Global Digital Payment Market

Market Size in USD Billion

CAGR :

%

USD

94.34 Billion

USD

317.27 Billion

2022

2030

USD

94.34 Billion

USD

317.27 Billion

2022

2030

| 2023 –2030 | |

| USD 94.34 Billion | |

| USD 317.27 Billion | |

|

|

|

|

Digital Payment Market Analysis and Size

Digital payment has witnessed significant growth and transformation in recent years, revolutionizing the way individuals and businesses conduct financial transactions. The digital payment market is highly competitive and comprises numerous players offering a wide range of services. Established financial institutions, technology companies, and fintech startups are actively involved in this space.

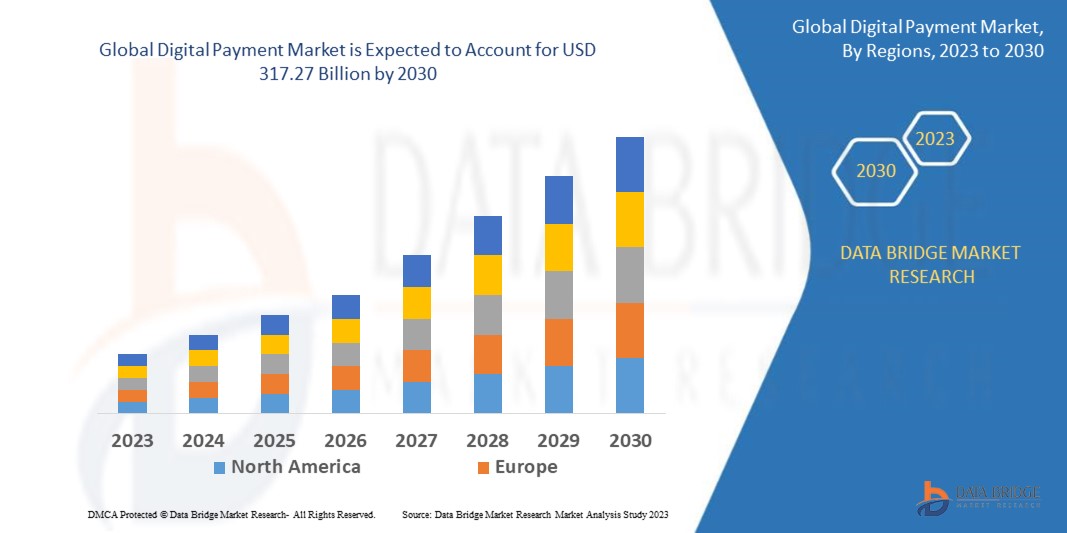

Data Bridge Market Research analyses that the digital payment market, which was USD 94.34 billion in 2022, is expected to reach USD 317.27 billion by 2030, at a CAGR of 20.60% during the forecast period 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Digital Payment Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Offering (Solutions, Services), Deployment Model (On-Premises, Cloud), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Mode of Payment (Payment Cards, Point of Sale, Unified Payments Interface (UPI) Service, Mobile Payment, Online Payment), Mode of Usage (Mobile Application, Desktop/Web Browser), Technology (Application Programming Interface (API), Data Analytics and ML, Digital Ledger Technology (DLT), AI and IoT, Biometric Authentication), End-User (BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-Commerce, Transportation, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

PayPal Holdings, Inc (U.S.), Fiserv, Inc (U.S.), Alipay (China), Apple Inc. (U.S.), Google, LLC (U.S.), Visa (U.S.), Mastercard (U.S.), American Express (U.S.), Amazon Pay (U.S.), Aurus Inc. (U.S.), Adyen (Netherlands), Kakao Pay Corp (South Korea), Grab (India), Paytm (India), SAMSUNG (South Korea), UnionPay International (China), MercadoLibre S.R.L (Argentina), WeChat Pay (China), Financial Software and Systems Pvt. Ltd. (U.S.), Novatti Group Ltd (Australia) |

|

Market Opportunities |

|

Market Definition

Digital payments refer to electronic transactions that facilitate the transfer of funds or the exchange of monetary value between individuals, businesses, or entities. It encompasses various methods such as online payments, mobile payments, contactless payments, and digital wallets. These transactions are conducted through digital platforms, leveraging technologies such as mobile devices, internet connectivity, and secure payment gateways. Digital payments offer convenience, speed, and security, eliminating the need for physical cash or traditional payment instruments. They enable seamless financial transactions across different channels, including e-commerce, retail, peer-to-peer transfers, and bill payments. The market for digital payments has witnessed substantial growth due to the increasing adoption of smartphones, internet penetration, and the growing preference for cashless transactions worldwide.

Global Digital Payment Market Dynamics

Drivers

- Increasing Smartphone Penetration:

The widespread availability and affordability of smartphones have played a significant role in driving digital payment adoption. As more individuals own smartphones, they gain access to mobile payment apps and can conveniently make transactions on-the-go. This is enhancing the demand of the digital payment market during the forecast period of 2023 to 2030.

- Changing Consumer Behavior and Preferences

Consumer behavior has shifted towards convenience and speed in financial transactions. Digital payments offer instant payment confirmations, easy tracking, and a simplified user experience compared to traditional payment methods. The convenience of mobile wallets, loyalty rewards, and cashback incentives further incentivize consumers to choose digital payments. Thus, helping the market to grow during the forecast period.

Opportunities

- Rapid Advancements in Technology

Technological advancements, including secure payment gateways, encryption techniques, and biometric authentication, have boosted consumer confidence in digital payment security. The development of near-field communication (NFC) technology has also facilitated contactless payments using smartphones or wearable devices. Thus the boom in technologies will create ample opportunities for the market to grow during the forecast period of 2023 to 2030.

- Government Initiatives and Regulatory Support

Governments and regulatory bodies have been actively promoting digital payments as part of their financial inclusion agendas. Initiatives such as demonetization, promoting digital wallets, and establishing regulatory frameworks for digital payments have accelerated adoption and usage. Thus the various initiatives taken by government is helping to create various opportunities for the digital payment market growth.

Restraints/Challenges

- Rise in Security Concerns

Security is a critical concern in digital payments. The risk of data breaches, identity theft, and fraud poses a significant challenge. Ensuring robust security measures, encryption technologies, and stringent authentication protocols is essential to maintain consumer trust and protect sensitive financial information. Thus, the rise in security concern is obstructing the growth of the market.

- Infrastructure Limitations

Digital payments rely heavily on a robust and reliable digital infrastructure, including internet connectivity and payment processing systems. In regions with limited or unstable internet access, conducting digital transactions can be challenging. Additionally, the availability of secure and efficient payment infrastructure in remote areas or developing countries may be inadequate, hindering widespread adoption.

This digital payment market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the digital payment market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In October 2020, Aliant Payments made an announcement regarding the inclusion of XRP, an open-source independent digital asset, in their CryptoBucks cryptocurrency payment mobile app. The app, powered by Aliant Payments, supports various cryptocurrencies including Bitcoin Cash, Bitcoin, Ethereum, Litecoin, and now XRP. This addition enables merchants to accept XRP payments both online and in physical stores. The availability of XRP on the CryptoBucks app is accessible to users on both Android and iOS platforms, expanding the range of digital payment options for merchants and customers alike.

- In March 2022, Visa launched the Visa Creator Program, an initiative aimed at supporting creators, including musicians, filmmakers, fashion designers, and artists, in leveraging non-fungible tokens (NFTs) to enhance and accelerate their small businesses. The program, aptly named Visa Creator Program, seeks to empower emerging entrepreneurs by providing them with the tools and knowledge to navigate the world of NFTs. By engaging with and understanding NFT technology, creators can unlock new opportunities and explore innovative ways to monetize their work and engage with their audience.

Global Digital Payment Market Scope

The digital payment market is segmented on the basis of offering, deployment model, organization size, mode of payment, mode of usage, technology, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Consulting

- Implementation

- Support and Maintenance

- Managed Services

Deployment Model

- On-Premises

- Cloud

Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Mode of Payment

- Payment Cards

- Point of Sale

- Debit Card @POS

- Credit Card @POS

- NFC Card

- Unified Payments Interface (UPI) Service

- Mobile Payment

- Proximity Payment

- Remote Payment

- Online Payment

Mode of Usage

- Mobile Application

- Desktop/Web Browser

Technology

- Application Programming Interface (API)

- Data Analytics and ML

- Digital Ledger Technology (DLT)

- AI and IoT

- Biometric Authentication

End-User

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-Commerce

- Transportation

- Others

Digital Payment Market Regional Analysis/Insights

The digital payment market is analysed and market size insights and trends are provided by country, offering, deployment model, organization size, mode of payment, mode of usage, technology, and end-user as referenced above.

The countries covered in the digital payment market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the digital payment market, particularly the U.S. Mobile wallets such as Apple Pay and Google Pay, along with the widespread usage of debit and credit cards for online and in-store transactions, have propelled the growth of digital payments in the region. The presence of established payment processors, financial institutions, and advanced financial infrastructure has further solidified North America's position in the digital payment market.

The Asia-Pacific region has experienced remarkable growth in digital payments and is expected to grow during the forecast period of 2023 to 2030, primarily driven by countries such as China, India, and Southeast Asian nations. The rise of mobile payment platforms, such as Alipay and WeChat Pay, has transformed the payment landscape in the region. High smartphone penetration, a large unbanked population, and the government's push for digital financial inclusion have contributed to the dominance of the Asia-Pacific region in digital payments.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Digital Payment Market Share Analysis

The digital payment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to digital payment market.

Some of the major players operating in the digital payment market are:

- PayPal Holdings, Inc (U.S.)

- Fiserv, Inc (U.S.)

- Alipay (China)

- Apple Inc. (U.S.)

- Google, LLC (U.S.)

- Visa (U.S.)

- Mastercard (U.S.)

- American Express (U.S.)

- Amazon Pay (U.S.)

- Aurus Inc. (U.S.)

- Adyen (Netherlands)

- Kakao Pay Corp (South Korea)

- Grab (India)

- Paytm (India)

- SAMSUNG (South Korea)

- UnionPay International (China)

- MercadoLibre S.R.L (Argentina)

- WeChat Pay (China)

- Financial Software and Systems Pvt. Ltd. (U.S.)

- Novatti Group Ltd (Australia)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.