Global Docketing Solution Market

Market Size in USD Billion

CAGR :

%

USD

4.13 Billion

USD

9.67 Billion

2025

2033

USD

4.13 Billion

USD

9.67 Billion

2025

2033

| 2026 –2033 | |

| USD 4.13 Billion | |

| USD 9.67 Billion | |

|

|

|

|

Docketing Solution Market Size

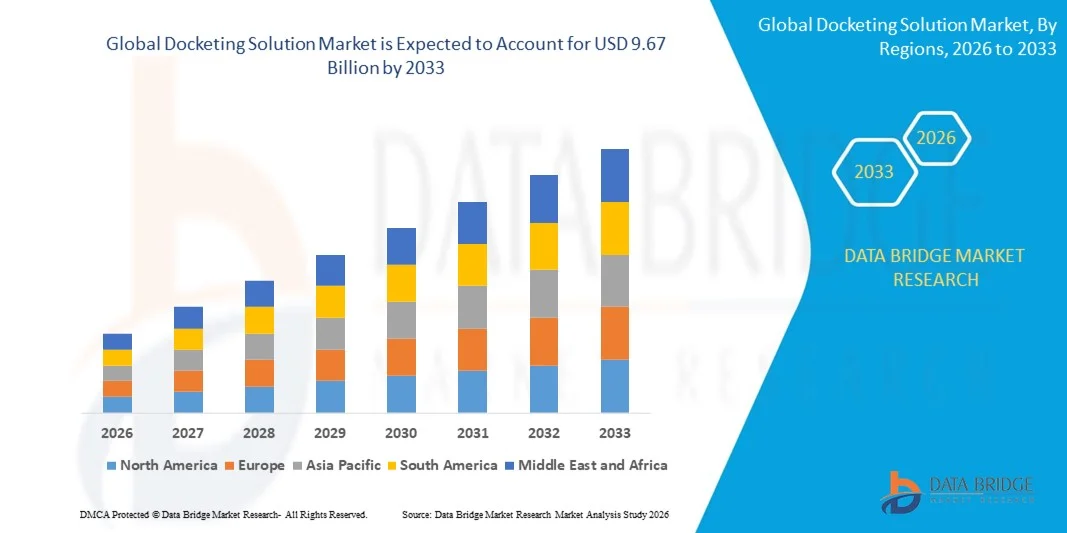

- The global docketing solution market size was valued at USD 4.13 billion in 2025 and is expected to reach USD 9.67 billion by 2033, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by the increasing digitization of legal and intellectual property management processes, leading to higher adoption of automated docketing solutions across law firms, corporate offices, and research centers

- Furthermore, rising demand for accurate, efficient, and integrated docketing platforms that reduce human errors and ensure compliance with complex deadlines is driving organizations to implement advanced software and service-based solutions. These converging factors are accelerating the uptake of docketing solutions, thereby significantly boosting the market’s growth

Docketing Solution Market Analysis

- Docketing solutions, offering automated tracking, management, and reporting of legal, patent, and trademark deadlines, are becoming essential tools for law firms, corporate IP departments, and research organizations due to their ability to enhance accuracy, streamline workflows, and ensure regulatory compliance

- The escalating demand for docketing solutions is primarily fueled by increasing patent and trademark filings globally, the need for deadline adherence, growing awareness of workflow automation, and the preference for cloud-based and AI-integrated platforms that enable remote and collaborative management of IP portfolios

- North America dominated the docketing solution market with a share of 42.9% in 2025, due to the growing adoption of digital IP management systems and increasing awareness of streamlined patent and legal docketing solutions

- Asia-Pacific is expected to be the fastest growing region in the docketing solution market during the forecast period due to increasing patent filings, digital transformation initiatives, and growing IP awareness in countries such as China, Japan, and India

- Software segment dominated the market with a market share of 62.5% in 2025, due to its core functionality in automating patent, trademark, and legal docket management tasks. Organizations prioritize software solutions for their ability to centralize docketing data, enhance workflow efficiency, and reduce human errors in deadline tracking

Report Scope and Docketing Solution Market Segmentation

|

Attributes |

Docketing Solution Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Docketing Solution Market Trends

Rising Adoption of AI-Powered and Cloud-Based Docketing Solutions

- A key trend in the docketing solution market is the increasing adoption of AI-driven and cloud-based platforms that streamline intellectual property (IP) and legal management workflows. These solutions are enhancing accuracy, reducing manual errors, and improving accessibility for law firms and corporate legal departments globally

- For instance, Anaqua and CPA Global offer AI-powered docketing platforms that automate task tracking, deadlines, and compliance monitoring, helping IP teams manage complex patent and trademark portfolios efficiently. Such solutions are reinforcing operational efficiency and minimizing risks associated with missed deadlines

- Legal and IP management firms are integrating advanced analytics and automation within docketing systems to extract actionable insights, prioritize critical tasks, and allocate resources more effectively. This adoption positions AI-enabled docketing as a central element for strategic decision-making in IP management

- The demand for centralized, cloud-hosted docketing solutions is rising as organizations seek scalable platforms that allow secure remote access and real-time collaboration. This trend is accelerating the shift from on-premise systems to SaaS-based offerings in the legal and IP sector

- Law firms and corporate IP teams are increasingly leveraging AI-driven features such as automated docket entries, deadline calculation, and anomaly detection. These features enhance operational reliability, reduce administrative burden, and support compliance with global IP regulations

- The market is witnessing growth in integrated legal technology ecosystems where docketing solutions connect with document management, patent analytics, and workflow automation tools. This integration is strengthening the role of AI-powered docketing as a foundation for modern legal operations

Docketing Solution Market Dynamics

Driver

Growing Digitization and Automation of Legal and IP Management Processes

- The digitization of legal and IP workflows is driving the adoption of advanced docketing solutions that automate routine tasks, track deadlines, and improve portfolio oversight. Organizations are increasingly prioritizing operational efficiency and accuracy in IP management to mitigate risk and enhance productivity

- For instance, Thomson Reuters offers cloud-based IP docketing solutions integrated with automated alerts and reporting capabilities, allowing legal teams to manage complex patent and trademark portfolios seamlessly. Such solutions enable firms to scale operations while maintaining compliance

- The push toward digital transformation in law firms and corporate IP departments is increasing demand for platforms that integrate task management, analytics, and compliance monitoring. These tools support faster decision-making and reduce reliance on manual intervention

- Growing competition and the complexity of IP portfolios are prompting organizations to adopt automated docketing systems to streamline workflow, ensure regulatory compliance, and maintain deadline integrity. This shift reinforces the strategic importance of digital docketing tools

- The rising focus on remote collaboration and global operations in legal services is strengthening the need for cloud-based docketing platforms. These systems provide secure, centralized access to information across distributed teams, supporting consistent IP management practices

Restraint/Challenge

Data Security and Compliance Concerns in Sensitive IP Workflows

- The docketing solution market faces challenges related to securing sensitive legal and IP data, particularly when leveraging cloud-based platforms. Organizations must ensure that critical information is protected against breaches while maintaining adherence to strict regulatory and compliance standards

- For instance, CPA Global and Clarivate face scrutiny to comply with global data protection regulations while providing cloud-hosted docketing services for multinational clients. Ensuring robust encryption and access control is critical to maintaining client trust

- Managing multi-jurisdictional compliance and data residency requirements adds complexity to implementing cloud-based docketing solutions. Organizations need to balance accessibility with stringent security measures

- The reliance on third-party cloud providers introduces concerns around data privacy, potential unauthorized access, and service reliability. These factors can slow adoption and necessitate additional investment in security infrastructure

- The market continues to grapple with ensuring auditability, traceability, and compliance reporting within automated docketing platforms. These challenges collectively emphasize the need for secure, compliant, and reliable solutions to manage sensitive IP workflows

Docketing Solution Market Scope

The market is segmented on the basis of component, deployment mode, module, and end user.

- By Component

On the basis of component, the docketing solution market is segmented into software and services. The software segment dominated the market with the largest revenue share of 62.5% in 2025, driven by its core functionality in automating patent, trademark, and legal docket management tasks. Organizations prioritize software solutions for their ability to centralize docketing data, enhance workflow efficiency, and reduce human errors in deadline tracking. The adoption of advanced features such as AI-powered alerts, analytics, and integration with existing legal management systems further strengthens the demand for software-based solutions. The software segment’s widespread deployment across corporate IP teams and law firms underscores its pivotal role in the overall docketing ecosystem.

The services segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing outsourcing of docket management and allied services by legal firms and corporate IP departments. For instance, companies such as CPA Global provide managed docketing services that help clients reduce operational overhead while ensuring compliance with complex international IP regulations. The growth of service offerings is also supported by the rising complexity of global IP portfolios and the need for specialized expertise in handling deadlines, filings, and legal correspondence efficiently.

- By Deployment Mode

On the basis of deployment mode, the docketing solution market is segmented into on-premises and cloud-based solutions. The cloud-based segment dominated the market in 2025, driven by its scalability, remote accessibility, and ability to support multiple users across locations. Legal firms and corporate IP departments increasingly prefer cloud-based solutions for real-time collaboration, automatic updates, and secure storage of sensitive IP data. The cloud segment’s compatibility with mobile platforms and integration with other enterprise software enhances operational efficiency and workflow automation, making it the preferred choice for modern IP management.

The on-premises segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing concerns over data privacy and regulatory compliance in sensitive legal and corporate environments. For instance, firms such as Anaqua offer on-premises docketing solutions that allow organizations to maintain full control over proprietary IP data while benefiting from advanced automation features. The segment’s growth is supported by organizations with strict IT governance policies and internal security protocols.

- By Module

On the basis of module, the docketing solution market is segmented into patent illustrations, proofreading, application preparation, IDS management, patent term adjustment, remote electronic docketing, docketing allied services, and others. The remote electronic docketing segment dominated the market in 2025, driven by the increasing digitization of patent offices and legal workflows. Remote electronic docketing ensures timely filing, real-time status tracking, and reduced risk of missed deadlines for IP professionals. The segment’s popularity is further strengthened by its integration with patent management software, offering seamless updates, notifications, and compliance tracking for complex IP portfolios.

The IDS management module is anticipated to witness the fastest growth from 2026 to 2033, fueled by the rising volume of prior art references and the need for efficient management of information disclosure statements. For instance, Clarivate’s IP management solutions provide automated IDS tracking and reporting that streamline the patent prosecution process while reducing manual effort. Increasing global patent filings and regulatory requirements drive the adoption of specialized IDS management modules in both law firms and corporate IP departments.

- By End User

On the basis of end user, the docketing solution market is segmented into legal firms, research centers, corporate offices, and others. The legal firms segment dominated the market in 2025, driven by the high demand for accurate deadline tracking, compliance management, and automation of repetitive IP management tasks. Law firms increasingly rely on docketing solutions to improve operational efficiency, minimize risk of missed deadlines, and enhance client service quality. The segment’s dominance is also supported by the widespread adoption of integrated software platforms that combine docketing with analytics, reporting, and document management capabilities.

The corporate offices segment is expected to witness the fastest growth from 2026 to 2033, fueled by the expansion of in-house IP teams and the growing need to manage extensive patent and trademark portfolios. For instance, IBM utilizes advanced docketing solutions internally to streamline patent workflows and maintain compliance across multiple jurisdictions. The rise of corporate IP awareness and the need for timely filings, renewal management, and internal reporting drive the accelerated adoption of docketing solutions among corporate end users.

Docketing Solution Market Regional Analysis

- North America dominated the docketing solution market with the largest revenue share of 42.9% in 2025, driven by the growing adoption of digital IP management systems and increasing awareness of streamlined patent and legal docketing solutions

- Organizations in the region highly value accuracy, automation, and integration capabilities offered by docketing solutions, which help manage complex IP portfolios and meet strict compliance requirements

- This widespread adoption is further supported by the presence of large corporate IP teams, advanced legal infrastructure, and the growing trend of outsourcing IP management tasks, establishing docketing solutions as a preferred tool for law firms and corporate offices

U.S. Docketing Solution Market Insight

The U.S. docketing solution market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of digital IP management tools and advanced automation technologies. Law firms and corporate IP departments are increasingly prioritizing timely deadline tracking, error reduction, and workflow efficiency through software solutions. The growing demand for cloud-based and AI-powered docketing systems, combined with integration with enterprise legal management platforms, further propels market growth. Moreover, regulatory compliance requirements and the expansion of patent and trademark filings significantly contribute to the market’s expansion.

Europe Docketing Solution Market Insight

The Europe docketing solution market is projected to grow at a substantial CAGR during the forecast period, primarily driven by stringent IP regulations and the rising need for error-free patent and legal docket management. Increased adoption of automated solutions among law firms and corporate IP teams supports operational efficiency. European organizations are also focusing on cloud-based and integrated solutions that offer secure access, timely notifications, and comprehensive reporting. The market is seeing steady growth across legal firms, research centers, and corporate IP offices.

U.K. Docketing Solution Market Insight

The U.K. docketing solution market is expected to grow at a notable CAGR during the forecast period, driven by the rising adoption of digital IP management tools and the demand for enhanced accuracy and compliance. Concerns regarding missed deadlines and the complexity of managing international IP portfolios are encouraging law firms and corporate offices to adopt automated docketing solutions. The U.K.’s robust legal and corporate infrastructure, along with increasing use of cloud-based platforms, is expected to continue driving market growth.

Germany Docketing Solution Market Insight

The Germany docketing solution market is anticipated to expand at a significant CAGR during the forecast period, fueled by increasing awareness of IP management automation and the growing need for compliance and timely filings. Germany’s focus on innovation, strong legal framework, and advanced corporate IP departments support the adoption of sophisticated docketing solutions. Integration with enterprise software and secure, privacy-compliant systems is becoming a key factor driving the adoption in both law firms and corporate offices.

Asia-Pacific Docketing Solution Market Insight

The Asia-Pacific docketing solution market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing patent filings, digital transformation initiatives, and growing IP awareness in countries such as China, Japan, and India. Organizations in the region are adopting cloud-based and automated solutions to improve efficiency, reduce errors, and ensure compliance. Furthermore, the expansion of multinational corporations and research centers in APAC is accelerating the demand for scalable and integrated docketing solutions.

Japan Docketing Solution Market Insight

The Japan docketing solution market is gaining traction due to the country’s high-tech ecosystem, increasing patent activity, and demand for efficient IP management. Law firms and corporate offices in Japan prioritize solutions that reduce manual effort and ensure accuracy in docketing. Integration with other enterprise and IP management systems further fuels growth. Moreover, Japan’s emphasis on compliance, innovation, and advanced technology adoption supports increased adoption of automated and cloud-based docketing solutions.

China Docketing Solution Market Insight

The China docketing solution market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, rising patent filings, and technological adoption in legal and corporate sectors. The growing number of domestic and multinational corporations, coupled with the push for efficient IP management, is driving market growth. Cloud-based solutions and automation tools are being increasingly deployed for accuracy and timely management of IP portfolios, further supporting market expansion in China.

Docketing Solution Market Share

The docketing solution industry is primarily led by well-established companies, including:

- Sagacious IP (U.K.)

- Cardinal Intellectual Property Inc. (U.S.)

- Clairvolex (U.S.)

- Einfolge (U.S.)

- FlexTrac (U.S.)

- American LegalNet (U.S.)

- Anaqua, Inc. (U.S.)

- Record Time Pty Ltd. (Australia)

- Thomson Reuters (Canada)

- LexisNexis (U.S.)

- CPA Global (U.K.)

- AppColl, Inc. (U.S.)

- DocketTrak (U.S.)

- IPfolio (U.S.)

Latest Developments in Global Docketing Solution Market

- In October 2025, Lexitas began a national rollout of its award‑winning case tracking and docketing software, eLaw, extending its availability to 39 states across the U.S. This expansion enhances access to a comprehensive, searchable docketing and calendaring platform for legal professionals, enabling streamlined management of active cases, real‑time alerts, and synchronization with case management systems, which is expected to significantly improve operational efficiency and reduce missed deadlines for law firms of all sizes

- In August 2025, Discover Docket launched its AI‑powered litigation intelligence platform that integrates docketing, case management, document automation, and research into a unified solution. This development represents a major innovation in the docketing solution market as it replaces disconnected legal tools with a single AI‑driven platform capable of automating calendaring, deadline tracking, document drafting, and research, thereby improving workflow efficiency and reducing reliance on multiple disparate systems

- In September 2025, LexisNexis (US) expanded its partnership with a leading legal technology firm to enhance its docketing solutions. This collaboration strengthens LexisNexis’s docketing offerings by embedding more robust capabilities into existing workflows, which is likely to boost user satisfaction, deepen client retention, and solidify its competitive position in the legal tech landscape

- In August 2025, Thomson Reuters (CA) announced the launch of a new AI‑driven docketing tool designed to streamline case management for legal professionals. The launch elevates the company’s product portfolio by integrating AI to enhance accuracy and efficiency in legal processes, reinforcing its position as a technology innovator and attracting a broader legal user base

- In July 2025, Clio (CA) introduced a new feature within its platform that allows for real‑time collaboration among legal teams. This development emphasizes Clio’s focus on digital transformation and the growing importance of collaborative tools in the legal industry, facilitating better communication and teamwork while strengthening its appeal among modern law firms that prioritize efficiency and flexibility in their operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Docketing Solution Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Docketing Solution Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Docketing Solution Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.