Global Diaphragm Valves Market, By Type (Weir and Straight), Valve Type (Two-Way Valve, Forged-T Valve, Multi-Port Valve, Block-T Valve, Tandem Valve, Forged Tank Outlet Valve, Block Tank Outlet Valve, and Others), Controller (Manual, Pneumatic, Electric, Hydraulic, Others), End Connection (Flanged, Butt Weld, Tri Clamp, and Others), Material (Metal, Rubber, Polytetrafluoroethylene (PTFE), Fluorine Plastic and Others), Size (Below 8”, 8”, 12”, 14”, 16”, 18”, 20” and Others, Body Material (Solid Plastic, Hygiene Valve, Fluorine Plastic and Others), Switch Type (Limit Switch, Basic Switches, Indicator Switch and Others), Usage (Multi Use and Single Use), Distribution Channel (Offline Channel and Online Channel), End User (Water and Wastewater Treatment, Pharmaceuticals, Chemical, Food and Beverages, Biopharma, Mining and Minerals, Power, Pulp and Paper and Others), Country (U.S., Canada, Mexico, U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Rest of Europe, China, Japan, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America) Industry Trends and Forecast to 2029.

Market Analysis and Insights: Global Diaphragm Valves Market

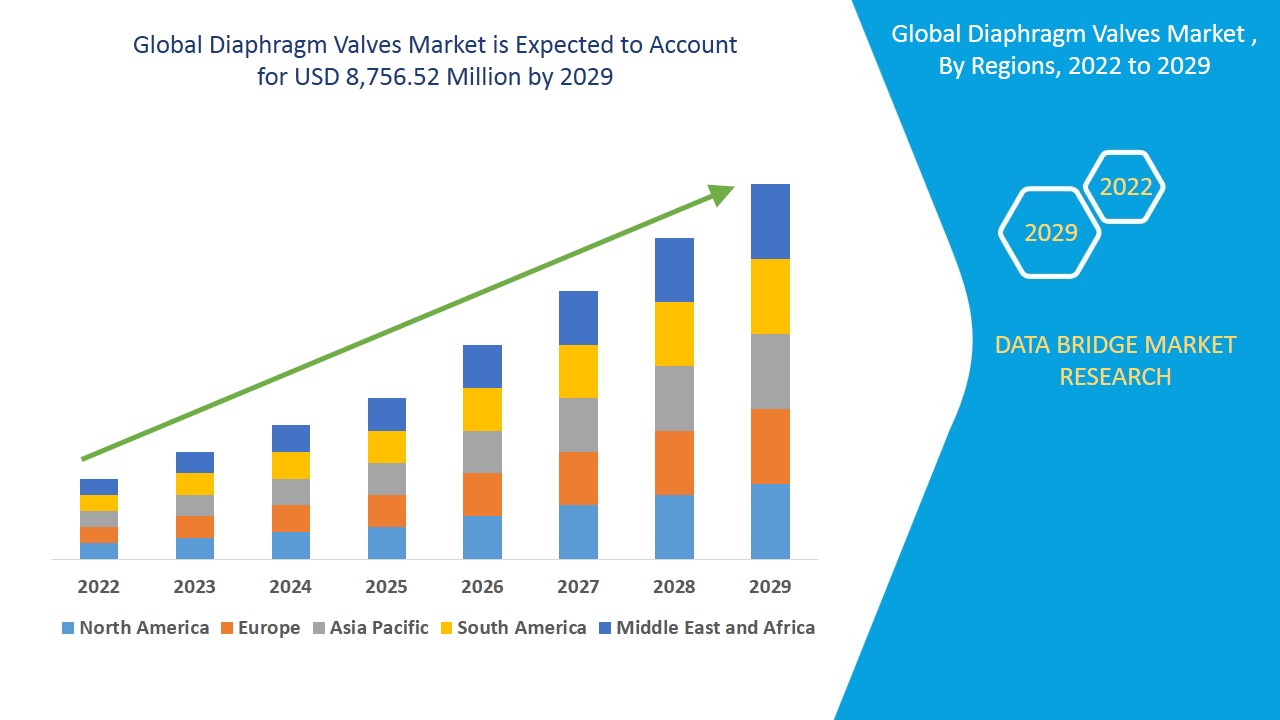

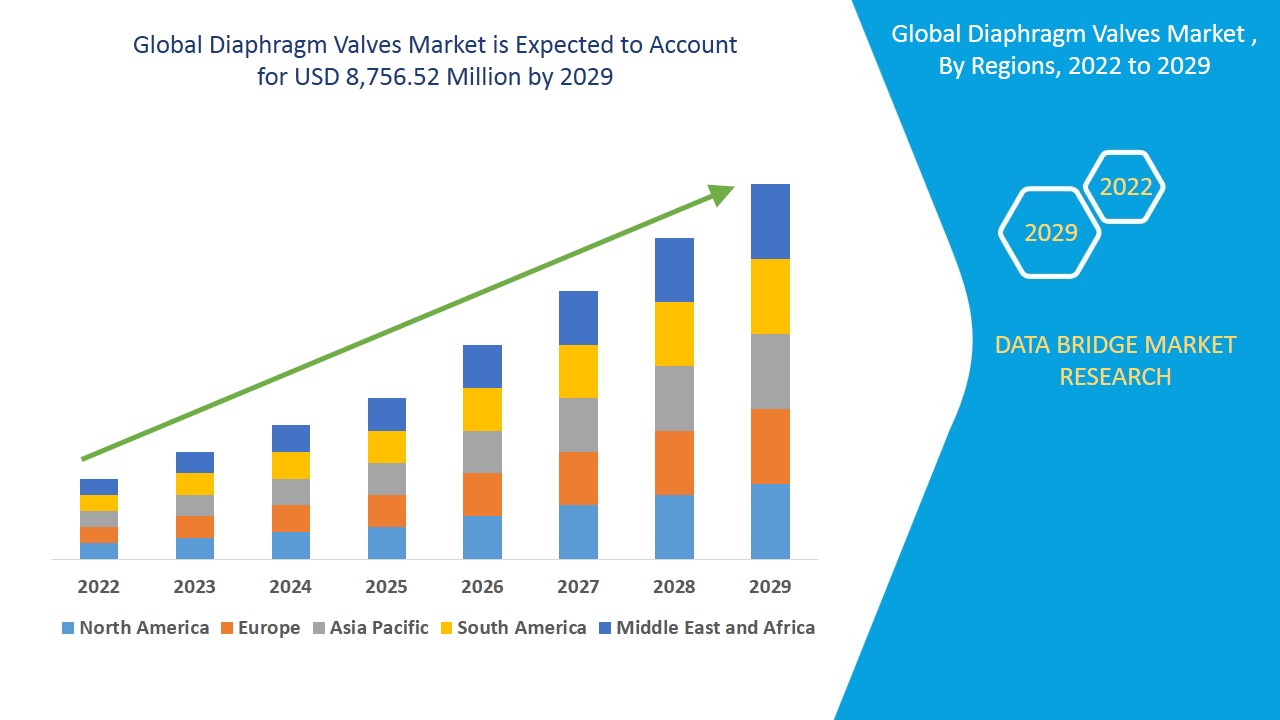

Diaphragm valves market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with the CAGR of 7.7% in the forecast period of 2022 to 2029 and is expected to reach USD 8,756.52 million by 2029.

Diaphragm valves (also known as membrane valves) are made up of a valve body having two or more ports, an elastomeric diaphragm, and a "weir or saddle" or seat that the diaphragm shuts. Depending on the intended function, the valve body might be made of plastic, metal, wood, or other materials. Diaphragm valves are used for throttling service and shut-off service for liquids, vacuum/gas, and slurries. These valves are available in a wide variety of solid plastics, metals, rubber, plastic, and glass linings; they are suitable for handling multiple chemical processing applications both slurries and clear fluids. The diaphragm valves have an extended utilization for applications at a low pressure and slurry fluid where most of the other valves become obstructed or corrode. Initially, the diaphragm valves were developed for industrial applications and pipe-organs. Gradually the design was adapted in the bio-pharmaceutical industry for sterilizing and sanitizing methods by using compliant materials. And now it is being used in almost every industry for safe production and adequate infrastructure, such as power generation, food & beverage, semiconductors, pulp & paper, chemical processing, and water/ wastewater treatment among other verticals.

The major factors driving the growth of the diaphragm valves market are rising demand for radioactive waste management and upsurge in demand for safe and reliable production across industries. Increasing usage of diaphragm valves in waste water treatment amd upsurge in demand for diaphragm valves in chemical, food and beverage industries is creating opportunities for the growth of the market. Decrease in performance over prolonged exposure to high temperature and pressure is acting as the major restraint for diaphragm valves market. Issues related with lead time in diaphragm valves is acting as a major challenge for the growth of the market.

This diaphragm valves market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Global Diaphragm Valves Market Scope and Market Size

Diaphragm valves market is segmented on the basis of type, valve type, controller, end connection, material, body material, size, switch type, usage, body material, distribution channel and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the diaphragm valves market is segmented into straight and weir. In 2022, weir segment holds the maximum market share in global diaphragm valves market as it is mostly utilized in every sort of application such as wastewater, chemical processing, pharmaceutical and others where heavy pressure work is required.

- On the basis of valve type, the global diaphragm valves market has been segmented into two-way valve, block-T-valve, forged-T-valve, tandem valve, block tank outlet valve, multi-port valve, forged tank outlet valve and others. In 2022, two way valves segment is dominating the global diaphragm valves market with respect to both value and volume due to its maximum utilization in different industries for its optimized flow. These are also used in isolation in many applications and are also consider to be cost effective as compared to others.

- On the basis of controller, the global diaphragm valves market has been segmented into manual, pneumatic, electric, and hydraulic and others. In 2022, manual segment dominates the global diaphragm valves market with respect to the segment. This domination is due to the rising usage of manual valves in remote systems to access power. However, the minimal applications of manual controllers hinders the market growth.

- On the basis of end connection, the global diaphragm valves market has been segmented into flanged, butt weld, tri clamp and others. In 2022, Flanged segment holds a dominant share in global diaphragm valves market. These end connection type mostly helps in controlling flow of fluid in every industrial application as well as provides corrosion resistance for which it is majorly used by the consumers.

- On the basis of material, the global diaphragm valves market has been segmented into metal, fluorine plastic, rubber, polytetrafluorethylene (PTFE) and others. In 2022, metal segment dominates the global diaphragm valves market with respect to the segment. This domination is due to the high pressure handling material of the valves. However, the problems of corrosion hinders the market growth.

- On the basis of size, the global diaphragm valves market has been segmented into below 8”, 8”, 12”, 14”, 16”, 18”, 20” and others. In 2022, below 8” segment is dominating the diaphragm valves market due to its wide usage across all sectors. These valves have better flow transmission rate, offer good temperature sensitivity and are affordable valves.

- On the basis of body material, the global diaphragm valves market has been segmented into solid plastic, hygiene valve, fluorine plastic and others. In 2022, solid plastic segment is dominating the global diaphragm valves market with respect to the segment. This domination is due to the precise surface finish and high industrial applications of solid plastic diaphragm valves. However, the high cost of the valves hinders the market growth.

- On the basis of switch type, the global diaphragm valves market has been segmented into limit switch, basic switch, indicator switch and others. In 2022, , limit switch is dominating the diaphragm valves market due to its basic functionality it’s easy to use and it is quite accurate in terms of maintaining flow levels and pressure levels. It has wide range of applications but it is mostly used in chemical, water treatment plants oil and gas industries.

- On the basis of usage, the global diaphragm valves market has been segmented into single use and multi-use. In 2022, multi-use diaphragm valves is dominating the global diaphragm valves market with respect to the usage segment. This domination is due to the availability of multiple applications in multi-use diaphragm valves. However, the multi-use valves getting easily damaged hinders the market growth.

- On the basis of distribution channel, the global diaphragm valves market has been segmented into online channel and offline channel. In 2022, Offline channel segment is dominating the global diaphragm valves market with respect to the distribution channel segment. This domination is due to the rising need for innovative benefits among diaphragm valves. However, the unavailability of wide product portfolio compared to online channels hinders the market growth.

- On the basis of end user, the global diaphragm valves market has been segmented into food and beverages, pharmaceuticals, biopharma, chemical, water and wastewater treatment, power, mining and minerals, pulp and paper and others. In 2022, water and wastewater treatment segment is dominating the market due to the increasing need for water treatment activities which in results drives to utilization of diaphragm valves in water treatment and filtration sector.

Global Diaphragm Valves Market Country Level Analysis

Diaphragm valves market is segmented on the basis of type, valve type, controller, end connection, material, body material, size, switch type, usage, body material, distribution channel and end user.

The countries covered in global diaphragm valves market report are U.S., Canada, Mexico in North America, U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Rest of Europe in Europe, China, Japan, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia Pacific (APAC), South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Rest of Middle East and Africa (MEA) in Middle East and Africa (MEA), Brazil, Argentina, Rest of South America in South America. In 2022, Asia-Pacific is anticipated to dominate the global application-specific integrated circuit (ASIC) market with a market share of 35.97% as the region has strong presence of major semiconductor manufacturing hub in developing countries such as China, Japan and South Korea. Also, increasing investment in different industries, including food and beverage, power plants, and chemical will continue to positively impact the demand for diaphragm valves in the Asia-Pacific region.

China accounted for maximum share in the diaphragm valves market as it is the highest semiconductor producing country globally. The U.S. has large number of local players. Germany has witnessed high growth due to large number of adoption of diaphragm valves in the region.

The country section of the diaphragm valves market report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Diaphragm Valves

Global diaphragm valves market also provides you with detailed market analysis for every country growth in installed base of different kind of products, impact of technology using lifeline curves and changes regulatory scenarios and their impact on the diaphragm valves market. The data is available for historic year 2012 to 2020.

Competitive Landscape and Diaphragm Valves Market Share Analysis

Diaphragm valves market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to diaphragm valves market.

Some of the major players operating in the diaphragm valves market are GEMU Group, KDVFlow, PureValve, KOSEN VALVE, Gopfert AG, Christian Burkert GmbH Co. KG Century Instrument Company, ASTECH VALVE CO.,LTD., Plast-O-Matic Valves, Inc., ITT INC., GEA Group Aktiengesellschaft, G.J. Johnson & Sons Ltd., GCE Group AB, International Polymer Solutions, FLOWONE, Valves Only, Valvorobica Industriale S.p.A., Xiamen Kemus Valve Co.,Ltd, FIP - Formatura Iniezione Polimeri S.p.A., Aquasyn LLC, Watson-Marlow Fluid Technology Group, IPEX Inc., ALFA LAVAL, Crane Co., NTGD Diaphragm Valve, SEMON ENGG INDUSTRIES PVT LTD, NIPPON DAIYA VALVE among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In December 2021, Crane Co. opened a Saunders factory in Cwmbran, UK. The main objective of this factory launch was to enhance its production capabilities in the region, as there is a growing demand from the consumer for advanced valve products. Through this company expanded its market.

- In December 2021, GEA Group Aktiengesellschaft expanded capacities at Ahus test center, Germany by adding two more modules to its technology offering. With this addition, GEA is raising the Ahaus Test Center’s profile as a key facility dedicated to piloting aseptic processing as well as the filling of sensitive foods and beverages. This expansion helps the company in improving the revenue of the company.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for diaphragm valves market through expanded product range.

SKU-