Global Desalting And Buffer Exchange Market

Market Size in USD Billion

CAGR :

%

USD

1.26 Billion

USD

3.94 Billion

2024

2032

USD

1.26 Billion

USD

3.94 Billion

2024

2032

| 2025 –2032 | |

| USD 1.26 Billion | |

| USD 3.94 Billion | |

|

|

|

|

Desalting and Buffer Exchange Market Size

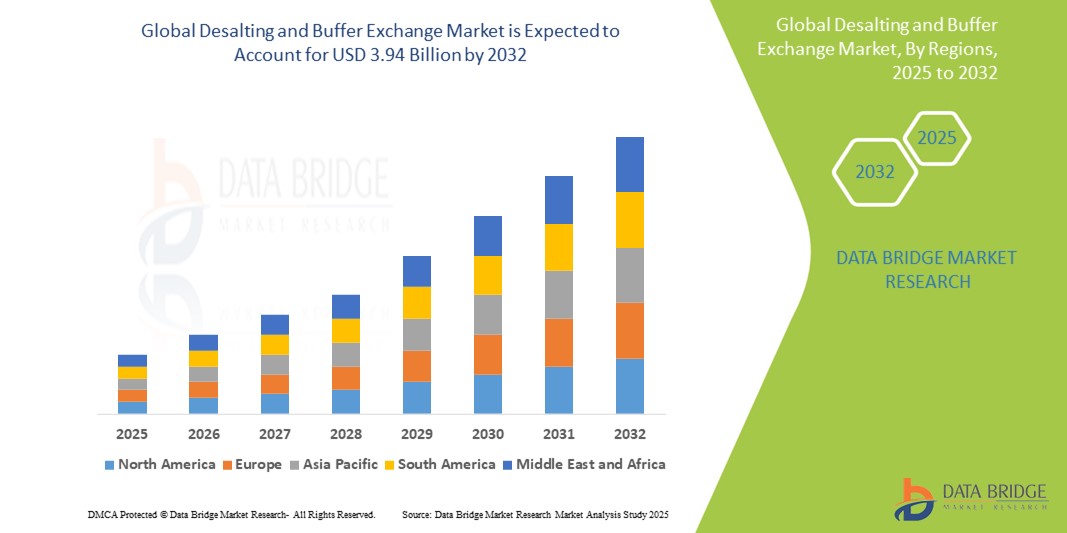

- The global desalting and buffer exchange market size was valued at USD 1.26 billion in 2024 and is expected to reach USD 3.94 billion by 2032, at a CAGR of 15.25% during the forecast period

- The market growth is largely fueled by the increasing demand for efficient bioprocessing techniques, particularly in the pharmaceutical and biotechnology industries

- Furthermore, the rising focus on biologics and biosimilars, the increase in monoclonal antibody production, and the growing demand for efficient downstream processing techniques are establishing desalting and buffer exchange as essential steps in drug development and manufacturing. These converging factors are accelerating the uptake of desalting and buffer exchange solutions, thereby significantly boosting the industry's growth

Desalting and Buffer Exchange Market Analysis

- Desalting and buffer exchange are crucial downstream bioprocessing steps that involve the removal of salts and small molecules or the replacement of buffer solutions, essential for preparing biological samples, particularly proteins and nucleic acids, for various analytical and purification applications

- The escalating demand for desalting and buffer exchange solutions is primarily fueled by the burgeoning biopharmaceutical sector, increasing research and development expenditure in proteomics and genomics, and the growing focus on the production of biologics, including monoclonal antibodies and vaccines

- North America dominates the desalting and buffer exchange market with the largest revenue share of 22.3% in 2024, characterized by high R&D investment in biopharmaceuticals, a strong presence of key industry players, and increasing demand for advanced purification processes in the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the desalting and buffer exchange market with a CAGR of 11.1%, during the forecast period due to the rapid expansion of the biotechnology industry, increasing investments in life sciences research, and the rising demand for biopharmaceuticals in countries

- Filtration segment dominates the desalting and buffer exchange market with a market share of 44.2% in 2024, driven by its efficiency in removing salts and exchanging buffers in large-scale bioprocessing operations, its speed compared to other methods such as dialysis, and its ability to concentrate samples simultaneously

Report Scope and Desalting and Buffer Exchange Market Segmentation

|

Attributes |

Desalting and Buffer Exchange Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Desalting and Buffer Exchange Market Trends

“Automation and High-Throughput Solutions for Enhanced Efficiency”

- A significant and accelerating trend in the global desalting and buffer exchange market is the increasing adoption of automation and high-throughput solutions. This shift is driven by the growing demand for processing a large number of samples quickly and efficiently, particularly in drug discovery, biopharmaceutical development, and diagnostics

- For instance, automated liquid handling systems integrate seamlessly with desalting and buffer exchange columns and plates, enabling parallel processing of multiple samples. Companies such as Cytiva offer automated systems such as the ÄKTA go Desalting and Buffer Exchange System, designed to streamline workflows and improve reproducibility

- Automation in desalting and buffer exchange allows for reduced manual labor, minimized human error, and increased sample consistency. This is crucial in research and manufacturing settings where precision and scalability are paramount. High-throughput capabilities are also being enhanced through the development of specialized kits, spin columns, and filter plates that are compatible with robotic systems

- The seamless integration of desalting and buffer exchange with automated platforms facilitates a more efficient overall bioprocessing workflow. This allows researchers and manufacturers to rapidly prepare samples for downstream applications such as mass spectrometry, chromatography, and various analytical assays

- This trend towards more automated, high-throughput, and integrated desalting and buffer exchange systems is fundamentally reshaping laboratory practices and manufacturing processes. Consequently, companies are investing in developing user-friendly, scalable, and versatile automated platforms to meet the evolving needs of the biopharmaceutical and research sectors

- The demand for desalting and buffer exchange solutions that offer enhanced automation and high-throughput capabilities is growing rapidly across pharmaceutical companies, research laboratories, and academic institutions, as they increasingly prioritize efficiency, accuracy, and scalability in their operations

Desalting and Buffer Exchange Market Dynamics

Driver

“Growing Demand for Biopharmaceuticals and Advancements in Bioprocessing”

- The increasing prevalence of chronic diseases and the subsequent surge in demand for novel biopharmaceutical products, such as monoclonal antibodies, vaccines, and gene therapies, is a significant driver for the heightened demand for desalting and buffer exchange solutions

- For instance, the biopharmaceutical industry is continuously investing in research and development to bring new and more effective treatments to market. This includes the development of complex biologics that require meticulous purification steps. Desalting and buffer exchange are critical for removing impurities and optimizing the formulation of these sensitive biological molecules, ensuring their stability, activity, and safety

- As biopharmaceutical production scales up, there's a growing need for efficient, high-throughput, and scalable desalting and buffer exchange techniques to meet the increasing demand for therapeutic proteins and other biologics. This drives innovation in the market, leading to the development of more advanced and automated systems

- Furthermore, advancements in bioprocessing technologies, including improved chromatography and filtration techniques, are making desalting and buffer exchange more efficient and cost-effective. The trend towards continuous bioprocessing and single-use systems also necessitates robust and integrated desalting and buffer exchange solutions

- The critical role these processes play in achieving high-purity biopharmaceutical products and facilitating downstream analytical applications are key factors propelling the adoption of desalting and buffer exchange in both research and industrial settings. The ongoing pipeline of novel therapeutics and biosimilars further contributes to market growth

Restraint/Challenge

“High Initial Investment and Technical Complexities”

- The significant initial investment required for acquiring and integrating advanced desalting and buffer exchange systems poses a considerable challenge to wider market adoption, particularly for smaller research laboratories, academic institutions, and emerging biotech companies with limited financial resources

- For instance, sophisticated automated chromatography systems, tangential flow filtration (TFF) setups, and specialized membrane filtration units can involve substantial upfront costs. This capital-intensive requirement can deter potential users from investing in these essential purification technologies

- Furthermore, the technical complexities associated with operating and maintaining these advanced systems, including the need for skilled personnel, precise calibration, and optimization of parameters for different biological samples, present an additional hurdle. While automation aims to simplify workflows, the initial setup and troubleshooting can be complex

- This can lead to increased operational costs beyond the initial purchase, impacting the overall cost-effectiveness for some users. While smaller, more affordable kits and spin columns exist for lower throughput needs, the high-capacity, high-efficiency systems essential for industrial bioprocessing remain a significant investment

Desalting and Buffer Exchange Market Scope

The market is segmented on the basis of technique, product, and application

- By Technique

On the basis of technique, the desalting and buffer exchange market is segmented into filtration, chromatography, and precipitation. The filtration segment dominates the largest market revenue share of 44.2% in 2024, driven by its efficiency in removing salts and exchanging buffers in large-scale bioprocessing operations, its speed compared to other methods such as dialysis, and its ability to concentrate samples simultaneously. This technique is particularly favored in industrial applications due to its scalability and ease of integration into existing workflows.

The chromatography segment is anticipated to witness significant growth during the forecast period, fueled by its high resolution and specificity in separating biomolecules from contaminants. This technique, including gel filtration (size exclusion chromatography), is widely used for critical purification steps where precise separation and high purity are essential, especially in research and development of sensitive biologics.

- By Product

On the basis of product, the desalting and buffer exchange market is segmented into kits, cassettes and cartridges, filter plates, spin columns, membrane filters, and others. The kits segment is expected to dominate the market share in 2024, driven by their ease of use, convenience, and widespread adoption in various research and industrial applications for efficient sample preparation. Kits offer pre-packaged components and simplified protocols, making them ideal for both experienced researchers and those new to the techniques.

The spin columns segment is anticipated to witness significant growth, driven by their suitability for rapid, small-scale sample processing and high-throughput applications. Spin columns provide a convenient and efficient method for desalting and buffer exchange in laboratory settings, making them popular for researchers working with multiple samples.

- By Application

On the basis of application, the desalting and buffer exchange market is segmented into bioprocess applications, pharmaceutical and biotechnology companies, CROs and CMOs, academic and research institutes, and diagnostic applications. The pharmaceutical and biotechnology companies segment is expected to dominate the market in 2024, driven by the increasing demand for advanced purification processes in drug discovery, development, and manufacturing. These companies heavily rely on desalting and buffer exchange for various stages of biopharmaceutical production, from early-stage research to final product formulation.

The bioprocess applications segment is anticipated to witness significant growth during the forecast period, fueled by the expanding needs of large-scale biomanufacturing and downstream processing. As the production of biologics and biosimilars continues to rise, the demand for efficient and scalable desalting and buffer exchange solutions within bioprocess workflows is accelerating.

Desalting and Buffer Exchange Market Regional Analysis

- North America dominates the desalting and buffer exchange market with the largest revenue share of 22.3% in 2024, driven by high R&D investment in biopharmaceuticals, a strong presence of key industry players, and increasing demand for advanced purification processes in the U.S. and Canada

- Consumers in the region highly value advanced bioprocessing solutions that offer efficiency, purity, and scalability for drug discovery, development, and manufacturing

- This widespread adoption is further supported by favorable regulatory frameworks, increasing demand for biologics and biosimilars, and the growing focus on personalized medicine, establishing desalting and buffer exchange as crucial steps in the region's life sciences sector

U.S. Desalting and Buffer Exchange Market Insight

The U.S. desalting and buffer exchange market captured a significant revenue share within North America in 2024, fueled by the booming biopharmaceutical industry and extensive research and development activities. The increasing focus on developing novel biologics and gene therapies, coupled with substantial investments by pharmaceutical and biotechnology companies, drives the demand for efficient purification techniques. The strong presence of leading academic and research institutions, as well as a well-established infrastructure for life sciences, further propels the market in the U.S.

Europe Desalting and Buffer Exchange Market Insight

The Europe desalting and buffer exchange market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing pharmaceutical R&D, increasing production of biosimilars, and rising government funding for life science research. The region's robust healthcare sector and the presence of numerous biopharmaceutical companies contribute to the consistent demand for advanced desalting and buffer exchange solutions across various applications, from drug discovery to manufacturing.

U.K. Desalting and Buffer Exchange Market Insight

The U.K. desalting and buffer exchange market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a strong focus on scientific research, a thriving biotechnology sector, and increasing investment in bioprocessing technologies. The U.K.'s significant contributions to drug discovery and development, along with a growing number of contract research and manufacturing organizations (CROs and CMOs), are propelling the adoption of advanced purification solutions.

Germany Desalting and Buffer Exchange Market Insight

The Germany desalting and buffer exchange market is expected to expand at a considerable CAGR during the forecast period, fueled by its leading position in pharmaceutical manufacturing and a strong emphasis on biotechnological innovation. Germany's well-developed research infrastructure, coupled with a high demand for high-purity biopharmaceutical products, promotes the adoption of efficient desalting and buffer exchange techniques in both academic and industrial settings.

Asia-Pacific Desalting and Buffer Exchange Market Insight

The Asia-Pacific desalting and buffer exchange market is poised to grow at the fastest CAGR of 11.1% during the forecast period, driven by rapid expansion of the biopharmaceutical industry, increasing investments in life sciences research, and rising disposable incomes in countries such as China, Japan, and India. The region's growing healthcare infrastructure, coupled with supportive government initiatives promoting biotechnology and pharmaceutical manufacturing, is accelerating the adoption of desalting and buffer exchange technologies.

Japan Desalting and Buffer Exchange Market Insight

The Japan desalting and buffer exchange market is gaining momentum due to the country’s advanced biotechnology sector, strong government support for healthcare innovation, and increasing demand for high-quality biopharmaceuticals. Japan's emphasis on precision and advanced research methods, coupled with a growing number of clinical trials and drug development activities, is driving the adoption of sophisticated desalting and buffer exchange solutions.

India Desalting and Buffer Exchange Market Insight

The India desalting and buffer exchange market accounted for a significant market revenue share in Asia Pacific, attributed to the country's rapidly growing pharmaceutical and biotechnology industries, increasing R&D investments, and a large patient pool driving demand for affordable therapeutics. The expansion of domestic drug manufacturers and the rising focus on biosimilar production are key factors propelling the market in India.

Desalting and Buffer Exchange Market Share

The Desalting and Buffer Exchange industry is primarily led by well-established companies, including:

- Cytiva (U.S.)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Repligen Corporation (U.S.)

- Pall Corporation (U.S.)

- Lonza (Switzerland)

- Avantor, Inc. (U.S.)

- Tosoh Corporation (Japan)

- Bio-Works (Sweden)

- Agilent Technologies, Inc. (U.S.)

- Waters Corporation (U.S.)

- Shimadzu Corporation (Japan)

- Hitachi High-Tech Corporation (Japan)

- Cole-Parmer Instrument Company, LLC (U.S.)

- Spectrum Laboratories, Inc. (U.S.)

- GE HealthCare. (U.S.)

- Sepax Technologies, Inc. (U.S.)

Latest Developments in Global Desalting and Buffer Exchange Market

- In May 2024, Asahi Kasei Medical, a bioprocess business, launched a new assembly plant for Planova virus removal filters. A new assembly plant for Planova was completed in 2024. This highlights continuous innovation in filtration technologies critical for biopharmaceutical safety

- In December 2024, Advances in peptide purification techniques for mass spectrometry-based proteomics have been reported, including the development of high-recovery desalting tip columns. These innovations are designed to minimize peptide loss during the desalting step, crucial for improving sensitivity and coverage in proteomics research

- In November 2023, Cytiva launched new ÄKTA go desalting and buffer exchange system. This system is designed to automate desalting and buffer exchange workflows, making them faster, more efficient, and more reproducible, addressing the growing need for automation in bioprocessing

- In October 2023, Cytiva, a part of Danaher, expanded its footprint in India with the launch of a biologics manufacturing hub in Pune.This 33,000 sq ft facility will manufacture bioprocessing equipment, including tangential flow, virus filtration, and inactivation systems, supporting the growing biopharmaceutical production in the region

- In February 2022, Sartorius Stedim Biotech, a subgroup of Sartorius, finalized the acquisition of Novasep's chromatography division.This strategic move expanded Sartorius's chromatography offerings and strengthened its position in the bioprocessing industry, indicating consolidation and strengthening of key players

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.