Global Dipropylene Glycol N Butyl Ether Market

Market Size in USD Billion

CAGR :

%

USD

16.68 Billion

USD

29.09 Billion

2025

2033

USD

16.68 Billion

USD

29.09 Billion

2025

2033

| 2026 –2033 | |

| USD 16.68 Billion | |

| USD 29.09 Billion | |

|

|

|

|

Dipropylene Glycol N-Butyl Ether Market Size

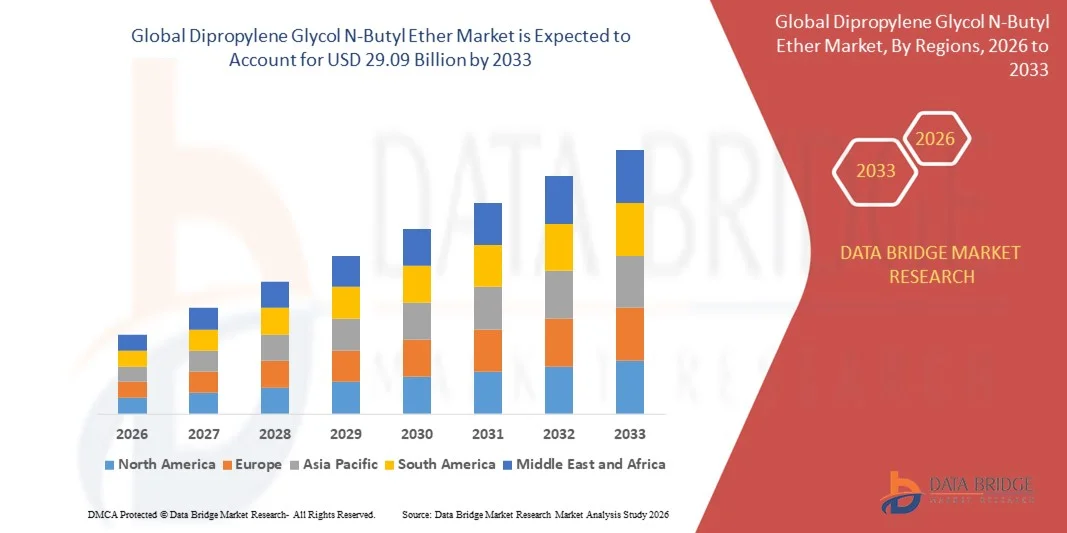

- The global dipropylene glycol N-butyl ether market size was valued at USD 16.68 billion in 2025 and is expected to reach USD 29.09 billion by 2033, at a CAGR of 7.2% during the forecast period

- The market growth is largely driven by the increasing demand for high-performance solvents in industrial, coatings, and cleaning applications, as they enhance product efficiency and reduce environmental impact

- Furthermore, rising adoption of eco-friendly and low-VOC formulations in paints, coatings, and cleaning products is encouraging manufacturers such as Dow and Eastman Chemical Company to incorporate Dipropylene Glycol N-Butyl Ether, boosting market expansion

Dipropylene Glycol N-Butyl Ether Market Analysis

- Dipropylene Glycol N-Butyl Ether serves as a versatile solvent with excellent solvency, low toxicity, and compatibility with a wide range of chemicals, making it indispensable in industrial processes and specialty chemical formulations

- The market is also supported by technological advancements in chemical processing and formulation techniques, which improve product performance and broaden its application scope in industries such as pharmaceuticals, personal care, and agrochemicals

- Asia-Pacific dominated the dipropylene glycol N-butyl ether market with a share of 35.7% in 2025, due to strong growth in paints and coatings, expanding cleaning and detergent manufacturing, and the presence of large-scale chemical production hubs

- North America is expected to be the fastest growing region in the dipropylene glycol N-butyl ether market during the forecast period due to strong demand for water-based coatings, industrial cleaners, and specialty formulations

- Coatings segment dominated the market with a market share of 43.9% in 2025, due to its widespread adoption in architectural, industrial, and protective coatings where dipropylene glycol N-butyl ether improves flow characteristics, enhances leveling, and ensures uniform film formation. Its strong compatibility with water-based systems and contribution to low-VOC formulations support consistent demand, particularly as regulatory pressure increases across construction and industrial applications

Report Scope and Dipropylene Glycol N-Butyl Ether Market Segmentation

|

Attributes |

Dipropylene Glycol N-Butyl Ether Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dipropylene Glycol N-Butyl Ether Market Trends

Rising Adoption of Eco-Friendly and Low-VOC Solvents

- A significant trend in the Dipropylene Glycol N-Butyl Ether market is the growing adoption of eco-friendly and low-VOC solvents across coatings, cleaning agents, and industrial applications, driven by increasing environmental regulations and consumer preference for safer chemical products. This trend is encouraging manufacturers to develop formulations that reduce volatile organic compound emissions while maintaining high performance

- For instance, Dow and Eastman Chemical Company are actively supplying low-VOC Dipropylene Glycol N-Butyl Ether-based solvents for industrial coatings and cleaning products. These solutions help clients meet regulatory compliance and environmental sustainability goals

- The rising focus on sustainable chemical solutions is promoting the replacement of conventional high-VOC solvents with Dipropylene Glycol N-Butyl Ether in architectural paints, automotive coatings, and surface cleaners. This is driving innovation in product formulations that enhance solvency while minimizing environmental impact

- Industrial cleaning applications are increasingly utilizing Dipropylene Glycol N-Butyl Ether due to its compatibility with water-based formulations and its ability to dissolve oils and resins efficiently. This trend supports safer work environments and reduces exposure to hazardous chemicals

- The pharmaceutical and personal care sectors are also exploring Dipropylene Glycol N-Butyl Ether as a solvent and carrier agent for active ingredients, accelerating its adoption beyond traditional industrial applications. This is positioning the chemical as a versatile component across multiple high-growth industries

- Rising global awareness of sustainable and non-toxic chemical alternatives is further strengthening market momentum. This growing preference is encouraging manufacturers to expand production capacity and diversify product offerings to meet evolving customer needs

Dipropylene Glycol N-Butyl Ether Market Dynamics

Driver

Growing Demand for High-Performance Industrial and Cleaning Solvents

- The increasing industrial demand for high-performance solvents that offer excellent solvency, low toxicity, and formulation flexibility is driving the Dipropylene Glycol N-Butyl Ether market. Industries such as coatings, cleaning, and specialty chemicals are relying on these solvents to improve product efficiency and safety

- For instance, Eastman Chemical Company provides high-purity Dipropylene Glycol N-Butyl Ether for industrial coatings and surface cleaners. These products enhance cleaning efficiency while maintaining regulatory compliance and reducing harmful emissions

- The trend toward water-based and environmentally safe formulations is fueling demand for solvents with low volatility and high solvency, positioning Dipropylene Glycol N-Butyl Ether as a preferred solution in industrial and household applications

- The chemical’s compatibility with diverse formulations enables manufacturers to create multi-functional products that meet industry-specific performance standards. This versatility continues to support its widespread adoption across industrial sectors

- Rising investment in research and development by leading chemical manufacturers is also enhancing solvent performance and broadening application areas. These advancements continue to strengthen market growth prospects and support long-term adoption

Restraint/Challenge

Fluctuating Raw Material Prices Affecting Production Costs

- The Dipropylene Glycol N-Butyl Ether market faces challenges due to volatility in the prices of key raw materials, such as propylene oxide and butanol, which directly influence production costs and profit margins. These fluctuations create uncertainty for manufacturers and can affect supply stability

- For instance, Dow has reported periodic adjustments in pricing to account for changes in upstream chemical costs, impacting downstream customers and market competitiveness

- Manufacturers must balance maintaining competitive pricing with adhering to regulatory standards and ensuring product quality, which adds pressure to operational efficiency. Cost volatility can also hinder expansion plans and investments in new production capacities

- Global supply chain disruptions, including transportation bottlenecks and raw material shortages, exacerbate cost fluctuations and affect timely delivery of solvents. This increases operational complexity for companies operating at scale

- The market continues to face constraints from economic cycles and international trade dynamics, which influence raw material availability and pricing stability. These challenges require manufacturers to optimize procurement strategies and production planning to sustain growth in a competitive environment

Dipropylene Glycol N-Butyl Ether Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the Dipropylene Glycol N-Butyl Ether market is segmented into Purity = 98.5% and Purity < 98.5%. The Purity = 98.5% segment dominated the market with the largest revenue share in 2025, driven by its high solvency performance, low odor profile, and consistent quality required in industrial and specialty applications. Manufacturers prefer this grade for applications where formulation stability and predictable evaporation rates are critical. Its widespread use in coatings, cleaning formulations, and chemical processing supports steady demand across multiple end-use industries. Strong acceptance among multinational formulators further reinforces its leadership position in the market.

The Purity < 98.5% segment is expected to witness the fastest growth from 2026 to 2033, supported by rising demand for cost-optimized solvents in large-volume industrial applications. This grade is increasingly adopted where ultra-high purity is not mandatory, allowing manufacturers to reduce raw material costs without compromising functional performance. Growth in developing economies and expansion of local chemical manufacturing units are accelerating its uptake. The segment benefits from broader usage in bulk cleaning and intermediary applications, driving higher volume consumption over the forecast period.

- By Application

On the basis of application, the Dipropylene Glycol N-Butyl Ether market is segmented into Cleaning Formulation, Coatings, Chemical Intermediates, and Others. The Coatings segment accounted for the largest market revenue share of 43.9% in 2025, driven by its widespread adoption in architectural, industrial, and protective coatings where dipropylene glycol N-butyl ether improves flow characteristics, enhances leveling, and ensures uniform film formation. Its strong compatibility with water-based systems and contribution to low-VOC formulations support consistent demand, particularly as regulatory pressure increases across construction and industrial applications.

The Cleaning Formulation segment is anticipated to register the fastest growth rate from 2026 to 2033, fueled by increasing consumption of household, institutional, and industrial cleaning products across commercial and residential settings. The solvent’s strong grease-cutting ability, low odor profile, and effectiveness in both hard-surface and specialty cleaners make it highly attractive to formulators, while rising hygiene standards and expansion of professional cleaning services continue to accelerate market growth.

Dipropylene Glycol N-Butyl Ether Market Regional Analysis

- Asia-Pacific dominated the dipropylene glycol N-butyl ether market with the largest revenue share of 35.7% in 2025, driven by strong growth in paints and coatings, expanding cleaning and detergent manufacturing, and the presence of large-scale chemical production hubs

- The region’s cost-efficient production capabilities, rising demand for water-based formulations, and increasing exports of glycol ethers are accelerating overall market expansion

- Rapid industrialization, supportive government policies, and continuous investments in construction, automotive, and consumer goods sectors are contributing to higher consumption across multiple applications

China Dipropylene Glycol N-Butyl Ether Market Insight

China held the largest share in the Asia-Pacific market in 2025, supported by its dominant position in chemical manufacturing and extensive production of coatings, cleaners, and industrial formulations. Strong domestic demand from construction and manufacturing sectors, along with large-scale export-oriented production, continues to drive market growth. Ongoing capacity expansions and government-backed industrial development further strengthen China’s leadership position.

India Dipropylene Glycol N-Butyl Ether Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding construction activity, rising demand for household and industrial cleaning products, and growth in local chemical manufacturing. Government initiatives promoting domestic chemical production and infrastructure development are supporting increased consumption. The shift toward water-based and environmentally compliant formulations is further accelerating market momentum.

Europe Dipropylene Glycol N-Butyl Ether Market Insight

The Europe market is growing steadily, driven by stringent environmental regulations and strong demand for low-VOC solvents in coatings and cleaning applications. The region emphasizes high-quality formulations, regulatory compliance, and sustainable chemical usage. Continued innovation in water-based coatings and industrial cleaners is supporting consistent market development.

Germany Dipropylene Glycol N-Butyl Ether Market Insight

Germany’s market is supported by its well-established chemical industry, strong industrial base, and high demand from automotive, construction, and industrial maintenance sectors. Advanced manufacturing capabilities and strong focus on formulation performance are sustaining demand. The country’s export-oriented chemical production further contributes to stable market growth.

U.K. Dipropylene Glycol N-Butyl Ether Market Insight

The U.K. market benefits from steady demand in coatings, professional cleaning products, and specialty chemical formulations. Increasing focus on environmentally compliant solvents and local production of specialty chemicals is strengthening market prospects. Investments in R&D and formulation optimization continue to support usage across industrial and commercial applications.

North America Dipropylene Glycol N-Butyl Ether Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand for water-based coatings, industrial cleaners, and specialty formulations. Increasing regulatory pressure on VOC emissions and rising adoption of sustainable solvents are key growth drivers. Expansion of construction and refurbishment activities further supports market acceleration.

U.S. Dipropylene Glycol N-Butyl Ether Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by a mature chemical industry, strong demand from architectural and industrial coatings, and high consumption of professional cleaning products. Focus on formulation performance, regulatory compliance, and sustainability is encouraging broader adoption. Presence of major chemical manufacturers and a robust distribution network reinforces the U.S. market position.

Dipropylene Glycol N-Butyl Ether Market Share

The dipropylene glycol N-butyl ether industry is primarily led by well-established companies, including:

- Dow (U.S.)

- Jiangsu Dynamic Chemical Co., Ltd. (China)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Aecochem (Singapore)

- Monument Chemical (U.S.)

- YIDA CHEMICAL (China)

- Banner Chemicals Limited (U.K.)

- Hefei TNJ Chemical Industry Co., Ltd. (China)

- Henan GP Chemicals Co., Ltd. (China)

- Eastman Chemical Company (U.S.)

- Shell Group of Companies (Netherlands)

- India Glycols Limited (India)

- KH Chemicals (Netherlands)

- Henan Haofei Chemical Co., Ltd. (China)

Latest Developments in Global Dipropylene Glycol N-Butyl Ether Market

- In December 2025, BASF expanded its glycol ether production capacity with a focus on high-performance dipropylene glycol N-butyl ether grades for coatings and industrial cleaning applications. This expansion is strengthening BASF’s supply position in key global markets while helping customers secure consistent volumes amid rising demand for low-VOC and water-based formulations, thereby intensifying competitive dynamics in the market

- In November 2025, Dow announced the optimization of its existing glycol ether manufacturing assets through process efficiency upgrades and energy reduction initiatives. This move is expected to lower production costs and improve product consistency, enabling Dow to offer more competitively priced dipropylene glycol N-butyl ether and enhance its appeal among large-volume formulators in coatings and cleaning segments

- In October 2025, Eastman Chemical Company entered into a strategic partnership with a leading technology firm to integrate AI-driven analytics into its production processes. This development is improving operational efficiency, yield optimization, and quality control, positioning Eastman as a technologically advanced supplier capable of responding faster to shifting customer requirements and market demand patterns

- In September 2025, Huntsman Corporation introduced a new range of eco-friendly dipropylene glycol N-butyl ether products aimed at sustainability-focused applications. This launch is enabling Huntsman to address increasing regulatory and customer pressure for environmentally compliant solvents, while also expanding its footprint in premium and value-added segments of the market

- In August 2025, SABIC announced a major investment in a new production facility to increase its output of dipropylene glycol N-butyl ether. This capacity expansion is reinforcing SABIC’s presence in the Asia-Pacific region, improving supply reliability, and positioning the company to capture growing demand from the rapidly expanding coatings and cleaning formulation industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dipropylene Glycol N Butyl Ether Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dipropylene Glycol N Butyl Ether Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dipropylene Glycol N Butyl Ether Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.