Global Digital Pathology Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

3.52 Billion

2024

2032

USD

1.37 Billion

USD

3.52 Billion

2024

2032

| 2025 –2032 | |

| USD 1.37 Billion | |

| USD 3.52 Billion | |

|

|

|

|

Global Digital Pathology Market Size

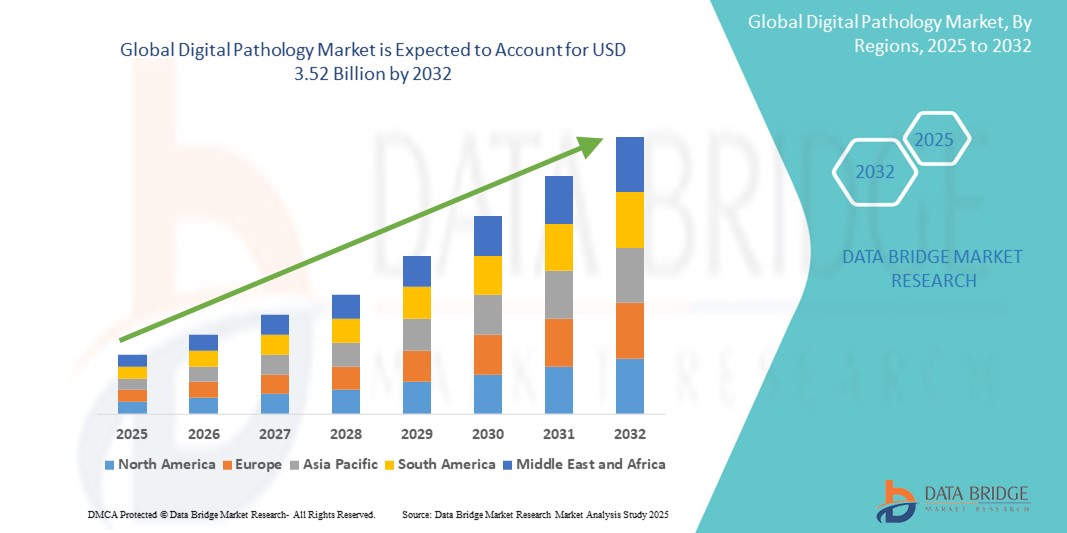

- The global digital pathology market was valued at USD 1.37 billion in 2024 and is expected to reach USD 3.52 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.50%, primarily driven by the increasing demand for more effective diagnostics

- This growth is driven by factors such as the growing need due to increasing prevalence of cancer and chronic diseases and rising adoption of telepathology and remote diagnostics

Global Digital Pathology Market Analysis

- Digital pathology systems are essential tools used in various medical diagnoses and research, providing high-resolution, digital images of tissue samples. These systems are crucial for tasks such as tumor detection, cellular analysis, and disease classification, facilitating more accurate and efficient diagnoses

- The demand for digital pathology systems is largely driven by the growing need for advanced diagnostic techniques, as well as the increasing prevalence of chronic diseases and cancer. A significant portion of global demand is driven by the need for oncology-related diagnostics, with the highest need observed in regions with aging populations and high cancer rates

- North America stands out as one of the leading markets for digital pathology, supported by its advanced healthcare infrastructure, rapid adoption of digital technologies, and substantial investments in medical research

- For instance, the number of pathology diagnoses in the U.S. has been consistently increasing, with large healthcare systems and specialized research institutions at the forefront of integrating digital pathology into their diagnostic and research processes

- On a global scale, digital pathology systems rank as one of the most critical components in modern pathology laboratories, second only to traditional microscopy, and are integral to enhancing diagnostic precision, improving workflow efficiency, and enabling more accurate and timely treatment decisions

Report Scope and Global Digital Pathology Market Segmentation

|

Attributes |

Global Digital Pathology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Digital Pathology Market Trends

“Increasing Adoption of AI and ML in Digital Pathology”

- One prominent trend in the global digital pathology market is the growing adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies

- These advanced technologies are enhancing the accuracy and efficiency of pathology by enabling automated image analysis, pattern recognition, and predictive insights, which support pathologists in diagnosing diseases more precisely

- For instance, AI-powered algorithms can analyse tissue samples, detect cancerous cells, and identify disease markers, significantly reducing human error and improving diagnostic speed

- Machine learning algorithms are also enabling systems to learn and improve from previous data, leading to continuous enhancement in diagnostic accuracy over time

- Digital integration in pathology also facilitates the seamless storage, sharing, and retrieval of patient data across different healthcare systems, enabling pathologists to collaborate more effectively and streamline workflows

- This trend is revolutionizing the way pathology is performed, reducing the time required for diagnosis, improving patient outcomes, and increasing the demand for AI-powered digital pathology solutions in the market

Global Digital Pathology Market Dynamics

Driver

“Growing Need Due to Increasing Prevalence of Cancer and Chronic Diseases”

- The rising prevalence of cancer and other chronic diseases such as cardiovascular diseases, diabetes, and infectious diseases is significantly contributing to the increased demand for digital pathology solutions

- As the global population ages and lifestyles change, the incidence of these conditions continues to grow, leading to an increased need for precise and timely diagnostic tools for early detection and treatment planning

- Digital pathology offers significant advantages by enabling pathologists to analyse and diagnose tissue samples with greater speed, accuracy, and consistency, which is critical in diseases such as cancer where early detection can drastically improve patient outcomes

- Advancements in molecular diagnostics and targeted therapies further emphasize the need for high-quality diagnostic imaging, supporting the demand for digital pathology systems that provide high-resolution images and facilitate easier data sharing among healthcare providers

- As healthcare providers seek more efficient solutions to handle the growing volume of pathology samples, digital pathology is becoming an essential tool in diagnosing complex conditions and improving patient care

For instance,

- In January 2023, according to an article published by the National Cancer Institute, the increasing global cancer burden, with an estimated 19.3 million new cases in 2020, highlights the need for more advanced diagnostic tools. This trend drives the demand for digital pathology systems, enabling faster and more accurate cancer diagnoses

- In December 2022, according to a report by the World Health Organization, chronic diseases such as cardiovascular diseases and diabetes are responsible for a growing number of deaths globally, further fuelling the need for advanced pathology technologies to aid in early detection and monitoring

- As a result, the rising prevalence of chronic diseases and cancer is a major driver for the increased demand for digital pathology solutions

Opportunity

“Leveraging Artificial Intelligence (AI) for Enhanced Diagnostics”

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) in digital pathology systems presents a major opportunity for transforming diagnostic processes, improving accuracy, and reducing diagnostic time

- AI algorithms can analyze pathology images, detect abnormalities, and help pathologists identify patterns in tissue samples that may be difficult for the human eye to detect. This leads to faster and more accurate diagnoses, improving the chances of timely intervention

- AI-powered digital pathology can also assist in creating predictive models for disease progression, enabling better patient management and personalized treatment planning

- In addition, AI can aid in automating repetitive tasks, such as image annotation and classification, which reduces the workload for pathologists and allows them to focus on more complex cases

For instance,

- In March 2024, according to a study published in the Journal of Digital Pathology, AI algorithms have demonstrated significant accuracy in identifying cancerous cells in pathology slides, helping pathologists detect early stages of cancer with improved precision

- In October 2023, a report from the National Institute of Health highlighted how AI-powered digital pathology systems are being used to predict patient outcomes and disease progression, particularly in cancer care, leading to earlier and more accurate intervention

- The incorporation of AI in digital pathology will not only improve the quality of diagnostics but also revolutionize the workflow, leading to enhanced patient outcomes and significant market growth

Restraint/Challenge

“High Initial Investment and Implementation Costs”

- One of the major challenges facing the digital pathology market is the high initial investment required for implementing digital pathology systems, which can be a barrier for healthcare facilities, especially in developing regions

- Digital pathology systems, which include high-resolution scanners, image storage solutions, and software for data analysis, can cost tens of thousands of dollars, making them unaffordable for smaller clinics and hospitals with limited budgets

- These high costs can delay the adoption of digital pathology in various healthcare settings, resulting in a reliance on traditional methods of diagnosis that may be less efficient and more prone to errors.

- In addition, the integration of digital pathology into existing healthcare infrastructures often requires significant time and effort, including staff training, software updates, and system maintenance, all of which contribute to the overall cost

For instance,

- In April 2023, according to a report published by the International Journal of Pathology, the cost of transitioning to digital pathology systems has been a significant hurdle, especially in low-resource settings where budget constraints are more prevalent

- In February 2024, an article from the Digital Pathology Association highlighted the financial strain that the implementation of digital pathology can put on healthcare providers, particularly smaller clinics, limiting their ability to adopt these advanced technologies and thus hindering the overall market growth

- As a result, the high initial costs and the need for ongoing investments in infrastructure and training are major challenges in the widespread adoption of digital pathology, potentially slowing the market’s growth in certain regions

Global Digital Pathology Market Scope

The market is segmented on the basis of type, product, application, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product |

|

|

By Application |

|

|

By End User |

|

Global Digital Pathology Market Regional Analysis

“North America is the Dominant Region in the Digital Pathology Market”

- North America dominates the digital pathology market, driven by advanced healthcare infrastructure, widespread adoption of digital technologies, and the presence of leading market players

- U.S. holds a significant share due to the increased demand for accurate diagnostics, rising cancer rates, and advancements in precision medicine

- Strong government support, well-established reimbursement policies, and growing investments in research and development by major healthcare and technology companies further bolster the market

- In addition, the increasing integration of AI and machine learning in digital pathology solutions and a rising number of pathology labs adopting digital technologies contribute to the region's market growth

Asia-Pacific is Projected to Register the Highest Growth Rate

- Asia-Pacific is expected to witness the highest growth rate in the digital pathology market, driven by rapid advancements in healthcare infrastructure, increasing adoption of digital solutions, and a growing demand for early disease detection

- Countries such as China, India, and Japan are emerging as key markets due to the rising incidence of chronic diseases, particularly cancer, and the growing aging population, which is more susceptible to various health conditions requiring digital diagnostic tool

- Japan, with its advanced medical technology and a high rate of adoption of digital solutions in healthcare, continues to be a significant market for digital pathology systems

- China and India, with their large populations and increasing healthcare investments, are witnessing the growth of digital pathology infrastructure. The expanding presence of global digital pathology solution providers and improvements in healthcare accessibility contribute to the region’s rapid market expansion

Digital Pathology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Hamamatsu Photonics K.K. (Japan)

- 3DHISTECH Ltd. (Hungary)

- AstraZeneca (U.K.)

- General Electric Company (U.S.)

- Healthcare Trading Co. LLC (UAE)

- Koninklijke Philips N.V. (Netherlands)

- Inspirata, Inc. (U.S.)

- Olympus Corporation (Japan)

- Sectra AB (Sweden)

- PerkinElmer (U.S.)

- Apollo Enterprise Imaging Corp (U.S.)

- Mikroscan Technologies, Inc. (U.S.)

- VMscope GmbH (Germany)

- Huron Technologies International Inc. (Canada)

- Objective Pathology Services Limited (Canada)

- OptraScan (U.S.)

- Pathcore Inc. (Canada)

- Agfa-Gevaert Group (Belgium)

- Proscia Inc. (U.S.)

Latest Developments in Global digital pathology Market

- In January 2025, Philips Healthcare announced the launch of its latest IntelliSite Pathology Solution in the United States, following FDA clearance. The system integrates high-resolution whole-slide imaging with advanced AI-powered analytics to help pathologists make faster, more accurate diagnoses. The solution is designed to improve workflow efficiency and enable better collaboration among healthcare providers. This marks a significant advancement in the digital pathology space, enabling healthcare providers to move toward fully digitized pathology workflows

- In December 2024, Ventana Medical Systems, a subsidiary of Roche, introduced its VENTANA DP 200 Digital Pathology System in Europe. This new system is designed to provide pathologists with enhanced image quality and faster processing speeds. It offers an improved user interface, greater storage capacity, and the ability to integrate seamlessly with existing laboratory information systems (LIS). The system is aimed at streamlining pathology workflows and increasing the speed of cancer diagnosis, which is critical for timely treatment

- In November 2024, Leica Biosystems announced a partnership with PathAI, a leader in artificial intelligence for pathology. This collaboration focuses on integrating AI algorithms with Leica’s digital pathology solutions to enhance the accuracy of cancer diagnostics. By using AI to automatically detect and classify abnormal tissue samples, the solution aims to reduce diagnostic errors and support pathologists in identifying early-stage cancer with higher precision

- In October 2024, Hamamatsu Photonics unveiled a new NanoZoomer S360 digital slide scanner at the Pathology Society Annual Conference. The scanner offers ultra-fast scanning capabilities with high-resolution imaging, making it ideal for both clinical and research applications. It provides pathologists with the ability to review slides quickly and accurately, contributing to faster diagnoses and improved patient outcomes. The scanner also features a modular design that allows users to scale their digital pathology infrastructure as needed

- These latest developments in the global digital pathology market reflect a growing emphasis on enhancing diagnostic accuracy, workflow efficiency, and the integration of AI technologies to support pathologists in making more informed decisions, ultimately improving patient care across the globe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.