Global Digital Ovulation Test Kit Market

Market Size in USD Million

CAGR :

%

USD

221.74 Million

USD

386.73 Million

2024

2032

USD

221.74 Million

USD

386.73 Million

2024

2032

| 2025 –2032 | |

| USD 221.74 Million | |

| USD 386.73 Million | |

|

|

|

|

Digital Ovulation Test Kit Market Size

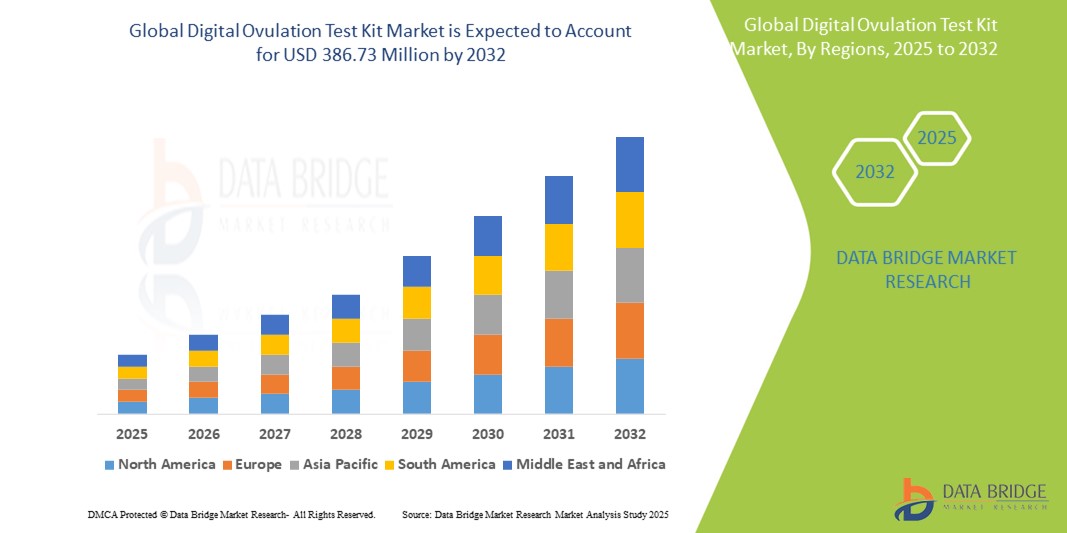

- The global digital ovulation test kit market size was valued at USD 221.74 million in 2024 and is expected to reach USD 386.73 million by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by increasing awareness of fertility monitoring and the growing prevalence of delayed pregnancies, especially among working women, leading to higher adoption of home-based diagnostic tools

- Furthermore, rising demand for convenient, accurate, and digitalized fertility solutions is positioning digital ovulation test kits as a preferred choice over traditional methods. These converging factors are accelerating the adoption of these kits, thereby significantly boosting the industry’s growth

Digital Ovulation Test Kit Market Analysis

- Digital ovulation test kits, which provide electronic detection of luteinizing hormone (LH) surges to predict peak fertility days, are becoming essential tools for reproductive health monitoring due to their high accuracy, ease of use, and real-time digital results compared to traditional methods

- The rising demand for digital ovulation test kits is primarily fueled by increasing infertility awareness, growing interest in family planning, and a rising number of women opting for home-based fertility tracking solutions

- North America dominated the digital ovulation test kit market with the largest revenue share of 39.5% in 2024, supported by high consumer awareness, favorable reimbursement scenarios, and the presence of leading market players, with the U.S. showing strong growth owing to widespread adoption of personal fertility monitoring tools and increasing availability through e-commerce platforms

- Asia-Pacific is expected to be the fastest growing region in the digital ovulation test kit market during the forecast period due to improved access to healthcare, rising female workforce participation, and growing digital health literacy

- The urine-based digital ovulation test kit segment dominated the market with a market share of 47.5% in 2024, driven by its non-invasive nature, affordability, and widespread consumer preference for convenient, at-home diagnostic solutions

Report Scope and Digital Ovulation Test Kit Market Segmentation

|

Attributes |

Digital Ovulation Test Kit Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Ovulation Test Kit Market Trends

“Rising Preference for Digital and Connected Fertility Monitoring”

- A significant and accelerating trend in the global digital ovulation test kit market is the growing integration of fertility monitoring devices with smartphones and health applications, enhancing user experience, accuracy, and accessibility. This digital shift enables real-time hormone tracking, predictive analytics, and personalized fertility insights that go beyond basic testing functionality

- For instance, Clearblue Connected Ovulation Test System links via Bluetooth to a mobile app, providing users with personalized fertility calendars and alerts. Similarly, products from Mira and Femometer offer AI-powered analysis and multi-hormone tracking through companion apps, delivering more detailed ovulation predictions

- The ability to sync test results with apps not only supports long-term reproductive planning but also allows users to share data with healthcare professionals as part of fertility consultations. These features are gaining popularity among users who prefer discreet, tech-enabled solutions that fit into their daily routines

- The seamless combination of digital ovulation kits with wearable health tech and smart fertility platforms is reshaping user expectations, promoting proactive reproductive health management

- Companies such as iProven, Premom, and Eveline are expanding their product offerings with enhanced app compatibility, data storage, and user education features to cater to this tech-savvy consumer base

- The demand for connected, digital fertility solutions is growing rapidly across developed and emerging markets as consumers increasingly prioritize precision, convenience, and control over their fertility journeys

Digital Ovulation Test Kit Market Dynamics

Driver

“Increasing Fertility Awareness and Demand for At-Home Testing”

- The rising awareness of fertility health, coupled with increasing incidences of delayed childbearing and infertility, is a major driver of the digital ovulation test kit market. Women are actively seeking private, reliable, and accessible methods to track ovulation and improve conception outcomes

- For instance, the World Health Organization reported that around 17.5% of the adult population is affected by infertility globally, prompting the need for accurate ovulation detection methods. Digital kits provide a first-line, home-based solution with high sensitivity and user-friendly digital displays

- These tools are particularly beneficial for women managing irregular cycles or undergoing early fertility assessments, offering an affordable and less invasive alternative to clinical testing

- The growing popularity of planned pregnancies, increased participation of women in the workforce, and delayed motherhood trends are further boosting demand for at-home fertility monitoring products

- The convenience of smartphone connectivity, app-based tracking, and real-time hormone analysis positions digital ovulation kits as essential tools in the evolving landscape of women’s digital health

- Expanded distribution through online platforms, increased health literacy, and the endorsement of digital fertility tools by medical professionals are driving significant adoption across both developed and emerging regions

Restraint/Challenge

“Data Privacy Concerns and High Cost of Advanced Kits”

- Growing concerns about data privacy and the higher cost of advanced digital ovulation test kits remain key barriers to widespread adoption, especially in price-sensitive or privacy-conscious markets. Many of these kits rely on app integration and cloud-based data storage, leading to fears over data security and potential misuse of personal reproductive health information

- For instance, concerns have been raised about health apps lacking clear consent mechanisms or sharing user data with third parties, which can undermine consumer trust in digital fertility solutions

- In addition, while basic ovulation tests are available at low cost, digital kits with features such as AI-powered hormone analysis, Bluetooth connectivity, and multi-hormone tracking often come at a premium. This makes them less accessible to low-income users or those in developing regions

- Bridging this affordability gap and building user trust through transparent data handling policies, regulatory compliance, and enhanced cybersecurity measures are essential for sustained growth

- Companies such as Mira and Clearblue are increasingly highlighting their commitment to data privacy and user security, while also exploring ways to make digital kits more cost-effective

- Overcoming these challenges through technological innovation, affordable pricing strategies, and consumer education will be critical in expanding the reach of digital ovulation test kits worldwide.

Digital Ovulation Test Kit Market Scope

The market is segmented on the basis of product type, end user, distribution channel, and test type.

- By Product Type

On the basis of product type, the digital ovulation test kit market is segmented into urine-based test kits. The urine-based test ovulation test kit segment dominated the market with the largest market revenue share of 47.5% in 2024, owing to its high accuracy in detecting luteinizing hormone (LH) surges and widespread consumer familiarity. Among urine-based kits, the mid-stream method is especially favored for its hygienic and convenient application, eliminating the need for separate sample collection tools. The reliability and ease of use associated with mid-stream digital kits continue to drive their dominance in both home and clinical use.

The saliva-based test ovulation test kit segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its reusable nature, non-invasive testing approach, and increasing awareness of alternative ovulation detection methods. Salivary ferning kits are gaining traction among tech-savvy and sustainability-focused consumers, as they offer smartphone compatibility and visual pattern recognition for ovulation prediction.

- By End User

On the basis of end user, the digital ovulation test kit market is segmented into hospitals, clinics, diagnostic centers, fertility centers, home care, and others. The home care segment held the largest market revenue share in 2024, as users increasingly prefer at-home testing for privacy, convenience, and cost-effectiveness. The surge in fertility awareness and delayed parenthood trends is leading women to adopt digital ovulation kits for regular, self-managed fertility tracking.

The fertility centers segment is anticipated to experience significant growth from 2025 to 2032, supported by the rising number of assisted reproductive technology (ART) procedures and a growing patient base seeking clinical support in ovulation timing. Digital test kits are increasingly used as a supplementary tool in fertility clinics to provide accurate ovulation windows and enhance treatment outcomes.

- By Distribution Channel

On the basis of distribution channel, the digital ovulation test kit market is segmented into hypermarkets and supermarkets, online sales, pharmacies and drugstores, gynecology and fertility clinics, and others. The online sales segment dominated the market with the largest share in 2024, driven by the growing popularity of e-commerce platforms and discreet purchasing options. Consumers benefit from wide product availability, user reviews, and home delivery, making online channels particularly appealing for reproductive health products.

The gynecology and fertility clinics segment is projected to witness the fastest growth rate during the forecast period, fueled by the increased collaboration between healthcare providers and diagnostic kit manufacturers. These clinics often recommend or directly provide digital ovulation kits as part of personalized fertility plans, contributing to stronger demand within clinical settings.

- By Test Type

On the basis of type, the digital ovulation test kit market is segmented into rapid test kits and normal test kits. The rapid test kits segment accounted for the largest market share in 2024 due to their high sensitivity, fast results, and convenience, particularly for home users tracking their fertility windows daily. These kits provide digital readouts within minutes, reducing user error and enabling real-time decision-making for conception planning.

The normal test kits segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their affordability and increasing use in low- and middle-income countries. While lacking digital features, these kits still offer a reliable and accessible solution for ovulation detection, particularly when cost is a major factor in consumer decisions.

Digital Ovulation Test Kit Market Regional Analysis

- North America dominated the digital ovulation test kit market with the largest revenue share of 39.5% in 2024, supported by high consumer awareness, favorable reimbursement scenarios, and the presence of leading market players, with the U.S. showing strong growth owing to widespread adoption of personal fertility monitoring tools and increasing availability through e-commerce platforms

- Consumers in the region increasingly prioritize accuracy, privacy, and convenience in fertility monitoring, leading to strong adoption of digital ovulation kits with app connectivity and AI-based tracking features

- The market's growth is further supported by high healthcare spending, strong presence of leading manufacturers, and growing reliance on e-commerce platforms for discreet and accessible reproductive health solutions, positioning digital ovulation kits as a preferred choice for self-managed fertility planning across the region

U.S. Digital Ovulation Test Kit Market Insight

The U.S. digital ovulation test kit market captured the largest revenue share in North America in 2024, driven by high fertility awareness, delayed childbearing trends, and the growing adoption of home-based health technologies. Consumers increasingly prefer digital kits with app connectivity and advanced hormone tracking to manage their reproductive health privately and accurately. The strong presence of leading manufacturers, widespread internet access, and robust e-commerce infrastructure further enhance accessibility and adoption across various user demographics.

Europe Digital Ovulation Test Kit Market Insight

The Europe digital ovulation test kit market is projected to expand at a substantial CAGR throughout the forecast period, fueled by increasing demand for at-home fertility solutions, growing health consciousness, and supportive healthcare frameworks. The region’s focus on reproductive health and access to advanced diagnostic tools is fostering adoption. Rising awareness campaigns, combined with consumer preference for non-invasive and digital ovulation monitoring, are supporting growth across both Western and Eastern European countries.

U.K. Digital Ovulation Test Kit Market Insight

The U.K. digital ovulation test kit market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a well-established healthcare system, tech-savvy consumers, and rising interest in fertility planning. The prevalence of delayed pregnancies, along with increasing digital health engagement, is prompting consumers to adopt intelligent ovulation tracking methods. Digital kits offering connectivity with fertility apps and data visualization are particularly appealing to women seeking precise and user-friendly solutions.

Germany Digital Ovulation Test Kit Market Insight

The Germany digital ovulation test kit market is expected to expand at a considerable CAGR during the forecast period, driven by growing awareness of fertility wellness and the demand for accurate, home-based testing methods. The market benefits from Germany’s advanced medical infrastructure, sustainability-focused consumers, and interest in data-driven healthcare solutions. Integration of ovulation tracking with broader digital health ecosystems is gaining traction, aligning with consumer expectations for personalized and secure health monitoring tools.

Asia-Pacific Digital Ovulation Test Kit Market Insight

The Asia-Pacific digital ovulation test kit market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, supported by increasing health awareness, expanding urbanization, and rising access to mobile technologies. Countries such as China, India, and Japan are witnessing a surge in demand for affordable and accurate fertility solutions, especially as women become more proactive about reproductive health. Government initiatives promoting digital health and broader internet access are also accelerating the market’s penetration.

Japan Digital Ovulation Test Kit Market Insight

The Japan digital ovulation test kit market is gaining momentum due to a strong culture of technology adoption, aging population dynamics, and growing interest in reproductive planning. Consumers prioritize precision and convenience, with digital kits offering app connectivity and real-time hormonal tracking gaining popularity. Integration with broader wellness and health monitoring systems is a key trend, as users seek comprehensive, tech-driven fertility management tools that align with Japan’s connected healthcare landscape.

India Digital Ovulation Test Kit Market Insight

The India digital ovulation test kit market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by a growing middle-class population, improving healthcare access, and rising digital adoption. Indian consumers are increasingly turning to at-home fertility solutions, supported by the rise of smart health devices and strong domestic production of affordable kits. Government efforts promoting women’s health, combined with awareness campaigns and online retail channels, are significantly expanding market reach across urban and semi-urban regions.

Digital Ovulation Test Kit Market Share

The digital ovulation test kit industry is primarily led by well-established companies, including:

- Swiss Precision Diagnostics GmbH (Switzerland)

- Mira (U.S.)

- Femometer (China)

- iProven (Netherlands)

- Modern Fertility (U.S.)

- Easy@Home Fertility (U.S.)

- Pearl Fertility (Switzerland)

- Ovusense (U.K.)

- AVA (Switzerland)

- Breathe ilo (Austria)

- OvaGraph (U.S.)

- Lutea (France)

- Tempdrop (Israel)

- HiMama Health (Canada)

- Fairhaven Health (U.S.)

- Ovy (Germany)

- Inito Health Inc. (U.S.)

What are the Recent Developments in Global Digital Ovulation Test Kit Market?

- In April 2024, Clearblue, a brand of SPD Swiss Precision Diagnostics GmbH, launched an upgraded version of its Connected Ovulation Test System with enhanced Bluetooth connectivity and AI-driven cycle prediction. This new version provides more personalized fertility insights and improved app integration, emphasizing the brand’s commitment to empowering women with accessible, technology-enhanced reproductive health tools that deliver greater accuracy and user control

- In March 2024, Mira, a leading provider of AI-based fertility monitoring devices, announced the release of its Mira Plus Analyzer, a multi-hormone digital fertility tracker capable of monitoring estrogen, LH, and progesterone levels. This development enables more comprehensive fertility profiling and supports both natural conception and fertility treatments, showcasing Mira’s continuous innovation in at-home hormone testing

- In February 2024, iProven introduced a new line of FDA-registered digital ovulation kits featuring smart display interfaces and app-based syncing. Designed to cater to tech-savvy and privacy-focused consumers, the product launch supports iProven’s strategic goal to expand its footprint in the U.S. and European consumer health markets with affordable, connected reproductive health solutions

- In January 2024, Easy@Home, a brand under Medimama Inc., announced a strategic expansion of its digital health portfolio with the integration of its ovulation test kits into its proprietary Premom app. The updated app allows real-time result logging and offers data-backed fertility recommendations. This development reflects the growing trend of combining diagnostic hardware with intelligent mobile platforms to improve health outcomes and engagement

- In December 2023, Femometer, a global digital health brand, launched the IVY Digital Ovulation Test Kit in Asian and European markets. With AI-powered LH surge detection and multilingual app support, this new offering strengthens Femometer’s position in emerging fertility tech markets by focusing on inclusivity, accessibility, and precise ovulation prediction for diverse populations worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.