Global Dns Service Market

Market Size in USD Million

CAGR :

%

USD

502.81 Million

USD

1,218.52 Million

2024

2032

USD

502.81 Million

USD

1,218.52 Million

2024

2032

| 2025 –2032 | |

| USD 502.81 Million | |

| USD 1,218.52 Million | |

|

|

|

|

Domain Name System (DNS) Market Size

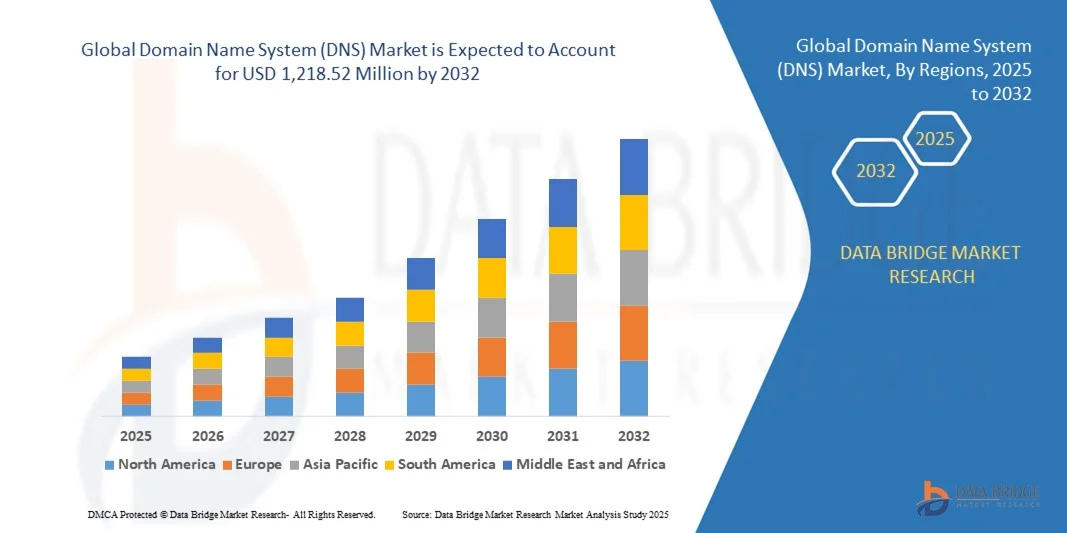

- The global domain name system (DNS) market size was valued at USD 502.81 million in 2024 and is expected to reach USD 1,218.52 million by 2032, at a CAGR of 11.70% during the forecast period

- The market growth is largely fuelled by the increasing adoption of cloud-based services, rising demand for secure and reliable internet infrastructure, and the growing importance of domain name management for enterprises

- The surge in cyber threats and the need for advanced DNS security solutions, such as DNS firewalls and threat intelligence integration, is also driving market expansion

Domain Name System (DNS) Market Analysis

- The increasing emphasis on enterprise network security, data protection, and uninterrupted internet access is encouraging investments in next-generation DNS solutions

- Enhanced DNS services that provide analytics, threat detection, and automated response capabilities are gaining traction among organizations to prevent outages, phishing, and DDoS attacks

- North America dominated the DNS market with the largest revenue share of 38.5% in 2024, driven by widespread cloud adoption, increasing reliance on digital infrastructure, and the need for robust DNS security solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global domain name system (DNS) market, driven by expanding IT infrastructure, rising demand for high-performance and secure DNS services, and government initiatives supporting digital transformation and smart city projects

- The Primary DNS Server segment held the largest market revenue share in 2024, driven by its critical role in domain resolution, fast query handling, and ensuring continuous availability of web services. Primary DNS servers are widely used across enterprises to maintain authoritative control over domain records, providing reliability and seamless integration with enterprise IT infrastructures

Report Scope and Domain Name System (DNS) Market Segmentation

|

Attributes |

Domain Name System (DNS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Domain Name System (DNS) Market Trends

Increasing Adoption of Cloud-Based and Managed DNS Services

- The growing shift toward cloud-based and managed DNS services is transforming the DNS market by enabling faster, more reliable, and scalable domain resolution. Organizations benefit from reduced downtime, improved website performance, and enhanced traffic management across multiple locations. In addition, centralized monitoring and automated failover features improve operational resilience and reduce dependency on in-house IT teams

- Rising demand for secure and resilient DNS solutions is accelerating adoption, particularly among enterprises and service providers. Cloud DNS platforms offer automated updates, load balancing, and geo-redundancy, ensuring seamless connectivity even during high traffic or attack scenarios. This adoption also helps companies comply with stringent uptime requirements and maintain global accessibility for critical applications

- The affordability and ease of integration of modern DNS solutions are making them attractive for businesses of all sizes. Companies can deploy DNS services quickly without extensive in-house infrastructure, which improves operational efficiency and reduces IT overhead. Moreover, subscription-based pricing models allow organizations to scale resources dynamically without large capital expenditure

- For instance, in 2023, several multinational companies implemented managed DNS services to optimize global website performance and prevent outages, improving user experience and safeguarding revenue streams. These deployments also allowed IT teams to focus on core business initiatives instead of managing DNS infrastructure manually

- While cloud and managed DNS adoption is growing rapidly, sustained market expansion depends on advanced security features, low latency, and continuous innovation in DNS management tools to meet evolving enterprise requirements. Vendors must continually enhance analytics, monitoring, and automation to retain competitive advantage in a fast-evolving digital ecosystem

Domain Name System (DNS) Market Dynamics

Driver

Rising Need for Robust DNS Security and Performance Optimization

- Increasing cyber threats such as DDoS attacks, DNS hijacking, and cache poisoning are driving the adoption of secure and resilient DNS solutions. Organizations are investing in advanced security protocols, including DNSSEC, to protect their digital assets and maintain customer trust. Integration with threat intelligence and anomaly detection further strengthens defenses against evolving attack vectors

- Businesses are seeking high-performance DNS services to ensure fast resolution times, reduce latency, and enhance the reliability of web and application delivery. This trend is particularly evident among e-commerce, financial, and cloud service providers. Consistent uptime and global load balancing capabilities also improve end-user experience and operational efficiency

- Government regulations and industry standards emphasizing cybersecurity and uptime are further accelerating demand for managed and cloud DNS services. Enterprises are integrating DNS solutions with broader security frameworks for compliance and risk mitigation. These frameworks often include incident response protocols, audit trails, and reporting mechanisms to meet regulatory expectations

- For instance, in 2022, several financial institutions in North America adopted DNS security solutions to prevent downtime and data breaches, resulting in improved network reliability and reduced operational risks. Enhanced redundancy and real-time monitoring capabilities enabled proactive threat mitigation and minimized service disruptions

- While the need for DNS security and performance is a major growth driver, the market requires continuous innovation, automated threat detection, and scalable infrastructure to meet increasing global demand. Vendors must provide AI-driven analytics, predictive maintenance, and robust SLAs to ensure high adoption rates and customer satisfaction

Restraint/Challenge

Complexity of DNS Management and Integration with Legacy Systems

- The deployment and management of DNS solutions can be complex, especially when integrating with existing legacy systems. Enterprises often require skilled personnel to configure, monitor, and maintain DNS infrastructures effectively. In addition, migration from on-premises to cloud-based DNS may involve compatibility testing and phased implementation, increasing project timelines

- High upfront costs for enterprise-grade DNS services, including advanced security and redundancy features, may limit adoption among small and medium-sized businesses. Cost concerns can slow the implementation of robust DNS solutions. Bundled offerings and subscription models can alleviate some financial pressure but may not cover the full range of enterprise requirements

- Inadequate awareness and training regarding DNS security best practices can increase vulnerability to cyberattacks and operational failures. Companies may struggle to fully leverage the capabilities of modern DNS platforms. Continuous education, workshops, and managed services support are essential to bridge the skill gap

- For instance, in 2023, several SMEs in Europe faced service disruptions due to misconfigured DNS systems, highlighting the importance of proper training and managed services. These incidents often led to revenue losses and customer dissatisfaction, emphasizing the operational risk associated with DNS mismanagement

- While technological capabilities continue to advance, addressing integration complexity, cost, and skill gaps remains crucial for broader DNS market adoption and sustainable growth. Vendors need to focus on user-friendly interfaces, automation, and robust support systems to ensure smooth deployment and long-term adoption

Domain Name System (DNS) Market Scope

The market is segmented on the basis of DNS server, DNS service, deployment type, organization size, and industrial vertical.

- By DNS Server

On the basis of DNS server, the DNS market is segmented into Primary DNS Server and Secondary DNS Server. The Primary DNS Server segment held the largest market revenue share in 2024, driven by its critical role in domain resolution, fast query handling, and ensuring continuous availability of web services. Primary DNS servers are widely used across enterprises to maintain authoritative control over domain records, providing reliability and seamless integration with enterprise IT infrastructures.

The Secondary DNS Server segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for redundancy, disaster recovery, and high availability in enterprise and cloud environments. Secondary DNS servers ensure failover support, reduce latency, and protect against service interruptions, making them essential for businesses with critical online operations.

- By DNS Service

On the basis of DNS service, the market is segmented into Anycast Network, Distributed Denial of Service (DDoS) Protection, GeoDNS, and Other DNS Services. The Anycast Network segment held the largest market revenue share in 2024, due to its ability to route user requests to the nearest server, improving query response times and resilience against traffic spikes. Anycast networks are increasingly integrated into managed DNS platforms to enhance global website performance.

The DDoS Protection segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising cyber threats and the growing need for secure, reliable DNS services. DDoS protection helps enterprises mitigate attacks, maintain uptime, and safeguard digital assets, which is particularly important for financial, e-commerce, and cloud service providers.

- By Deployment Type

On the basis of deployment type, the DNS market is segmented into Cloud and On-Premises. The Cloud segment held the largest revenue share in 2024, owing to its scalability, ease of management, and lower infrastructure requirements. Cloud DNS services allow businesses to manage domains without maintaining in-house servers, reducing IT overhead and enabling rapid global deployment.

The On-Premises segment is expected to witness the fastest growth rate from 2025 to 2032, driven by organizations seeking complete control over DNS infrastructure, enhanced security, and compliance with industry regulations. On-premises deployments remain preferred in sectors such as banking, government, and healthcare, where data sovereignty and privacy are critical.

- By Organization Size

On the basis of organization size, the market is segmented into Large Enterprises and Small and Medium-Sized Enterprises (SMEs). Large Enterprises held the largest market share in 2024 due to their extensive online presence, need for robust DNS performance, and investment capacity for advanced DNS security and redundancy. Enterprise-grade DNS solutions support multi-location operations, high query volumes, and integration with broader IT and security frameworks.

The SME segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing digital adoption, cloud-based DNS services, and cost-effective subscription models that enable smaller organizations to enhance web reliability and security without heavy capital investment.

- By Industrial Vertical

On the basis of industrial vertical, the DNS market is segmented into Banking, BFSI, Financial Services, and Insurance; Telecom and IT, Media and Entertainment, Retail and E-commerce, Healthcare, Government, Education, and Other sectors. The Banking, BFSI, Financial Services, and Insurance segment held the largest market share in 2024, driven by stringent uptime requirements, regulatory compliance, and critical dependence on secure DNS infrastructure for online transactions.

The Retail and E-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing online transactions, customer demand for uninterrupted service, and the adoption of cloud and managed DNS solutions to handle high traffic, prevent outages, and ensure smooth user experiences.

Domain Name System (DNS) Market Regional Analysis

- North America dominated the DNS market with the largest revenue share of 38.5% in 2024, driven by widespread cloud adoption, increasing reliance on digital infrastructure, and the need for robust DNS security solutions

- Organizations in the region prioritize low-latency, high-performance DNS services to support critical applications, enterprise networks, and digital operations

- This widespread adoption is further supported by advanced IT infrastructure, high internet penetration, and stringent cybersecurity regulations, establishing DNS solutions as a key component of enterprise digital strategy

U.S. DNS Market Insight

The U.S. DNS market captured the largest revenue share in 2024 within North America, fueled by rapid adoption of cloud-based services, managed DNS solutions, and the growing emphasis on network resilience. Enterprises are increasingly investing in secure, scalable DNS infrastructures to protect against cyberattacks and ensure continuous online availability. The proliferation of e-commerce, SaaS platforms, and remote work environments further drives demand for advanced DNS solutions across industries.

Europe DNS Market Insight

The Europe DNS market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent data protection regulations, cybersecurity mandates, and the increasing adoption of cloud services. Organizations across Germany, France, and the U.K. are focusing on secure, high-performance DNS solutions to ensure operational continuity and regulatory compliance. The region is witnessing strong growth across banking, IT, and government sectors.

U.K. DNS Market Insight

The U.K. DNS market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing digital transformation initiatives, rising cyber threats, and the need for resilient domain name resolution systems. Businesses are prioritizing DNS security, redundancy, and integration with cloud-based IT infrastructures. The robust technology ecosystem and widespread adoption of managed DNS services are expected to further boost market growth.

Germany DNS Market Insight

The Germany DNS market is expected to witness the fastest growth rate from 2025 to 2032, fueled by strong IT infrastructure, adoption of enterprise cloud services, and government initiatives for digital security. Enterprises are implementing DNS solutions to enhance application performance, reduce downtime, and comply with cybersecurity standards. The focus on secure, low-latency DNS networks supports market growth across multiple industrial verticals.

Asia-Pacific DNS Market Insight

The Asia-Pacific DNS market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing digitalization, rapid cloud adoption, and expansion of IT and telecom infrastructure in countries such as China, Japan, and India. Organizations are increasingly prioritizing secure and reliable DNS services to manage growing online traffic and prevent cyber threats. Government initiatives to promote smart cities and cloud computing adoption are also driving demand.

Japan DNS Market Insight

The Japan DNS market is expected to witness the fastest growth rate from 2025 to 2032 due to high internet penetration, advanced IT infrastructure, and strong cybersecurity awareness. Enterprises are adopting DNS solutions to ensure high availability, low latency, and enhanced protection against DNS-based attacks. The growing adoption of cloud services and managed DNS platforms further supports market growth across commercial and government sectors.

China DNS Market Insight

The China DNS market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to rapid digital transformation, cloud adoption, and expansion of e-commerce and IT services. Organizations are investing in DNS security and performance optimization to support mission-critical applications and enhance end-user experiences. The push for smart cities, robust IT infrastructure, and local managed DNS service providers are key factors propelling the market in China.

Domain Name System (DNS) Market Share

The Domain Name System (DNS) industry is primarily led by well-established companies, including:

- Allied Telesis, Inc. (U.S.)

- BlueCat Networks (Canada)

- Cisco Systems Inc. (U.S.)

- Cloudflare, Inc. (U.S.)

- Comodo Security Solutions, Inc. (U.S.)

- DigiCert, Inc. (U.S.)

- Efficient IP (U.S.)

- Mission Secure Inc. (U.S.)

- F5, Inc. (U.S.)

- IBM Corporation (U.S.)

- Infoblox. (U.S.)

- Insight (U.S.)

- Akamai Technologies (India)

- ThreatSTOP (U.S.)

- Verigio Inc. (U.S.)

- VeriSign Inc. (U.S.)

Latest Developments in Global Domain Name System (DNS) Market

- In April 2023, IBM acquired NS1, integrating its managed DNS capabilities and core networking services into IBM's network automation software portfolio. This acquisition enhances IBM's offerings, providing clients with comprehensive solutions for network management and optimization. IBM strengthens its position in the market by expanding its capabilities, offering advanced networking solutions to businesses worldwide

- In February 2023, CDNetworks supported QUIC and HTTP/3 protocols, strengthening its web application performance capabilities and enhancing network transmission efficiency. CDNetworks enables faster and more secure data delivery by adopting these advanced protocols, enhancing user experience and optimizing network performance for businesses, thus benefiting the market with improved web application performance and efficiency

- In February 2022, Cloudflare acquired Vectrix to enhance its Cloudflare One Zero Trust platform. Vectrix enables the scanning of third-party tools such as Google Workspace and GitHub for security vulnerabilities. This integration enhances application visibility and control, empowering businesses to mitigate risks and ensure secure operations, thereby advancing market security standards

- In September 2022, Cloudflare introduced Turnstile, a privacy-focused alternative to CAPTCHA, simplifying human validation on the internet. Turnstile enhances user experience by streamlining authentication processes while preserving privacy. This innovation contributes to improved security and usability standards, ultimately benefiting the market with enhanced online interactions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.