Global Digital Assistant Market

Market Size in USD Billion

CAGR :

%

USD

16.87 Billion

USD

177.50 Billion

2025

2033

USD

16.87 Billion

USD

177.50 Billion

2025

2033

| 2026 –2033 | |

| USD 16.87 Billion | |

| USD 177.50 Billion | |

|

|

|

|

Digital Assistant Market Size

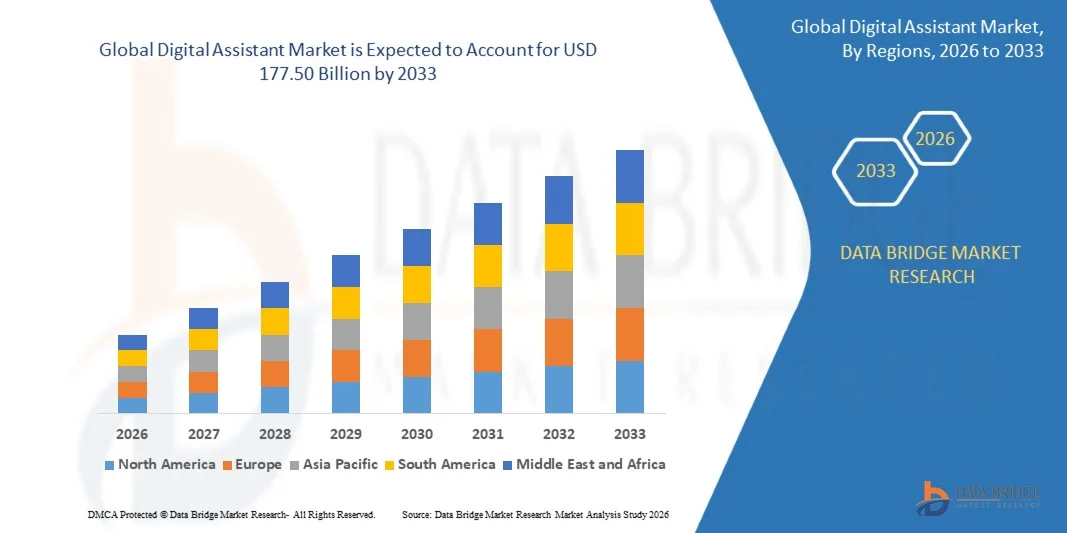

- The global digital assistant market size was valued at USD 16.87 billion in 2025 and is expected to reach USD 177.50 billion by 2033, at a CAGR of 34.20% during the forecast period

- The market growth is largely fuelled by rapid advancements in artificial intelligence, natural language processing, and machine learning, enabling more accurate voice recognition and contextual understanding

- Increasing adoption of smart devices, growing integration of digital assistants across enterprise workflows, customer support, and productivity applications, and rising consumer preference for hands-free and personalized digital experiences

Digital Assistant Market Analysis

- The market is characterised by intense innovation, with continuous improvements in conversational AI, multilingual capabilities, and emotional intelligence driving differentiation among solution providers

- In addition, expanding use cases across healthcare, banking, retail, and education, along with increasing investments by technology companies to embed digital assistants into operating systems and platforms, are strengthening long-term market growth prospects

- North America dominated the digital assistant market with the largest revenue share in 2025, driven by early adoption of advanced AI technologies, high penetration of smart devices, and strong demand for voice-enabled and conversational interfaces

- Asia-Pacific region is expected to witness the highest growth rate in the global digital assistant market, driven by rising urbanization, growing adoption of AI-powered applications, supportive government digitalization initiatives, and an expanding base of tech-savvy consumers

- The Google Assistant segment held the largest market revenue share in 2025, driven by its deep integration with the Android ecosystem, wide availability across smartphones and smart home devices, and strong capabilities in natural language processing and contextual search. Its seamless compatibility with third-party applications and cloud services has further strengthened adoption among both consumers and enterprises

Report Scope and Digital Assistant Market Segmentation

|

Attributes |

Digital Assistant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Digital Assistant Market Trends

“Rising Adoption Of AI-Powered Conversational Technologies”

• The increasing integration of artificial intelligence, natural language processing, and machine learning is significantly shaping the digital assistant market, as users demand more accurate, context-aware, and human-like interactions. Digital assistants are gaining traction due to their ability to enhance productivity, automate routine tasks, and deliver personalized experiences across consumer and enterprise environments. This trend is accelerating adoption across smartphones, smart homes, workplaces, and digital platforms, encouraging continuous innovation in conversational capabilities

• Growing reliance on voice-enabled and chat-based interfaces has expanded the use of digital assistants across customer support, scheduling, information retrieval, and workflow automation. Enterprises are increasingly deploying digital assistants to reduce operational costs, improve response times, and enhance user engagement. This rising dependence on intelligent virtual assistants is reinforcing investments in scalable and secure AI-driven solutions

• User expectations around seamless, multilingual, and omnichannel experiences are influencing product development strategies. Companies are focusing on improving speech recognition accuracy, emotional intelligence, and contextual understanding to differentiate offerings and strengthen user trust. In addition, data privacy and responsible AI practices are becoming integral to product positioning and long-term adoption

• For instance, in 2024, companies such as Microsoft in the U.S. and Samsung in South Korea expanded AI-powered digital assistant features across productivity tools and smart devices. These enhancements were introduced to improve personalization, task automation, and cross-device integration, supporting stronger user engagement and ecosystem lock-in

• While adoption is accelerating, sustained market growth depends on continuous advancements in AI models, interoperability across platforms, and the ability to deliver consistent performance across diverse use cases. Providers are increasingly investing in R&D, cloud infrastructure, and ethical AI frameworks to support long-term scalability and user confidence

Digital Assistant Market Dynamics

Driver

“Growing Demand For Automation And Personalized Digital Experiences”

• Rising demand for automation and personalized interactions is a key driver of the digital assistant market. Organizations and consumers are increasingly adopting digital assistants to manage tasks, access information, and streamline daily activities. This shift is encouraging developers to enhance personalization, contextual awareness, and predictive capabilities to meet evolving user expectations

• Expanding use across enterprise functions such as customer service, human resources, IT support, and sales is contributing to market growth. Digital assistants help improve efficiency, reduce manual workloads, and deliver consistent user experiences, making them valuable tools for digital transformation initiatives

• Technology providers are actively promoting digital assistant solutions through platform integrations, feature upgrades, and partnerships. These efforts are supported by the growing adoption of cloud computing and AI-as-a-service models, which lower deployment barriers and enable faster innovation

• For instance, in 2023, Google in the U.S. and IBM in the U.S. reported increased deployment of digital assistants across enterprise applications and customer engagement platforms. This expansion was driven by demand for automation, real-time insights, and personalized interactions, supporting improved productivity and customer satisfaction

• Although automation demand is strong, sustained growth relies on improving accuracy, reducing bias, and ensuring secure handling of user data. Continued investment in advanced AI architectures and compliance frameworks will be essential to maintain trust and competitive advantage

Restraint/Challenge

“Data Privacy Concerns And Integration Complexity”

• Data privacy and security concerns remain a major challenge for the digital assistant market, as these systems rely on continuous data collection and processing. Users and enterprises are increasingly cautious about data misuse, unauthorized access, and regulatory compliance, which can slow adoption and limit functionality in sensitive applications

• Integration complexity across legacy systems and diverse platforms also restricts widespread deployment. Enterprises often face challenges in aligning digital assistants with existing IT infrastructure, workflows, and data sources, leading to higher implementation costs and longer deployment timelines

• Performance limitations in understanding accents, languages, and complex queries further impact user experience. Inconsistent accuracy can reduce trust and hinder adoption, particularly in professional and mission-critical environments

• For instance, in 2024, enterprises in sectors such as finance and healthcare across the U.S. and Europe reported slower adoption of digital assistants due to strict data protection regulations and integration challenges with existing systems. Concerns around compliance and system interoperability affected large-scale deployments and return on investment

• Addressing these challenges will require robust data governance frameworks, improved interoperability standards, and continuous refinement of AI models. Collaboration between technology providers, regulators, and enterprises will be critical to unlocking the long-term growth potential of the global digital assistant market

Digital Assistant Market Scope

The market is segmented on the basis of product, deployment, and application.

• By Product

On the basis of product, the global digital assistant market is segmented into Apple Siri, Google Assistant, Microsoft Cortana, and Amazon Alexa. The Google Assistant segment held the largest market revenue share in 2025, driven by its deep integration with the Android ecosystem, wide availability across smartphones and smart home devices, and strong capabilities in natural language processing and contextual search. Its seamless compatibility with third-party applications and cloud services has further strengthened adoption among both consumers and enterprises.

The Amazon Alexa segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its expanding presence in smart home ecosystems, continuous feature enhancements, and strong partnerships with device manufacturers and service providers. Alexa’s dominance in voice-enabled smart speakers and growing use in home automation and entertainment applications are supporting rapid market expansion.

• By Deployment

On the basis of deployment, the digital assistant market is segmented into On-Premise and On-Cloud. The On-Cloud segment accounted for the largest market share in 2025, fuelled by scalability, cost efficiency, and ease of integration with AI and analytics platforms. Cloud-based digital assistants enable real-time updates, advanced learning capabilities, and seamless access across multiple devices, making them the preferred choice for enterprises and consumers.

The On-Premise segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand from organizations with strict data security, privacy, and compliance requirements. Industries such as banking, healthcare, and government are increasingly deploying on-premise digital assistants to maintain greater control over sensitive data and internal systems.

• By Application

On the basis of application, the market is segmented into Smartphones, Wearables, Smart Homes, and TV Devices. The Smartphones segment dominated the market revenue share in 2025, supported by the widespread use of voice assistants for daily tasks such as search, navigation, messaging, and personal productivity. Integration of digital assistants as default features in smartphones has significantly boosted user engagement and adoption.

The Smart Homes segment is expected to register the highest growth rate from 2026 to 2033, driven by increasing adoption of connected home devices and rising demand for voice-controlled automation. Digital assistants are increasingly used to manage lighting, security, climate control, and entertainment systems, reinforcing their role as central interfaces in smart home environments.

Digital Assistant Market Regional Analysis

• North America dominated the digital assistant market with the largest revenue share in 2025, driven by early adoption of advanced AI technologies, high penetration of smart devices, and strong demand for voice-enabled and conversational interfaces

• Consumers and enterprises in the region highly value the convenience, productivity enhancement, and seamless integration of digital assistants with smartphones, smart homes, enterprise software, and cloud platforms

• This widespread adoption is further supported by high digital literacy, strong purchasing power, and continuous investments by major technology companies, positioning digital assistants as essential tools across both personal and professional environments

U.S. Digital Assistant Market Insight

The U.S. digital assistant market captured the largest revenue share in 2025 within North America, fuelled by rapid adoption of AI-driven applications and widespread use of smart devices. Consumers and businesses are increasingly leveraging digital assistants for automation, information retrieval, and personalized experiences. The growing deployment of digital assistants across smartphones, smart speakers, workplaces, and customer service platforms, along with strong integration with ecosystems such as Alexa, Google Assistant, Siri, and enterprise AI tools, continues to propel market growth.

Europe Digital Assistant Market Insight

The Europe digital assistant market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption of AI technologies, rising digital transformation initiatives, and growing focus on automation across industries. Strong regulatory emphasis on data protection and ethical AI is shaping product development, while demand for multilingual and localized digital assistants is accelerating adoption across consumer and enterprise applications.

U.K. Digital Assistant Market Insight

The U.K. digital assistant market is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing use of smart devices, growing acceptance of voice-based technologies, and rising demand for convenience-driven digital solutions. Expanding use of digital assistants in smart homes, e-commerce, and enterprise productivity tools, combined with a mature digital infrastructure, is contributing to sustained market expansion.

Germany Digital Assistant Market Insight

The Germany digital assistant market is expected to witness the fastest growth rate from 2026 to 2033, fuelled by strong emphasis on digital innovation, automation, and data security. Adoption is particularly high across enterprise applications, smart manufacturing, and connected homes. The preference for secure, privacy-focused digital assistant solutions aligns with local regulatory frameworks and consumer expectations, supporting steady market growth.

Asia-Pacific Digital Assistant Market Insight

The Asia-Pacific digital assistant market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, expanding smartphone user base, and rising adoption of AI-powered applications in countries such as China, Japan, and India. Government initiatives promoting digitalization and smart infrastructure are further accelerating the integration of digital assistants across consumer and enterprise use cases.

Japan Digital Assistant Market Insight

The Japan digital assistant market is expected to witness the fastest growth rate from 2026 to 2033, supported by the country’s advanced technology ecosystem, high adoption of connected devices, and strong demand for convenience-oriented solutions. Integration of digital assistants with smart homes, robotics, and IoT-enabled systems is driving adoption, while an aging population is increasing demand for voice-enabled and easy-to-use digital interfaces.

China Digital Assistant Market Insight

The China digital assistant market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid digital transformation, widespread smartphone adoption, and strong presence of domestic technology providers. Growing use of digital assistants across smart homes, e-commerce platforms, customer service, and enterprise applications, along with government support for AI and smart city initiatives, continues to propel market expansion.

Digital Assistant Market Share

The Digital Assistant industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Google LLC (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Facebook Inc. (Meta Platforms, Inc.) (U.S.)

- Amazon Inc. (U.S.)

- Customer Inc. (U.S.)

- Artificial Solutions International AB (Sweden)

- Nuance Communications, Inc. (U.S.)

- Baidu, Inc. (China)

- Samsung C&T Corporation (South Korea)

- Apple Inc. (U.S.)

- Alphabet Inc. (U.S.)

- eGain Corporation (U.S.)

- Amelia US LLC (U.S.)

- Verint Systems Inc. (U.S.)

- Clara Labs, Inc. (U.S.)

- Creative Virtual Ltd. (U.K.)

- Kognito Solutions LLC (U.S.)

- MedRespond Ltd. (U.K.)

Latest Developments in Global Digital Assistant Market

- In February 2023, Bluestem Health, a Nebraska-based healthcare provider, announced the launch of a Mediktor-powered AI-based virtual medical assistant aimed at improving digital patient engagement. The solution enables both existing and new patients to assess symptoms online and receive guidance on the appropriate level of care. This development enhances access to healthcare services, reduces the burden on clinical staff, and supports early decision-making. The introduction of AI-driven virtual assistants in healthcare is strengthening demand for intelligent, patient-centric digital solutions and accelerating adoption of digital assistants across medical applications

- In February 2023, Samsung Electronics Co., Ltd. introduced significant updates to its digital assistant Bixby to enhance performance, functionality, and overall user experience. The upgrades focused on improving language recognition and contextual understanding, allowing users greater control over smartphone features and interactions. These enhancements improve usability, personalization, and responsiveness of voice-based interfaces. The development reinforces competition in the digital assistant market and highlights the growing emphasis on advanced AI capabilities to drive user engagement and market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.