Global Devops Market

Market Size in USD Billion

CAGR :

%

USD

10.45 Billion

USD

59.04 Billion

2024

2032

USD

10.45 Billion

USD

59.04 Billion

2024

2032

| 2025 –2032 | |

| USD 10.45 Billion | |

| USD 59.04 Billion | |

|

|

|

|

DevOps Market Size

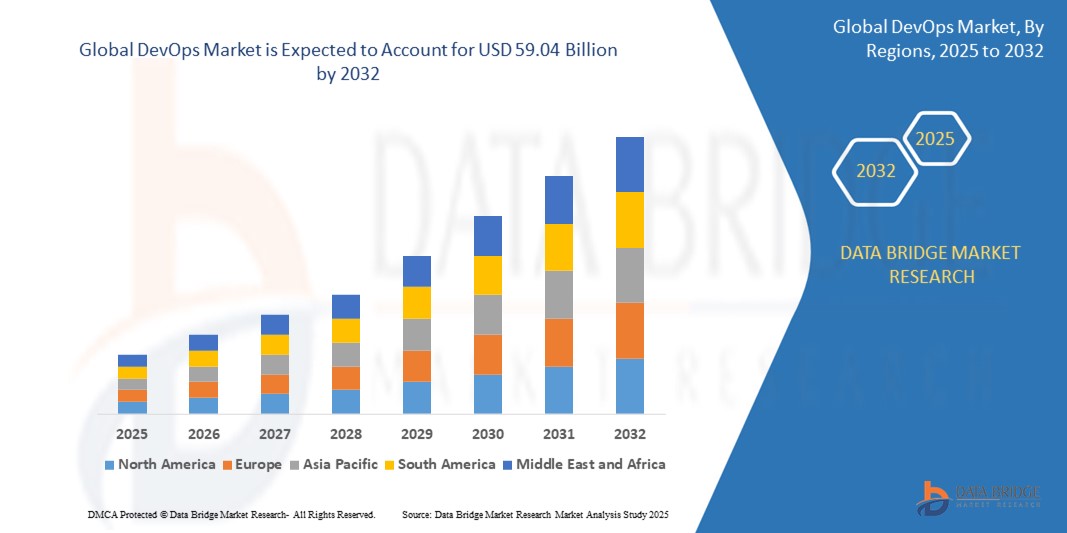

- The global DevOps market size was valued at USD 10.45 billion in 2024 and is expected to reach USD 59.04 billion by 2032, at a CAGR of 24.16% during the forecast period

- The market growth is largely fueled by the increasing demand for streamlined software development processes, continuous integration/continuous deployment (CI/CD) practices, and the rising emphasis on faster time-to-market in the IT and software sectors

- Furthermore, growing investments in cloud infrastructure, containerization, and automation tools are enhancing collaboration between development and operations teams. These converging factors are accelerating the adoption of DevOps solutions across enterprises of all sizes, thereby significantly boosting the industry's growth

DevOps Market Analysis

- DevOps, which integrates software development (Dev) and IT operations (Ops), is becoming a critical component of modern software delivery pipelines across industries due to its ability to improve deployment frequency, reduce failure rates, and enhance operational efficiency through automation and continuous delivery practices

- The escalating demand for DevOps is primarily fueled by the rising adoption of agile frameworks, increasing need for digital transformation, and growing pressure on organizations to deliver software faster and with higher quality

- North America dominates the global DevOps market with the largest market share of 35.5%, driven by the region's advanced IT infrastructure, widespread adoption of cloud technologies, and a high concentration of tech giants and early adopters of DevOps practices across sectors like BFSI, healthcare, and retail

- Asia-Pacific is expected to be the fastest growing region in the DevOps market during the forecast period due to expanding tech-savvy enterprises, increasing startup activity, and government-led digital initiatives in countries like India, China, and Southeast Asia

- Cloud segment is expected to dominate the DevOps market with a largest market share of 62.5%, due to the widespread adoption of IT trends and policies such as Bring your own device (BYOD), Internet of Things (IoT), mobility, containerization, and virtualization across enterprises. Cloud technology offers several on-demand capabilities such as cybersecurity, automation, Machine Learning (ML), and big data analytics creating ample number of opportunities in the development to operations industry

Report Scope and DevOps Market Segmentation

|

Attributes |

DevOps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

DevOps Market Trends

“Enhanced Efficiency Through AI and Automation Integration”

- A significant and accelerating trend in the global DevOps market is the growing integration of artificial intelligence (AI), machine learning (ML), and intelligent automation into the DevOps lifecycle. This fusion is revolutionizing how teams develop, test, deploy, and monitor applications by enabling faster decision-making, reducing manual errors, and optimizing workflows

- For instance, platforms like GitHub Copilot and Harness are leveraging AI to automate code suggestions, monitor deployment pipelines, and dynamically allocate resources based on application needs. Similarly, tools such as Dynatrace use AI to provide real-time insights into application performance and predict potential failures before they impact users

- AI-powered DevOps tools can analyze vast datasets from CI/CD pipelines, identify anomalies, and suggest corrective actions autonomously. This enhances the reliability of deployments and accelerates incident response times. Additionally, predictive analytics are being used to anticipate infrastructure needs and allocate cloud resources efficiently, reducing operational costs

- The seamless integration of AI and automation with DevOps practices enables continuous testing, deployment, and monitoring without human intervention, which is vital for achieving true continuous delivery. With voice-enabled assistants and bots being tested in IT operations, teams can soon trigger builds or check system health using natural language commands, further simplifying operational management

- This trend toward more intelligent, automated, and autonomous DevOps environments is fundamentally reshaping enterprise IT operations. As a result, companies such as IBM, Google, and Microsoft are heavily investing in AI-driven DevOps platforms to help organizations streamline software delivery and enhance agility

- The demand for AI-enabled DevOps solutions is rapidly increasing across enterprises of all sizes, as businesses prioritize speed, stability, and scalability in their digital transformation journey

DevOps Market Dynamics

Driver

“Growing Need Due to Rising Demand for Agility, Automation, and Digital Transformation”

- The increasing need for agile, responsive, and scalable software development processes across industries is a significant driver for the rising demand for DevOps solutions globally. As organizations undergo digital transformation, DevOps practices are becoming essential to accelerate software delivery and improve operational efficiency

- For instance, in early 2024, Microsoft enhanced its Azure DevOps suite by incorporating expanded AI capabilities and improved integrations with GitHub Actions, targeting faster release cycles and reduced operational silos. Such advancements by major players are expected to further drive DevOps market growth during the forecast period

- As businesses strive to meet customer expectations for continuous innovation and high-performance digital services, DevOps enables faster and more reliable software deployment. Features such as CI/CD pipelines, infrastructure as code, and real-time monitoring allow organizations to respond quickly to market changes and user feedback

- Furthermore, the growing adoption of cloud computing, containerization (e.g., Docker, Kubernetes), and microservices architecture is making DevOps a natural fit for modern IT environments. These technologies require agile workflows and automated processes, which DevOps provides to ensure speed, flexibility, and scalability

- The ability to automate repetitive tasks, improve collaboration between development and operations teams, and enhance visibility into software performance and delivery pipelines is a key factor driving adoption across sectors including finance, healthcare, retail, and telecommunications. The shift toward hybrid and multi-cloud environments further strengthens the need for robust DevOps strategies

- The rising demand for faster release cycles, enhanced software quality, and continuous innovation is pushing organizations—both large enterprises and startups—to embrace DevOps as a core part of their digital transformation agenda

Restraint/Challenge

“Rising Concerns Regarding Security, Skill Gaps, and High Implementation Complexity”

- Security and compliance concerns in automated DevOps environments, along with the shortage of skilled professionals and the complexity of implementation, pose significant challenges to broader DevOps adoption. As DevOps integrates multiple tools, processes, and departments, ensuring secure and compliant workflows becomes increasingly difficult—particularly in highly regulated industries like healthcare and finance

- For instance, high-profile incidents involving misconfigured cloud environments or compromised CI/CD pipelines have raised alarms about the potential vulnerabilities within automated DevOps workflows. Organizations must invest in robust DevSecOps strategies to address these risks, embedding security at every stage of the development lifecycle

- the lack of skilled personnel capable of managing complex toolchains, cloud-native technologies, and agile methodologies continues to be a barrier. Many organizations struggle to find professionals with combined expertise in development, operations, and automation—slowing down DevOps adoption or leading to poorly implemented practices

- The high initial investment in setting up a DevOps pipeline—along with the challenges of integrating it with legacy systems—can deter small and mid-sized enterprises. Unlike plug-and-play solutions, DevOps often requires a cultural shift, organizational restructuring, and significant training efforts, which can delay ROI and increase resistance from traditional IT teams

- While many platform providers now offer simplified DevOps toolsets and training resources, overcoming these challenges will require continuous upskilling, better integration frameworks, and stronger security standards across the ecosystem to ensure scalable and secure DevOps adoption

DevOps Market Scope

The market is segmented on the basis of component, cloud type, deployment, enterprise size, and industry vertical

- By Component

On the basis of component, the DevOps market is segmented into solution, and service. The solutions segment dominates the market, driven by the widespread adoption of automation tools, CI/CD platforms, infrastructure as code (IaC), and version control systems. Enterprises increasingly rely on DevOps solutions to streamline software delivery pipelines, reduce errors, and improve collaboration between development and operations teams. The growing integration of AI and cloud-native tools within these solutions also enhances their scalability, reliability, and appeal across industries

The services segment is anticipated to witness the fastest growth rate of 26.8% from 2025 to 2032, fueled by rising demand for consulting, implementation, and managed services. As organizations face challenges in DevOps toolchain integration, cultural adoption, and workflow restructuring, they increasingly seek expert guidance to ensure successful transitions. This trend is especially prominent among SMEs and traditional enterprises embarking on digital transformation. Additionally, the expansion of DevOps-as-a-Service (DaaS) offerings is helping businesses adopt DevOps with minimal upfront infrastructure investment, contributing to strong growth in this segment

- By Deployment

On the basis of deployment, the DevOps market is segmented into cloud, and on-premise. The cloud segment held the largest market revenue share of 62.5%, in 2025, driven by the widespread adoption of cloud-native applications and the scalability, flexibility, and cost-efficiency offered by cloud infrastructure. Cloud-based DevOps solutions facilitate seamless collaboration, faster deployment cycles, and integration with a broad array of automation and monitoring tools, making them the preferred choice for enterprises pursuing digital transformation and agile development

The on-premise segment is expected to witness the fastest CAGR from 2025 to 2032, driven by regulatory compliance requirements, data security concerns, and the need for full control over infrastructure in highly sensitive industries such as finance, government, and healthcare. On-premise deployments remain critical for organizations with legacy systems or stringent data sovereignty policies, offering tailored customization and internal governance capabilities that cloud solutions may not fully support.

- By Cloud Type

On the basis of cloud type, the DevOps market is segmented into private cloud, public cloud, and hybrid cloud. The public cloud segment held the largest market revenue share in 2025, driven by the scalability, flexibility, and cost-effectiveness that public cloud platforms provide. Public cloud solutions enable organizations to quickly scale their DevOps operations, access a wide array of tools, and streamline collaboration across teams without the need for heavy upfront investment in infrastructure. The growth of public cloud offerings from providers like AWS, Azure, and Google Cloud further supports this segment's dominance

The hybrid cloud segment is expected to witness the fastest CAGR from 2025 to 2032, driven by organizations’ need for a flexible environment that balances the advantages of both private and public clouds. Hybrid cloud allows businesses to run sensitive applications and store critical data on private clouds while taking advantage of public clouds for less sensitive operations. This model offers enhanced scalability, security, and cost efficiency, making it ideal for organizations with complex, multi-cloud strategies. The increasing demand for hybrid cloud solutions is expected to accelerate as enterprises seek to optimize their DevOps workflows across various cloud environments

- By Organization Size

On the basis of organization size, the DevOps market is segmented into large enterprise, and SMEs. The large enterprises segment held the largest market revenue share in 2025, driven by the increasing need for automation, faster software delivery, and improved collaboration across large, distributed teams. Large enterprises typically have complex IT infrastructures and require DevOps solutions to streamline their operations, reduce time to market, and enhance security and compliance. The availability of enterprise-grade DevOps tools and the ability to integrate them across various departments make DevOps a strategic necessity for these organizations

The SMEs segment is expected to witness the fastest CAGR from 2025 to 2032, as smaller businesses increasingly embrace digital transformation and seek scalable, cost-effective solutions to enhance their software development processes. SMEs are adopting cloud-based DevOps platforms to streamline workflows, reduce operational overhead, and improve software delivery without the need for extensive IT resources. The growing adoption of SaaS-based DevOps tools, which offer flexibility and lower initial costs, is driving rapid growth in this segment

- By Industry Vertical

On the basis of industry vertical, the DevOps market is segmented into IT and telecom, BFSI, retail, government and public sector, manufacturing, healthcare, and others. The IT and telecom segment held the largest market revenue share in 2025, driven by the industry’s inherent need for rapid software deployment, continuous innovation, and agile infrastructure. With a strong emphasis on automation, scalability, and real-time system monitoring, IT and telecom companies leverage DevOps to accelerate service delivery, improve system uptime, and maintain competitiveness in a fast-paced digital environment

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the sector’s ongoing digital transformation, increasing adoption of health tech applications, and the need for secure, compliant software development processes. Healthcare providers are turning to DevOps to improve the reliability and speed of electronic health record (EHR) systems, telemedicine platforms, and patient engagement apps. The demand for HIPAA-compliant DevOps solutions and the integration of AI in medical software development are further contributing to rapid growth in this vertical

DevOps Market Regional Analysis

- North America dominates the DevOps market with the largest revenue share of 35.5% in 2025, driven by strong demand for agile development practices, widespread adoption of cloud technologies, and a highly developed IT infrastructure

- Organizations in the region prioritize speed, scalability, and automation, leading to rapid integration of DevOps tools across industries such as technology, finance, and healthcare

- This widespread adoption is further supported by the presence of leading DevOps solution providers, a skilled workforce, and significant investments in AI and cloud innovation, positioning North America as a global hub for DevOps growth and innovation

U.S. DevOps Market Insight

The U.S. DevOps market captured the largest revenue share of approximately 35% within North America in 2025, driven by the rapid adoption of cloud-native technologies and the increasing emphasis on agile and continuous software delivery practices. Enterprises across sectors are prioritizing the modernization of their IT infrastructure to support faster, more reliable deployment cycles and real-time collaboration between development and operations teams

Europe DevOps Market Insight

The European DevOps market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent data protection regulations, such as the GDPR, and the increasing need for secure, compliant, and efficient software development practices. As European enterprises accelerate digital transformation efforts, the demand for automated and scalable DevOps solutions is rising significantly across various sectors, including finance, government, and healthcare

U.K. DevOps Market Insight

The U.K. DevOps market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing emphasis on digital transformation across both public and private sectors. The country’s growing adoption of agile methodologies, cloud-native infrastructure, and open-source technologies is encouraging the widespread implementation of DevOps practices to improve software delivery and operational efficiency

Germany DevOps Market Insight

The German DevOps market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's strong emphasis on IT modernization, digital sovereignty, and secure development practices. As Germany pushes forward with Industrie 4.0 initiatives and cloud adoption, organizations are investing in DevOps to enhance software automation, increase deployment speed, and ensure system reliability. Germany’s well-developed enterprise infrastructure and commitment to data privacy and compliance with EU standards, such as GDPR, are driving the demand for DevOps strategies that integrate security and traceability

Asia-Pacific DevOps Market Insight

The Asia-Pacific DevOps market is poised to grow at the fastest CAGR of over 24% in 2025, driven by the region's rapid digital transformation, expanding cloud infrastructure, and increasing investment in modern software development practices. Countries like China, Japan, India, and South Korea are adopting DevOps at scale to support digital-first strategies across sectors such as BFSI, telecom, and retail. Government initiatives promoting IT modernization and smart city development, particularly in India and China, are reinforcing the need for agile development and continuous delivery

Japan DevOps Market Insight

The Japan DevOps market is gaining momentum due to the country’s high-tech infrastructure and strong demand for secure, efficient software delivery, particularly in sectors like electronics, automotive, and healthcare. Japan’s enterprises are increasingly integrating DevOps to manage complex legacy systems while pursuing innovation through automation and cloud-native architectures. With a cultural focus on precision and continuous improvement, DevOps adoption in Japan is characterized by an emphasis on reliability, security, and quality. The integration of DevOps with IoT and AI-based technologies, especially in smart city and manufacturing applications, is contributing to steady market growth

China DevOps Market Insight

The China DevOps market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by its strong digital economy, large-scale cloud adoption, and booming e-commerce and fintech sectors. Chinese enterprises are aggressively implementing DevOps to support rapid innovation, agile product cycles, and competitive differentiation. As China advances its “Digital China” and “New Infrastructure” strategies, organizations are investing in DevOps platforms that support container orchestration, real-time analytics, and automated testing

DevOps Market Share

The DevOps industry is primarily led by well-established companies, including:

- Microsoft Corporation (U.S.)

- Amazon Web Services (AWS) (U.S.)

- IBM Corporation (U.S.)

- Google LLC (U.S.)

- Oracle Corporation (U.S.)

- Atlassian Corporation Plc (Australia)

- Red Hat, Inc. (U.S.)

- GitLab, Inc. (U.S.)

- CircleCI (U.S.)

- JFrog Ltd. (U.S.)

- CloudBees, Inc. (U.S.)

- Puppet, Inc. (U.S.)

- Docker, Inc. (U.S.)

- VMware, Inc. (U.S.)

- ServiceNow, Inc. (U.S.)

- Splunk Inc. (U.S.)

- Buildkite Pty Ltd (Australia)

- Progress Software Corporation (U.S.)

- Cigniti Technologies Ltd. (India)

- To The New (Singapore)

Latest Developments in Global DevOps Market

- In February 2023, GitLab introduced a series of incremental updates to its comprehensive DevOps platform aimed at reducing operational friction and enhancing the overall user experience. These enhancements were part of its regular monthly release cycle, spanning versions 15.3 through 15.8, with version 15.9 scheduled for release by the end of February. These updates reflect the broader trends in the global DevOps market, particularly the growing emphasis on AI-driven automation, security integration (DevSecOps), and continuous delivery pipeline

- In September 2022, Atlassian announced a series of significant enhancements across its suite of work management and collaboration tools, including Trello, Confluence, Atlas, and Jira Work Management. The updates introduced new smart connections and centralized administrative controls, aimed at improving cross-team visibility, operational efficiency, and unified project governance. These developments underscore a growing trend in the global DevOps market toward greater integration between collaboration tools and DevOps pipelines

- In May 2021, Amazon Web Services (AWS) launched Amazon DevOps Guru, a fully managed operations service powered by machine learning, designed to simplify the process for developers to enhance application availability. This service automatically identifies operational issues and offers targeted recommendations for remediation. The introduction of Amazon DevOps Guru highlights a key trend in the global DevOps market, the integration of machine learning and artificial intelligence to optimize application performance and operational efficiency

- In November 2024, Azure DevOps introduced a series of new features designed to enhance development workflows and improve security. Among these updates are commit-less builds for dependency scanning in GitHub Advanced Security, file previews and annotations for CodeQL scans, and a new REST API limit on work item comments, aimed at optimizing performance and usability. These advancements underscore the increasing importance of automation, security, and collaboration in the global DevOps market. As enterprises continue to prioritize speed and security in their software development cycles, the integration of dependency scanning and automated code analysis plays a crucial role in reducing vulnerabilities and improving overall code quality

- In January 2024, IBM DevOps Deploy 2023.12 (8.0.0) unveils a unified DevOps Automation platform, following its rebranding from UrbanCode Deploy. This release marks a significant enhancement in automation capabilities, representing the first version under the newly unified platform. The introduction of IBM’s unified DevOps Automation platform highlights the growing trend in the global DevOps market towards more integrated and streamlined solutions. As organizations continue to embrace automation to accelerate software delivery and improve operational efficiency, this rebranding and enhancement reinforce the demand for platforms that provide seamless integration, scalability, and comprehensive automation across the entire development lifecycle

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.