Global Desalting and Buffer Exchange Market, By Technique (Filtration, Chromatography, and Precipitation), Product (Kit, Cassettes and Cartridges, Filter Plates, Spin Columns, Membrane Filters, and Other), Application (Bioprocess Applications, Pharmaceutical and Biotechnology Companies, CMOS and CROS, Academic and Research Institutes, and Diagnostic Applications) – Industry Trends and Forecast to 2031.

Desalting and Buffer Exchange Market Analysis and Size

The desalting and buffer exchange market is experiencing exponential growth fueled by the latest technological advancements. Cutting-edge methods such as membrane-based filtration and chromatography are revolutionizing purification processes. These innovations optimize efficiency, reduce costs, and enhance product purity, catering to the escalating demands of pharmaceutical, biotechnology, and food industries. This surge reflects a dynamic landscape driven by continuous research and development.

The global desalting and buffer exchange market size was valued at USD 1.10 billion in 2023, is projected to reach USD 3.42 billion by 2031, with a CAGR of 15.25% during the forecast period 2024 to 2031. This indicates that the market value. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Technique (Filtration, Chromatography, and Precipitation), Product (Kit, Cassettes and Cartridges, Filter Plates, Spin Columns, Membrane Filters, and Other), Application (Bioprocess Applications, Pharmaceutical and Biotechnology Companies, CMOS and CROS, Academic and Research Institutes, and Diagnostic Applications)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

Thermo Fisher Scientific, Inc. (U.S.), Avantor Inc. (U.S.), Bio-Rad Laboratories Inc. (U.S.), Merck KGaA (Germany), Danaher (U.S.), General Electric Company (U.S.), Repligen Corporation. (U.S.), Sartorius (Germany), Agilent Technologies Inc. (U.S.), PhyNexus Inc. (U.S.), Biotage (Sweden), Norgen Biotek Corp. (Canada), and Bio-Works Technologies AB (Sweden)

|

|

Market Opportunities

|

|

Market Definition

Desalting is a process that removes salt and other small molecules from a solution, typically using techniques such as dialysis or gel filtration. Buffer exchange involves replacing the buffer solution surrounding a biomolecule with a different buffer solution while maintaining its stability and functionality. Both methods are crucial in biochemistry for purification and altering experimental conditions.

Desalting and Buffer Exchange Market Dynamics

Drivers

- Growing Biopharmaceutical Industry

The growing biopharmaceutical sector, fueled by escalating investments in the development of biologics, vaccines, and biosimilars, is propelling the need for advanced desalting and buffer exchange technologies. For instance, the global market for monoclonal antibodies is rapidly expanding, driving the demand for efficient purification processes. Consequently, manufacturers are increasingly adopting innovative desalting and buffer exchange solutions to meet the stringent quality standards and address the growing production volumes in this thriving industry.

- Rising Demand for Therapeutic Proteins

The increasing incidence of chronic diseases and the surge in demand for therapeutic proteins such as monoclonal antibodies and hormones underscore the necessity for efficient purification processes. Technologies facilitating desalting and buffer exchange play a pivotal role in ensuring the quality and safety of these biopharmaceuticals. For instance, the growing demand for monoclonal antibodies for cancer treatment intensifies the need for robust purification methods to meet regulatory standards and deliver effective therapies.

Opportunities

- Increasing Bioproduction Outsourcing

The trend of biopharmaceutical companies outsourcing manufacturing to CDMOs presents a significant opportunity in the desalting and buffer exchange market. CDMOs often require advanced purification technologies to meet diverse client needs efficiently. Companies offering innovative desalting and buffer exchange solutions tailored for CDMOs can capitalize on this growing demand. For instance, introducing customizable, scalable systems that streamline purification processes can enhance competitiveness and capture a larger market share in this expanding segment.

- Growing Adoption of Single-Use Systems

The increasing adoption of single-use systems in bioprocessing presents a significant opportunity for desalting and buffer exchange solutions. These solutions offer compatibility with single-use technologies, catering to the industry's demand for flexible, contamination-resistant, and cost-effective purification processes. For instance, companies developing disposable chromatography columns and membrane-based filtration systems specifically designed for single-use applications are well-positioned to capitalize on this growing market trend.

Restraints/Challenges

- Limited Freshwater Alternatives

The preference for traditional freshwater sources over desalination persists due to their lower costs and established infrastructure, posing a significant challenge to the desalination market. Despite technological advancements, the entrenched reliance on existing water sources inhibits the widespread adoption of desalination solutions in many regions, limiting market growth and development.

- High Initial Investment

The high initial investment required for setting up desalination plants serves as a significant barrier for market entry, particularly in small or developing regions. This financial obstacle hampers market growth and limits access to desalination technology, perpetuating water scarcity challenges in areas where alternative freshwater sources are scarce or inadequate.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In February 2022, Sartorius Stedim Biotech, a subgroup of Sartorius, finalized the acquisition of Novasep's chromatography division after receiving approval from the United States Federal Trade Commission, expanding its chromatography offerings and strengthening its position in the bioprocessing industry

- In June 2022, Trajan Group Holdings Limited finalized the acquisition of Chromatography Research Supplies, Inc. (CRS), enhancing its portfolio with the addition of high-quality analytical consumables and reinforcing its presence in the analytical science and device sector

- In January 2023, Sartorius extended its strategic collaboration partnership agreement with RoosterBio Inc. to address purification challenges and establish scalable downstream manufacturing processes for exosome-based therapies, enhancing the bioprocessing portfolio and bolstering capabilities in the field of advanced therapeutics

Desalting and Buffer Exchange Market Scope

The market is segmented on the basis of technique, product, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technique

- Filtration

- Ultrafiltration

- Dialysis

- Chromatography

- Size Exclusion Chromatography

- Other Chromatography Techniques

- Precipitation

Product

- Kit

- Cassettes and Cartridges

- Filter Plates

- Spin Columns

- Membrane Filters

- Other

- Consumables

- Accessories

Application

- Bioprocess Applications

- Pharmaceutical and Biotechnology Companies

- CMOS and CROS

- Academic and Research Institutes

- Diagnostic Applications

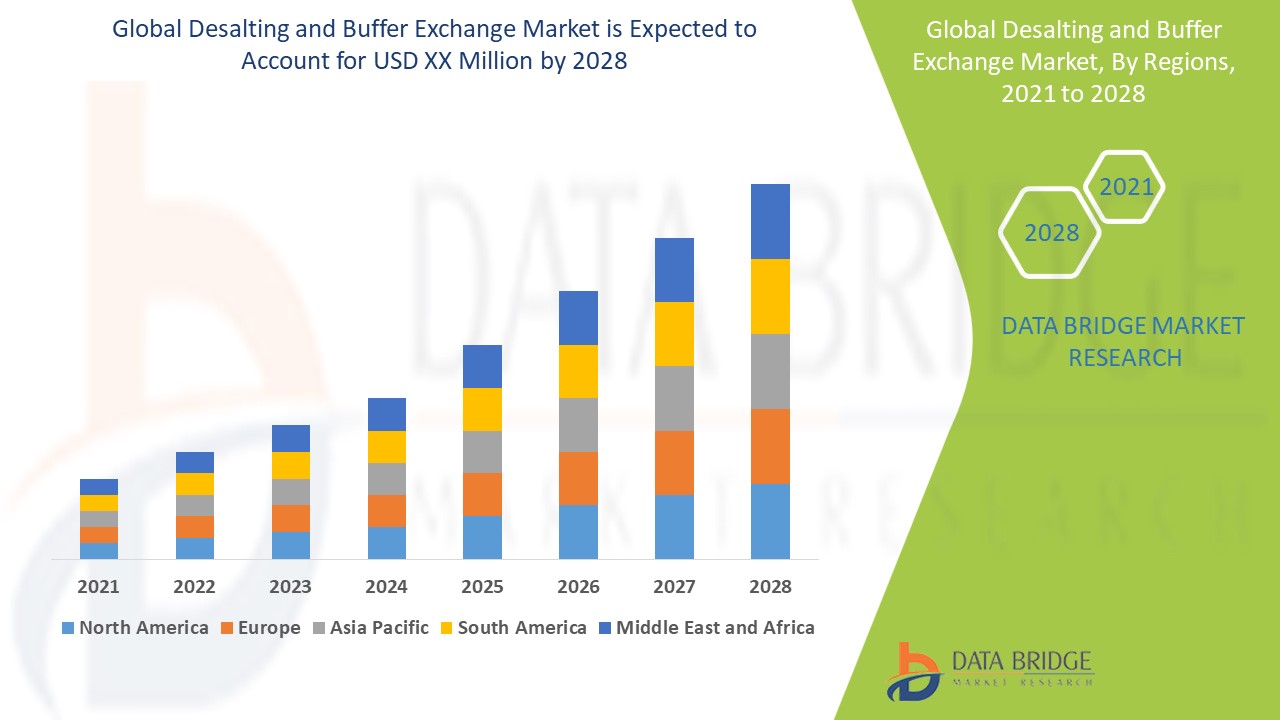

Desalting and Buffer Exchange Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, product, technique, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is estimated to witness a significant surge in the desalting and buffer exchange market due to the growing presence of clinical research organizations and biopharmaceutical companies, coupled with the abundance of skilled personnel. This growth trajectory underscores the region's pivotal role in advancing biotechnology and pharmaceutical sectors.

North America is expected to dominate the desalting and buffer exchange market due to increasing demand for biopharmaceuticals, rising research and development expenditure by biopharmaceutical companies, and growing research activities in genomics and proteomics, driving the need for efficient purification processes in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the market. The data is available for historic period 2016-2021.

Competitive Landscape and Desalting and Buffer Exchange Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- Thermo Fisher Scientific, Inc. (U.S.)

- Avantor Inc. (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

- Merck KGaA (Germany)

- Danaher (U.S.)

- General Electric Company (U.S.)

- Repligen Corporation. (U.S.)

- Sartorius (Germany)

- Agilent Technologies Inc. (U.S.)

- PhyNexus Inc. (U.S.)

- Biotage (Sweden)

- Norgen Biotek Corp. (Canada)

- Bio-Works Technologies AB (Sweden)

SKU-