to establish a reclamation area for the creation of the Xuan Thien Nam Dinh green steel complex

- In 2022, the dredging corporation of India, a government-owned dredging company, announced plans to repay vendor debts by June 2022 to improve its financial position. These enhancements will help the firm to boost cash flow in the next two to three quarters.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.