Global Dental Lab Market

Market Size in USD Billion

CAGR :

%

USD

23.18 Billion

USD

38.36 Billion

2024

2032

USD

23.18 Billion

USD

38.36 Billion

2024

2032

| 2025 –2032 | |

| USD 23.18 Billion | |

| USD 38.36 Billion | |

|

|

|

|

Dental Lab Market Size

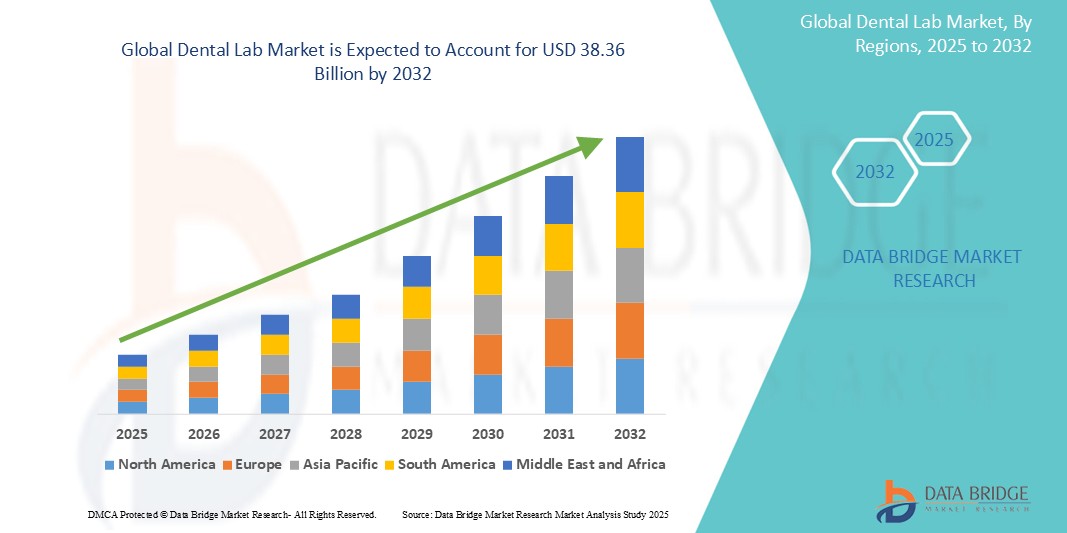

- The global dental lab market size was valued at USD 23.18 billion in 2024 and is expected to reach USD 38.36 billion by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fuelled by the increasing demand for cosmetic dentistry, rising prevalence of dental disorders, and growing adoption of digital technologies such as CAD/CAM in dental laboratories

- Rising awareness about oral health and the growing geriatric population globally are further contributing to the demand for advanced dental prosthetics and restorative solutions, boosting the dental lab market expansion

Dental Lab Market Analysis

- The dental lab market is experiencing strong momentum as advancements in materials and digital technologies are enhancing the precision and speed of prosthetic production

- Increasing adoption of computer-aided design and manufacturing systems is streamlining workflows and enabling customized dental solutions for better patient satisfaction

- North America dominates the dental lab market with the largest revenue share of 38.5% in 2025, driven by advanced healthcare infrastructure, widespread adoption of digital dental technologies, and high demand for cosmetic dental procedures

- Asia-Pacific is expected to be the fastest growing region in the dental lab market during the forecast period due to increasing dental tourism, rising disposable income, and growing awareness of oral health and aesthetics

- The CAD/CAM systems segment dominates the largest market revenue share in 2025, driven by its ability to enhance the precision, efficiency, and speed of dental restoration production. Dental laboratories often prioritize CAD/CAM systems for their capacity to create high-quality prosthetics with reduced manual errors and turnaround times. The market also sees strong demand for CAD/CAM systems due to their compatibility with various materials and their integration with digital workflows, streamlining the entire dental restoration process

Report Scope and Dental Lab Market Segmentation

|

Attributes |

Dental Lab Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Lab Market Trends

“Digitalization and Adoption of CAD/CAM Technology Transforming Dental Lab Operations”

- Digitalization is transforming dental labs with the widespread use of computer-aided design and manufacturing systems that enable faster and more precise prosthetic production

- CAD/CAM technology helps create custom-fit crowns, bridges, and dentures with improved accuracy and efficiency compared to traditional manual techniques

- The integration of 3D printing with CAD/CAM allows labs to produce high-quality restorations and prototypes in less time, streamlining operations

- For instance, Dentsply Sirona’s CEREC system and 3Shape’s TRIOS workflow offer seamless digital solutions from scanning to final product, enhancing collaboration between labs and dental clinics

- Dental labs using digital tools experience fewer errors, faster turnaround, and better patient outcomes, gaining a competitive advantage in a growing market

Dental Lab Market Dynamics

Driver

“Advancements in dental technology and increasing demand for cosmetic dentistry”

- Advancements in dental technology such as intraoral scanners, 3D printers, and CAD/CAM systems are enabling labs to produce restorations that are more accurate, aesthetically appealing, and durable

- For instance, labs using 3Shape’s CAD/CAM solutions can complete crown fittings faster with higher precision

- These innovations allow for quicker turnaround times and greater customization, improving both workflow efficiency and patient satisfaction

- For instance, Dentsply Sirona’s digital workflow system, which reduces restoration time from days to hours

- The demand for cosmetic procedures such as veneers, smile makeovers, and teeth whitening is rising due to increased awareness of dental aesthetics and personal appearance

- Minimally invasive techniques and enhanced imaging tools are making modern dental treatments more appealing and accessible for patients of all ages

- Dental tourism is expanding the market by attracting international patients seeking affordable, high-quality care in emerging economies, driving growth in global dental labs

Restraint/Challenge

“High cost of advanced equipment and lack of skilled professionals”

- High costs of adopting advanced technologies such as CAD/CAM systems, 3D printers, and digital software limit modernization efforts, especially for small or mid-sized dental labs

- For instance, purchasing a full CAD/CAM suite with milling units and scanners can cost more than many small labs can afford

- The shift to digital workflows requires specialized skills, but a shortage of trained dental technicians poses a major barrier to efficient adoption and use of these tools

- Many regions lack accessible education and training programs for dental lab professionals, resulting in a widening skills gap in digital design and equipment handling

- Ongoing maintenance and the need for regular software and hardware upgrades further add to operational costs, increasing financial strain on labs trying to remain competitive

- Inadequate training and misuse of advanced tools can result in errors, such as poorly fitted prosthetics from incorrect use of 3D printing or CAD software

- For instance, labs inexperienced with digital workflows may face high remake rates, leading to wasted resources and dissatisfied patients

Dental Lab Market Scope

The market is segmented on the basis of equipment type and product type.

- By Equipment Type

On the basis of equipment type, the dental lab market is segmented into milling equipment, dental scanners, 3D printing systems, CAD/CAM systems, casting machines, radiology equipment, and others. The CAD/CAM systems segment dominates the largest market revenue share in 2025, driven by its ability to enhance the precision, efficiency, and speed of dental restoration production. Dental laboratories often prioritize CAD/CAM systems for their capacity to create high-quality prosthetics with reduced manual errors and turnaround times. The market also sees strong demand for CAD/CAM systems due to their compatibility with various materials and their integration with digital workflows, streamlining the entire dental restoration process.

The 3D printing systems segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in dental labs for its ability to produce accurate and complex dental models and prosthetics. 3D printing offers advantages such as material versatility, reduced material waste, and the capability to create customized solutions, making it a cost-effective and innovative solution for dental restorations. The technology's ability to facilitate chairside production and its expanding range of applications in dentistry contribute to its growing popularity in dental lab settings.

- By Product Type

On the basis of product type, the dental lab market is segmented into orthodontics, endodontics, restorative, oral care, implants, and prosthodontics. The prosthodontics segment holds the largest market revenue share in 2025, driven by the increasing demand for dentures, crowns, and bridges due to the rising prevalence of edentulism and an aging global population. Dental laboratories often focus on prosthodontic products due to their essential role in restoring oral function and aesthetics. The market also sees strong demand for these products due to the continuous advancements in materials and techniques used in prosthodontics.

The implants segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing preference for dental implants as a long-term solution for missing teeth. Dental implants offer superior stability, durability, and aesthetics compared to traditional dentures, driving their adoption among both patients and dentists. The rising success rates of implant procedures and the growing awareness of their benefits are contributing to the rapid growth of the implants segment in the dental lab market.

Dental Lab Market Regional Analysis

- North America dominates the dental lab market, with the largest revenue share of 38.5% in 2025, driven by a growing demand for advanced dental solutions and a strong emphasis on aesthetic dentistry, as well as increased awareness of oral health

- Consumers in the region highly value high-quality dental prosthetics, advanced materials, and cutting-edge technologies

- This widespread adoption is further supported by high disposable incomes, a well-established healthcare infrastructure, and the increasing prevalence of dental insurance coverage, establishing advanced dental care as a favoured solution for both restorative and cosmetic dentistry

U.S. Dental Lab Market Insight

The U.S. dental lab market captured the largest revenue share of 79% within North America in 2025, fuelled by the swift uptake of digital dentistry and the expanding trend of cosmetic dentistry. Consumers are increasingly prioritizing the enhancement of dental aesthetics and oral function through advanced restorative solutions. The growing preference for minimally invasive procedures, combined with robust demand for CAD/CAM systems and 3D-printed prosthetics, further propels the dental lab industry. Moreover, the increasing integration of advanced technologies, such as digital scanners and milling equipment, is significantly contributing to the market's expansion.

Europe Dental Lab Market Insight

The European dental lab market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent quality standards and the escalating need for enhanced dental care in aging populations. The increase in disposable incomes, coupled with the demand for innovative dental solutions, is fostering the adoption of advanced dental prosthetics. European consumers are also drawn to the durability, precision, and aesthetic appeal these devices offer. The region is experiencing significant growth across restorative, orthodontic, and cosmetic dentistry, with dental labs playing a crucial role in both traditional and digital workflows.

U.K. Dental Lab Market Insight

The U.K. dental lab market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of cosmetic dentistry and a desire for heightened patient satisfaction and advanced dental solutions. In addition, concerns regarding the longevity and appearance of traditional dental restorations are encouraging both dentists and patients to choose advanced prosthetic solutions. The UK's embrace of digital dentistry, alongside its robust healthcare system and a growing emphasis on preventive dental care, is expected to continue to stimulate market growth.

Germany Dental Lab Market Insight

The German dental lab market is expected to expand at a considerable CAGR during the forecast period, fuelled by increasing awareness of oral health and the demand for technologically advanced, high-quality dental restorations. Germany's well-developed healthcare infrastructure, combined with its emphasis on precision and quality manufacturing, promotes the adoption of advanced dental technologies, particularly in restorative and prosthetic dentistry. The integration of CAD/CAM systems and 3D printing is also becoming increasingly prevalent, with a strong preference for durable, biocompatible, and aesthetically pleasing solutions aligning with local patient expectations.

Asia-Pacific Dental Lab Market Insight

The Asia-Pacific dental lab market is poised to grow at the fastest CAGR in 2025, driven by increasing urbanization, rising disposable incomes, and growing awareness of oral health in countries such as China, Japan, and India. The region's growing demand for quality dental care, supported by expanding healthcare infrastructure and increasing dental tourism, is driving the adoption of advanced dental lab products and services. Furthermore, as APAC emerges as a manufacturing hub for dental materials and equipment, the affordability and accessibility of advanced dental solutions are expanding to a wider patient base.

Japan Dental Lab Market Insight

The Japan dental lab market is gaining momentum due to the country’s high standards for dental care, rapid urbanization, and demand for advanced solutions. The Japanese market places a significant emphasis on precision and aesthetics, and the adoption of advanced dental technologies is driven by the increasing number of elderly patients and a growing focus on preventive dentistry. The integration of CAD/CAM systems and advanced materials, such as zirconia and lithium disilicate, is fuelling growth. Moreover, Japan's aging population is likely to spur demand for high-quality, durable, and comfortable prosthetic solutions in both restorative and geriatric dentistry.

China Dental Lab Market Insight

The China dental lab market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's expanding middle class, rapid urbanization, and increasing awareness of oral health. China stands as one of the largest markets for dental products and services, and advanced dental solutions are becoming increasingly popular in both urban and rural areas. The push towards improved healthcare infrastructure and the availability of affordable dental lab services, alongside a growing number of domestic dental laboratories, are key factors propelling the market in China.

Dental Lab Market Share

The dental lab industry is primarily led by well-established companies, including:

- Ultradent Products Inc. (U.S.)

- Young Innovations, Inc. (U.S.)

- Dentatus (Sweden)

- Carestream Dental LLC. (U.S.)

- Roland DGA Corporation (U.S.)

- 3Shape A/S (Denmark)

- Formlabs (U.S.)

- PLANMECA OY (Finland)

- Septodont (France)

- VOCO GmbH (Germany)

- 3M (U.S.)

- Henry Schein, Inc. (U.S.)

- GC Corporation (Japan)

- BIOLASE, Inc. (U.S.)

- Dentsply Sirona. (U.S.)

- BEGO GmbH & Co. KG (Germany)

- Bicon (U.S.)

- CAMLOG Biotechnologies GmbH (Switzerland)

- Institut Straumann AG (Switzerland)

Latest Developments in Global Dental Lab Market

- In March 2022, Ultradent Products introduced a new line of premium accessories for its VALO Grand curing lights, including six innovative lenses. This product enhancement aims to provide dental professionals with greater flexibility and precision during procedures, improving clinical outcomes and elevating the standard of care. The expanded functionality is expected to strengthen Ultradent’s market position and drive adoption of its light-curing systems

- In January 2022, Formlabs launched the Form 3+ and Form 3B+ 3D printers, marking a significant advancement in dental manufacturing capabilities. These next-generation printers offer faster print speeds and improved reliability, catering to a broad range of dental lab needs. This launch is poised to accelerate digital transformation in dental labs and contribute to market expansion in North America

- In February 2021, Dentsply Sirona rolled out the CEREC SW 5.1.3 software update, validating 17 new materials for use with the CEREC Primemill system. Among these are PMMA for surgical guides and bridge blocks optimized for grinding workflows. This update expands the system’s versatility, enabling dental labs and clinics to streamline workflows and broaden their restorative treatment offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.