Global Direct Current (DC) Switchgear Market, By Insulation (Gas Insulated, Air Insulated), Voltage (Up to 750 V, 750 V to 1,800 V, 1,800 V to 3,000 V, 3,000 V to 10 kV, Above 10 kV), Deployment Type (Fixed Mounting, Plug-In, Withdrawable Units), Component Type (Power Distributor Switch Breaker, Switch Disconnector, Moulded Case Circuit Breaker (MCCB), High Rupturing Capacity (HRC) Fuse, Earth Switch, Miniature Circuit Breakers (MCB)), Installation (Indoor, Outdoor), End-Users (Training and Development (T&D) Utilities, Industries, Commercial and Residential, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Over the recent years, there has been a growing need for need for a stable and reliable T&D network. According to reports, the United States experiences more blackouts than any other developed country, with power outages lasting more than an hour and increasing steadily in recent years, costing American businesses approximately USD 150 billion per year. This creates massive demand for the direct current (DC) switchgear market. Furthermore, the inclination toward renewable power generation has led to a surge in investments in renewable energy, which has largely accelerated the growth for the market and is projected to continue at the same pace over the forecast period due to the increase in demand for energy.

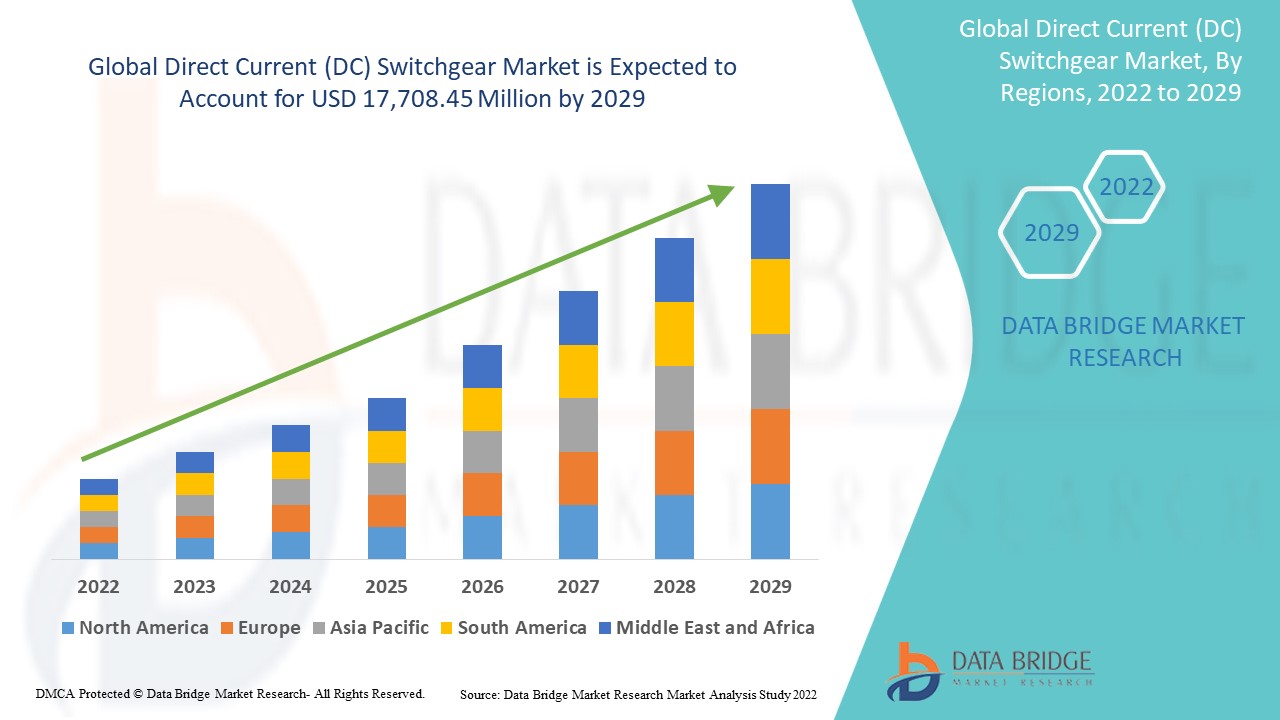

Global Direct Current (DC) Switchgear Market was valued at USD 10,700.0 million in 2021 and is expected to reach USD 17,708.45 million by 2029, registering a CAGR of 6.50% during the forecast period of 2022-2029. The market report curated by the Data Bridge Market Research team includes technological advancements, regulatory framework, PESTEL, porter's five forces analysis, industry standards-at a glance, raw material costs/ operational expenditure-overview, supply chain analysis, vendor selection criteria, pricing analysis, production analysis, and climate chain scenario.

Market Definition

Switchgear is a group of electrical devices that include fuses, circuit breakers, and electrical disconnect switches. They are used to protect, monitor, control, and isolate electrical equipment. Furthermore, by clearing the electrical fault, switchgear breaks, carries, and allows the smooth flow of current load. Switchgear is a collection of components found in the grid used to control fluctuation. The direct current (DC) switchgear is designed to protect the direct current powered railway line and is integrated with high speed circuit breakers for the rectifier, power feeder, and backup application to prevent safety incidents.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

By Insulation (Gas Insulated, Air Insulated), Voltage (Up to 750 V, 750 V to 1,800 V, 1,800 V to 3,000 V, 3,000 V to 10 kV, Above 10 kV), Deployment Type (Fixed Mounting, Plug-In, Withdrawable Units), Component Type (Power Distributor Switch Breaker, Switch Disconnector, Moulded Case Circuit Breaker (MCCB), High Rupturing Capacity (HRC) Fuse, Earth Switch, Miniature Circuit Breakers (MCB)), Installation (Indoor, Outdoor), End-Users (Training and Development (T&D) Utilities, Industries, Commercial and Residential, Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Poland, Norway, Finland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Nigeria, Algeria, Angola, Ghana, Rest of Middle East and Africa

|

|

Market Players Covered

|

Mass-Tech Controls Pvt. Ltd. (India), MEIDENSHA CORPORATION (Japan), Hitachi Energy Ltd. (Japan), ABB (Switzerland), Siemens (Germany), Eaton (Ireland), Toshiba Infrastructure Systems & Solutions Corporation (Japan), Myers Power Products, Inc. (U.S.), ENTEC Electric & Electronic (South Korea), PLUTON Rail PTY LTD (Ukraine), Schneider Electric (France), Sécheron (Switzerland), LS ELECTRIC Co., Ltd ( South Korea), General Electric (U.S.), KDM Steel (China), Powell Industries (U.S.), Brush (UK), Grimard (Canada), DAQO Group (China) and Ningbo Tianan (Group) Co., Ltd (China).

|

|

Market Opportunities

|

|

Direct Current (DC) Switchgear Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Deteriorating Power Infrastructure

There has been a surging number of blackouts across the globe and the primary causes are ageing infrastructure, a lack of investment, and a lack of a clear policy to modernize the grid. According to the DOE and the North American Electric Reliability Corp., only a system capable of handling sudden power spikes and drops can ensure uninterrupted power. Switchgear alerts the maintenance team when ageing and over-used equipment is on the verge of failure and enables them to make smarter decisions by providing real-time data to reveal problems and improvement opportunities. The growing energy demand has necessitated the establishment of a stable and dependable transmission and distribution (T&D) network. Therefore, with the deteriorating power infrastructure, there has been high demand for reliable and secure power supply worldwide, which largely accelerates the market demand over forecasted period.

Furthermore, the major factors driving the direct current (DC) switchgears market are increased construction activity globally, owing to a greater emphasis on infrastructure combine with the growing demand for safe and reliable systems. Moreover, the expansion of extra high-tension transmission networks to meet rising energy demand in the manufacturing and industrial sectors is estimated to further bolster the product demand. In tandem with increased investments in sustainable power generation technologies, the ongoing integration of smart monitoring and control units will drive up product demand even further.

Opportunities

- Investments, Norms and Funds

Furthermore, the increasing investments to develop renewable energy further extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, favorable norms of the governments to support the new technology coupled with the surging fund allocations toward solar and offshore wind farms across developed and developing countries are anticipated to further expand the future growth of the direct current (DC) switchgear market.

Restraints/Challenges

- Extensive Environmental Conditions

The various environmental parameters such as temperature and humidity and groundwater seepage are some of the factors that can affect the efficiency of switchgear electrical networks, particularly those installed outdoors. The equipment must meet or exceed the rigorous specifications to ensure switchgear's reliable and proper operation within the substation environment. As a result, the environmental condition might create hindrances in the market growth over the forecasted period.

- Cybersecurity Issues

The installation of modernized direct current (DC) switchgear is associated with many challenges, especially the technical aspects that pose a threat to any nation's economy. Smart devices help any power supply system run smoothly, but they may pose a security risk from anti-social elements. Data theft or security breaches could be accomplished by circumventing remote access security measures, resulting in blackouts and power outages. According to government research, two-thirds of large businesses in the UK are victims of cyber breaches or attacks. As a result, a multi-layer shield is required to ensure the cybersecurity of substations, which include DC switchgear. This factor will pose as a threat for the 'market's growth over the forecasted period.

- Extremely High Costs of Direct Current (DC) Switchgear

The power-conducting components, such as switches, fuses, circuit breakers and lightning arrestors, that conduct or interrupt the flow of electrical power, and control systems such as control panels, current transformers, protective relays, potential transformers and associated circuitry that monitor, control, and protect the power-conducting components that make the switchgear solution complex and costly. The high cost of these switchgears pose as a serious challenge to the growth of the direct current (DC) switchgear market.

This direct current (DC) switchgear market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the direct current (DC) switchgear market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Direct Current (DC) Switchgear Market

The recent outbreak of coronavirus had a negative impact on the direct current (DC) switchgear market. The global economy has slowed as most countries worldwide imposed nationwide lockdowns to prevent the virus from spreading further. The effects of the COVID-19 pandemic, including actions taken by businesses and governments to contain the virus's spread, have resulted in a significant and rapid decrease in energy demand. As of May 28, 2020, the pandemic had affected 212 countries, and individual governments had ordered nationwide lockdowns. This resulted in a significant decrease in transportation and related activities, which further impacted energy demand. These events had caused significant disruptions in the corresponding activities of market participants, thereby impeding demand for direct current (DC) switchgear. Furthermore, the pandemic has caused deep recessions and is expected to have a long-term impact on the global economy due to decreased investment and disruptions in global trade and supply chains. The growth of the direct current (DC) switchgear market was also massively hampered by the shutdown of manufacturing operations and a drop in demand for commercial services in 2020. As a result, demand for direct current (DC) switchgears in the residential, commercial, and industrial sectors fell. The pandemic crisis has brought global construction and industrial activity to a halt, putting a damper on demand for direct current (DC) switchgears. HVAC production lines in the European Union were shut down for several weeks, and new installation projects were pushed back.

However, the 'government's assistance to manufacturers and distributors of direct current (DC) switchgears, on the other hand, is expected to lessen the impact of the pandemic crisis on market participants.

Recent Development

- In June 2020, ABB announced a collaboration with an Italian switchgear designer for a significant water purification plant in Northern Italy to provide technology for the expansion of a cooperative water purification plant. This project is critical for preserving water quality in the rivers and lakes of one of the Po Valley's most industrialised areas.

- In December 2021, Rail Vikas Nigam Limited (RVNL), a government of India organisation under the Ministry of Railways, has chosen Hitachi Energy India's advanced power automation and control solution. Hitachi Energy India provided remote terminal units and a SCADA system for the Baranagar and Dakshineswar traction substations (TSS). The scope of work included the design, supply, installation, testing, and commissioning of a SCADA system for 33 KV power distribution, traction substations, auxiliary substations, and a 750 V dc third rail traction system for the Joka-Majerhat and airport-new Garia corridors.

- In June 2021, Siemens Energy and Mitsubishi Electric signed a Memorandum of Understanding (MoU) to conduct a feasibility study on the joint development of zero-GWP high-voltage switching solutions that replace greenhouse gases with clean air for insulation.

Global Direct Current (DC) Switchgear Market Scope

The direct current (DC) switchgear market is segmented on the basis of insulation, voltage, deployment type, component type, installation and end-users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Insulation

- Gas Insulated

- Air Insulated

Voltage

- Up to 750 V

- 750 V to 1,800 V

- 1,800 V to 3,000 V

- 3,000 V to 10 kV

- Above 10 kV

Deployment Type

- Fixed Mounting

- Plug-In

- Withdrawable Units

Component Type

- Power Distributor Switch Breaker

- Switch Disconnector

- Moulded Case Circuit Breaker (MCCB)

- High Rupturing Capacity (HRC) Fuse

- Earth Switch

- Miniature Circuit Breakers (MCB)

Installation

- Indoor

- Outdoor

End-Users

- Transmission and Distribution (T&D) Utilities

- Industries

- Commercial and Residential

- Others

Direct Current (DC) Switchgear Market Regional Analysis/Insights

The direct current (DC) switchgear market is analysed and market size insights and trends are provided by country, insulation, voltage, deployment type, component type, installation and end-users as referenced above.

The countries covered in the direct current (DC) switchgear market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Poland, Norway, Finland, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Nigeria, Algeria, Angola, Ghana, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the direct current (DC) switchgear market because of the surge in shale gas exploration activities and the commencement of several offshore drilling activities within the region.

Asia-Pacific on the other hand, is estimated to show lucrative growth during the forecast period of 2022 to 2092 due to the commencement of planned exploration and production of oil and gas wells within the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Direct Current (DC) Switchgear Market Share Analysis

The direct current (DC) switchgear market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to direct current (DC) switchgear market.

Some of the major players operating in the direct current (DC) switchgear market are

- Mass-Tech Controls Pvt. Ltd. (India)

- MEIDENSHA CORPORATION (Japan)

- Hitachi Energy Ltd. (Japan)

- ABB (Switzerland)

- Siemens (Germany)

- Eaton (Ireland)

- Toshiba Infrastructure Systems & Solutions Corporation (Japan)

- Myers Power Products, Inc. (U.S.)

- ENTEC Electric & Electronic (South Korea)

- PLUTON Rail PTY LTD (Ukraine)

- Schneider Electric (France)

- Sécheron (Switzerland)

- LS ELECTRIC Co., Ltd (South Korea)

- General Electric (U.S.)

- KDM Steel (China)

- Powell Industries (U.S.)

- Brush (UK)

- Grimard (Canada)

- DAQO Group (China)

- Ningbo Tianan (Group) Co., Ltd (China)

SKU-