Global Dental Syringes Market

Market Size in USD Billion

CAGR :

%

USD

1.86 Billion

USD

2.76 Billion

2024

2032

USD

1.86 Billion

USD

2.76 Billion

2024

2032

| 2025 –2032 | |

| USD 1.86 Billion | |

| USD 2.76 Billion | |

|

|

|

|

Dental Syringes Market Size

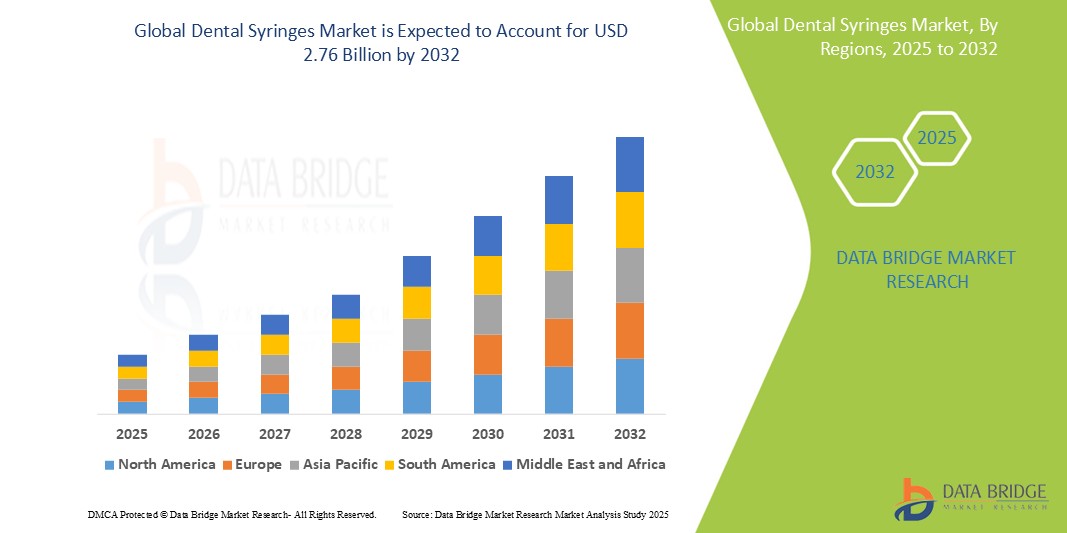

- The global dental syringes market size was valued at USD 1.86 billion in 2024 and is expected to reach USD 2.76 billion by 2032, at a CAGR of 5.10 % during the forecast period

- This growth is driven by factors such as the increasing demand for dental procedures, technological innovations, and a focus on patient comfort and safety.

Dental Syringes Market Analysis

- The dental syringes market is experiencing steady growth due to the increasing demand for dental procedures and advancements in syringe technologies. The rise in dental treatments has led to a higher requirement for precision and comfortable syringes for patients

- As the market continues to evolve, there is a shift towards more innovative, user-friendly designs that enhance the efficiency of dental professionals. This ongoing innovation ensures better control during procedures, contributing to the expansion of the market

- North America is expected to dominate the dental syringes market due to its advanced healthcare infrastructure, high adoption of innovative dental technologies, and strong demand for minimally invasive procedures

- Asia-Pacific is expected to be the fastest growing region in the dental syringes market during the forecast period due to increasing healthcare investments, rising awareness of oral health, and expanding dental infrastructure

- The disposable dental syringes segment is expected to dominate the dental syringes market with the largest share of 55-60% in 2025 due to its hygiene and safety benefits. Disposable syringes minimize the risk of cross-contamination, aligning with stricter infection control protocols in dental practices

Report Scope and Dental Syringes Market Segmentation

|

Attributes |

Dental Syringes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Syringes Market Trends

“Integration of Smart Technology in Dental Syringes”

- The integration of smart technology in dental syringes is growing, with features such as electronic dosage control and tracking systems, enhancing precision and patient safety

- For instance, smart syringes with built-in sensors allow real-time monitoring and dosage adjustments, improving overall treatment outcomes

- These advancements cater to the increasing demand for minimally invasive procedures, as smart syringes offer enhanced comfort and more accurate anesthesia delivery

- The adoption of smart syringes is also driven by a focus on safety, such as reduced needle-stick injuries and improved infection control

- Smart dental syringes benefit from innovations in materials and ergonomic design, improving usability and appeal for dental professionals

- For instance, lightweight and comfortable syringe designs combined with advanced technology enhance ease of use during dental procedures

- As dental practices continue to embrace technological advancements, the demand for smart syringes is expected to rise, fueling market growth

- The growing trend of personalized dental care, supported by smart syringes, indicates a shift towards more precise and patient-centered treatments

Dental Syringes Market Dynamics

Driver

“Increasing Demand for Minimally Invasive Dental Procedures”

- The increasing demand for minimally invasive dental procedures is driving the growth of the dental syringes market, as patients seek treatments that are less painful and require quicker recovery

- For instance, treatments such as root canals and fillings, which require local anesthesia, are becoming more common due to their minimal recovery times and improved patient outcomes

- Dental professionals are increasingly turning to advanced syringes that offer precise doses of anesthesia, ensuring minimal discomfort during procedures

- For instance, Advanced syringes with features such as automatic dosage control and vibration reduction enhance the comfort of patients by delivering a smoother, more controlled injection

- Technological advancements in dental syringes have led to greater precision and accuracy in local anesthesia delivery, ensuring more effective and comfortable treatments

- Patient awareness of the benefits of minimally invasive procedures is growing, driving the demand for advanced dental syringes that align with modern treatment practices

- The shift towards minimally invasive treatments combined with an emphasis on patient comfort and anxiety reduction is expected to continue fueling the market for dental syringes

Opportunity

“Expansion in Emerging Markets”

- The dental syringes market is experiencing significant opportunities in emerging markets due to improving healthcare infrastructure and expanding access to dental care

- For instance, regions such as Asia-Pacific and Latin America are witnessing rapid growth in dental services due to better living standards and increased healthcare investments

- Rising disposable incomes and growing awareness of oral health in developing regions are driving more individuals to seek dental treatments, increasing the demand for dental syringes

- For instance, Countries such as India and Brazil are seeing a growing middle class that is more likely to access dental care, creating a larger market for dental syringes

- Government initiatives to improve public health, along with better access to dental insurance and urbanization, are contributing to the expansion of dental care services

- For instance, In India, government programs aimed at improving healthcare access are making dental treatments more accessible to a larger portion of the population

- As dental clinics in emerging markets adopt advanced technologies to meet the growing demand for routine and specialized procedures, the need for modern dental syringes is increasing

- The increasing focus on preventive dental care in these regions is driving regular dental visits, further boosting the demand for dental syringes

Restraint/Challenge

“High Cost of Advanced Dental Syringes”

- One of the key challenges in the dental syringes market is the high cost of advanced syringes that incorporate the latest technologies, which can limit adoption, especially in smaller practices

- For instance, features such as automatic dose control and vibration reduction improve the precision and comfort of procedures but also increase production costs, making these syringes more expensive

- The high price of advanced dental syringes, particularly those with smart technologies, may deter dental professionals, especially in emerging markets, where affordability is a concern

- For instance, in developing countries, the cost of advanced syringes may be prohibitive for smaller clinics, where budgets are tighter and cheaper alternatives are available

- The initial investment and ongoing maintenance costs for high-tech syringes may discourage some dental clinics from upgrading their equipment, particularly in regions with limited financial resources

- The availability of more affordable traditional syringes further adds to the reluctance of dental professionals to invest in higher-cost, high-tech syringes

- To address this challenge, manufacturers will need to reduce production costs and improve economies of scale to offer more affordable versions of advanced syringes for broader market adoption

Dental Syringes Market Scope

The market is segmented on the basis of product, type, material, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Product

|

|

|

By Type

|

|

|

By Material |

|

|

By End-User |

|

In 2025, the disposable dental syringes is projected to dominate the market with a largest share in product segment

The disposable dental syringes segment is expected to dominate the dental syringes market with the largest share of 55-60% in 2025 due to its hygiene and safety benefits. Disposable syringes minimize the risk of cross-contamination, aligning with stricter infection control protocols in dental practices.

The aspirating dental syringes is expected to account for the largest share during the forecast period in type segment

In 2025, the aspirating dental syringes segment is expected to dominate the market with the largest market share of 40-45% due to its enhanced safety features. Aspirating syringes allow dental professionals to confirm the absence of blood vessels before administering anaesthesia, reducing the risk of complications.

Dental Syringes Market Regional Analysis

“North America Holds the Largest Share in the Dental Syringes Market”

- The North American region is projected to dominate the dental syringes market

- The U.S. dental syringes market held a 30.6% market share and is expected to maintain its leading position through steady growth

- The market in North America is expected to grow, reflecting sustained demand in the region

- With a strong market presence and advanced healthcare infrastructure, the U.S. is expected to remain the dominant player in the global dental syringes market

“Asia-Pacific is Projected to Register the Highest CAGR in the Dental Syringes Market”

- India’s dental syringes market held a 2.9% market share globally, with expectations of rapid growth due to improving healthcare infrastructure

- Aspirating syringes were the largest revenue-generating type in India in 2023 and are expected to continue leading in the coming years

- The market in Asia-Pacific is projected to grow at the fastest rate, driven by increasing healthcare investments

- As India’s dental care sector expands, the market share is expected to rise, making it a significant player in the global dental syringes market

Dental Syringes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Septodont Holding (France)

- 3M (U.S.)

- Dentsply Sirona (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Vista Apex (U.S.)

- Power Dental Group, Inc. (U.S.)

- 4tek Viale dell'Industria (Italy)

- Titan Instrument (U.S.)

- DELMAKS SURGICO MEDICAL TRADING CO. L.L.C (U.A.E.)

- Kohdent Roland Kohler Medizintechnik GmbH & Co. KG (Germany)

- RØNVIG Dental Mfg. A/S (Denmark)

- Henke-Sass, Wolf GmbH (Germany)

- Acteon (France)

- Anqing Topeak Medical Co., Ltd. (China)

- Dentsply International Inc. (U.S.)

Latest Developments in Global Dental Syringes Market

- In January 2024, Sharps Technology signed a Letter of Intent (LOI) with Roncadelle Operations to expand the global sales and distribution of its safe drug delivery systems. The partnership aims to leverage Roncadelle’s extensive network to introduce Sharps' safety syringe technologies to markets in Europe, the Middle East, Africa, and Asia-Pacific. This collaboration will enhance the reach of Sharps' Securegard and Sologard products, offering healthcare providers safer and more efficient drug delivery solutions, and addressing the increasing global demand for advanced injection systems

- In April 2022, Thermo Fisher Scientific's PPD clinical research division partnered with Matrix Clinical Trials to enhance decentralized clinical trial solutions. This collaboration introduces mobile research sites and a virtual investigator network across the U.S., aiming to increase patient diversity and improve access to clinical trials. By reducing the need for patients to travel to traditional sites, the initiative seeks to enhance patient experience and engagement. The impact on the market includes broader geographic reach, improved data quality, and faster development timelines, aligning with the growing demand for patient-centric trial participation

- In March 2022, Colgate introduced its innovative Elixir toothpaste in Canada, following its European launch the previous spring. The product features a clear, recyclable PET tube with LiquiGlide’s EveryDrop coating, enabling users to easily dispense nearly every drop of toothpaste. This advancement enhances user convenience and reduces product waste, aligning with Colgate's commitment to sustainability. The Elixir line is available in select retailers and online platforms in Canada, marking a significant step in Colgate's global expansion of eco-friendly oral care products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.