Global Diagnostic Reagents Market

Market Size in USD Billion

CAGR :

%

USD

48.90 Billion

USD

84.01 Billion

2022

2030

USD

48.90 Billion

USD

84.01 Billion

2022

2030

| 2023 –2030 | |

| USD 48.90 Billion | |

| USD 84.01 Billion | |

|

|

|

|

Diagnostic Reagents Market Analysis and Size

The market for diagnostic reagents is expected to grow during the forecast period of 2023 to 2030. Diagnostic reagents are lab chemicals to identify particular pathogens, metabolic irregularities, physiological anomalies, and hereditary illnesses. They are employed in vivo or in vitro to identify certain disorders and rely on medical professionals to make reliable diagnosis.

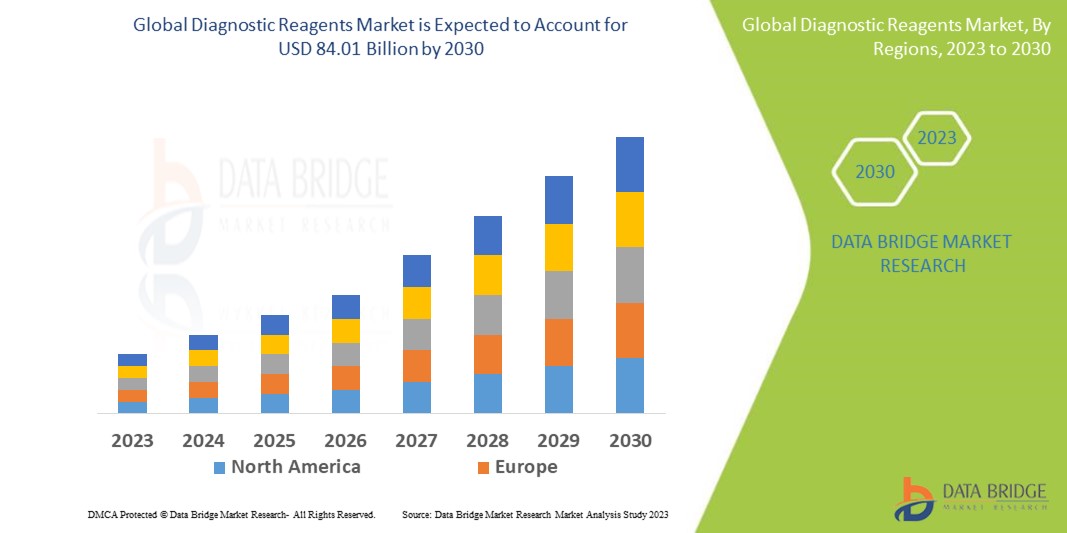

Data Bridge Market Research analyses that the diagnostic reagents market, valued at USD 48.90 billion in 2022, is expected to reach USD 84.01 billion by 2030, growing at a CAGR of 7.00% during the forecast period of 2023 to 2030. “Hospitals” dominates the end segment of the diagnostic reagents market owing to the higher in-house diagnostic testing comparatively to the others in the segment. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Diagnostic Reagents Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Sample Preparation Kits, Microarray Kits, PCR Assay Kits, In Situ Hybridization Kits, Sequencing Kits), End User (Hospitals, Research Institutes, Laboratories, Biopharmaceutical Companies, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Siemens (Germany),Hologic, Inc. (U.S.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Abbott (U.S.), BD (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), NeuroLogica Corp.(U.S.), Shimadzu Medical (India) pvt. Ltd. (Japan), GENERAL ELECTRIC (U.S.), Quest Diagnostics Incorporated (U.S.), Sysmex India Pvt. Ltd. (Japan), Hitachi, Ltd. (Japan), Canon Inc. (Japan), FUJIFILM Holdings Corporation (U.K.) |

|

Market Opportunities |

|

Market Definition

A diagnostic reagent is any reagent used in vitro or in vivo to detect or screen a particular disease or any health-related issue. Any organic or inorganic substances that are added to an analyte or biological specimen, such as urine, blood, or biopsied human tissue, to identify aetiology or abnormalities are referred to as diagnostic reagents. Substances or compounds used in diagnostic testing to identify, detect, or measure specific biological or chemical substances in patient samples. These reagents are essential components of diagnostic tests and play a crucial role in disease diagnosis, monitoring, and treatment.

Global Diagnostic Reagents Market Dynamics

Drivers

- Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is a significant driver for the diagnostic reagents market. Chronic diseases, such as cardiovascular disorders, diabetes, and cancer, have become increasingly common worldwide. Diagnostic reagents play a crucial role in accurately identifying and monitoring these diseases. They are used in various diagnostic procedures, including blood tests, imaging techniques, and genetic testing, to detect biomarkers, specific molecules, or genetic variations associated with these diseases. By enabling early disease detection and monitoring, diagnostic reagents facilitate timely intervention, treatment planning, and disease management. With the rising burden of chronic diseases, the demand for diagnostic reagents continues to grow, driving market expansion.

- Technological Advancements in Diagnostics

Technological advancements in diagnostics have revolutionized the field of medicine and significantly impacted the demand for diagnostic reagents. Molecular diagnostics, immunoassays, and point-of-care testing are among the key technological innovations that have driven the market growth. Molecular diagnostics, including techniques like polymerase chain reaction (PCR) and next-generation sequencing (NGS), have enhanced the sensitivity and specificity of diagnostic tests. These advancements enable the detection of genetic variations, mutations, and infectious agents with high accuracy and precision. Immunoassays, such as enzyme-linked immunosorbent assays (ELISA), utilize specific antibodies to identify and quantify target molecules in patient samples. Point-of-care testing has also gained prominence due to its convenience and rapid results. These technological advancements have expanded the applications of diagnostic reagents, improved diagnostic accuracy, and accelerated testing workflows, leading to increased adoption of diagnostic reagents in healthcare settings.

- Growing Aging Population

The global aging population is a significant driver for the global diagnostic reagents market. As people age, the incidence of age-related diseases and conditions increases. Elderly individuals are more susceptible to chronic diseases, including cardiovascular disorders, neurodegenerative diseases, and certain types of cancer. Regular diagnostic testing becomes essential for disease detection, monitoring, and management in this population. Diagnostic reagents are critical in facilitating early disease detection, identifying disease progression, and monitoring treatment efficacy. They enable healthcare professionals to assess biomarkers, measure specific molecules, and detect genetic variations associated with age-related diseases. The growing aging population, coupled with the increasing focus on preventive healthcare, has led to a higher demand for diagnostic reagents to support geriatric care and improve patient outcomes.

Opportunities

- Emerging Markets

Developing economies present significant growth opportunities for the global diagnostic reagents market. The expanding healthcare infrastructure, increasing access to diagnostic services, and rising awareness about early disease detection in these regions are driving the demand for diagnostic reagents.

- High Prevalence and increase in the Incidence of Chronic Infectious Diseases

One of the most common uses of in vitro diagnostic reagents is the diagnosis of infectious and chronic disorders. Any diagnostic test requires the use of diagnostic reagents, including biological and chemical reagents. IVD reagents are essential in developing new diagnostic tools and tests for the early diagnosis and prevention of diseases, which have become more difficult due to the emergence and breakout of several infectious diseases.

Restraints

- Stringent Regulatory Frameworks

The global diagnostic reagents market faces challenges due to strict regulations imposed by regulatory authorities. The complex approval processes, stringent quality standards, and compliance requirements can hinder market growth and increase the time and cost of product development.

Challenges

- Supply Chain Disruptions

The global diagnostic reagents market is susceptible to supply chain disruptions, such as raw material shortages, transportation issues, and production delays. These disruptions can impact the availability and delivery of diagnostic reagents, leading to challenges in meeting the growing demand and potentially affecting patient care.

This global diagnostic reagents market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global diagnostic reagents market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2021, CYTENA launched C. LIVE Tox, reagents for real-time direct detection of cytotoxicity. C.LIVE Tox Green and Red are sensitive DNA-binding dyes that are nonpermeable to viable cells and nonfluorescent on the outside

- In March 2019, Ortho Clinical Diagnostics launched four new key assays to meet the demand of the rapidly rising diagnostics market in China. In order to address the need of the rapidly expanding diagnostics market, Ortho Clinical Diagnostics, a global pioneer in in vitro diagnostics, has launched four new critical assays. Cystatin C, -Hydroxybutyrate Dehydrogenase (HBDH), Homocysteine (HCY), and Total Bile Acid (TBA) are the assays that are added as part of this product launch, which was made possible by a partnership with Beijing Leadman Biochemistry Co., Ltd. of Beijing

Global Diagnostic Reagents Market Scope

The global diagnostic reagents market is segmented on the basis of product type and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Chromatography Reagents

- Molecular Diagnostic Reagents

- Immunoassay Reagents

- Clinical Chemistry Reagents

- Flow Cytometry Reagents

- Cell and Tissue Culture Reagents

- Hematology and Hemostasis Reagents

- Microbiology Reagents

- Others

End-User

- Hospitals

- Research Institutes

- Laboratories

- Biopharmaceutical Companies

- Others

Diagnostic Reagents Market Regional Analysis/Insights

The diagnostic reagents market is analysed and market size insights and trends are provided by country, product type and end-user as referenced above.

The countries covered in the diagnostic reagents market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the global diagnostic reagents market due to the increasing use of molecular diagnostics in cancer screening and genetic disorders availability of government funds and the presence of major key players in the region.

Asia-Pacific is expected to grow at the highest growth rate in the global diagnostic reagents market in the forecast period of 2029 to 2030 due to the increase in popularity of molecular test over traditional tests such as microbiology test, surge in the incidence of lifestyle-related and chronic illnesses.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The diagnostic reagents market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for diagnostic reagents market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the diagnostic reagents market. The data is available for historic period 2015-2020.

Competitive Landscape and Diagnostic Reagents Market Share Analysis

The diagnostic reagents market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global diagnostic reagents market.

Some of the major players operating in the global diagnostic reagents market are:

- Siemens (Germany)

- Hologic, Inc. (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Abbott (U.S.)

- BD (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- NeuroLogica Corp.(U.S.)

- Shimadzu Medical (India) pvt. Ltd. (Japan)

- GENERAL ELECTRIC (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Sysmex India Pvt. Ltd. (Japan)

- Hitachi, Ltd. (Japan)

- Canon Inc. (Japan)

- FUJIFILM Holdings Corporation (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DIAGNOSTIC REAGENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DIAGNOSTIC REAGENTS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DIAGNOSTIC REAGENTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL DIAGNOSTIC REAGENTS MARKET, BY TYPE

16.1 OVERVIEW

16.2 CHROMATOGRAPHY REAGENTS

16.3 MOLECULAR DIAGNOSTIC REAGENTS

16.4 IMMUNOASSAY REAGENTS

16.5 CLINICAL CHEMISTRY REAGENTS

16.6 FLOW CYTOMETRY REAGENTS

16.7 CELL AND TISSUE CULTURE REAGENTS

16.8 HEMATOLOGY AND HEMOSTASIS REAGENTS

16.9 MICROBIOLOGY REAGENTS

16.1 OTHERS

17 GLOBAL DIAGNOSTIC REAGENTS MARKET, BY PRODUCTS

17.1 OVERVIEW

17.2 MOLECULAR DIAGNOSTIC REAGENTS

17.2.1 NUCLEIC ACID EXTRACTION REAGENTS

17.2.1.1. DNA EXTRACTION REAGENTS

17.2.1.2. RNA EXTRACTION REAGENTS

17.2.2 POLYMERASE CHAIN REACTION (PCR) REAGENTS

17.2.2.1. DNA POLYMERASE

17.2.2.2. PRIMERS

17.2.2.3. NUCLEOTIDE MIX

17.2.2.4. BUFFER SOLUTIONS

17.2.2.5. MGCL2

17.2.2.6. OTHERS

17.2.3 REVERSE TRANSCRIPTION REAGENTS

17.2.3.1. REVERSE TRANSCRIPTASE

17.2.3.2. RANDOM PRIMERS OR OLIGO(DT)

17.2.4 QUANTITATIVE PCR (QPCR) REAGENTS

17.2.4.1. FLUORESCENT PROBES

17.2.4.2. REFERENCE STANDARDS

17.2.4.3. OTHERS

17.2.5 DNA/RNA LABELING AND DETECTION

17.2.5.1. FLUORESCENT DYES OR RADIOACTIVE PROBES

17.2.5.2. CHEMILUMINESCENT SUBSTRATES

17.2.5.3. OTHERS

17.2.6 NEXT-GENERATION SEQUENCING (NGS) REAGENTS

17.2.6.1. SEQUENCING REAGENTS

17.2.6.2. INDEXING PRIMERS

17.2.6.3. OTHERS

17.2.7 PROTEIN DETECTION REAGENTS

17.2.8 ISOTHERMAL AMPLIFICATION REAGENTS

17.2.9 CRISPR-CAS REAGENTS

17.2.9.1. GUIDE RNA (GRNA)

17.2.9.2. CAS PROTEIN

17.2.9.3. OTHERS

17.2.10 HYBRIDIZATION AND MICROARRAY REAGENTS

17.2.10.1. CAPTURE PROBES

17.2.10.2. DETECTION PROBES

17.2.10.3. OTHERS

17.3 IMMUNOASSAY REAGENTS

17.3.1 ANTIBODIES

17.3.1.1. PRIMARY ANTIBODIES

17.3.1.2. SECONDARY ANTIBODIES

17.3.2 ENZYMES

17.3.2.1. HORSERADISH PEROXIDASE (HRP)

17.3.2.2. ALKALINE PHOSPHATASE (AP)

17.3.3 FLUOROPHORES

17.3.3.1. FLUORESCEIN ISOTHIOCYANATE (FITC)

17.3.3.2. RHODAMINE

17.3.3.3. ALEXA FLUOR DYES

17.3.3.4. OTHERS

17.3.4 CHEMILUMINESCENT SUBSTRATES

17.3.5 BIOTINYLATION REAGENTS

17.3.6 BLOCKING REAGENTS

17.3.7 CALIBRATORS AND CONTROLS

17.3.7.1. CALIBRATION STANDARDS

17.3.7.2. POSITIVE AND NEGATIVE CONTROLS

17.3.8 BUFFER SOLUTIONS

17.3.8.1. PBS (PHOSPHATE-BUFFERED SALINE)

17.3.8.2. TRIS-HCL

17.3.8.3. OTHERS

17.3.9 RECOMBINANT OR PURIFIED ANTIGENS

17.3.10 WASH BUFFERS

17.3.11 OTHERS

17.4 CLINICAL CHEMISTRY REAGENTS

17.4.1 ENZYMES

17.4.1.1. ALANINE AMINOTRANSFERASE (ALT) REAGENTS

17.4.1.2. ASPARTATE AMINOTRANSFERASE (AST) REAGENTS

17.4.1.3. ALKALINE PHOSPHATASE (ALP) REAGENTS

17.4.1.4. OTHERS

17.4.2 SUBSTRATES

17.4.2.1. GLUCOSE REAGENTS

17.4.2.2. OTHERS

17.4.3 LIPID PROFILE REAGENTS

17.4.3.1. CHOLESTEROL REAGENTS

17.4.3.2. TRIGLYCERIDE REAGENTS

17.4.3.3. HIGH-DENSITY LIPOPROTEIN (HDL) CHOLESTEROL REAGENTS

17.4.3.4. LOW-DENSITY LIPOPROTEIN (LDL) CHOLESTEROL REAGENTS

17.4.4 ELECTROLYTES

17.4.4.1. SODIUM

17.4.4.2. POTASSIUM

17.4.4.3. CHLORIDE REAGENTS

17.4.4.4. OTHERS

17.4.5 KIDNEY FUNCTION REAGENTS

17.4.5.1. BLOOD UREA NITROGEN (BUN) REAGENTS

17.4.5.2. CREATININE REAGENTS

17.4.5.3. OTHER

17.4.6 LIVER FUNCTION REAGENTS

17.4.6.1. BILIRUBIN REAGENTS

17.4.6.2. GAMMA-GLUTAMYL TRANSFERASE (GGT) REAGENTS

17.4.6.3. OTHERS

17.4.7 CARDIAC MARKERS

17.4.7.1. TROPONIN REAGENTS

17.4.7.2. CREATINE KINASE (CK) REAGENTS

17.4.7.3. OTHERS

17.4.8 HORMONES

17.4.8.1. THYROID FUNCTION REAGENTS

17.4.8.2. CORTISOL REAGENTS

17.4.8.3. OTHERS

17.4.9 PROTEINS

17.4.9.1. ALBUMIN REAGENTS

17.4.9.2. TOTAL PROTEIN REAGENTS

17.4.9.3. OTHERS

17.4.10 COAGULATION REAGENTS

17.4.10.1. PROTHROMBIN TIME (PT) REAGENTS

17.4.10.2. ACTIVATED PARTIAL THROMBOPLASTIN TIME (APTT) REAGENTS

17.4.10.3. OTHERS

17.4.11 URINE CHEMISTRY REAGENTS

17.4.11.1. URINE GLUCOSE REAGENTS

17.4.11.2. URINE PROTEIN REAGENTS

17.4.11.3. OTHERS

17.4.12 SPECIFIC PROTEINS

17.4.12.1. C-REACTIVE PROTEIN (CRP) REAGENTS

17.4.12.2. HEMOGLOBIN A1C (HBA1C) REAGENTS

17.4.12.3. OTHERS

17.5 FLOW CYTOMETRY REAGENTS

17.5.1 FLUOROCHROME-CONJUGATED ANTIBODIES

17.5.1.1. FLUORESCEIN ISOTHIOCYANATE (FITC)

17.5.1.2. PHYCOERYTHRIN (PE)

17.5.1.3. PERIDININ-CHLOROPHYLL PROTEIN (PERCP)

17.5.1.4. ALLOPHYCOCYANIN (APC)

17.5.1.5. ALEXA FLUOR DYES

17.5.1.6. OTHERS

17.5.2 CELL VIABILITY DYES

17.5.2.1. PROPIDIUM IODIDE (PI)

17.5.2.2. 7-AMINOACTINOMYCIN D (7-AAD)

17.5.2.3. FIXABLE VIABILITY DYES

17.5.2.4. OTHERS

17.5.3 NUCLEIC ACID STAINS

17.5.3.1. 4',6-DIAMIDINO-2-PHENYLINDOLE (DAPI)

17.5.3.2. HOECHST DYES

17.5.3.3. OTHERS

17.5.4 ISOTYPE CONTROLS

17.5.5 OTHERS

17.6 CELL AND TISSUE CULTURE REAGENTS

17.6.1 CELL CULTURE MEDIA

17.6.1.1. DULBECCO'S MODIFIED EAGLE MEDIUM (DMEM)

17.6.1.2. RPMI 1640

17.6.1.3. MINIMUM ESSENTIAL MEDIUM (MEM)

17.6.1.4. OTHERS

17.6.2 SERUM

17.6.2.1. FETAL BOVINE SERUM (FBS)

17.6.2.2. BOVINE SERUM ALBUMIN (BSA)

17.6.2.3. OTHERS

17.6.3 ANTIBIOTICS AND ANTIMYCOTICS

17.6.3.1. PENICILLIN-STREPTOMYCIN

17.6.3.2. AMPHOTERICIN B

17.6.3.3. OTHERS

17.6.4 TRYPSIN AND TRYPSIN INHIBITORS

17.6.4.1. TRYPSIN

17.6.4.2. TRYPSIN-EDTA

17.6.4.3. TRYPSIN INHIBITOR

17.6.4.4. OTHERS

17.6.5 CELL DISSOCIATION REAGENTS

17.6.5.1. ACCUTASE

17.6.5.2. COLLAGENASE

17.6.5.3. DISPASE

17.6.5.4. OTHERS

17.6.6 GROWTH FACTORS AND CYTOKINES

17.6.7 CELL FREEZING AND THAWING REAGENTS

17.6.7.1. DMSO (DIMETHYL SULFOXIDE)

17.6.7.2. CRYOPROTECTIVE AGENTS

17.6.7.3. OTHERS

17.6.8 EXTRACELLULAR MATRIX PROTEINS

17.6.8.1. COLLAGEN

17.6.8.2. FIBRONECTIN

17.6.8.3. LAMININ

17.6.8.4. OTHERS

17.6.9 HYBRIDOMA CULTURE REAGENTS

17.6.10 OTHERS

17.7 HEMATOLOGY AND HEMOSTASIS REAGENTS

17.7.1 HEMATOLOGY REAGENTS

17.7.1.1. HEMATOLOGY STAINS

17.7.1.1.1. WRIGHT-GIEMSA STAIN

17.7.1.1.2. NEW METHYLENE BLUE STAIN

17.7.1.2. CBC REAGENTS

17.7.1.2.1. DILUENT

17.7.1.2.2. LYSING REAGENTS

17.7.1.2.3. OTHERS

17.7.1.3. AUTOMATED HEMATOLOGY ANALYZER REAGENTS

17.7.1.3.1. HEMATOLOGY CONTROLS

17.7.1.3.2. CALIBRATION STANDARDS

17.7.1.3.3. OTHERS

17.7.1.4. MANUAL CELL COUNTING REAGENTS

17.7.1.5. HEMOGLOBIN REAGENTS

17.7.1.6. ERYTHROCYTE SEDIMENTATION RATE (ESR) REAGENTS

17.7.1.7. OTHERS

17.7.2 HEMOSTASIS REAGENTS

17.7.2.1. PROTHROMBIN TIME (PT) REAGENTS

17.7.2.2. THROMBOPLASTIN REAGENTS

17.7.2.3. ACTIVATED PARTIAL THROMBOPLASTIN TIME (APTT) REAGENTS

17.7.2.4. CLAUSS METHOD REAGENTS

17.7.2.5. ANTICOAGULANT MONITORING REAGENTS

17.7.2.6. OTHERS

17.8 MICROBIOLOGY REAGENTS

17.8.1 BIOCHEMICAL TEST REAGENTS

17.8.1.1. TRIPLE SUGAR IRON (TSI)

17.8.1.2. SIMMONS' CITRATE AGAR

17.8.1.3. UREA AGAR

17.8.1.4. OTHERS

17.8.2 SEROLOGICAL REAGENTS

17.8.2.1. ANTIBODY REAGENTS

17.8.2.2. ANTIGEN DETECTION REAGENTS

17.8.2.3. OTHERS

17.8.3 ANTIMICROBIAL SUSCEPTIBILITY TESTING (AST) REAGENTS

17.8.4 MYCOLOGY REAGENTS

17.8.4.1. SABOURAUD DEXTROSE AGAR (SDA)

17.8.4.2. LACTOPHENOL COTTON BLUE STAIN

17.8.4.3. OTHERS

17.8.5 MICROBIAL PRESERVATION REAGENTS

17.8.6 LYOPHILIZATION REAGENTS

17.8.7 OTHERS

17.9 CHROMATOGRAPHY REAGENTS

17.1 OTHERS

18 GLOBAL DIAGNOSTIC REAGENTS MARKET, BY NATURE

18.1 OVERVIEW

18.2 CHEMICAL REAGENTS

18.3 BIOLOGICAL REAGENTS

19 GLOBAL DIAGNOSTIC REAGENTS MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 INFECTIOUS DISEASE TESTING

19.2.1 HIV

19.2.2 HEPATITIS

19.2.3 TUBERCULOSIS

19.2.4 COVID-19

19.2.5 OTHERS

19.3 ONCOLOGY

19.3.1 CANCER BIOMARKERS

19.3.2 GENETIC TESTING

19.3.3 OTHERS

19.4 CARDIOLOGY

19.4.1 CARDIAC MARKERS

19.4.2 LIPID PROFILES

19.4.3 OTHERS

19.5 DIABETES:

19.5.1 GLUCOSE TESTING

19.5.2 HBA1C TESTING

19.5.3 OTHERS

19.6 HEMATOLOGY

19.6.1 COMPLETE BLOOD COUNT (CBC)

19.6.2 COAGULATION TESTS

19.6.3 OTHERS

19.7 OTHERS

20 GLOBAL DIAGNOSTIC REAGENTS MARKET, BY END USER

20.1 OVERVIEW

20.2 HOSPITALS

20.3 DIAGNOSTIC CENTER

20.4 RESEARCH LABS & INSTITUTES

20.5 BLOOD BANKS

20.6 SPECILATY CLINICS

20.7 AMBULATORY SURGICAL CENTERS (ASCS)

20.8 OTHERS

21 GLOBAL DIAGNOSTIC REAGENTS MARKET, BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 DIRECT TENDERS

21.3 RETAIL SALES

21.4 ONLINE SALES

21.5 OTHERS

22 GLOBAL DIAGNOSTIC REAGENTS MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.2 COMPANY SHARE ANALYSIS: EUROPE

22.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.4 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

22.5 COMPANY SHARE ANALYSIS: SOUTH AMERICA

22.6 MERGERS & ACQUISITIONS

22.7 NEW PRODUCT DEVELOPMENT & APPROVALS

22.8 EXPANSIONS

22.9 REGULATORY CHANGES

22.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL DIAGNOSTIC REAGENTS MARKET, BY REGION

GLOBAL DIAGNOSTIC REAGENTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 FRANCE

23.2.3 U.K.

23.2.4 HUNGARY

23.2.5 LITHUANIA

23.2.6 AUSTRIA

23.2.7 IRELAND

23.2.8 NORWAY

23.2.9 POLAND

23.2.10 ITALY

23.2.11 SPAIN

23.2.12 RUSSIA

23.2.13 TURKEY

23.2.14 BELGIUM

23.2.15 NETHERLANDS

23.2.16 SWITZERLAND

23.2.17 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 AUSTRALIA

23.3.6 SINGAPORE

23.3.7 THAILAND

23.3.8 MALAYSIA

23.3.9 INDONESIA

23.3.10 PHILIPPINES

23.3.11 NEW ZEALAND

23.3.12 TAIWAN

23.3.13 VIETNAM

23.3.14 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 PERU

23.4.4 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 SAUDI ARABIA

23.5.3 UAE

23.5.4 EGYPT

23.5.5 KUWAIT

23.5.6 ISRAEL

23.5.7 REST OF MIDDLE EAST AND AFRICA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL DIAGNOSTIC REAGENTS MARKET, SWOT AND DBMR ANALYSIS

25 GLOBAL DIAGNOSTIC REAGENTS MARKET, COMPANY PROFILE

25.1 THERMO FISHER SCIENTIFIC

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENTS

25.2 QUIDELORTHO CORPORATION

25.2.1 COMPANY OVERVIEW

25.2.2 REVENUE ANALYSIS

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENTS

25.3 ILLUMINA, INC.

25.3.1 COMPANY OVERVIEW

25.3.2 REVENUE ANALYSIS

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENTS

25.4 MERCK KGAA,

25.4.1 COMPANY OVERVIEW

25.4.2 REVENUE ANALYSIS

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENTS

25.5 PERKINELMER INC

25.5.1 COMPANY OVERVIEW

25.5.2 REVENUE ANALYSIS

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 PRODUCT PORTFOLIO

25.5.5 RECENT DEVELOPMENTS

25.6 SHIMADZU CORPORATION

25.6.1 COMPANY OVERVIEW

25.6.2 REVENUE ANALYSIS

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 PRODUCT PORTFOLIO

25.6.5 RECENT DEVELOPMENTS

25.7 HOLOGIC, INC.

25.7.1 COMPANY OVERVIEW

25.7.2 REVENUE ANALYSIS

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 PRODUCT PORTFOLIO

25.7.5 RECENT DEVELOPMENTS

25.8 CYTENA GMBH

25.8.1 COMPANY OVERVIEW

25.8.2 REVENUE ANALYSIS

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 PRODUCT PORTFOLIO

25.8.5 RECENT DEVELOPMENTS

25.9 ABBOTT

25.9.1 COMPANY OVERVIEW

25.9.2 REVENUE ANALYSIS

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 PRODUCT PORTFOLIO

25.9.5 RECENT DEVELOPMENTS

25.1 BIO-RAD LABORATORIES, INC.

25.10.1 COMPANY OVERVIEW

25.10.2 REVENUE ANALYSIS

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 PRODUCT PORTFOLIO

25.10.5 RECENT DEVELOPMENTS

25.11 DANAHER

25.11.1 COMPANY OVERVIEW

25.11.2 REVENUE ANALYSIS

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 PRODUCT PORTFOLIO

25.11.5 RECENT DEVELOPMENTS

25.12 BIOMÉRIEUX

25.12.1 COMPANY OVERVIEW

25.12.2 REVENUE ANALYSIS

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 PRODUCT PORTFOLIO

25.12.5 RECENT DEVELOPMENTS

25.13 QIAGEN

25.13.1 COMPANY OVERVIEW

25.13.2 REVENUE ANALYSIS

25.13.3 GEOGRAPHIC PRESENCE

25.13.4 PRODUCT PORTFOLIO

25.13.5 RECENT DEVELOPMENTS

25.14 GRIFOLS, S.A.

25.14.1 COMPANY OVERVIEW

25.14.2 REVENUE ANALYSIS

25.14.3 GEOGRAPHIC PRESENCE

25.14.4 PRODUCT PORTFOLIO

25.14.5 RECENT DEVELOPMENTS

25.15 FUJIREBIO DIAGNOSTICS AB

25.15.1 COMPANY OVERVIEW

25.15.2 REVENUE ANALYSIS

25.15.3 GEOGRAPHIC PRESENCE

25.15.4 PRODUCT PORTFOLIO

25.15.5 RECENT DEVELOPMENTS

25.16 MERIDIAN BIOSCIENCE

25.16.1 COMPANY OVERVIEW

25.16.2 REVENUE ANALYSIS

25.16.3 GEOGRAPHIC PRESENCE

25.16.4 PRODUCT PORTFOLIO

25.16.5 RECENT DEVELOPMENTS

25.17 EKF DIAGNOSTICS HOLDINGS PLC

25.17.1 COMPANY OVERVIEW

25.17.2 REVENUE ANALYSIS

25.17.3 GEOGRAPHIC PRESENCE

25.17.4 PRODUCT PORTFOLIO

25.17.5 RECENT DEVELOPMENTS

25.18 RANDOX LABORATORIES LTD.

25.18.1 COMPANY OVERVIEW

25.18.2 REVENUE ANALYSIS

25.18.3 GEOGRAPHIC PRESENCE

25.18.4 PRODUCT PORTFOLIO

25.18.5 RECENT DEVELOPMENTS

25.19 SEKISUI DIAGNOSTICS

25.19.1 COMPANY OVERVIEW

25.19.2 REVENUE ANALYSIS

25.19.3 GEOGRAPHIC PRESENCE

25.19.4 PRODUCT PORTFOLIO

25.19.5 RECENT DEVELOPMENTS

25.2 BD

25.20.1 COMPANY OVERVIEW

25.20.2 REVENUE ANALYSIS

25.20.3 GEOGRAPHIC PRESENCE

25.20.4 PRODUCT PORTFOLIO

25.20.5 RECENT DEVELOPMENTS

25.21 SIEMENS HEALTHCARE GMBH

25.21.1 COMPANY OVERVIEW

25.21.2 REVENUE ANALYSIS

25.21.3 GEOGRAPHIC PRESENCE

25.21.4 PRODUCT PORTFOLIO

25.21.5 RECENT DEVELOPMENTS

25.22 F. HOFFMANN-LA ROCHE LTD

25.22.1 COMPANY OVERVIEW

25.22.2 REVENUE ANALYSIS

25.22.3 GEOGRAPHIC PRESENCE

25.22.4 PRODUCT PORTFOLIO

25.22.5 RECENT DEVELOPMENTS

25.23 DIASORIN S.P.A.

25.23.1 COMPANY OVERVIEW

25.23.2 REVENUE ANALYSIS

25.23.3 GEOGRAPHIC PRESENCE

25.23.4 PRODUCT PORTFOLIO

25.23.5 RECENT DEVELOPMENTS

25.24 SYSMEX CORPORATION

25.24.1 COMPANY OVERVIEW

25.24.2 REVENUE ANALYSIS

25.24.3 GEOGRAPHIC PRESENCE

25.24.4 PRODUCT PORTFOLIO

25.24.5 RECENT DEVELOPMENTS

25.25 ORTHO CLINICAL DIAGNOSTICS

25.25.1 COMPANY OVERVIEW

25.25.2 REVENUE ANALYSIS

25.25.3 GEOGRAPHIC PRESENCE

25.25.4 PRODUCT PORTFOLIO

25.25.5 RECENT DEVELOPMENTS

25.26 AGILENT TECHNOLOGIES INC.

25.26.1 COMPANY OVERVIEW

25.26.2 REVENUE ANALYSIS

25.26.3 GEOGRAPHIC PRESENCE

25.26.4 PRODUCT PORTFOLIO

25.26.5 RECENT DEVELOPMENTS

25.27 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

25.27.1 COMPANY OVERVIEW

25.27.2 REVENUE ANALYSIS

25.27.3 GEOGRAPHIC PRESENCE

25.27.4 PRODUCT PORTFOLIO

25.27.5 RECENT DEVELOPMENTS

25.28 FUJIFILM

25.28.1 COMPANY OVERVIEW

25.28.2 REVENUE ANALYSIS

25.28.3 GEOGRAPHIC PRESENCE

25.28.4 PRODUCT PORTFOLIO

25.28.5 RECENT DEVELOPMENTS

25.29 BIOSINO BIO-TECHNOLOGY AND SCIENCE INC.

25.29.1 COMPANY OVERVIEW

25.29.2 REVENUE ANALYSIS

25.29.3 GEOGRAPHIC PRESENCE

25.29.4 PRODUCT PORTFOLIO

25.29.5 RECENT DEVELOPMENTS

25.3 DAAN GENE CO., LTD.

25.30.1 COMPANY OVERVIEW

25.30.2 REVENUE ANALYSIS

25.30.3 GEOGRAPHIC PRESENCE

25.30.4 PRODUCT PORTFOLIO

25.30.5 RECENT DEVELOPMENTS

25.31 HIPRO BIOTECHNOLOGY CO.,LTD.

25.31.1 COMPANY OVERVIEW

25.31.2 REVENUE ANALYSIS

25.31.3 GEOGRAPHIC PRESENCE

25.31.4 PRODUCT PORTFOLIO

25.31.5 RECENT DEVELOPMENTS

25.32 TRIVITRON HEALTHCARE

25.32.1 COMPANY OVERVIEW

25.32.2 REVENUE ANALYSIS

25.32.3 GEOGRAPHIC PRESENCE

25.32.4 PRODUCT PORTFOLIO

25.32.5 RECENT DEVELOPMENTS

25.33 DIAGNOSTIC SYSTEMS GMBH

25.33.1 COMPANY OVERVIEW

25.33.2 REVENUE ANALYSIS

25.33.3 GEOGRAPHIC PRESENCE

25.33.4 PRODUCT PORTFOLIO

25.33.5 RECENT DEVELOPMENTS

26 RELATED REPORTS

27 CONCLUSION

28 QUESTIONNAIRE

29 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.